FX Charges: Understanding, Managing, and Reducing Extra Costs for Your Business

You may think that foreign transaction fees refer to all of the additional costs associated with overseas payments—but that isn’t the case. Foreign transaction fees are just one of several charges that can apply to cross-border transactions, and understanding how FX fees are added to your payments can help you identify opportunities to reduce costs and manage foreign exchange risk more effectively.

In this guide, we’ll explain FX fees in depth: why they exist, where they’re applied in the payment process, and how they can impact your business’s international operations. We’ll also cover broader concepts related to global payments, including currency conversion rates and FX risk management, to help you navigate cross-border transactions with greater confidence.

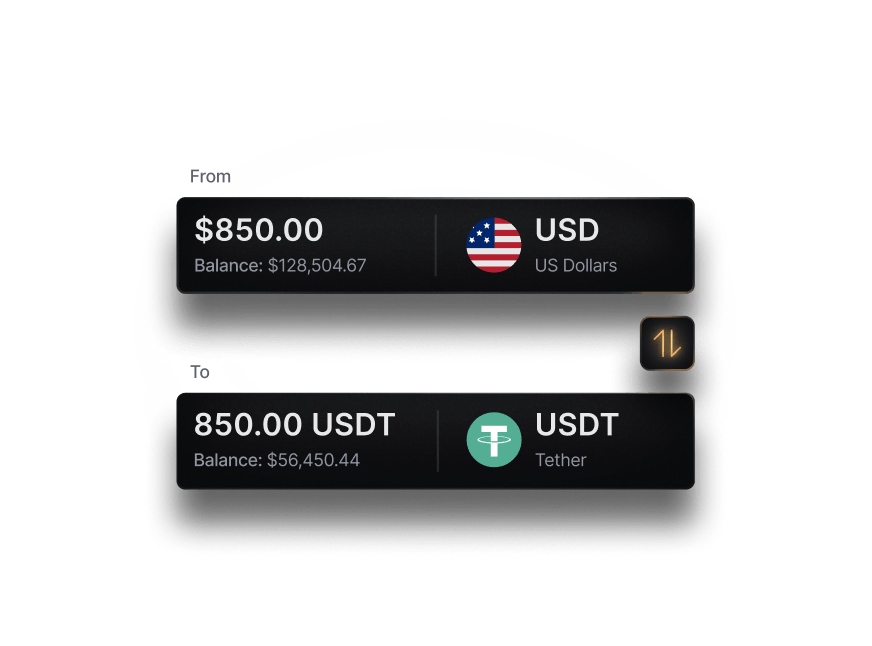

We’ll also show how Slash helps minimize your exposure to FX fees through modern global payment capabilities: spend company funds internationally with the Slash Visa Platinum Card, which charges a low 1% FX fee (or a $0.40 minimum).¹ Slash also lets you bypass traditional banking fees by enabling cryptocurrency payments directly within the dashboard, allowing you to hold, send, and receive USD-pegged stablecoins like USDC and USDT while seamlessly moving funds between your Slash account and the blockchain.⁴ Read on to learn more about how Slash can enhance your global payment strategy.

How forex fees work in today’s payments landscape

Foreign transaction fees, also referred to as foreign exchange or FX fees, are additional charges applied when a transaction involves converting one currency into another. These fees are most commonly encountered during international card payments, ATM withdrawals, or cross-border bank transfers.

Currencies constantly fluctuate in value relative to one another. These movements are tracked through foreign exchange markets, which establish the mid-market rate—the true, fee-free currency exchange rate between two currencies. While the rate shifts throughout the day, the daily average mid-market rate typically provides an accurate reference point for a foreign currency’s real value.

For example, converting U.S. dollars to Vietnamese dong at the mid-market rate would yield roughly $1 to ₫26,300, assuming no added surcharges. In practice, however, when you make a payment in VND using a U.S. credit card or bank account, the exchange rate you receive is often slightly worse than the mid-market rate. That difference—the markup added to the mid-market conversion rate—is the foreign transaction fee.

Foreign transaction fees are often just one of several surcharges that can apply to an international payment. Depending on the payment method and financial institutions involved, additional international transaction fees may include the following:

- Conversion fees: A bank or payment provider’s processing charge for facilitating the conversion of one currency into another. Unlike FX fees, conversion fees are not tied to the mid-market exchange rate itself; instead, they are fixed or percentage-based operational surcharges applied for handling the conversion.

- Processing fees: A broad category that includes per-transaction charges applied for initiating or routing a payment. These can include wire transfer fees charged by the originating bank, as well as additional processing fees imposed by intermediary or correspondent banks that help move funds through the international payment network.

- Settlement fees: Charges associated with clearing and settling transactions between financial institutions. These fees cover the back-end costs of reconciling payments, managing liquidity between banks, and finalizing fund transfers, and are typically embedded in the overall cost of international payments rather than shown as a separate line item.

With Slash, you can send international wires at a lower cost than most traditional banks at just $25 per transfer. The biggest cost savings, however, come from cryptocurrency payments. Sending USD-pegged stablecoins over the blockchain removes intermediary banks from the payment flow, eliminating many hidden fees and reducing settlement times from days to minutes.

Slash business banking

Works with cards, crypto, plus cards, crypto, accounting, and more.

How credit card FX fees actually work

When you use a credit card for an international purchase, multiple parties are involved in processing the transaction, including the card network (such as Visa or Mastercard) and the issuing bank. In many cases, the FX fee you pay is a combination of network-level costs and issuer markups.

The card network first converts the transaction from the merchant’s local currency into your card’s billing currency (usually U.S. dollars) using its own daily exchange rate, which is typically close to the mid-market rate. On top of that conversion, your credit card issuer may apply a foreign transaction fee, often expressed as a percentage of the transaction amount.

Visa and Mastercard both publish exchange rates and may include a small network assessment, while the issuing bank adds its own surcharge for handling the foreign transaction. These fees are usually applied automatically at settlement, meaning the final posted amount on your account may differ slightly from what you saw at checkout, even if the merchant displayed pricing in your home currency.

Finding foreign transaction fees on your credit card statement

Foreign transaction fees don’t always appear as a clearly labeled line item on your statement, which can make them easy to miss. Some credit card issuers list them explicitly as “foreign transaction fee” or “international service fee,” while others bake the cost directly into the converted transaction amount by applying a marked-up currency exchange rate.

To identify your credit card’s effective FX markup, start by comparing the transaction amount shown on your statement to the original purchase amount on the receipt. Divide the final posted amount by the original transaction amount, then compare the resulting figure to the mid-market rate on the transaction date. The difference between the two represents the FX and conversion markups applied by your card issuer.

For credit cards that itemize FX fees, review the transaction details or the monthly summary section of your statement, where these charges are often grouped together. For reconciliation purposes, recording the original transaction currency, converted amount, and applied exchange rate can help finance teams track FX costs over time and identify unusually high fees across cards or vendors.

6 smart strategies to avoid FX fees on international payments

1. Use cards or accounts with low FX markups

Not all “no FX fee” claims are equal. Some cards may eliminate the explicit foreign transaction fee but still apply a marked-up exchange rate. Look for:

- Transparent foreign transaction pricing, including FX markups and other fees.

- Visa or Mastercard network rates close to mid-market.

- Fewer intermediaries between you and the merchant.

2. Pay in the local currency, not your home currency

When given the option to pay in USD instead of the local currency, always choose the local currency. Dynamic currency conversion (DCC) almost always applies inflated exchange rates, which means that merchants and point of sale (POS) providers profit from the markup. Let your card network handle the conversion instead. And, if sending a bank transfer, look for bank service providers with multi-currency capabilities like Slash, which enables international payments in over 135 different currencies.

Additionally, before you withdraw cash at a foreign out-of-network ATM while traveling abroad, check if your debit card issuer will cover any fees or exchange markups.

3. Consolidate international spend on fewer payment methods

Spreading payments across multiple cards, banks, and processors makes FX fees harder to track. Centralizing spend can improve visibility into effective exchange rates, make it easier to identify high-cost providers and negotiate alternatives, and simplify reconciliation and FX reporting. With Slash, you get a unified global payment infrastructure that automatically records transaction details and enables seamless syncing with accounting platforms like QuickBooks.

4. Use local payment rails when possible

International wires and SWIFT transfers may involve correspondent or intermediary banks that can add hidden processing fees. Sending a global ACH payment to a regional clearing house network can limit the chance that your payment is processed through an intermediary. This strategy can be especially effective for recurring vendor payments. Slash can send global ACH payments on many different foreign clearing house networks, including SEPA, BECS, BACS, and more.

5. Leverage stablecoins for international payments

For businesses that operate globally in U.S. dollars, using USD-pegged stablecoins can be an effective way to avoid FX fees altogether. Because stablecoins like USDC or USDT are denominated in USD, there’s no currency conversion involved, which means no FX markup layered onto the exchange rate.

These payments also bypass correspondent banks and traditional international wire networks, reducing both processing fees and the risk of unexpected deductions along the way. In addition to lower costs, stablecoin transfers typically settle in minutes rather than days, making cash flow more predictable and easier to manage across borders.

The top credit cards built for international spending

Not all cards designed for international use are created equal. While many eliminate foreign transaction fees, fewer offer predictable FX pricing, broad global acceptance, and the operational controls businesses need to manage international spend at scale. Here’s how five popular options compare.

Slash Visa Platinum Card

The Slash Visa Platinum Card is the best card for businesses managing complex international transactions and want visibility and control over cross-border costs. The card is included with the Slash business banking platform and operates as a charge card with no revolving balances. Slash charges a transparent 1% FX fee (or $0.40 minimum) making international costs easier to forecast.

The Slash Card stands out for its operational depth. Card transactions automatically capture receipts, are categorized in real time, and can be managed with granular spend controls across teams. Because it runs on the Visa network, the card is accepted broadly worldwide, making it a practical option for both travelling abroad and international vendor spend.

American Express Business Platinum Card

The Amex Business Platinum is positioned as a premium charge card, carrying a $895 annual fee but no foreign transaction fees. It’s designed primarily as a rewards and travel perks card, offering point multipliers through the Amex Membership Rewards program and Amex Travel portal.

However, Amex’s closed card network limits acceptance in many international markets, particularly outside North America and Western Europe. From an operations standpoint, the card also falls short for teams: spend management features are relatively light, analytics are limited, and it functions as a single card for owners rather than a configurable card program for employees.

Bank of America Business Advantage Travel Rewards World Mastercard

The Bank of America Business Advantage Travel Rewards World Mastercard is a no-annual-fee travel credit card designed for basic international travel spending. The card earns points through the Bank of America Preferred Rewards program and avoids foreign transaction fees, making it a low-cost option for international use.

However, the card offers limited value beyond its fee structure. It lacks advanced spend controls, expense automation, and built-in analytics, making it less practical for teams or businesses managing ongoing international expenses. As a traditional credit card, it’s better suited for individual business owners regularly traveling abroad than for companies that need structured oversight and predictable international payment management.

Brex Card

The Brex Card is a corporate charge card included with the Brex platform, with pricing that scales based on the number of users. It supports global card issuance and offers built-in expense tracking and card controls, making it functional for distributed teams.

The primary drawback for international spending is cost. Brex charges a 3% FX fee—significantly higher than most competitors—which can materially increase expenses for businesses with frequent cross-border transactions. While Brex offers points-based rewards, their effective cash value is relatively low, making the higher FX fees harder to offset.

Capital One Venture X Business Card

The Capital One Venture X Business Card is a charge card with a $395 annual fee and no foreign transaction fees. It earns travel miles that can be redeemed for Capital One Rewards or used for booking through the Capital One Travel portal. The card is issued on either the Visa or Mastercard network.

Like many premium travel cards, however, the Venture X is intended for use by one business owner. Spend controls and analytics are limited, and the card functions as a single account rather than a configurable card program for employees. As a result, it’s best suited for owner-led travel spending rather than managing international expenses across a growing organization.

A Better Way to Manage Global Spend With Slash

FX fees and international payment costs don’t have to be confusing or unavoidable. When businesses understand how exchange rates, processing layers, and intermediaries affect cross-border payments, they can make smarter choices about how money moves internationally. With the right setup, it’s possible to reduce FX costs, speed up settlement, and gain better visibility into where fees are coming from.

Slash gives businesses more control over FX costs by offering multiple ways to send and receive money globally. With access to Global ACH transfers, wires to 180+ countries in 135+ currencies, and cryptocurrency payment options, finance teams can choose the most cost-effective method for each transaction instead of relying on high-markup defaults. All of this lives within a single banking and payments platform designed to simplify international operations. Here’s what Slash offers:

- Native cryptocurrency support: On- and off-ramp USDC, USDT, and USDSL with conversion fees under 1%, and send or receive stablecoins across 8 blockchains with processing that can take minutes, not days.

- Accounting integrations: Streamline how you verify international spending by syncing your Slash transaction data into QuickBook for automated reconciliation and reporting, helping you meet international financial reporting standards (IFRS).

- Slash Visa Platinum Card: Issue unlimited physical and virtual cards, group cards by team, set spending limits, and restrict categories—all with a low 1% FX fee (or $0.40 minimum) and up to 2% cash back on U.S. purchases.

- Real-time analytics dashboard: Track expenses and cash flow as they happen, with clear breakdowns by payment method, recipient, and currency.

- Global USD Account: Lets non-U.S. businesses access Slash’s full banking, payment, and crypto features without needing a U.S.-registered LLC.³

Apply in less than 10 minutes today

Join the 5,000+ businesses already using Slash.

Frequently asked questions

What credit card charges apply for currency conversion?

Credit cards typically apply a foreign transaction or FX fee, which is charged as a percentage of the purchase amount and added either as a separate line item or through a marked-up exchange rate. Some cards also pass along network or issuer-level processing costs tied to currency conversion.

How to Choose the Right Corporate Credit Card Program

What are the types of international transactions?

International transactions include cross-border card purchases, international wire transfers, global ACH or local bank transfers, and cryptocurrency-based payments. Each method carries different fee structures, settlement speeds, and levels of FX exposure.

Cross-Border Payments Guide: Choosing the Right Solutions

Can foreign transaction fees get refunded?

Foreign transaction fees are rarely refunded, as they’re generally treated as a standard cost of processing international payments. One way to reduce FX exposure is by using payment methods with transparent, lower FX fees or alternatives—such as the Slash Card’s low FX fee or platform support for cryptocurrency transfers.