Put your idle cash to work

Earn up to 3.83%6 yield by investing in institutional-grade funds

powered by BlackRock and Morgan Stanley.

3.83%

3.83%

Competitive yield for modern businesses

Earn a competitive return on idle funds.

Backed by U.S. Treasuries

Invest in a BlackRock government money market fund that holds U.S. Treasury bills and other government-backed assets.

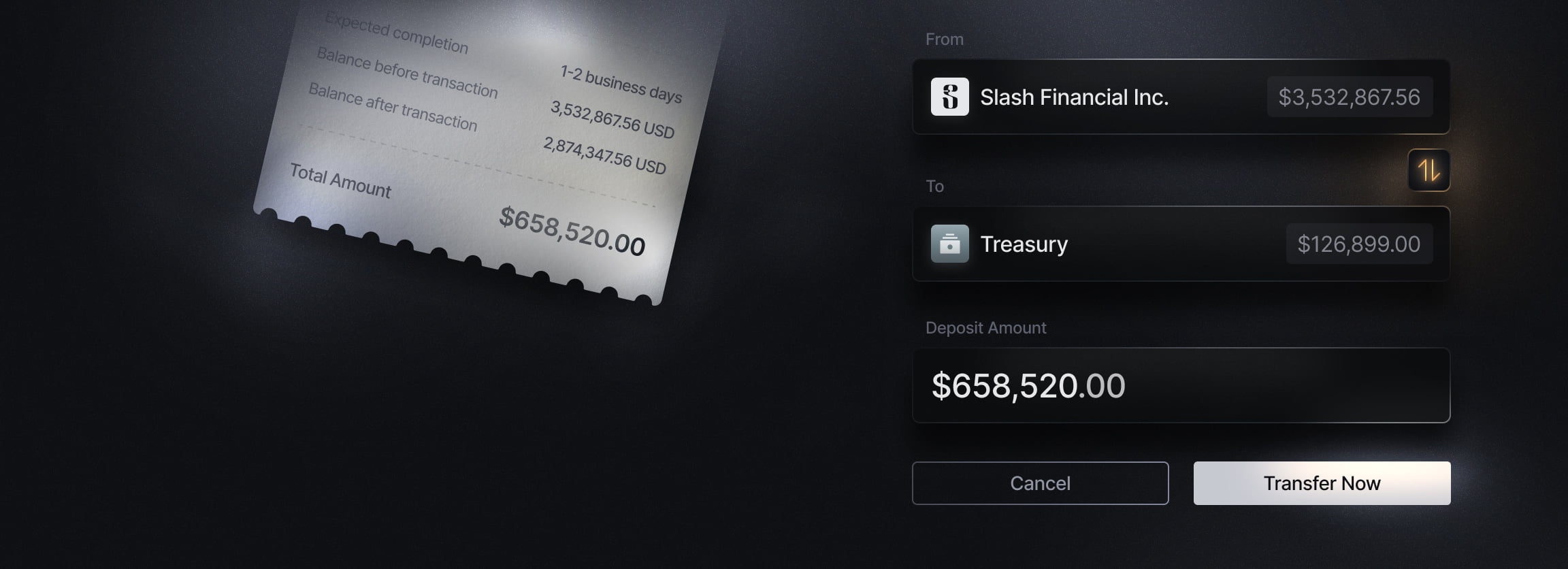

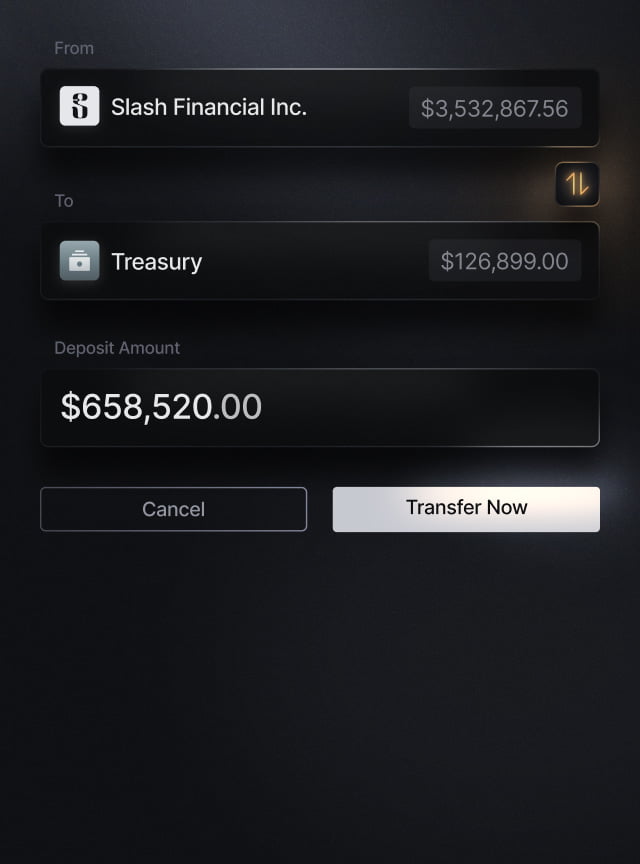

Seamless, On-platform Experience

Move funds in and out of Treasury quickly from your Slash dashboard. No separate logins, ACH delays, or learning curves.

Liquidity When You Need It

Withdrawals typically settle in 1 business day, so your capital can be in reach when it matters most.

We’ve tried over a dozen Treasury products and have settled on Slash. We’re investing idle cash into high-yield money market funds without leaving the platform we already use to manage our finances. It’s seamless, and it lets us earn while we can focus on building our company.

Jake Brooks, Triumph

Built for founders who think like CFOs

3.83%6

Industry-Leading Yield

Earn a 3.83%6 annualized yield with minimal markups, all within your Slash account with an extremely intuitive interface.

Access Top Quality Funds

Grow your cash through institutional-grade money market and ultra-short income funds by BlackRock and Morgan Stanley.

One-Click Capital Allocation

Easily move excess cash into Treasury with a single click — perfect for managing recent fundraising, parking capital between big purchases, or conservatively growing your war chest.

Earn up to 3.83%6 yield. No surprise fees.

View the options available today within your Treasury account, along with their gross market APYs.

Transparent pricing with features tailored to your business

Free

$0/month

Full-featured banking essentials with no strings attached.

Start for FreePro

$25/month

Scale your business with advanced industry-specific capabilities.

Get Started

Frequently asked questions

Don’t see the answer you’re looking for? Get in touch.