Working Capital Loans: How Small Businesses Can Apply and Qualify

Running a profitable business doesn’t always mean you'll have cash available when you need it.

A time-sensitive investment may arise while your cash is tied up in unpaid invoices. You might be preparing for your busiest season without enough cash from the slow season to purchase sufficient inventory. Or an unexpected disruption, like equipment failure or property damage, may require immediate attention before insurance claims or customer payments are settled.

Many business owners are familiar with loans used for major purchases like equipment or real estate, but working capital financing serves a different purpose. These short-term financing options are designed to cover routine operating expenses that arise between revenue cycles. In this guide, we will walk through the different types of working capital financing available to small businesses, how each option works, and how they are commonly used.

We will also explain how Slash Working Capital can support your business’s growth.⁵ Slash offers a line of credit that you can access directly from your business banking dashboard, allowing you to draw funds whenever you need additional liquidity.¹ You can choose short-term repayment options that match your cash flow, helping you cover operating expenses, manage timing gaps, and fund growth without taking on long-term debt.

What is a working capital loan? Definition, purpose, and how it works

A working capital loan is a form of short-term financing intended to cover day-to-day business expenses. There are several types of working capital financing instruments, each differing in how funds are disbursed, what is required to qualify, and what the borrower can use as collateral. Common examples include SBA loans, business lines of credit, borrowing against accounts receivable, and similar options.

The term “working capital loan” comes from the financial concept of working capital, which represents the difference between a company’s current assets and current liabilities. In this context, “current” refers to the assets and liabilities that are expected to be converted to cash or settled within the next year. Calculating your working capital shows how much liquidity you have available to support daily operations.

When funds fall short—or when your business needs additional cushion to support growth—working capital loans can help bridge the gap. Working capital financing is typically used to cover short-term investments and immediate operational needs. Unlike long-term loans that are used for major investments such as equipment or real estate, working capital financing is not tied to ownership or equity and is designed to support ongoing business operations rather than long-term asset purchases.

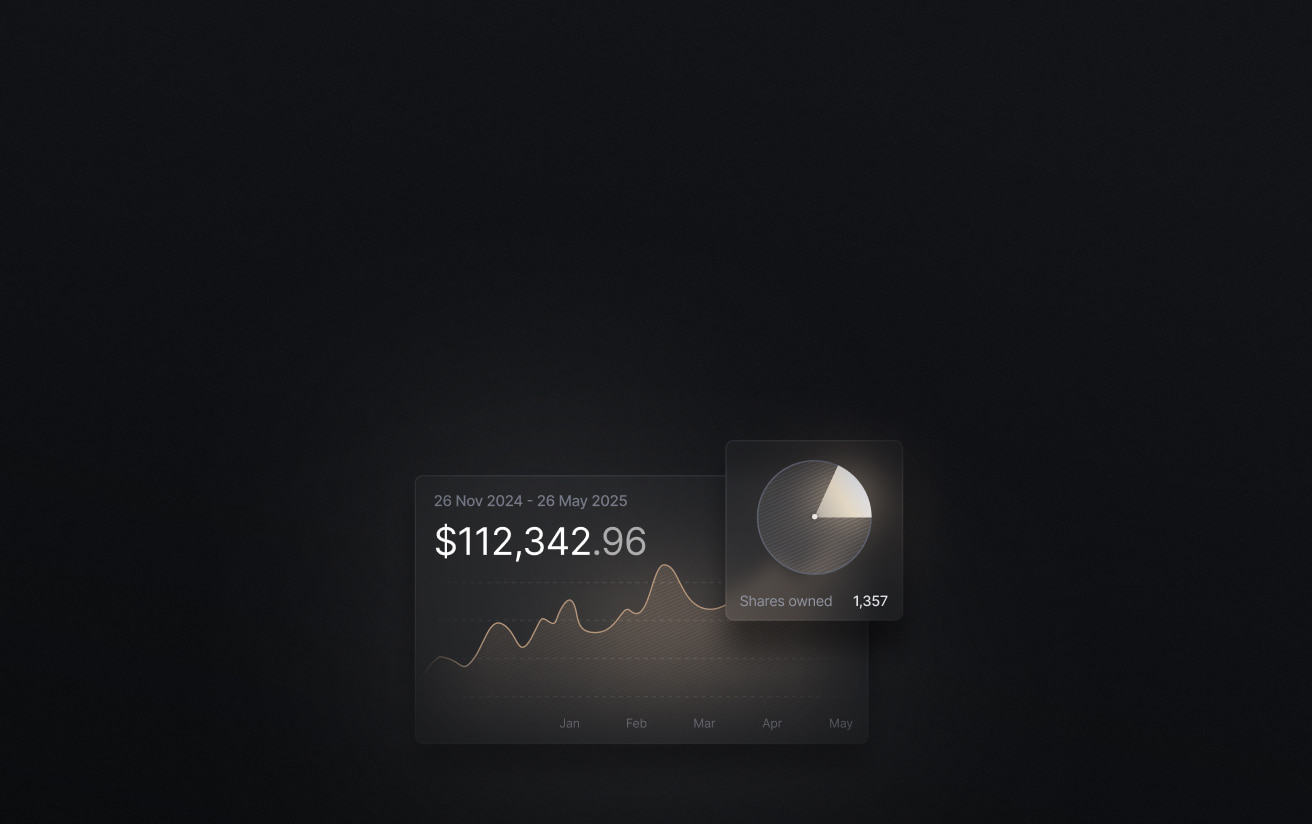

Slash’s working capital financing functions as a line of credit, meaning you have access to a pre-approved amount of funding that you can draw from as needed rather than receiving a lump sum upfront. You can access funds whenever necessary and choose flexible repayment terms of 30, 60, or 90 days. This structure allows you to align repayments with your revenue cycles and pay only for the capital you actually use.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

Common ways small businesses use working capital loans

Small businesses typically use working capital financing for two main reasons: to support growth and to manage short-term cash gaps. Sometimes, it can even serve both purposes at the same time. Below are some of the most common ways businesses use working capital loans:

Purchasing inventory and supplies

Businesses often need to buy inventory ahead of busy seasons or to fulfill large orders that exceed the stock they currently have on hand. A working capital loan can provide the funds to purchase materials and products without draining cash needed to sustain daily operations.

Managing seasonal cash flow fluctuations

Many businesses experience predictable ups and downs in revenue throughout the year, such as retailers during holiday seasons or landscapers during winter months. Working capital financing can help smooth out these cyclical patterns by providing funds during slower periods that can be repaid once revenue picks back up.

Handling unexpected expenses

Equipment breakdowns, emergency repairs, or sudden supply chain disruptions can create urgent, unplanned expenses. Working capital loans can help to cover these costs so your business can continue operating while resolving issues.

Funding growth initiatives

Opportunities to expand into new markets, launch new product lines, or start a marketing campaign often require upfront investment before generating returns. Short-term financing can help businesses pursue these growth opportunities without waiting to build up cash reserves.

Investing in time-sensitive business opportunities

Some opportunities won't wait: securing a bulk discount, purchasing discounted inventory, or taking on a large contract that demands immediate capacity. Working capital financing gives businesses the flexibility to move quickly when there’s an opportunity to secure a competitive advantage.

6 types of working capital loans

Working capital financing can take several forms. While term loans are a common option, businesses may also use tools like lines of credit, business credit cards, and financing tied to receivables to help manage day-to-day cash needs. Below are six ways to access working capital, along with practical considerations for when each option makes sense:

Term loans

A term loan provides a lump sum of capital that is repaid over a fixed schedule with regular payments and a set interest rate. While term loans are often used for long-term investments, shorter-term options can be used for working capital to cover operating expenses, manage uneven cash flow, or finance seasonal fluctuations in revenue.

SBA loans

SBA loans are partially guaranteed by the U.S. Small Business Administration, which enables lenders to offer lower interest rates and longer repayment terms than many conventional term loans. Programs such as the SBA 7(a) loan can be used for working capital, as well as refinancing existing debt or funding growth initiatives, making them well suited for businesses seeking stable, lower-cost capital.

Business lines of credit

A business line of credit allows a company to borrow up to a preset limit and pay interest only on the amount drawn, with funds becoming available again as the balance is repaid. This revolving structure makes lines of credit a flexible form of working capital, commonly used to cover ongoing expenses like payroll, inventory purchases, or short-term cash shortfalls. Slash Working Capital follows this same structure, giving you on-demand access to funds without taking on a lump-sum loan.

Business credit cards

Business credit cards provide revolving access to credit for everyday operating expenses, often with added benefits such as rewards or cash back. Although credit limits are typically lower than those of loans or lines of credit, business cards can function as a short-term working capital tool for managing routine purchases and bridging gaps between billing cycles.

Invoice financing and factoring

Invoice financing allows businesses to borrow against outstanding invoices, while factoring involves selling those invoices to a third party at a discount in exchange for immediate payment. Both options can accelerate access to cash tied up in accounts receivable, helping businesses maintain working capital without waiting for customers to pay.

Merchant cash advances (MCAs)

A merchant cash advance provides upfront funding in exchange for a portion of future sales, with repayment typically occurring through automatic daily or weekly deductions. While MCAs are relatively easy to obtain, they often carry high effective costs and are generally used when other working capital options are unavailable, particularly by businesses with consistent card-based revenue.

How to apply for an SBA working capital loan: A step-by-step guide

SBA loans are a common source of working capital for small businesses because they are partially guaranteed by the Small Business Administration, which reduces risk for lenders and expands access to financing.

However, applying for an SBA working capital loan can be more involved than applying for other types of financing. The process typically requires detailed documentation, strict eligibility checks, and longer approval timelines. The steps below outline general guidelines to help you understand what to expect and how to prepare when applying for an SBA loan:

Step 1: Determine your eligibility

Before applying, ensure your business meets SBA requirements: you must operate as a for-profit business in the United States, qualify as a small business by SBA size standards, demonstrate a legitimate business purpose for the funds, and show ability to repay the loan. Check that you don't have any disqualifying factors such as outstanding government debts or recent bankruptcies.

Step 2: Choose the right SBA loan program

The SBA offers several working capital programs, with the 7(a) loan being the most common for general working capital needs. Other options include the SBA Express loan for faster processing with lower amounts, or specialized programs like disaster loans if you're recovering from an emergency situation.

Step 3: Gather required documentation

Prepare comprehensive financial documents including at least two years of business tax returns, personal tax returns for all owners with 20% or more ownership, year-to-date profit and loss statements, balance sheets, business bank statements, and a current business debt schedule. Additional documentation may be required.

Step 4: Create a business plan

Another requirement for your application will be submitting a comprehensive business plan. Develop a clear explanation of how you'll use the working capital and how it will benefit your business. Include financial projections, market analysis, and a specific repayment strategy that demonstrates your ability to service the debt while maintaining operations.

Step 5: Find an SBA-approved lender and submit your application

Not all banks offer SBA loans, so research lenders in your area that participate in SBA programs. Complete the lender's application forms along with any additional forms required by your chosen program; SBA Form 1919 is typically used for 7(a) loan applications. Submit all documentation at once to avoid delays, and be prepared to answer follow-up questions or provide additional information.

Step 6: After approval, review the SBA loan’s terms

The lender will review your application, verify your information, and assess your creditworthiness and business viability. Once approved, carefully review the loan agreement including interest rates, repayment schedule, collateral requirements, and any covenants or restrictions before proceeding.

Step 7: Close the loan and receive funds

Complete final paperwork, provide any additional documentation requested, and sign closing documents. After closing, funds are typically disbursed either as a lump sum or as a line of credit you can draw from as needed.

Turn working capital into business momentum with Slash

Slash Working Capital is a flexible line of credit built for businesses that need working capital without long-term commitments. It provides access to flexible financing with 30, 60, or 90-day repayment terms, allowing you to match repayments to your revenue cycles. Pricing is straightforward, with no collateral requirements, no personal guarantees, and no penalties for early repayment.

To apply, businesses are asked to provide basic information, including an estimate of annual revenue and connections to their bank accounts for revenue verification. Eligibility is based on standard factors such as business requirements, revenue thresholds, and credit review. Many businesses can receive instant approval for funding amounts up to $150,000, with higher limits available for those that submit additional information.

In addition to financing options, Slash can support your everyday financial operations with core banking features that can support how your business moves and manages its money, including:

- High cashback corporate cards: The Slash Visa® Platinum Card earns up to 2% cash back on company spending. Businesses can issue unlimited virtual cards, apply granular spending controls, receive real-time alerts, and sync card transactions directly with cash flow analytics in the Slash dashboard.

- Modern business banking: Create separate virtual accounts to organize cash flows. Send payments through global ACH, domestic and international wire transfers to over 180 countries via SWIFT, as well as instant payment networks like RTP and FedNow.

- Accounting integrations: Automatically sync transaction data with QuickBooks for simplified reconciliation and reporting. Connect via Plaid to integrate with additional financial tools, or import data from Xero to enhance your accounting workflow.

- Cryptocurrency payments: Integrated conversion tools let you convert business funds into USD-pegged stablecoins like USDT or USDC for blockchain-based payments, which can cut transaction costs and processing times—especially when sending funds overseas.⁴

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Frequently asked questions

How does business seasonality impact loan needs?

Seasonal businesses often experience uneven cash flow, which can create short-term funding gaps during slow periods or ahead of peak demand. Working capital loans are commonly used to cover operating expenses or inventory purchases until revenue rebounds.

6 Working Capital Management Solutions for Business Growth

Why would my business not qualify for a loan?

Loan applications may be declined due to factors such as limited operating history, inconsistent revenue, weak cash flow, high existing debt, or poor credit. Lenders may also deny applications if financial documentation is incomplete or the business does not meet minimum eligibility requirements.

What type of loan does not require a credit check?

Most traditional loans involve some form of credit review, but options like merchant cash advances or certain invoice factoring arrangements may place less emphasis on credit history. Instead, these products typically rely on sales volume or outstanding receivables, often at a higher overall cost.