What is an IBAN and How Does it Work?

International payments are tricky. Even for organizations that routinely send money across borders, factors like fluctuating exchange rates and high fees can complicate transactions and cause accounting mishaps. One of the most frustrating aspects, however: the IBAN.

An IBAN (International Bank Account Number) is a standardized identifier used in many countries to route a cross-border financial transaction to the correct bank account. It may be a simple concept, but due to the variety of countries that do and don’t use IBAN numbers, it gets more complex as your company scales and expands to more locations. For instance, the United States recognizes the IBAN system and uses the codes for outgoing transfers, but US bank accounts themselves do not have IBANs.

This guide covers what an IBAN is, when you’ll need it, where you’ll find it, and what they’re used for. We’ll also go over the ways Slash can make international payments easier thanks to global ACH transfers and tools that make it easy to lookup, organize, and store different IBANs.¹

You’ll be meeting a few other important acronyms along the way, such as SWIFT, BIC, BBAN, and SEPA – so you might want to grab your notepad.

What is an IBAN?

While the acronym IBAN stands for International Bank Account Number, it isn’t simply a bank account number from another country. It’s a globally standardized format for identifying an international bank account so a bank can route wire transfers to the right location with fewer errors.

The difference lies in how the IBAN is constructed, as it includes the following parts:

- Country code

- Check digits

- Bank identifier

- Bank account number

These elements are included to uniquely identify a customer’s account, validate their bank, and make international routing more reliable. Ultimately, it was created to make validation as holistic as possible, providing every piece of information necessary in one spot.

Before the IBAN, each country had its own distinct bank account numbering system, and there was no system in place to check for errors in transcription. In 1997, the International Organization for Standardization (ISO) published a proposal that would create a more universal code that included check digits. It was originally developed with the European Union in mind, but as of today, 89 countries around the world use the IBAN system.

While not all countries have adopted IBANs, those who have are able to quickly and cleanly process cross-border payments with other nations – especially those who use the same system.

Slash business banking

Works with cards, crypto, plus cards, crypto, accounting, and more.

What Can an IBAN Be Used For?

You’ll need an IBAN to send money to international suppliers and contractors, receive funds from overseas clients, and set up recurring payments to foreign vendors. Different scenarios require you to be ready with specific information and codes, starting with sending vs receiving money.

When sending an international transfer, you’ll need the recipient’s full name (or company name), address, IBAN, bank name, and bank address. You may be asked for extra information, like your relationship with the recipient and the purpose of the transfer.

If you’re on the receiving end of the transfer, you simply need to ensure the sending bank has the correct name, address, and IBAN for your business.

It’s important you have the correct codes and details for overseas transactions to keep everything quick and streamlined. Inputting the incorrect IBAN can get your international wire transfer returned to sender, which massively delays business deals (and can be a bit awkward).

What do IBANs Look Like?

The length of IBANs vary from country to country, but they all follow the same structure. The first two letters are the country code – for example, DE means Germany, and BI means Burundi. Afterwards, you’ll see two numbers called, “check digits”. This is the validation check, acting as a sort of secret code for the bank’s program. If the system detects that something’s wrong with the check digits, it may flag the payment as illegitimate.

The rest of the digits in the IBAN completely depend on that country’s BBAN, or Basic Bank Account Number. While BBANs aren’t nearly as universal, they’re typically constructed using the institution’s bank code, branch, and account number.

Your recipient’s bank account number attaches itself to the country code and check digits to complete the IBAN, which can be up to 34 alphanumeric characters. Written out, it looks like this:

Country code + check digits + bank/branch identifiers + account number

Let’s take a look at an example:

IE64 IRCE 9205 0112 3456 78

The country code seen here is IE, referring to Ireland, and the check digits are 64. From there, everything from IRCE on is Ireland’s BBAN. Don’t be caught off guard by the letters after the check digits in this instance – that’s just how Ireland’s bank account numbers are formatted.

As of 2025, 89 countries use IBANs when receiving and sending money across borders. That’s a lot of different BBANs and country codes, so let’s take a look at a few more examples:

- United Kingdom (GB): GB98 MIDL 0700 9312 3456 78

- France (FR): FR76 3000 6000 0112 3456 7890 189

- Dominican Republic (DO): DO22 ACAU 0600 0000 0001 2345 6789

- Netherlands (NL): NL91 ABN A0417 1643 00

Some are long, some are short, some have letters in the BBAN, and some strictly have numbers. The most important thing to keep an eye out for are the first four digits, which will always be the country code and check digits.

Where Do You Find Your IBAN?

There are a few places you can find your IBAN, including:

- Your online banking portal

- Your bank statements (digital and paper)

- Your bank card

If you don’t spot it in any of those places, you can also reach out to your bank itself.

One further option is using an online calculator tool, in which you input your bank code and account number to search for your IBAN. Make sure to utilize a trustworthy website, and be mindful of the fact that the IBAN it finds for you isn’t guaranteed to be accurate.

US bank accounts don’t carry their own IBANs. If you’re in the US and you’ve been scrambling to find yours before making an international wire transfer, you can stop looking. However, you may still need the recipient’s IBAN when paying someone abroad, depending on their location.

Companies based out of the United States, Canada, and many other countries actually carry a different bank code that comes from the Society for Worldwide Interbank Financial Telecommunication: the SWIFT code.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

IBAN vs SWIFT vs BIC vs SEPA

All right, this is where it starts to get complex. SWIFT codes are 8-11 digits long: 4 letters to identify the recipient’s bank, a two letter country code, a two digit location code, and often three additional digits to identify the specific branch. For example, the SWIFT code for a given Bank of America branch in New York City would be BOFAUS3N###. BOFA is Bank of America, US is United States, 3N is New York, and the #’s can be filled in to identify the branch in question.

Before continuing, we’ll also note that the term “BIC code” ( bank identifier code) refers to the SWIFT code and is used interchangeably. From here, we’ll call it a SWIFT code, but banks use both terms.

IBAN vs SWIFT/BIC

SWIFT codes and IBANs are both used to process global payments. While IBANs are only used in about 89 countries, SWIFT codes are recognized internationally. They don’t supplant each other, however; since IBAN codes are used so frequently, especially in the EU, you’ll actually often need both in tandem.

If you’re making a SWIFT transfer to a country that uses IBAN, you’ll also be asked for that IBAN. If you don’t have access to your recipient’s IBAN, you’ll need their BBAN and some extra information, depending on the context of the payment.

You may be wondering, “Are there any instances where I’ll need the IBAN and not the SWIFT code?” There are indeed – if your company operates out of Europe. This is where SEPA comes in.

Using an IBAN For SEPA Payments

SEPA (Single Euro Payments Area) is a payment integration meant to ease cross-border payments among countries that use euros and IBANs. SEPA enables users to make cashless euro payments to any account located in one of the 41 member nations, often called “eurozones”.

So, here are our takeaways: If you’re in the United States or certain other countries, you have a SWIFT code, not an IBAN – but you’ll need to be familiar with both. If you’re in a country that uses euros, you’ll need to know SWIFT codes for many outbound payments, but you’ll generally just need the IBANs for transactions in Europe, thanks to SEPA.

Need to Make an International Wire Transfer? Use Slash

Growing businesses often have lots of international transfers to make and lots of banking details to keep track of. With the Slash business banking platform, you can stay organized, unlock a clearer view of your cash flow, and obtain greater control over receiving and sending money globally.

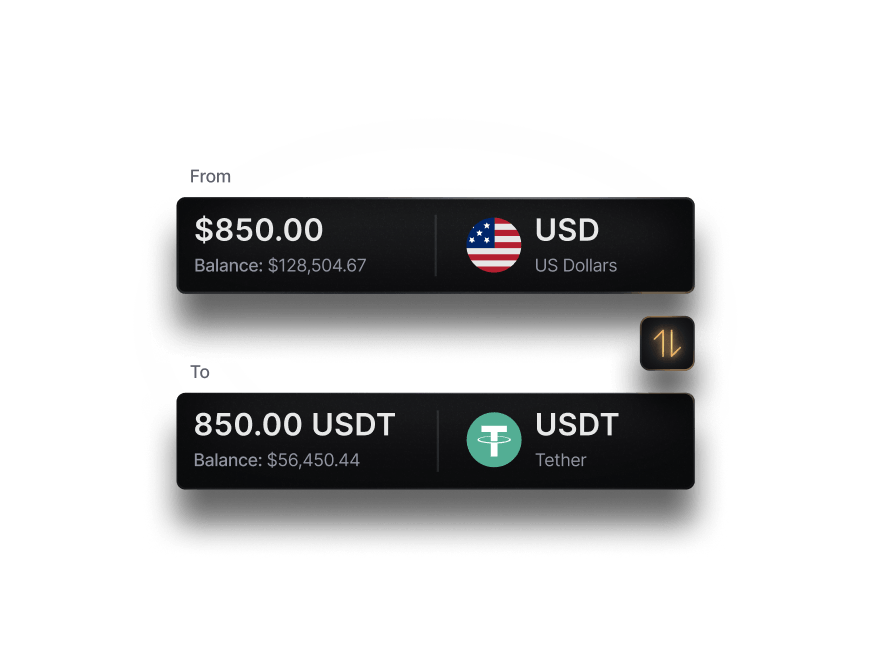

We offer built-in recipient management, so you can sort SWIFT/BIC codes, IBANs, and any other details you need within the Slash dashboard. With access to global ACH transfers, wires to 180+ countries in 135+ currencies, and cryptocurrency payment options, you can equip yourself with the right banking codes and scale your business across borders more efficiently.⁴ Thanks to transparent pricing and fees, you’ll also be able to identify the most cost-effective method for each transaction.

With dozens of banking codes at your fingertips and full insights into international charges, your company will be able to move nimbly, save money, and avoid costly delays and cancelled transactions. All these benefits can be found on a single business banking platform designed to simplify international operations.

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

FAQs

What happens if I put in the wrong IBAN?

Enacting an international transfer with an invalid IBAN won’t give you an alert right away. The transaction may be rejected hours or days later, and your bank may charge you a fee - but you can go ahead and try again. If you’re unlucky, though, that wrong IBAN could actually belong to a completely separate, random bank account. In that case, you wouldn’t be notified at all, your client or vendor would ask you where the money is, and there would be a big problem on your hands.

Does it cost money to use an IBAN?

International transfers often incur a variety of fees, so the answer is generally yes – but the use of the IBANs themselves isn’t what costs the sender money. SWIFT transfers come with fees at similar rates.

Is it safe to share my IBAN?

It’s safe to communicate your IBAN to the sender/recipient who needs it, but if you’re asking whether it’s safe to spread your routing number around and shout it from the rooftops? Probably not a good idea.