LLC Expenses 101: How to Maximize Deductions for Your Business

A limited liability company, or LLC, is a go-to business structure for owners who want protection without unnecessary complexity. It pairs corporate-style legal safeguards with pass-through tax treatment. Navigating IRS tax filing requirements can be complex, so this guide is intended to clarify how taxes and deductions work for LLC members.

Although LLCs are formed at the state level, their federal taxes and deductions are governed by the Internal Revenue Service (IRS). The IRS allows business owners to deduct many of the costs required to operate a company. These deductions reduce the amount of income an LLC is taxed on and can apply to everyday expenses such as rent, equipment, software, professional services, and employee benefits. Understanding which expenses qualify and how they must be reported is essential to avoiding filing errors and overpaying taxes.

This LLC expenses cheat sheet provides a clear, practical overview of common deductible and non-deductible expenses, along with the basic rules that determine when and how those deductions can be claimed. It is designed to help you better understand how LLC taxation works, identify potential deductions, and organize your expenses more effectively at tax time.

This guide is for educational purposes. The information presented should not be considered legal or tax advice. Tax rules can vary based on your business structure, state of operation, and individual circumstances. For guidance specific to your situation, consult a qualified tax professional or accountant.

Key things to know about your business structure

Before claiming tax deductions, it’s important to understand exactly how your business is structured. The basics determine how your business expenses are reported, who claims them, and how much they ultimately reduce your tax obligation.

In the U.S., businesses are classified into separate legal and tax structures, each with different rules for how income and deductions are handled. While many LLCs use the IRS’s default tax treatment, owners can also elect to be taxed under a different structure. Below is a brief overview of how each structure works:

- Sole proprietorship: An unincorporated business owned and operated by one individual. Income and expenses are reported directly on the owner’s personal tax return, and the business itself does not pay federal income tax.

- Partnership: The default tax classification for an LLC with two or more members that does not elect corporate taxation. The partnership does not pay federal income tax; instead, profits, losses, and deductions pass through to the partners and are reported on their personal tax returns according to the operating agreement.

- S corporation: A business that elects pass-through taxation while operating under corporate rules. Income, losses, deductions, and credits pass through to shareholders, but owners who work for the company must be paid a reasonable salary subject to payroll taxes. S corporations are limited to 100 shareholders and cannot be publicly traded.

- C corporation: A separately taxed legal entity. The corporation pays federal corporate income tax, and shareholders are taxed again on dividends, a structure commonly referred to as double taxation. This is the only U.S. business structure subject to entity-level federal income tax.

If an LLC does not want to accept its default tax classification, it can elect a different treatment by filing Form 8832 (to elect corporate taxation) or Form 2553 (to elect S corporation status).

Single-member vs multi-member LLCs

Single-member LLCs are taxed as disregarded entities by default, meaning the LLC itself does not pay federal income tax. Business income and deductions are reported directly on the owner’s personal tax return. Multi-member LLCs are generally taxed as partnerships, with income and deductions passed through to owners based on the operating agreement. In both cases, the LLC does not pay federal income tax unless it elects corporate taxation.

Self-employed founders vs LLCs with employees

An LLC run by a solo founder has different tax considerations than one with employees. Self-employed owners typically pay self-employment tax on their share of business profits, and deductions reduce taxable income used to calculate that tax.

Once an LLC hires employees, additional deductions become available, including payroll wages, employer payroll taxes, and employee benefits. In some cases, particularly when an LLC elects S corporation status, owners must pay themselves a reasonable salary, which changes how payroll taxes and deductions are calculated.

Choosing an accounting method

How your LLC accounts for income and expenses determines when deductions can be taken. Cash-basis taxpayers deduct expenses in the year they are paid and report income when it is received. Accrual-basis taxpayers deduct expenses when they are incurred and report income when it is earned, even if payment happens later. This choice does not affect which expenses are deductible, but it can significantly affect the timing of deductions and year-to-year tax outcomes.

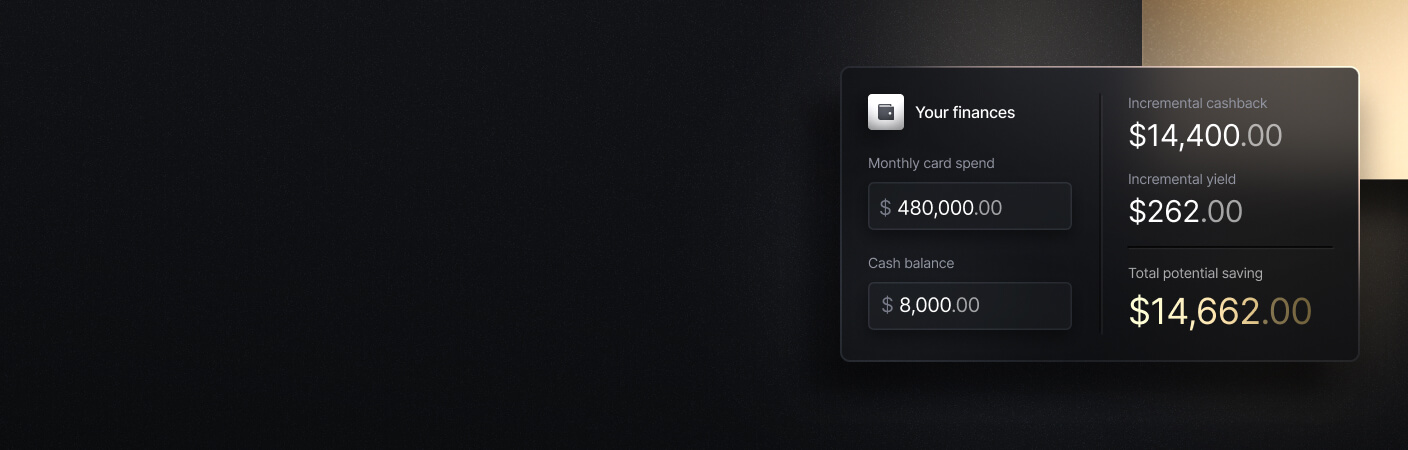

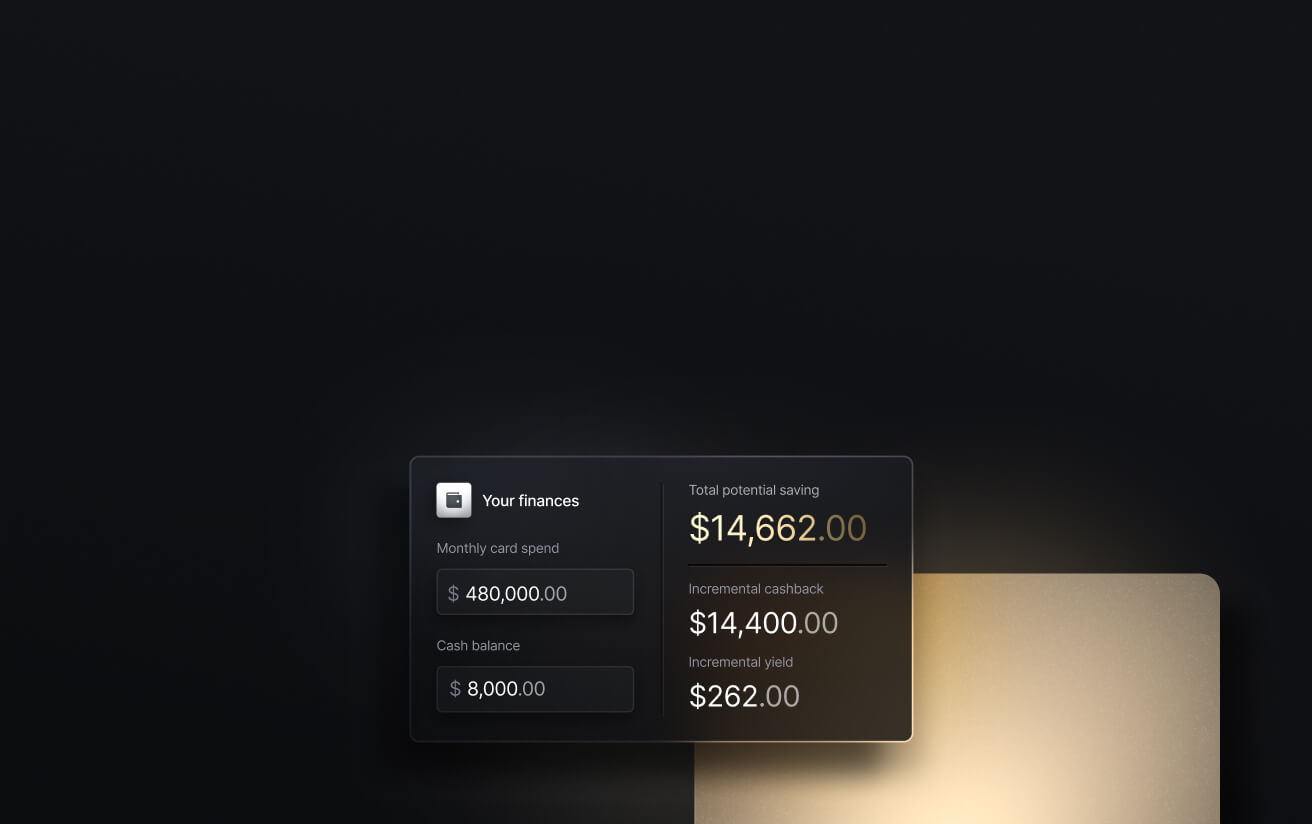

See the ROI behind your spend

Use this calculator to understand impact, then manage and track it all in Slash.

What are LLC business expenses?

According to the IRS, a deductible business expense must be both ordinary and necessary. An ordinary expense is common and accepted in your industry, while a necessary expense is helpful and appropriate for carrying on your trade or business. Meeting both standards allows an LLC to deduct the expense and reduce taxable income. Here’s additional detail about the different IRS-designated expense types:

Business expenses

Business expenses are the ongoing costs of operating an active LLC and are generally deductible in the year they are paid or incurred. These operating expenses commonly include rent, utilities, payroll, insurance, supplies, and professional services.

In practice, the “ordinary and necessary” standard depends on context. An expense does not need to be essential, but it must have a clear business purpose and be reasonable in amount. Furthermore, what qualifies as a deductible business expense can vary by industry. Certain costs may be considered ordinary and necessary in one field but excessive in another. Professional licenses, specialized equipment, regulatory compliance costs, and industry-specific insurance are common examples.

Capital expenses

Capital expenses are costs associated with assets that have a useful life longer than one year, such as equipment, vehicles, machinery, or major property improvements. These costs are typically recovered over time through depreciation, though certain assets may qualify for immediate expensing under Section 179 or bonus depreciation rules. For more information about depreciation, see IRS Publication 946.

Personal expenses

Personal expenses are costs related to personal living, family needs, or non-business activities. The IRS does not allow personal expenses to be deducted, even if they indirectly support your ability to work. Expenses that serve both personal and business purposes must be allocated, with only the business portion eligible for deduction. Failing to separate personal and business expenses is a common reason deductions are disallowed during audits.

What are deductible LLC expenses?

Deductible LLC expenses are costs the IRS allows your business to subtract from its taxable income. These deductions reduce the amount of income your LLC is taxed on, but they do not reduce your tax bill dollar for dollar. For example, a $1,000 deduction lowers the amount of income subject to tax, not the amount of tax you owe. The actual tax savings depend on your tax rate and how your LLC is taxed.

The categories below cover many of the most common deductible expenses. However, the exact rules and limitations can vary based on your LLC’s tax classification and individual circumstances:

Payroll and staff costs

Payroll expenses generally include employee wages and salaries, employer-paid payroll taxes, and compensation such as bonuses and commissions. It’s important to distinguish between employees and independent contractors, as they follow different tax rules and reporting requirements. Employees are reported using Form W-2, while independent contractors are reported using Form 1099-NEC. Misclassifying workers can result in penalties, back taxes, and disallowed deductions.

Employee perks and benefits

Many employee benefits qualify as deductible business expenses, including health insurance, retirement plan contributions, and educational assistance. Certain fringe benefits may also be deductible, such as employer-provided meals, transportation benefits, or wellness programs.

The rules differ for owners. Owners of single-member LLCs and partners in multi-member LLCs are generally not treated as employees for tax purposes, which means benefits like health insurance and retirement contributions may be deducted differently or reported on the owner’s personal tax return.

Startup costs

The IRS distinguishes startup costs from regular operating expenses. Startup costs are incurred before your business is actively operating, and may include market research, legal fees to form the LLC, initial advertising, or pre-opening travel.

The IRS allows businesses to deduct a limited portion of startup expenses in the first year of operation, with remaining costs deducted over time through amortization, which means spreading the tax deduction evenly across multiple years. Once a business is active, ongoing operating expenses are typically deductible in full.

Rent, utilities, and facility costs

Costs associated with the space where your business operates are often among the largest of your tax write-offs. Rent for office space, coworking memberships, warehouses, and storage facilities is generally deductible, as are utilities such as electricity, water, internet, and phone service used for business purposes.

When a space serves both personal and business use, expenses must be allocated based on the portion used for business. Notably, the home office deduction has additional requirements: the space must be used regularly and exclusively for business. Both renters and homeowners may be eligible for a home office deduction, though homeowners may also deduct a portion of mortgage interest, property taxes, and depreciation.

Business insurance

Many types of business insurance are deductible, including general liability insurance, professional liability insurance, workers’ compensation, and cybersecurity insurance. These policies are considered necessary to protect business operations. Personal insurance, such as life insurance where the owner is the beneficiary, is generally not deductible. Homeowner’s or renter’s insurance may be partially deductible if you have a qualifying home office, but only the business-use portion applies.

Office supplies and equipment

The IRS distinguishes between supplies and equipment. Supplies are items consumed quickly, such as paper, ink, and small tools, and are usually deducted in the year they are purchased. Equipment includes assets with a useful life longer than one year, such as computers, furniture, or machinery. Equipment is typically treated as a capital expense and depreciated over time, but businesses may be able to deduct the full cost immediately using Section 179, subject to annual limits and eligibility rules. Technology items like laptops and phones may qualify for immediate expensing, but mixed personal and business use for these items requires allocation.

Fees for professional services

Fees paid for legal, accounting, and consulting services are generally deductible when they relate directly to your business. This includes bookkeeping, payroll processing, tax preparation, and compliance services. For services that are partially personal and partially business-related, only the business portion is deductible.

What are non-deductible LLC expenses?

Not all business-related spending qualifies for a tax deduction. Understanding which costs are not deductible can help you avoid filing errors, penalties, and overstated deductions:

- Personal spending: Personal expenses are never deductible, even if they indirectly support your ability to work. This includes costs related to childcare, personal clothing, groceries, commuting expenses, non-business travel, and more. Expenses that mix personal and business use must be allocated, and only the business portion may be deducted.

- Recreational and entertainment spending: Entertainment expenses are generally not deductible under current IRS rules. Business meals may be partially deductible if they meet specific requirements, but entertainment itself is excluded, even when clients or employees are present.

- Business-related gifts: Business gifts are deductible only up to $25 per recipient per year. Any amount above this limit is not deductible. This cap applies per recipient, not per gift, and does not include certain promotional items of minimal value.

Key tax considerations for LLCs

In addition to knowing which expenses are deductible, LLC owners should understand several broader rules that can affect their tax obligations:

Qualified business income deduction

The QBI deduction allows eligible owners of pass-through businesses to deduct up to 20 percent of qualified business income, which generally means net income from domestic business operations. The deduction is claimed on Form 1040 and calculated using Form 8995 or 8995-A, depending on income level. Limitations apply for higher-income taxpayers and certain service businesses.

Self-employment tax deduction

Owners of single-member LLCs and partners in multi-member LLCs generally pay self-employment tax on their share of net business income. While the full self-employment tax must still be paid, the IRS allows owners to deduct the employer-equivalent portion of this tax when calculating adjusted gross income on their personal tax return. LLCs that elect to be taxed as S corporations follow different rules. In those cases, owners pay payroll taxes on wages they receive as employees, rather than self-employment tax on all business profits.

State-specific tax rules and limits

State tax treatment of LLCs can differ significantly from federal rules. Some states conform closely to IRS tax deductions and classifications, while others impose additional taxes, limits, or filing requirements. These may include franchise taxes, gross receipts taxes, minimum annual fees, or state-level limitations on certain deductions.

How to write off LLC expenses

Writing off LLC expenses follows a consistent process, regardless of business size. The key is to correctly identify eligible expenses, document them properly, and report them on the correct tax forms based on how your LLC is taxed. Below is a more in-depth explanation of the identification and filing process:

1. Identify deductible business expenses

Start by determining which costs are ordinary and necessary for your business operations, with close attention to what is typical in your specific industry. At the same time, identify expenses that are personal. For mixed-use expenses such as home offices, vehicles, phones, or computers, you must calculate the portion used for business and only deduct that percentage. Clear separation between business and personal use is critical, as improper classification is a common cause of disallowed deductions.

2. Track and document spending

All deductible expenses should be supported by documentation such as receipts, invoices, bank or credit card statements, or mileage logs. The IRS generally expects records that show the amount, date, business purpose, and payee for each expense. Using a financial management software like Slash can automate this process by centralizing transactions, attaching documentation, and minimizing manual tracking errors. Consistent, real-time tracking throughout the year makes tax filing significantly easier and reduces the risk of missing deductions.

3. Categorize expenses correctly

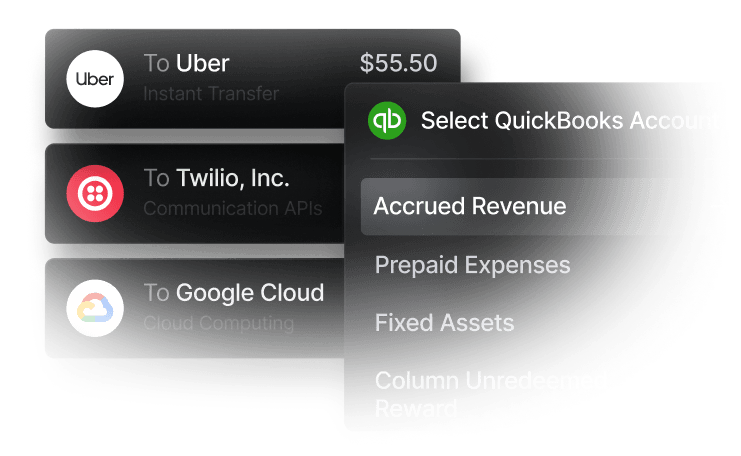

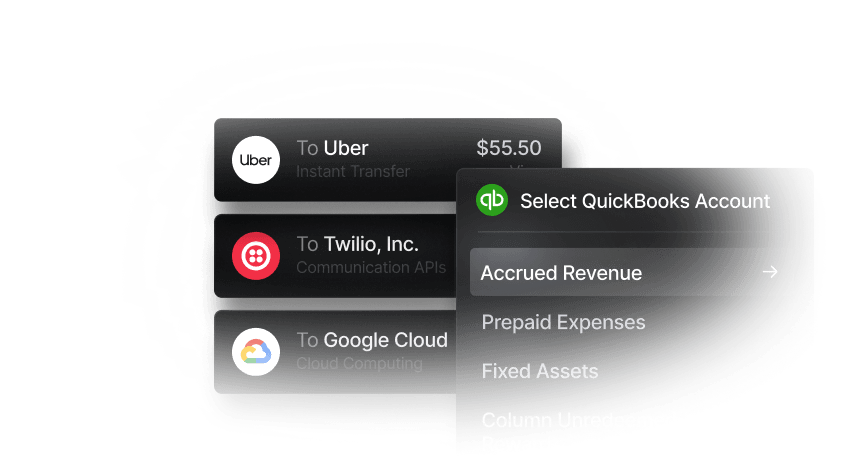

Accurate categorization ensures expenses are reported in the correct sections of your tax return. Today, many financial management systems and accounting software platforms use pre-populated, tax-compliant expense categories designed to align with IRS reporting requirements. For example, Slash’s expense categorization features export cleanly into QuickBooks, helping streamline bookkeeping and tax preparation.

Some category-specific tax deductions require additional forms. Sole proprietors, business partners, and S corporation shareholders may file IRS Form 3800, the General Business Credit (GBC) form, along with their personal income tax returns when claiming eligible business credits. Each type of credit reported on Form 3800 has its own supporting form; a complete list of deductible General Business Credits can be found in IRS Publication 334, Section 4.

4. Report business expenses on the appropriate tax forms

It can be overwhelming to keep track of all the forms required to report tax deductions correctly. However, understanding how each form corresponds to your LLC’s tax classification makes the process easier. The forms you may encounter when filing deductions during tax season include:

- Schedule C (Form 1040): Used by single-member LLCs taxed as sole proprietorships to report business income and deductions alongside the owner’s personal income tax return

- Form 1065: Used to report income and deductions for multi-member LLCs taxed as partnerships

- Form 1120: Used to report income and deductions for LLCs taxed as C corps

- Form 1120-S: Used to report income and deductions for LLCs taxed as S corps, with amounts passed through to shareholders

Each of these forms includes designated expense categories that flow into the calculation of taxable income.

5. Apply the deduction to reduce taxable income

To ensure tax deductions are accurate, you can review expense totals, confirm that mixed-use allocations are reasonable, and verify that reported amounts match supporting documentation. For most people filing taxes in the U.S., the deadline to file your Form 1040 for the previous year is April 15th. The deadline for the Form 1120 is also usually April 15th, while the deadline for Form 1065 is March 15th. The IRS also allows filers to request six-month extensions.

How to track and manage LLC expenses: 5 best practices

Getting the most out of your tax return is one of the most direct ways to recover money for your business. However, annual tax savings are small compared to the long-term efficiency and cost control a strong expense management system can provide. The following best practices can help streamline your financial processes, simplify tax season, and reduce day-to-day business costs:

Set a clear expense policy

One of the simplest ways to save money is to establish a clear company culture around spending. Drafting a detailed expense policy with rules for individual employees, teams, and executive leadership should be a top priority. Clear guidelines help prevent unnecessary or noncompliant spending, streamline approval workflows, and reduce time spent tracking down missing receipts or clarifying purchases after the fact.

Keep detailed and consistent records

Beyond receipts and invoices, businesses may be required to provide additional documentation during tax season, such as mileage logs, asset purchase records, and depreciation schedules. Keeping consistent, organized records throughout the year makes compliance easier and strengthens your position if deductions are ever questioned.

Pay with dedicated business cards

Using dedicated business cards helps separate personal and business spending and simplifies expense tracking. Modern corporate cards also allow finance teams to apply granular spending controls to keep employee expenses in check.

For example, with the Slash Visa Platinum Card, businesses can set customizable spending limits and create card groupings to enforce spending controls at the team level.¹ Additionally, the Slash card earns up to 2% cashback on company spending and enables unlimited issuance of virtual and physical cards, making it easier to give employees access to funds quickly while maintaining visibility and control.

Implement an expense tracking software

Manual expense tracking increases the risk of missing receipts, miscategorized transactions, and inconsistent records. An expense tracking system centralizes spending data, making tax filing easier and less prone to errors. Slash supports expense tracking by automatically capturing transaction data from card spending, organizing receipts and invoices, and recording payments made through bank and crypto rails. Rather than relying on employees to submit documentation after the fact, expenses are logged as they occur, reducing gaps, reconciliation issues, and last-minute cleanup at tax time.

Regularly conduct expense reviews

Automation makes it easier to conduct regular expense reviews and analyze spending patterns over time. One way to streamline this process is by integrating Slash with QuickBooks, a third-party accounting platform. By importing business expense data directly from Slash into QuickBooks, businesses can perform reconciliation, spend analysis, invoice and purchase order matching, and tax preparation more efficiently. Regular reviews help identify cost-saving opportunities, enforce policies, and maintain financial visibility as the business grows.

Optimize your LLC finances with Slash

There’s no denying it: taxes are complicated. But managing your business finances doesn’t have to be. With the right tools in place, expense tracking, payments, and tax filing can be simpler.

Slash is a modern expense management platform built with the full-stack capabilities of a 21st-century bank. By combining international payment rails, crypto-native transfers, accounting integrations, and granular spend controls, Slash helps businesses manage complex financial operations without sacrificing flexibility or visibility.

For international founders navigating U.S. taxation or LLC requirements, Slash also offers our Global USD Account.³ This account allows international businesses to hold, send, and receive U.S. dollars without requiring a U.S. bank account or a registered U.S. LLC, making it easier to operate globally while transacting in USD.

Here are a few additional ways Slash can support your business’s financial operations:

- Slash Visa Platinum Card: Earn up to 2% cashback, issue unlimited virtual and physical cards, and set customizable spending limits and controls. All transactions are captured automatically and monitored in real time through a centralized dashboard, simplifying reconciliation and expense tracking.

- Virtual accounts and expense management: Create configurable accounts to separate funds by team or purpose. Automatically capture payment details, gain real-time visibility into cash flow, enforce compliant spending policies, and sync transactions directly with QuickBooks to simplify month-end close.

- Slash Working Capital financing: Access financing designed for growing businesses directly within your Slash account.⁵ Draw funds as needed to support operations or expansion, with flexible 30-, 60-, or 90-day repayment terms aligned to your cash flow cycle.

- High-yield treasury: Earn up to 4% annualized yield by placing idle cash in money market accounts backed by BlackRock and Morgan Stanley.⁶

Slash simplifies how you manage your LLC’s financial operations. Spend less time navigating tax prep and more time growing your business. Learn more at slash.com today.

Apply in less than 10 minutes today

Join the 5,000+ businesses already using Slash.

Frequently asked questions

What tax deductions can I claim without receipts?

Examples include:

- Home office expenses

- Eligible retirement plan contributions

- Health insurance premiums

- The deductible portion of self-employment taxes

- Cell phone expenses (with reasonable allocation)

- Charitable contributions

- Vehicle expenses or mileage tracked with a contemporaneous log.

Even when receipts aren’t required, you should still keep records that show how amounts were calculated and that the expense was business-related.

Do you get all the money back from tax write-offs?

No. Tax write-offs (deductions) reduce your taxable income, not your tax bill dollar for dollar.

Is an operating agreement mandatory for an LLC?

Some states require LLCs to have an operating agreement, while others do not. Even when it isn’t legally required, having one is strongly recommended because it defines ownership, management structure, profit distribution, and decision-making rules.

When can I deduct business expenses?

The timing depends on your accounting method. Cash-basis LLCs generally deduct expenses in the year they are paid. Accrual-basis LLCs deduct expenses in the year they are incurred, even if payment happens later.