How to Categorize Expenses for Accurate Business Bookkeeping

Business expense categorization does more than rein in your budget – it also allows you to accurately claim and deduct taxes for business expenses on your annual IRS returns. Deductible business expenses are determined by this categorization, easing your tax burden and freeing up capital for greater flexibility. In order to unlock these deductions and track expenditures within your company, it’s helpful to set up a precise expense categorization process.

Developing expense categories gives you a clearer picture of where, when, and why payments are made, enabling cleaner financial reports and fixing issues before they arise. Without the ability to track category expenses, growing organizations can quickly become overwhelmed with charges from unexpected sources. Modern organizations utilize expense management software to automate data entry, unlock greater visibility, and take control of their business expenses. The question remains, though: what is the right piece of software?

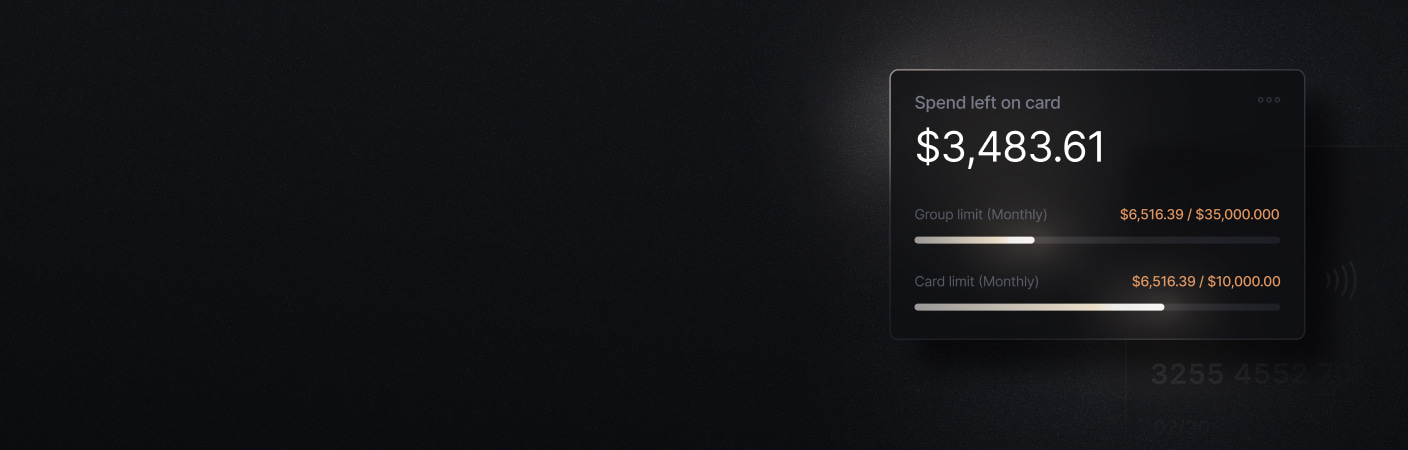

Slash automatically records transactions and categorizes expenses across your company’s corporate cards and payments all on a single platform.¹ With the ability to instantly categorize expenditures and sync with tools like Quickbooks and Xero, you’ll get expanded control of your organization’s cashflow and a clearer path to deductible business expenses. Let’s break down some typical expenses companies encounter, how they should be organized, and when business tax deductions may arise.

Understanding Business Expense Categories

Categorizing business expenses is the act of identifying and sorting various types of payments for purposes of boosting visibility, staying organized, and taking advantage of tax deductions. For example, the cost of employee health insurance should be logged separately on the balance sheet from employee salaries.

For the record, expense categorization shouldn’t be confused with budgeting – budgeting cuts back on spending, while categorizing clarifies and reports it.

Sorting business expenses effectively is beneficial for scaling companies and finance teams that are looking to keep accurate records and get the most out of their spending.

Common Types of Business Expenses

Business expense categories are often very granular; your company can end up with a few dozen different types of spend on its balance sheet. Some are fixed while others are variable, and some are routine while others are unexpected. Certain business expenses are tax deductible, but only in certain scenarios. Good news; we purpose-built Slash’s expense tracking software to cure the headaches associated with sorting these manually.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

How to Categorize Expenses: 15 Standard Business Expense Categories

Let’s dive into 15 of the most common expense categories. Many of these can split into their own distinct sub-categories, unlocking specific, actionable insight into your business’ spending habits.

Materials

The purchasing of raw materials is a pivotal factor for any manufacturer or construction company’s profit margins. Knowing the cost of goods, how much you’re spending on materials, and how often transactions are made is a great way to keep operations organized. Materials are also one of many business expense categories that can be tax deductible.

Office Supplies

Along with the standard pens and paper, office supplies can encompass computers, internet, wi-fi, printers, ink, bathroom supplies, telephones, and a host of other miscellaneous items that serve business purposes. Just like with corporations and small businesses, the IRS also allows workers with home offices to deduct these expenses on their tax returns.

Utilities and Upkeep

There are a number of cyclical expenses that come with maintaining your workplace, including rent, utilities, infrastructure updates, repairs, and cleaning. Consistent maintenance is even more critical for warehouses and factories.

Marketing & Advertising

Certain businesses treat marketing and advertising as an afterthought, while others lean heavily on long-term campaigns. Either way, advertising should be included as an expense category, both in cases as simple as social media posts or as complex as business expo booths.

Research & Development

R&D refers to the actions companies take to innovate current products, develop new products, and stay on the forefront of their field. It’s a process that looks different for each organization, but usually brings its own business expenses.

Employee Hiring & Training

The business expenses accrued from hiring & onboarding employees can catch organizations by surprise; losing, replacing, and training a position may cost roughly half that position’s salary. Turnover is expensive, so it’s wise to keep your team happy – but that’s a conversation for another time.

This expense category also includes recurring training and education as individuals grow within your company, which is commonplace in fields like science/healthcare as well as in regards to OSHA guidelines.

Employee Salary & Benefits

Nowadays, paychecks are only one part of an employee’s compensation & taxable income. You have the typical benefits of health insurance and 401k plans, but perks can also extend to stock options, retirement plans, wellness programs, meals, daycare, and more.

Contractor Payments

Conversely, paychecks to agencies and self employed contractors typically make up the entirety of their compensation. This can apply to CPA services, hiring agencies, legal fees, freelancers, or anyone else that your business pays to do temporary work.

Insurance

There are many different kinds of insurance a company can carry for itself, such as property insurance, liability & worker’s compensation, and even cyber insurance. Make sure not to include employee health insurance in this group - that’s one of the common expense categorization mistakes we’ll examine later on.

Vehicles/Depreciation

Another type of insurance is auto insurance, which is a significant factor for businesses with fleets of trucks or vans. One cost of vehicular ownership that’s more hidden than purchasing, insuring, and gas is depreciation.

It’s often said that your car loses value the second it leaves the dealer’s lot, and that’s true of a business’ vehicles as well. Tracking the gradual depreciation of trucks and vans is key to recognizing the true worth of your fleet – and when you might need reinforcements. This approach applies to more than just vehicles, as machinery, computers, and other types of office materials depreciate in a similar fashion.

The IRS also allows you to deduct vehicle ownership and gas expenses, as long as the vehicle is used strictly for business purposes.

Subscriptions & Licenses

Recurring payments like property taxes, licenses, and permits never go away, but can be easy to overlook when categorizing expenses. Software subscriptions are just as important to monitor, as many companies lean on HR, design, and project management platforms.

Interest

Interest can come from many different sources, including property mortgages, business loans, lines of credit, business credit cards, or outstanding debt. Interest payments can get out of control rather quickly, so it’s vital to gain visibility into what’s coming and when.

Security

Some organizations are armed with heavy cybersecurity contracts, while others use high-tech systems on facility grounds. Whether you’re guarding against hacks & breaches or protecting proprietary technology, security is an expense category that may be important for your business.

Business Travel & Accommodations

Many organizations are regular attendees at national business conventions, which means booking flights & hotels for each employee that joins. Meals, rideshare bills, and seminars often contribute to the trip’s total travel expenses. Interestingly, meals for business purposes are 50% tax deductible according to the IRS, not 100%.

Banking Fees & Payment Processing

Finally, any company with multiple financial accounts and a consistent cash flow can expect to accrue lots of different bank fees & transaction charges. Wire transfer fees, international transaction fees, merchant service fees, and bank fees are some examples of small charges that attach themselves to payments of all kinds. For businesses looking to save on monthly account fees and wire transfers, the Slash Pro plan may be your answer.

Common Reporting Mistakes to Watch For

It can be easy to make mistakes while arranging expense categories, which often lead to complications down the road. Some common ones include:

- Lumping employee health insurance in with company insurances.

- Ignoring small office supply purchases in favor of more significant ones.

- Missing tax deduction opportunities and/or misidentifying expenses that actually aren’t deductible.

- Overlooking the element of depreciation.

- Combining contract worker payments with employee salaries.

- Forgetting to track the cost of hiring (around half an employee’s salary).

What is an Expense Approval Process?

Organizing each expenditure is only half the battle. Many of these expenses should go through an approval process, involving several people and verifiable receipts. These are most commonly travel & work spends that come from employees, though they can also extend to other areas like office supplies and vehicles. In any case, these approval processes are tedious on a good day, and difficult on a day when receipts are missing or team members are untrustworthy.

These expenses are submitted with context, reviewed for policy and budget alignment, approved or rejected, and documented for reporting. Alongside your categorization, it’s wise to build a structured workflow for approvals.

This process becomes easier with the Slash expense management tool, which allows you to automatically approve expenses based on categorization. Each transaction syncs with your existing accounting system, ensuring consolidated access on a single dashboard.

Disorganized approval processes, recurring payments, unexpected charges, and inconsistent reports make it impossible for an organization to track payments and prepare for tax filings. That’s why Slash stepped in.

Smarter Expense Categorization for Growing Businesses With Slash

Your expense tracking software should do more than keep an eye on expenditures. Our platform is built to both manage your transactions and the systems that work behind them.

Slash sorts expenses for you; after setting up your categories, all purchases and fees are displayed in the correct place in real time, keeping your reports easy, your accounting organized, and your expenses tax compliant. Each transaction appears instantly on the dashboard, from inbound and outbound payments to employee purchases made with Slash’s corporate card.

Most businesses that pick up expense tracking software have to add it to their pile of tools, which leads to issues downstream. More apps and accounts create more disconnects and mistakes, making consistent, clean financial reports a challenge. This is why Slash centralizes corporate cards, bank accounts, multi-entity transactions, and automated expense categorization onto one financial platform.

You'll also get a clear view of what's deductible in the eyes of the IRS. Deductible business expenses and tax write offs are some of the biggest benefits to identifying business expense categories.

Along with solutions for expenses and deductions, Slash also offers:

- Free business checking with no minimum balance requirements.

- Unlimited virtual charge cards earning up to 2% cashback.

- Millions in FDIC insurance through the Column N.A. sweep network.²

- Slash Treasury accounts that earn up to 3.93% annualized yield.⁶

- Free, unlimited ACH transfers, domestic wires, and outgoing FedNow/RTP real-time payments for Pro members.

Leading businesses are completely moving away from antiquated manual entry and disorganized reporting, seeking solutions for automatic business expense categories and transparent cash flow. With Slash, you can connect these capabilities with your corporate bank accounts, financial analytics, and other accounting tools.

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

FAQs

Can Slash integrate with my current accounting solutions?

Absolutely. Companies that rely on platforms such as Intuit Quickbooks and Xero don’t have to worry about clashing capabilities, as Slash is designed to integrate with and complement these tools. Slash automatically captures merchant data from card transactions and syncs expense categories directly into your current software, reducing manual cleanup. Our business banking, corporate cards, expense management, and payment processing features also feed into your accounting tools.

Expense categorization becomes even easier with Quickbooks’ receipt scanning feature, enabling employees to instantly upload purchases made with cards other than the Slash corporate card. (But really, why would you use anything else?)

The Best QuickBooks Integrations to Automate Accounting

Which category expenses are tax deductible?

Many of the 15 categories listed above are eligible for tax deductions, including advertising, employee benefits, rent, utilities, cybersecurity, travel, and even office supplies. Remote workers can utilize home office deductions to get many of the same benefits for their taxable income. With the IRS, situations regarding tax deductions vary, so always consult with a tax professional before making tax return decisions based around deductible business expenses.