Foreign Exchange Risk Management: Strategies to Protect Your Business from Currency Volatility

Many business owners understand that currency values fluctuate. What may catch them off-guard is discovering how much money they're losing to foreign exchange risk.

Transactional FX risk emerges during the settlement period of international payments. When you pay overseas suppliers, currency appreciation in their market means your dollars buy less, increasing your actual costs.

Conversely, when you collect revenue from foreign customers, currency depreciation means you receive less value when converting those funds back to your home currency. The slower the payment method, the longer you're exposed to these shifts, and over time the losses compound.

Businesses aren’t powerless against foreign exchange risk. A range of FX risk management strategies exist, from operational decisions that reduce exposure altogether to financial tools that help stabilize outcomes. The right approach depends on how frequently you transact internationally, how predictable your cash flows are, and how much volatility your business can reasonably absorb.

Slash is a modern business banking platform that can help companies manage and reduce FX exposure.¹ With flexible payment rails, native stablecoin support, end-to-end USD payments, and real-time cash flow visibility, Slash enables better protected global transactions without the overhead of managing a dedicated forex operation or trading desk.⁴

What are foreign exchange risks?

Foreign exchange risk (also called currency risk, FX risk, or exchange-rate risk) refers to the potential financial impact caused by fluctuations in currency values during international transactions.

Fiat currencies, or government-issued money not backed by a physical commodity, constantly shift in value based on exchange rates influenced by central banks, interest rates, and global trade dynamics. When businesses transact across borders, these shifts can create mismatches in value between the time an agreement is made and when payment settles—often resulting in one party absorbing a loss.

Here's how it works. Imagine a U.S. based company working with a supplier in India. You agree on a contract for materials worth $500,000 that will be payable in 30 days. If the rupee appreciates in value over that period and the U.S. dollar stays the same or depreciates in value, then the initial agreed-upon $500,000 payment will no longer cover the costs of goods being sold. The end result is a higher-than-expected payment.

The more frequently a business transacts internationally, the more these risks compound. Broader forces such as central bank policy decisions, interest rate changes, and macroeconomic trends also can influence currency volatility and can magnify FX exposure over time.

Slash business banking

Works with cards, crypto, plus cards, crypto, accounting, and more.

Understanding the 3 types of foreign exchange risk

Foreign exchange risk generally falls into three categories: transaction risk, translation risk, and economic risk. While all three relate to shifts in the foreign exchange market, each can affect businesses in different ways:

Transaction Risk

Transaction risk arises from the delay between entering into a contract and settling payment in a foreign currency. If the currency you’re paying appreciates before settlement, your costs increase. If the currency you’re receiving depreciates, your revenue decreases when converted back to USD. This type of risk most directly affects importers, exporters, e-commerce businesses, and any company with international suppliers or customers.

Translation Risk

Translation risk occurs when a parent company converts the financial statements of foreign subsidiaries into its home currency for reporting purposes. While this doesn’t always result in immediate cash losses, it can materially change how revenue, assets, and liabilities appear on financial statements. For example, if a U.S. company owns a European subsidiary reporting in EUR, a strengthening dollar makes the subsidiary's revenue appear lower when translated to USD.

Economic Risk

Economic risk, sometimes called forecast risk, reflects the long-term impact of currency movements on a company’s competitiveness and market value. Exchange rates can influence pricing power, demand, and cost structures over time. A stronger dollar can make U.S.-manufactured goods more expensive abroad while making foreign competitors’ more attractive domestically. Even businesses without direct foreign transactions can feel these effects through pricing pressure and shifting demand.

FX risk management: 7 practical strategies for mitigating currency risk

Companies take many different approaches to managing FX exposure. Strategies range from straightforward operational adjustments to sophisticated hedging techniques involving options, futures, and swaps. While advanced instruments can be effective, they’re often impractical for smaller global businesses. Below are eight common strategies for managing FX risk, along with guidance on when each approach makes sense:

1. Negotiate a forward contract

A forward contract locks in an exchange rate for a future transaction, reducing uncertainty around currency costs. If you know you’ll need to pay a supplier €500,000 in 90 days, a forward contract allows you to secure today’s exchange rate for that payment. These contracts work best for businesses with predictable payment schedules and pair well with platforms that support scheduled payments and automated transfers, such as Slash.

2. Quote your prices and require payments in US dollars

Requiring overseas customers to pay in USD shifts FX risk away from your business entirely. When invoices are denominated in dollars, revenue becomes predictable regardless of currency movements. However, this approach can strain customer relationships or limit market access in regions where USD payments are less practical.

3. Leverage cryptocurrency and stablecoins

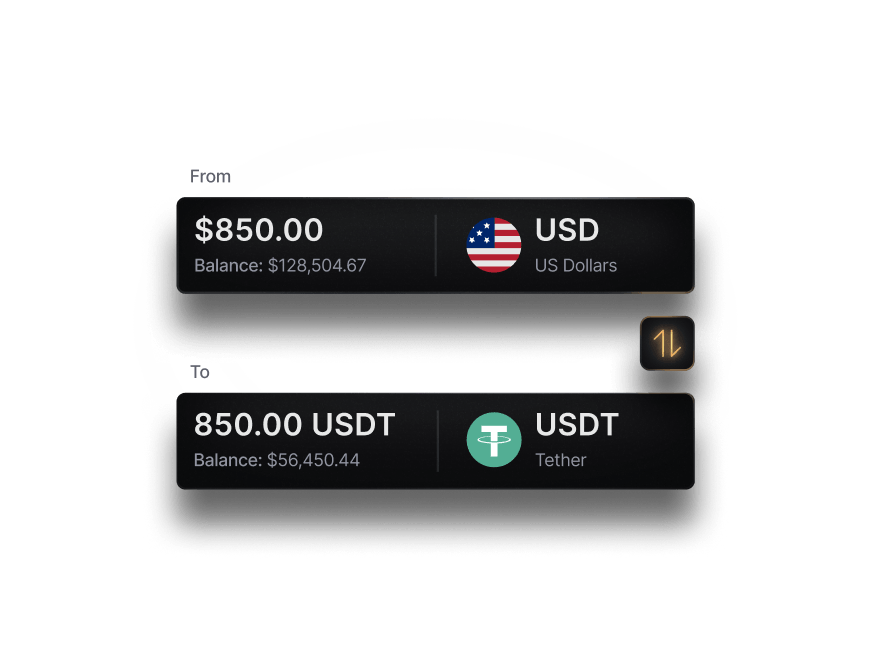

USD-pegged stablecoins like USDC and USDT allow businesses to transact in digital dollars without traditional currency conversion. Using stablecoins for international transfers can minimize one of the greatest sources of FX exposure: payment delays.

Crypto payments settle near-instantly on the blockchain, minimizing the possibility of currency values moving against you. Slash supports holding, sending, and receiving crypto with built-in on- and off-ramps, allowing even non-U.S. businesses to transact in USD without a U.S.-registered entity by using the Slash Global USD account.³

4. Open a multi-currency account

Multi-currency accounts allow businesses to hold balances in multiple currencies, reducing the need for frequent conversions. For companies with offsetting inflows and outflows in the same currency, this can meaningfully reduce FX exposure. However, managing balances across currencies requires careful cash planning and can increase exposure to translation risk.

5. Maintain correspondent bank accounts

Correspondent banking allows businesses to hold local currency accounts abroad, reducing conversion frequency. However, this approach is costly, operationally complex, and often requires large balances and dedicated FX teams. Slash’s Global USD Account offers a simpler alternative, enabling businesses to make USD payments with their partners without the need for foreign bank accounts or local entity setup.

6. Hedge with currency options or futures contracts

Currency futures and options allow businesses to hedge FX exposure using standardized financial contracts. Futures lock in rates, while options provide downside protection with upside flexibility. These tools require expertise, active management, and upfront costs, making them better suited for larger organizations with experienced forex trading teams.

7. Consider currency swaps

Currency swaps help manage long-term FX exposure by exchanging currencies upfront and reversing the transaction later at predetermined rates. While effective, they introduce counterparty risk and operational complexity and. Like options and futures, currency swaps are typically reserved for larger enterprises.

Choosing the right FX risk management tool: Key criteria

Modern business banking platforms can provide accessible tools to help minimize FX exposure without introducing unnecessary complexity. When evaluating solutions, consider the following capabilities:

Native cryptocurrency support

Native crypto support has become increasingly important for FX risk management. USD-pegged stablecoins offer an alternative to traditional forex markets, and near-instant settlement reduces the transaction risk created by bank processing delays. Slash combines crypto custody, payments across multiple blockchains, and built-in on/off ramps into one system, enabling faster, more cost-efficient global transfers.

Diverse payment method options

Access to multiple payment rails allows businesses to optimize each transaction based on urgency, size, and currency exposure. For high-value transfers where FX risk can exceed transfer fees, faster settlement methods are particularly valuable. Slash supports global ACH, international wires to 180+ countries, and crypto payments, giving businesses flexibility to choose the most cost-effective settlement method for any scenario.

Real-time tracking capabilities

Managing FX exposure requires visibility. Real-time analytics help businesses identify where currency losses occur, which suppliers or markets create the most risk, and where adjustments may have the greatest impact. Slash provides real-time cash flow tracking through its analytics dashboard to support more informed decision-making when managing foreign transactions.

Powerful expense management tools

While not directly tied to FX risk itself, using a platform that offers low–foreign transaction fee corporate cards, automated accounting workflows like reconciliation and invoice matching, and built-in invoice management can significantly reduce the operational burden of managing international transactions.

Slash brings these tools together in one system, including the Slash Visa Platinum Card with a low 1% or $0.40 foreign transaction fee, seamless QuickBooks integration, and upcoming invoicing features to help track and manage outstanding payments more efficiently.

Discover smarter global payment solutions with Slash

Slash can help businesses of all sizes manage FX risk without relying on complex forex trading strategies or fragmented tools. By combining traditional banking rails with stablecoin payments, Global USD accounts, and real-time financial visibility, Slash enables businesses to transact globally with more predictability and control. Slash can optimize your global payment strategy with feature like:

- Diverse payment rails: Global ACH, international wires to 180+ countries via the SWIFT network, and real-time payment options such as RTP and FedNow.

- Native cryptocurrency support: Hold, send, and receive crypto directly within the Slash dashboard. Use USD-pegged stablecoins like USDC and USDT for near-instant, low-cost transfers, with seamless on- and off-ramps between crypto and fiat for under a 1% conversion fee.

- Slash Visa Platinum Card: Customizable card controls, team-based spend rules, a low 1% or $0.40 foreign transaction fee, and up to 2% cashback on U.S. purchases.

- Powerful financial insights: Real-time cash flow analytics, seamless QuickBooks integration, and customizable tools for tracking and managing employee spend.

- Global USD Account: Enable international businesses to hold, send, and receive USD-denominated payments without a U.S. bank account. Onboard vendors to transact end-to-end in USD, helping simplify negotiations and minimize FX risk.

If your business regularly sends or receives cross-border payments, Slash can help you minimize FX risk—or eliminate it entirely—without adding operational complexity. Get started with Slash today and take control of your global payments.

Apply in less than 10 minutes today

Join the 5,000+ businesses already using Slash.

Frequently asked questions

What is FX exposure?

FX exposure is the potential for financial losses a company could face due to currency exchange rate fluctuations. Companies with FX exposure face uncertainty because they cannot predict exact currency values when payments settle or financial statements are translated.

What are the negative effects associated with foreign currency?

Foreign currency exposure can erode profit margins, complicate forecasting, and introduce volatility into cash flow. Exchange rate movements can also affect a company’s competitiveness in global markets. Platforms like Slash can help mitigate these risks through end-to-end USD settlement and faster global payment methods.

Mastering Cross-Border Fees: The Ultimate Guide on What They Are and How to Reduce Them

What is the safest foreign currency?

For U.S. businesses, the safest approach is often transacting in USD whenever possible. While this isn’t always feasible, tools like Slash’s Global USD Account can make USD settlement easier for overseas partners without sacrificing operational flexibility.