Unknown chargesmean unknown risk

Understand your business exposure before it compounds.

Seeing a SP AFF SAN FRANCISCO charge on your statement?

Common ways SP AFF SAN FRANCISCO charges might appear on your statement

- SP AFF SAN FRANCISCO CA

SP AFFIRM SAN FRANCISCO CA

SP *AFFIRM SAN FRANCISCO CA

AFFIRM PAYMENT SAN FRANCISCO CA

SP AFF SAN FRANCISCO CC 0

SP AFFIRM PURCHASE CA

What is SP AFF SAN FRANCISCO?

SP AFF SAN FRANCISCO refers to Affirm, a financial technology company based in San Francisco that offers “Buy Now, Pay Later” installment loans for online and in-store purchases. When you see this descriptor, it usually represents a payment or installment made through Affirm’s platform. Learn more at affirm.com.

Common causes for SP AFF SAN FRANCISCO charges

- Installment payments made on a purchase financed through Affirm.

- Automatic recurring payments toward an active Affirm loan or plan.

- Initial loan disbursement or repayment posting through Affirm’s billing network.

- Refunds or credits when a financed purchase is canceled or returned.

Decoding SP AFF SAN FRANCISCO charge tags

- SP designates “service provider”, the payment processor handling the charge.

- AFF or AFFIRM identifies Affirm as the lending and payment platform.

- SAN FRANCISCO CA denotes Affirm’s corporate headquarters location.

- CC 0 or similar suffixes reference transaction routing or internal processor codes.

- Descriptors may vary slightly depending on merchant, card network, or payment gateway.

What to do

if you

don’t recognize this charge

Spot, verify, and resolve suspicious charges in minutes.

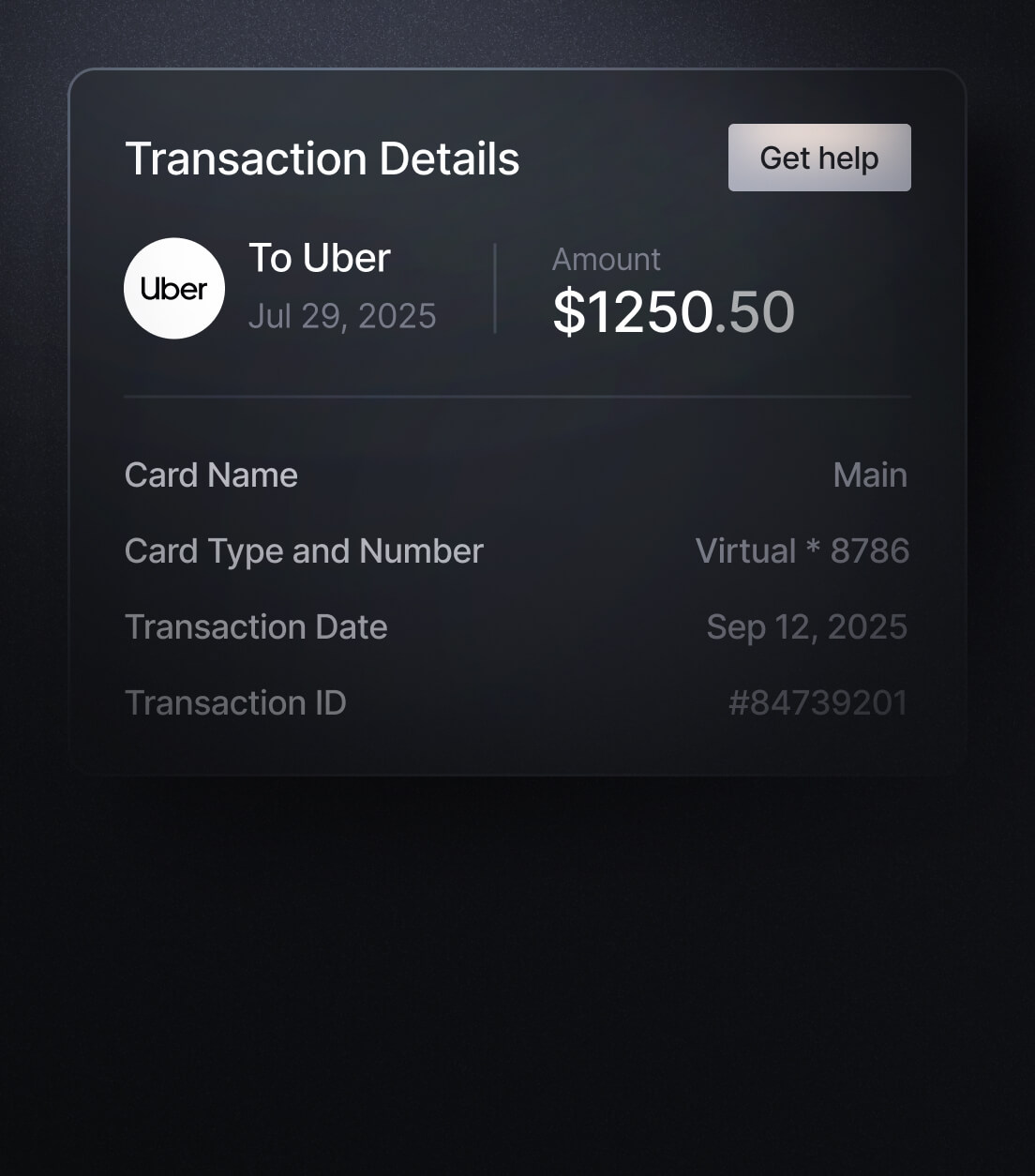

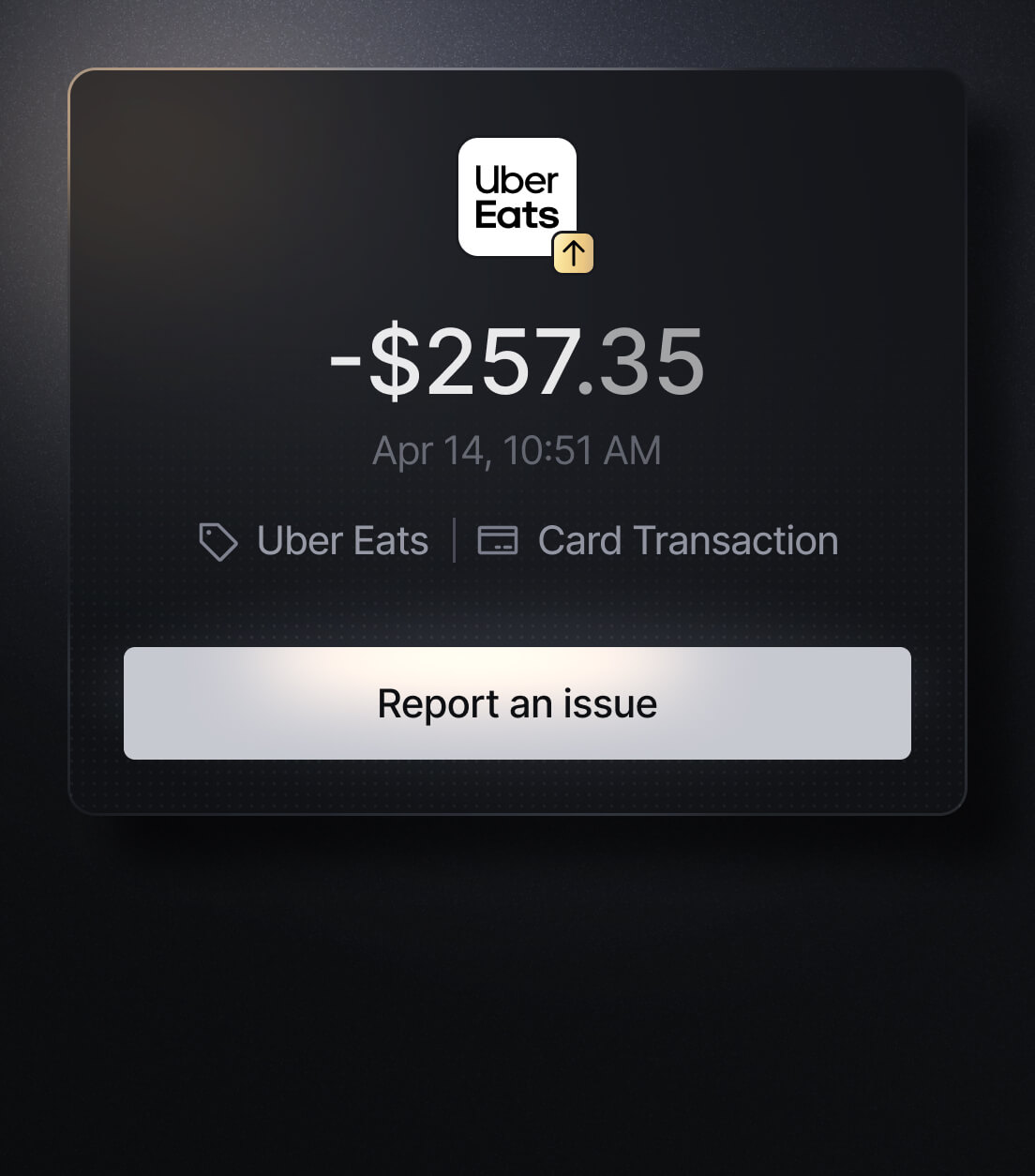

Easily Identify Every Charge with Slash

See exactly where, when, and how each charge occurred, complete with merchant names, payment types, and connected team cards with Slash’s detailed card logs and expense tracking tools.