Top Business Checking Accounts for LLCs: Fees, Features, and How to Select the Best for Your Business

For years, institutional banks and credit unions have largely operated the same way. Business checking accounts were built around paper checks, in-branch visits, and phone calls for basic account support. While these systems may feel familiar, they're outdated, built around workflows that made sense decades ago but no longer fit the needs of modern businesses. In reality, many of the limitations associated with traditional business banking persist more out of habit than necessity.

Modern banking platforms like Slash are built around eliminating these shortcomings by rethinking how businesses manage their finances.¹ Why use checks when digital payments can be faster and more secure? Why don’t cards automatically capture receipts and transaction details? Why do international payments still come with delays and hidden fees? Why isn’t more of accounting automated? Instead of accepting outdated processes, Slash delivers a digital-first banking platform designed to reduce costs, automate workflows, and give LLCs complete financial control.

In this guide, we'll evaluate the top business checking accounts for LLCs, compare how their fees and features stack up, and clarify what to prioritize when selecting an account that aligns with your modern business needs. We’ll also highlight how Slash goes beyond the capabilities of legacy banks, with more flexible payment options, real-time visibility into funds, centralized financial controls, and more.

What your business should expect from a business checking account

Business checking accounts once offered a fairly limited set of features. Most accounts were tied to a basic debit card, came with standard FDIC insurance coverage, and supported only a handful of electronic funds transfer (EFT) methods.

Today, businesses can expect more from their bank accounts to help manage finances. Modern business checking accounts may include features such as:

- Sweep-network FDIC insurance: Standard FDIC insurance covers up to $250,000 per depositor, per bank. With insured cash sweep networks, like the Column N.A. Sweep Network used by Slash, funds can be distributed across multiple banks to provide millions of dollars in FDIC coverage while keeping balances accessible.²

- Merchant services: Many business accounts now integrate with tools for accepting customer payments. Slash supports direct payment acceptance via platforms including Stripe, Shopify, and more.

- Charge or debit cards: Debit cards allow businesses to spend directly from their account balance, while charge cards are a newer alternative that allow short-term borrowing, with balances paid in full at the end of each billing cycle. Unlike debit cards, charge cards can earn rewards. Slash’s charge card earns up to 2% cash back and allows businesses to issue multiple cards with customizable limits.

- Virtual accounts: Some providers offer virtual or segmented accounts that allow businesses to separate funds for better cash flow management. Slash makes it possible to organize funds into distinct pools, improving visibility into account-specific trends and transactions.

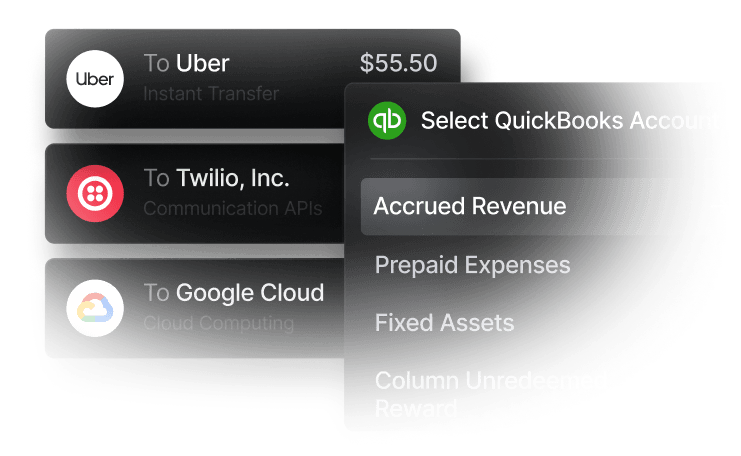

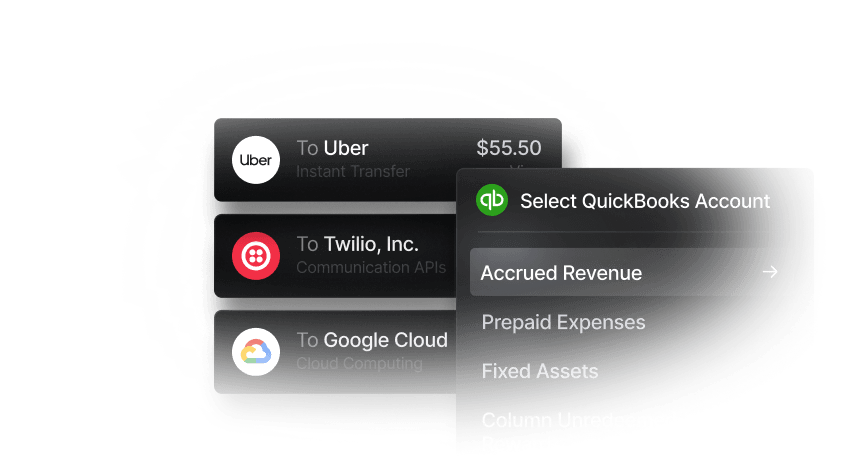

- Automation capabilities: Modern business accounts and cards can automatically collect transaction details, schedule and execute payments, route approvals, and export financial data to accounting platforms to support reconciliation, reporting, and audit preparation.

Evaluating different business banking options for LLCs

Not all business checking accounts work the same way, even when they appear similar at first glance. The section below breaks down how leading providers compare across fees, features, and overall flexibility for LLCs:

Slash

Slash is a digital-first business banking platform designed for companies seeking greater control over cash flow, payments, and spend management. The Slash Business Account supports configurable virtual accounts, making it easier to separate entities, departments, or specific cash flows from a single dashboard.

Slash Pro Business Account features and considerations:

- Fees and minimums: Free business checking with no minimum balance requirements. Unlimited free domestic transfers and 2% cashback are available with the Pro plan for $25 per month.

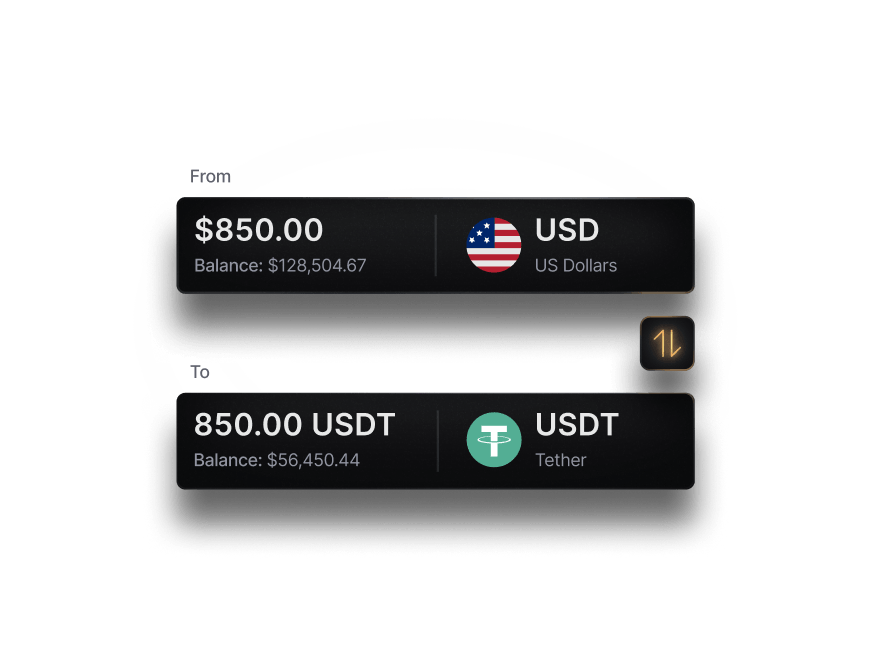

- Diverse transfers: Free, unlimited ACH transfers, domestic wires, and outgoing FedNow/RTP real-time payments, with international transfers available via wire to 180+ countries or through USD-pegged stablecoins like USDT and USDC.

- Cash back and cards: Unlimited virtual charge cards earning up to 2% cashback on company spending.

- Savings and insurance: Millions in FDIC insurance through the Column N.A. sweep network for business accounts.

- High-yield treasury accounts: Earn up to 3.93% annualized yield through money market funds from BlackRock and Morgan Stanley.⁶

- Merchant services: Built-in tools to accept payments through platforms like Shopify, Amazon, Stripe, and more.

Slash business banking

Works with cards, crypto, plus cards, crypto, accounting, and more.

Chase Bank

Chase offers traditional business checking accounts with in-branch access and a wide range of services, though many features depend on account tier and minimum balance requirements. The Platinum Business Checking Account comes with prohibitively high costs, requiring either substantial monthly fees or a high minimum balance that locks up capital.

Chase Bank Platinum Business Checking Account features and considerations:

- Fees and minimums: $95 monthly maintenance fee or $100,000 minimum balance. Fee waivers may apply based on activity and balances.Incidental fees: Only four free wire transfers per statement cycle; additional wires cost up to $40 each. Same-day ACH and real-time payments require added fees.

- Invoice tools: Built-in invoicing tools through the Chase app and online portal.

Ramp

Ramp prioritizes charge cards over traditional debit cards and offers a digital-first platform with automation and integration capabilities. However, Ramp gates access behind a steep minimum balance requirement at account opening, immediately excluding early-stage LLCs and businesses without substantial cash reserves already on hand.

Ramp Business Account features and considerations:

- Fees and minimums: Requires $25,000 minimum balance at account opening. Plans range from $0-$15/month/user. Costs can escalate quickly for growing teams.

- Cashback structure: Rewards capped at 1.5% cashback, lower than leading competitors

- Financing options: No built-in credit or financing products available

- Automations: Supports scheduled payments, approval workflows, and integrations with accounting software and ERPs

American Express National Bank

American Express National Bank (AENB) is the business banking arm of American Express. Despite Amex’s long history in banking, AENB is a relatively recent entrant to business checking, launching its account in October 2021. However, the debit card's rewards structure is surprisingly weak for an Amex product, earning a fraction of what cardholders typically expect and falling far below competitors' cashback rates.

AENB Business Checking Account features and considerations:

- Membership Rewards: Debit card earnings limited to just 0.5x points per dollar—significantly lower than Amex's credit and charge card offerings and well below competitor cashback rates

- Overdraft policy: No overdraft protection available; transactions exceeding your balance are declined rather than covered

- Fees and minimums: No monthly service fee and no minimum balance requirement

U.S. Bank

The U.S. Bank Gold Business Checking Package is offered in two versions: traditional and interest-bearing. While it includes some free transactions, the account imposes transaction limits that penalize businesses with high volumes, charging additional fees once you exceed the monthly cap. Additionally, U.S. Bank lacks the automated expense tracking and real-time financial visibility that modern fintech platforms provide.

U.S. Bank Gold Business Checking Package features and considerations:

- Transaction limits: Only 350 free transactions per month; additional transactions cost $0.45 each, adding up quickly for active businesses.

- Fees and minimums: $20 monthly service fee unless you maintain a $10,000 average balance.

- Interest rates: Interest-bearing versions of the account earn just 0.01% APY, well below most competitors.

Bluevine

Bluevine offers a small business checking account with interest-earning capabilities that vary by plan. However, accessing competitive interest rates requires paying a steep monthly fee that can quickly erode the value of higher yields, making the account financially viable only for businesses with large balances.

Bluevine Business Checking Account features and considerations:

- Interest structure: Competitive 3.0% APY requires $95/month Premier plan; Standard plan earns just 1.3% APY.

- Balance limits: Interest earned only on balances up to $250,000 on lower-tier plans; Premier increases cap to $3 million but at significant monthly cost.

- Transfer fees: $15 fee for external wire transfers across all plans; ACH transfers are free but take one to three business days.

Brex

Brex is designed for highly capitalized startups and larger businesses with complex financial needs, offering treasury features that provide higher yields at larger balances. However, the platform may be inaccessible for most LLCs, requiring significant capital and operational scale that excludes most small businesses from consideration.

Brex Business Checking Account features and considerations:

- Target customer profile: Restricted to well-funded startups and larger companies; most LLCs and small businesses don't qualify.

- Yield structure: Treasury yields favor large accounts. Balances up to $500,000 earn approximately 3.4% versus 3.75% for accounts holding $20 million or more.

- FDIC coverage: Up to $6 million in FDIC insurance.

Capital One

Capital One's Enhanced Business Checking is a standard business checking account designed for small to mid-sized businesses that want access to traditional banking services, including branches and a large ATM network. However, Capital One falls short on digital capabilities, offering limited automation and integration features compared to purpose-built fintech solutions.

Capital One Enhanced Business Checking features and considerations:

- Fees and minimums: $35 monthly service fee unless you maintain a $25,000 minimum balance.

- International wires: Incoming wires cost $15; outgoing wires cost $40–$50 depending on currency—among the highest fees for international transfers.

- Wire transfers: Only five free outgoing domestic wires per month; additional wires cost $25 each.

- ATM access: Fee-free cash withdrawals and deposits through the Allpoint ATM network.

Opening an online business bank account: What should you consider when selecting one?

LLCs come in many different structures and sizes, so there is no one-size-fits-all approach when choosing a banking partner. That said, every LLC should prioritize two core considerations: whether the banking system simplifies accounting and tax preparation, and whether it saves the business time and money. Below are key factors to consider when comparing different business bank accounts:

Monthly fees and minimums

Many banks charge monthly service fees or require minimum balances to avoid them. When evaluating options, look beyond the advertised monthly fee and review the full fee structure, including how minimum balance requirements compare to your LLC’s typical cash reserves. Slash business bank accounts have no minimum balance requirements and no monthly fees on the free plan.

Transaction limits and volume

Some business accounts limit the number of transfers or withdrawals allowed before additional fees apply. While domestic ACH transfers are often inexpensive, providers may offset this by charging higher fees for wire or international payments. With the $25/month Slash Pro plan, businesses can send unlimited domestic ACH, wire transfers, and real-time payments over RTP and FedNow without per-transaction fees.

Online banking access

While most banks offer online portals, not all provide the full functionality of a modern business banking platform. In some cases, businesses may need to call or email their bank to confirm transfer details or wait for mailed statements to review transaction activity. Slash provides real-time visibility across accounts, cards, and payments, allowing businesses to monitor cash flow and transaction details directly from the dashboard.

FDIC insurance and security

Today, account holders can access FDIC insurance well beyond the standard limits. Slash partners with Column N.A., which uses an insured cash sweep network to increase the total amount of FDIC insurance available by spreading deposited funds across multiple banks. Slash is also a SOC 2 Type II–certified financial services provider, reinforcing our commitment to protecting customer financial data.

Additional banking features

Many banks promote high-yield business savings accounts alongside business checking. However, businesses should carefully evaluate yields and access to funds when deciding where to hold idle cash. Slash partners with BlackRock and Morgan Stanley to offer money market accounts that earn 3.93% interest yield on your funds.

How to open a business bank account: Key requirements you should know

Opening a business bank account typically requires a mix of personal identification and business documentation. While exact requirements vary by bank and business structure, most financial institutions will ask for the following information:

Personal identification

Banks need to verify the identity of the business owner or authorized signers. This usually includes a Social Security Number (SSN) or another government-issued ID, such as a passport or driver’s license, as well as personal contact details, including name, phone number, and email address

Business entity information

Financial institutions also require basic details about your business to confirm its legal status:

- Legal business name as registered with the state.

- Business address, either physical or mailing.

- Type of business entity, such as a sole proprietorship, partnership, LLC, or corporation.

- Business registration certificate or state filing confirming the business is officially registered.

Federal and tax documentation

Tax identification is required to support reporting and compliance. During your application, you’ll likely need your LLC’s Employer Identification Number (EIN) issued by the IRS. In some cases, sole proprietors without employees may be allowed to use an SSN instead, depending on the bank’s policies.

Formation and governing documents

Depending on your business structure, banks may request documentation that outlines ownership and authority, including:

- Articles of Incorporation for corporations.

- Corporate bylaws that define governance and decision-making authority.

- LLC operating agreements that describe ownership and responsibilities.

- Partnership agreements showing who is authorized to act on behalf of the business.

- Additional documents that help confirm business ownership or structure, if required.

Licenses and certificates

Some banks may also request proof that your business is authorized to operate by asking for a valid business license. Requirements may vary depending on your state or local jurisdiction.

Making the switch to Slash for business banking

Choosing the right business checking account for your LLC means looking beyond basic banking services and evaluating how your account can actively support your operations. It’s important to consider how an account handles fees, supports online access, and reduces manual work as your operations become more complex.

Slash removes many of the structural constraints that can complicate day-to-day banking for LLCs. Without minimum balance requirements or per-transaction limits, businesses have more flexibility in how and when they move money, manage spending, and allocate cash across accounts. A simpler fee structure also reduces the need to track thresholds or avoid incidental charges.

At the same time, built-in automation helps handle routine financial tasks that are often manual with traditional banks, from payment workflows to transaction tracking. Taken together, these features make Slash a practical option for LLCs that want a business checking account designed to support ongoing operations, rather than one that adds administrative overhead as the business grows.

Whether you're just forming your LLC or scaling an established operation, Slash provides the tools and flexibility to manage your finances efficiently while keeping more capital in your business where it belongs.

Apply in less than 10 minutes today

Join the 5,000+ businesses already using Slash.

Frequently asked questions

Can I use my personal bank account for my LLC?

While it can be legally possible for single-member LLCs, using a personal account can blur the line between personal and business finances, complicate accounting and tax preparation, and weaken liability protection. Most LLCs benefit from keeping business transactions in a dedicated business checking account.

What Is Business Spend Management? Key Components Explained

Is it better to open a business bank account online or in-person?

Online accounts are often faster to open and tend to offer more automation and lower fees, while in-person accounts may be useful if you need branch access or cash services. The better option depends on how your LLC handles payments, deposits, and day-to-day banking.

How do transaction limits affect which bank account is best for an LLC?

Transaction limits can lead to unexpected fees as payment volume grows, especially for businesses that send frequent transfers or wires. Accounts with higher or unlimited transaction allowances are generally better suited for LLCs with active cash flow and recurring payments.