Business Expense Tracking: Tools and Tips for Small Business Owners

Tracking business expenses is like opening a window into how your company operates, where money flows, and what investments drive the most growth. Managing your expenses inefficiently, however, can cause you to miss out on insights from your expense reports that tell a deeper story.

As businesses scale and their operations become more spread out, tracking business expenses becomes more difficult – and more important. That’s why, for small business owners and first-time founders, it’s smart to establish a smooth system for expense tracking. It can help you save time, prevent errors, and help capture those insights before they’re lost in a sea of archived files.

The Slash business banking platform can automate expense categorization and data entry for you, freeing up time and minimizing errors.¹ Before we get there, let’s break down the reasons that it’s important to track business expenses, practical strategies to streamline the process, software that can help – and what business expenses are in the first place.

Small Business Expense Tracking - Key Concepts

Business expenses are the payments you make to acquire materials, hire individuals and teams, and keep your organization running. Small business owners who dive headfirst into operations often discover that, between utilities, the cost of goods, hiring, insurance, and more, business finances can quickly become tough to monitor.

Tracking business expenses is a great way to lay everything out in front of you and stop your head from spinning. Beyond that, it also unlocks plenty of other benefits for your company:

Optimizing tax deductions

Do some research to see which of your business expenses are deductible for the sake of tax savings, as the IRS allows more tax deductions than you might expect.

Discovering oversights

Whether it’s a change in insurance rates, suspicious use of the corporate credit card, or a subscription you thought was a one-time payment, looking more closely at your expense reports and invoices can expose some unexpected charges that need addressing.

Projecting future expenses

Knowing where funds are going and how often cyclical payments occur can make it much easier to look to the future and determine what you’ll be spending downstream.

Enhancing budget planning

Unlocking a deeper view into your company’s cash flow can help identify areas of potential cost savings, enabling you to set a more realistic budget.

The importance of expense categorization

The first step to accessing these insights is developing expense categories, which are distinct categories that encompass every business purchase, charge, and fee. There are a large number of expense categories that your organization can create, but a few of the most common examples are:

- Marketing and advertising

- Payroll

- Office supplies (of all scales)

- Utilities and rent

- Subscriptions and licenses

- Banking fees and processing

With the variety of potential expense categories your company may require, deciphering and sorting countless receipts often becomes tedious. That’s why Slash's expense tracking software automates data entry and categorizes transactions automatically.

How Can I Keep Track of Expenses For a Small Business?

Before developing a plan for tracking business expenses, it’s smart to set up a dedicated business bank account. Not only does this consolidate your cash flow into one location, but many business bank accounts offer features and benefits that will allow you to get the most out of your capital.

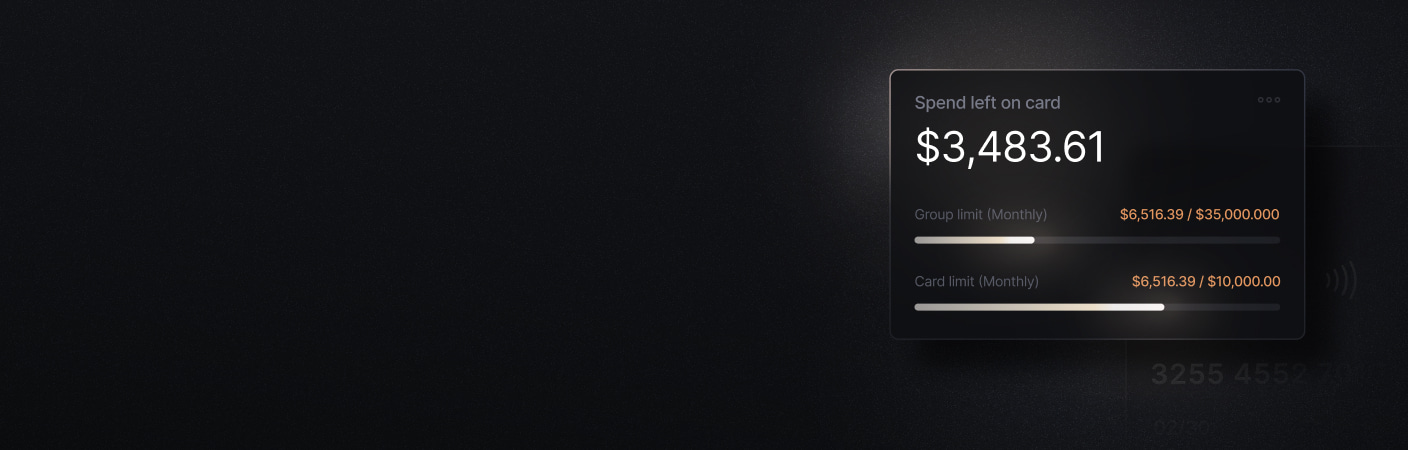

In tandem, you’ll also want to select a corporate credit card to separate personal and business spending while making expense tracking easier. Slash offers corporate charge cards that come with granular spend controls, automated expense tracking, and the ability to assign unlimited physical and virtual cards to team members. You can also earn up to 2% cash back on all business spending, empowering you to save capital and reinvest it when you need to.

Another step is setting up an expense approval process. Companies with a multitude of corporate credit cards belonging to different employees often find that keeping track of transactions is a challenge. Expense approval processes involve verifying receipts and getting an O.K. from more than one person before fully confirming a purchase. It’s a smart way to keep spending in check while getting extra visibility into certain expense categories.

Ultimately, the best way to track your expenses is to adopt dedicated software. In the olden days, accountants would sit down and sift through bills, receipts, and other papers in order to manually log and categorize charges. We’re far past that. Today, there are a variety of solutions for automating expense tracking that are both quicker and more accurate than any other means.

Why Automation is the Best Way to Track Business Expenses

Automating business expense tracking isn’t just the “easy” method. Well, it is – but there’s a lot more to it than that. Automation can provide the following benefits:

- Fewer mistakes: The manual, human method for tracking expenses is prone to errors, especially when companies scale and receipts begin to pile up. Automatically capturing transaction information and syncing with accounting keeps those mistakes to a minimum.

- Stronger compliance controls: Staying tax compliant is a high priority for accountants. When your software automates data entry, you won’t have to worry about typos and mistakes when reconciling that could lead to a non-compliant tax return. You’ll also be able to stay consistent with your tax reporting all year – that means no more waiting until tax season to cobble everything together.

- Enhanced security protections: Your company’s financial data needs to be fully safeguarded at all times. Most automated systems offer secure access controls and methods of encryption that comply with data protection regulations, keeping your most important information secure.

- Built to scale: Unlike the old-fashioned accountant who spends longer nights working as their company grows, expense tracking software handles 10 receipts as easily as it handles 1000 receipts. Platforms that support instant data entry and unlimited virtual cards allow fast scaling without the adjustments that come with it.

- Greater operational efficiency: Finally, and perhaps most importantly, automation saves lots of time and effort. This allows you to move more nimbly, reallocate resources, and even relax a little bit.

It’s easy to see how adopting expense tracking software can give small business owners a leg up. But now that you know how important this software is, it’s time to choose the one that works best for your company.

What’s the Best Software for Tracking Business Expenses?

Expense tracking tools can be found on various pieces of accounting software and financial platforms, but they’re not typically one-size-fits-all. When looking to choose a solution for tracking your business expenses, you’ll want to be mindful of your company’s size, budget, and common use cases.

Here are some of our picks for the top options for expense tracking software in 2026:

Slash

The Slash business banking platform gives businesses a powerful, integrated way to categorize and manage their spending. Not only does our software support automated data entry and expense categorization, but it also allows you to track ACH, wire, and crypto payments in real time.⁴ You can finally issue cards, approve spend, and track expenses automatically on one all-encompassing dashboard.

Even when multiple accounting and expense management apps are smoothly integrated, working across a cluster of them can still be a pain. Thanks to its single management solution and intuitive dashboard, Slash eliminates the need for several different tools.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

Freshbooks

While more often used as an accounting system, FreshBooks also offers built-in expense tracking features that work naturally for small businesses and first-time founders. It syncs with your credit card and bank accounts for automatic imports, and its combination of receipt scanning and invoice management tools make expense tracking more convenient.

However, some may call Freshbooks a “beginner software”, since it’s better suited for smaller teams, as opposed to organizations with multiple departments that have to juggle intensive expense reports while maintaining tax compliance.

Expensify

With tools like receipt scanning and reimbursement management, Expensify is another option for expense tracking. It also integrates with accounting platforms like Xero and Netsuite, meaning it’s a plug-and-play solution for some organizations who are committed to their current software.

Similarly to Freshbooks, though, larger companies aren’t always the best fit for Expensify. Organizations that utilize corporate credit cards in particular might be tripped up by the fact that the platform still requires separate systems for card management and payments.

Intuit Quickbooks

Quickbooks is one of the most widely used pieces of accounting software out there, thanks to its robust capabilities and its versatility. One of its key features is its openness to integrations – Quickbooks integrates with data from dozens of banking services and fits in with a variety of financial tools.

The success of Quickbooks can vary case by case, as organizations can use it for different purposes and with lots of third-party apps. Trouble can arise when these platforms operate in separate silos, leading to accountants monitoring cards in one system, analytics in another, and payments in a third. Good thing, Quickbooks integrates with your expense tracking system in Slash, so you can easily sync expenses and stay up-to-date on your accounting.

See How Easy Tracking Expenses Can Be With Slash

Both small businesses and large enterprises can benefit from Slash’s expense-tracking tools. One of the advantages of our platform is its ease of use; your employees will ultimately be the ones using it the most, so accessibility matters. Let’s take a look at the process step by step:

- Your employee makes a purchase with a corporate card or through a connected Slash account, and our software records the transaction.

- Your current accounting software can use tools such as receipt scanners to automatically sort receipts into the appropriate expense categories as they are captured.

- With granular spending controls, you can set up guardrails and ensure potential compliance issues are flagged immediately.

- You can also assign unlimited virtual cards and link them to different expense categories, allowing you to track any number of transaction types on a single screen.

Adopting our expense tracking software reduces friction, gives teams actionable insights, and helps business owners make proactive financial decisions that can save them capital in the long term. With unlimited free domestic transfers, in-depth expense tracking, multiple stablecoins, and access to high-yield treasury accounts earning up to 3.93% annually, the Slash platform may be exactly what you’re looking for to launch your small business to the next level.⁶

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Frequently asked questions

What expenses can I claim without receipts?

When tax filing and claiming tax deductions on your business expenses, the IRS will typically need to see expense receipts. However, this isn’t always the case, as certain transactions don’t come with convenient receipts that can be logged like everyday purchases. Charitable contributions, vehicle expenses, self-employment taxes, health insurance premiums, and retirement plan contributions are some of the business expenses that don’t require expense receipts to include among your tax deductions.

How to Categorize Expenses for Your Business: Examples & Best Practices

What are common expense categorization mistakes for LLCs?

There are some easy oversights small business owners can make while developing their business expense categories. For instance, insurance is a common category, but it’s important to make sure employee health insurance isn’t recorded in the same place that company insurances like property insurance are.

Other potential bookkeeping errors include ignoring small office supply purchases, combining contract worker payments with employee salaries, and forgetting to track the cost of hiring altogether.