Understanding Payment Terms and Their Impact on Business Cash Flow

When you send an invoice without clear payment terms, you're essentially letting your client decide when, or if, they'll pay you. You’ve done the work and delivered the product, and now your cash flow depends entirely on their timeline, priorities, and internal payment processes. For many businesses, this lack of control creates a cycle of uncertainty: you can’t predict when money will arrive, plan expenses with confidence, or focus on your actual work because you’re busy chasing payments.

The fix is straightforward. Clear payment terms establish when payments are due, how they should be made, and what happens if deadlines aren’t met. This can shift the dynamic between you and your clients for the better: instead of hoping they will pay on time, you set clear expectations that both parties agree to from the start.

This guide explains how payment terms protect your cash flow and help you get paid consistently. We'll cover the different types of industry-standard payment terms, the legal frameworks that safeguard your business, and best practices for applying terms to different transactions. We'll also show how Slash's invoicing and analytics tools can help you create professional invoices, collect payments efficiently, and make informed decisions about your short-term cash flow needs.

What are payment terms?

An invoice documents a payment request for goods or services provided. While invoices serve as important records of transaction activity and proof of work completed or goods delivered, their enforceability depends on the underlying agreement between parties.

Payment terms on an invoice communicate when an invoice payment is due, how payment should be made, and any incentives or penalties that may apply to payment timing. These terms may be established through a signed contract, purchase order, prior business relationship, or by the client's acceptance of goods or services. Clear payment terms help businesses manage cash flow and set expectations with clients about when and how they'll receive payment.

The specific terms included in an invoice depend on the type of goods or services being provided and the agreement between parties. Common elements of payment terms include:

- Due dates: The specific date by which payment must be received. The due date establishes clear expectations and helps businesses manage their cash flow and accounts receivable.

- Payment methods: The accepted payment options available to clients, such as credit card, bank transfer, check, cash on delivery (COD), or line of credit. Specifying payment methods upfront helps streamline the payment process and ensures clients can pay the invoice using their preferred method.

- Discounts: Early payment incentives that encourage clients to pay before the standard due date. These discounts can incentivize faster payment and improve your business's cash flow.

- Late fees: Penalties or interest charges applied to overdue invoices, usually calculated as a percentage of the outstanding amount or a flat fee. Late fees help discourage late payment and compensate for delayed cash flow.

- Billing cycles: The regular schedule for invoicing clients. Consistent billing cycles can help both you and your clients plan for payment periods and manage budgets effectively.

- Payment period: The specific timeframe within which payment must be made, which may differ from the due date in cases involving payment in advance, upfront payment requirements, or installment plans outlined in a contract.

- Advance payment requirements: Terms specifying when payment must be made before work begins or goods are delivered. Including these terms can protect small businesses from non-payment risk on large projects.

Clear payment terms set expectations, but having the right tools in place makes them easier to enforce. With Slash’s invoicing tool, you can generate professional invoices using your clients’ saved contact and banking information, embed payment collection links directly into your invoice emails, and clearly track payment status from your dashboard.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

The importance of establishing payment terms

Payment terms are the foundation of healthy business transactions. They protect both parties by establishing expectations upfront and creating a framework for when and how payment should occur. Without them, businesses risk confusion, delayed payments, and strained client relationships. Here are some of the advantages of establishing clear payment terms with your clients:

Improve cash flow management

The first and most obvious advantage of establishing clear, consistent payment terms is that they help structure your accounts receivable collection process, thereby improving your cash flow. Instead of hoping that a customer will pay you in a reasonable amount of time, payment terms allow you to predict when payments will arrive, so you can manage your expenses accordingly and prevent cash flow gaps.

Minimize late or missing payments

Clear payment terms don't just improve cash flow; they can help ensure you actually get paid, too. By specifying the due date, accepted payment methods, and consequences for overdue invoices upfront, you reduce ambiguity and give clients no excuse for delayed payment. This documentation becomes crucial if a client goes radio silent or disputes the amount owed, giving you leverage to pursue payment through follow-up communications or, if necessary, legal action.

Incentivize faster payments

While payment terms establish final deadlines, they can also be used to encourage earlier payment through discounts or other incentives. Early payment discounts give clients a financial reason to pay invoices quickly. This creates a win-win situation: your client saves money while you receive payment sooner, improving your immediate cash flow. Faster payment means you can cover your own expenses on time, reinvest in your business, or take advantage of time-sensitive opportunities without waiting for the standard due date.

Build trust with clients

Establishing clear payment terms isn't aggressive or rude. It's professional. Clients often appreciate the transparency and clarity that well-defined terms provide. When you specify payment expectations upfront, you eliminate awkward conversations later and demonstrate that you run an organized, legitimate operation. This professionalism strengthens your business relationships and positions you as a reliable partner rather than someone who has to chase payments months after delivering goods or services.

Protect your business legally

Finally, payment terms create a legal framework for your transactions. While the exchange of goods or services implies an obligation to pay, having clients acknowledge your invoice and its payment terms provides stronger legal protection. In the event of a payment dispute or non-payment, documented payment terms serve as evidence of the agreed-upon arrangement. This documentation can be critical if you need to pursue collection efforts or take legal action to recover what you're owed.

7 common types of payment terms

Payment terms define when and how your clients are expected to pay. Choosing the right structure helps you manage cash flow, reduce delays, and set clear expectations from the start. Below are seven common types of payment terms and how each one works:

- Net 7/30/60/90: Establishes a payment deadline within a set number of days after the invoice is received. The number indicates how many days a client has to pay; net 30 means payment is due within 30 days, net 60 for payment within 60 days, and so on.

- Due on receipt: Requires immediate payment when the client receives the invoice, with no grace period. This is the most aggressive payment term and works best for small invoices, one-time transactions, cash-based businesses, or situations where you need immediate payment.

- 2/10 Net 30: Offers an early payment discount to incentivize faster payment. The client receives a 2% discount if they pay within 10 days of the invoice date; otherwise, the full amount is due within 30 days. You can adjust these numbers (e.g. 1/15 Net 30 or 3/10 Net 45) based on how aggressively you want to encourage early payment.

- CIA/CWO: Cash in advance or cash with order; requires full or partial payment before any work begins or goods are shipped. Many businesses may request a percentage upfront (e.g. 50% payment in advance) with the full balance due upon completion.

- COD: Cash on delivery; requires payment at the exact moment goods are delivered or services are completed. The client pays the delivery driver, service provider, or business representative on-site before taking possession of goods or accepting completed work. This is common in shipping, retail delivery, and field service businesses.

- EOM: End of month; sets the payment deadline at the last day of the month in which the invoice was issued. For example, any invoice dated in February (whether February 1 or February 25) would be due by the end of February. Some variations include "Net 30 EOM," meaning payment is due 30 days after the end of the month the invoice was issued.

Lastly, for larger projects or ongoing work, installment or milestone-based payment terms can be used to divide the total amount due into multiple payments tied to specific deliverables or timeframes. For example, a web design contract might specify 30% upfront, 40% upon design approval, and 30% upon completion. These terms can benefit both parties: the client only pays for completed work, while you receive payment throughout the project rather than waiting until the end.

Best practices for establishing clear payment terms

Clear payment terms are only effective if they are written and applied consistently. Small details in wording and structure can make a significant difference in how quickly and reliably you get paid. The following best practices will help you establish terms that are easy to understand and enforce:

Use specific, unambiguous language

Vague payment terms like "Pay soon" or "Payment expected shortly" leave too much room for interpretation and can lead to delayed payments. Instead, use precise language such as "Due within 30 days of invoice date" or "Due on November 15, 2026" so there's no confusion about the deadline.

Make payment terms highly visible

Your payment terms should be easy to find on the invoice. Place them prominently near the total amount due, in the header, or in the footer where clients naturally look when reviewing the document.

Align invoice terms with your contract

Your invoice payment terms should always match what was agreed upon in the original contract, purchase order, or verbal agreement. Inconsistencies between contracts and invoices can create confusion, erode trust, or give clients a reason to dispute or delay payment.

Clearly state late payment penalties

Don't assume clients understand there will be consequences for late payment. Explicitly state your late fee policy on every invoice, such as "A 1.5% monthly interest fee will be applied to invoices overdue by more than 10 days" or "Late payments are subject to a $50 fee."

Specify accepted payment methods

Tell clients exactly how they can pay the invoice with a clear list such as "Payment accepted via bank transfer (ACH), credit card, or check." Providing multiple payment options makes it easier for clients to pay quickly using their preferred method.

Offer early payment discounts

Incentivize faster payment by offering a small discount for early settlement. Terms like "2/10 Net 30" (2% discount if paid within 10 days, full amount due in 30 days) give clients a financial reason to prioritize your invoice and can significantly improve your cash flow.

Include both net terms and specific due dates

While "Net 30" is standard, it can create confusion about when the 30-day period actually starts. You can eliminate ambiguity by including both the net terms and a specific calendar date, such as "Net 30 (Due Date: January 25, 2026)."

Choosing the right invoice terms and conditions

Choosing the right payment terms for an invoice depends on your cash flow needs, the type of work you do, and your relationship with each client. Before deciding which terms to use, assess your financial obligations and consider how different terms might work across various client types and project sizes. Here are some considerations to help you choose payment terms that align with your business needs:

Assess cash flow needs

Start by understanding your short-term cash flow requirements and when you need funds to cover your own expenses. Review your upcoming bills, payroll obligations, and other financial commitments to determine how quickly you need to receive payment from clients. With Slash, you can get detailed insights into your cash flow trends through the analytics dashboard. The dashboard shows recent and upcoming payment obligations and breaks down which payment methods are receiving payments most frequently.

Consider industry standards

The typical deliverable timelines and transaction structures in your industry should inform how you structure your payment deadlines, discounts, and late fees. For example, you wouldn't normally expect full payment due on receipt for a large custom project that takes months to complete. Instead, milestone-based payment structures are more appropriate for that type of work. Understanding what's standard in your field helps you set terms that feel reasonable to clients.

Review client payment history

Tailor your payment terms based on each client's track record and financial stability. Long-term clients with a history of on-time payment can be offered more favorable terms like net 45 or net 60, which builds goodwill and strengthens the relationship. New clients or those with a history of late payment should receive stricter terms such as payment in advance, net 15, or cash on delivery to protect your cash flow and minimize risk.

Factor in project size and scope

The size and complexity of a project should influence your payment structure. Small, quick projects under a few thousand dollars can typically use simple terms like net 30 or due upon receipt. Larger projects or contracts spanning several months benefit from installment or milestone-based payment terms that break the total amount into manageable chunks, ensuring you receive payment throughout the project rather than waiting until completion for a large lump sum.

Legal aspects of payment terms

In the U.S., payment terms for the sale of goods and services are primarily governed by the Uniform Commercial Code (UCC), a standardized set of laws adopted by all 50 states that regulates commercial transactions. The UCC establishes default rules for payment timing, delivery obligations, and remedies when buyers fail to pay for goods or services. For service-based contracts, state contract law typically applies, which means the specific terms you include in your invoice or contract determine your rights and obligations.

If you work with international clients, be aware that payment terms may be governed by different legal systems depending on where your client is located and where the contract was formed. The E.U., U.K., Canada, and other regions have their own commercial codes and payment regulations that differ significantly from U.S. law. When dealing with cross-border transactions, specify which country's laws govern the contract and consider consulting with legal counsel to ensure compliance.

Following legal guidelines when setting your payment terms can protect your business in multiple ways:

- Legally compliant terms make your contracts enforceable, meaning courts will uphold them if you need to pursue legal action for non-payment.

- Compliance ensures any late fees, interest charges, or penalties you impose are valid and collectible rather than being thrown out as unenforceable or usurious.

- Well-structured payment terms provide clear documentation of the agreement, which strengthens your position in disputes.

For payment terms to be legally binding, both parties must agree to them, either through a signed contract, acceptance of goods or services, or acknowledgment of the invoice. Once agreed upon, these terms give you legal remedies if the client fails to pay.

Simplify invoicing and improve cash flow with Slash

Managing payment terms effectively requires the right tools to create professional invoices, manage cash flow, and collect payments. Slash invoicing lets you generate professional invoices with your company's custom branding and use saved banking information for your contacts. You can embed payment collection links directly in invoice emails and track payment status in real time. Offer your clients multiple payment options, including credit card, ACH, wire transfer, or crypto to get paid faster in the method that works best for you.

Slash's analytics dashboard gives you clear visibility into your cash flow to help you make informed decisions about your payment terms. The dashboard shows recent payments received and upcoming payment obligations, giving you a clear view of your financial position at any given time. You can also monitor payment patterns across different clients and methods to identify opportunities for faster collection. With Slash, you can choose more effective payment terms, maintain healthier cash flow, and spend less time chasing down overdue invoices.

Here are some of Slash’s additional features to optimize how your business manages it finances:

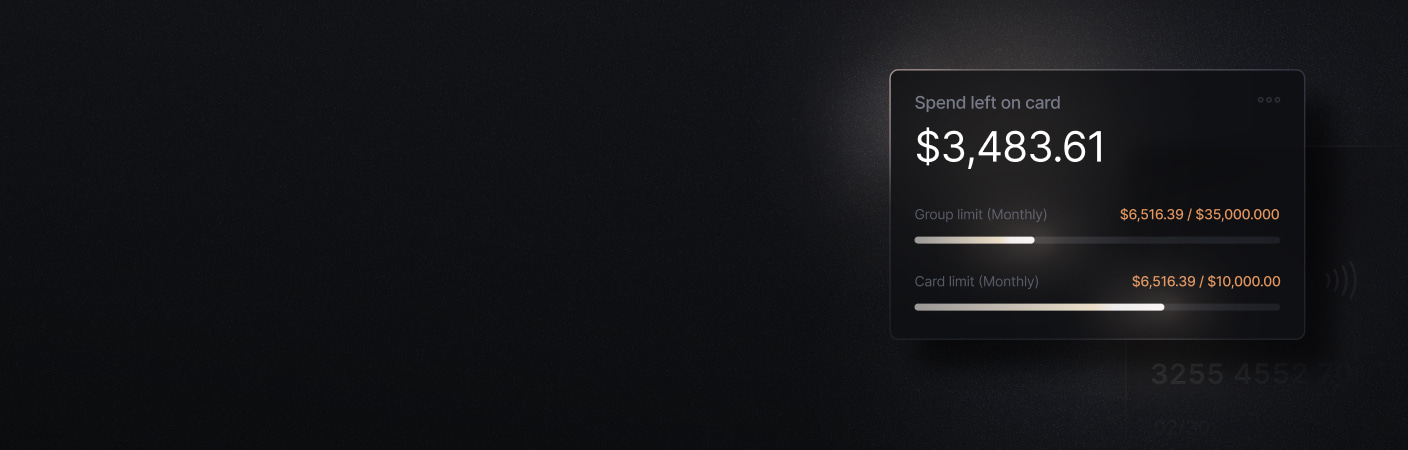

- Slash Visa® Platinum Card: Earn up to 2% cash back on business expenses, set customizable spending controls and limits, and issue unlimited virtual cards for your team members, vendor payments, and subscriptions.¹

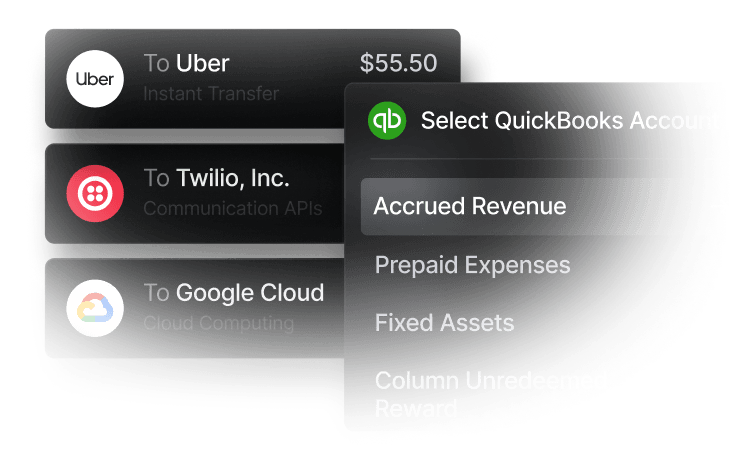

- Accounting integrations: Automatically sync transaction data with QuickBooks for simplified reconciliation and reporting. Use Plaid to connect with additional financial tools, or import data from Xero to enhance your accounting workflow.

- Diverse payment methods: Support for global ACH settlement, wire transfers to 180+ countries, and real-time payment rails like RTP and FedNow. Pro users pay no additional per-transaction fees.

- Working Capital Financing: Access short-term financing with flexible 30-, 60-, or 90-day repayment terms to bridge cash flow gaps when needed.⁵

- High-yield treasury accounts: Earn up to 3.86% annualized yield on idle funds with money market investments from BlackRock and Morgan Stanley, all managed directly from your Slash account.⁶

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Frequently asked questions

Can I change payment terms for existing clients?

Absolutely, but it’s best to communicate any changes in advance and clearly explain your reasoning. For clients with ongoing contracts, review your contract first to see if payment terms are pre-specified; in this case, they would need to be renegotiated.

What happens if a client refuses to pay an invoice?

Start by sending a polite payment reminder, then escalate to a formal demand letter outlining the amount owed and potential consequences like late fees or legal action. If informal collection efforts fail, you can hire a collection agency, file a small claims court case, or pursue a lawsuit while documenting all communications.

Business Fraud Prevention: A Guide for Protecting Your Company

Are verbal payment agreements legally binding?

Verbal payment agreements can be legally binding, but they're much harder to enforce than written contracts because there's no documentation proving what terms were agreed upon. Always put payment terms in writing through a contract, invoice, or email confirmation to protect both parties and create a clear record of the agreement.