ACH, Wire Transfers, and the Differences That Matter To Your Business

Like you, your money rarely sits still when developing your business. Instead, constant cash flow is one of the key aspects of seeking return, growing your company, and extending your market reach. That movement happens in many forms, but with so many ways to transfer, receive, and deposit your money, choosing the right method can get confusing.

Credit cards, cash, and checks are a few common options to transfer money, yet for transactions that need to move swiftly, cross borders, or issue recurrently, these methods fall short. Many businesses thus turn to electronic transfers as the go-to money transfer method. Electronic Funds Transfer (EFT) is a broad category of electronic transactions, covering multiple ways money can move between sender bank accounts without any physical exchange.

Electronic transfers in themselves erase the physical barriers impeded by other transaction options. But there is more to just electronic transfer; there are two commonly used EFT methods, ACH payments and wire transfers. Each method has its own strengths and weaknesses, and in this guide, we’ll break down how each method works, when to use them, and which aligns best with your business goals, so you can move money more efficiently and get back to developing your business.

What is an ACH Transfer?

Automated Clearing House (ACH) is a batch-based payment network that moves money between U.S. bank accounts and credit unions. ACH is the common money transfer method for bill payments, direct deposits, and other bank-to-bank money transfers. Rather than processing each transfer individually in real-time, ACH collects transactions into batches that are processed several times per day. This makes it efficient and cost effective, especially for recurring or high-volume payments. However, because of the batch-based system, you may need to wait 2-3 business days for your payment to be processed.

Using ACH as a transaction method is a regulated and safe process, overseen by NACHA (National Automated Clearing House Association), with two main operators: the Federal Reserve and The Clearing House’s Electronic Payments Network (EPN). Most transfers stay within U.S. financial institutions, meaning ACH is a largely domestic-only rather than international or cross-border system. Additional regulations on AHC transfers mean that the amount you transfer is often limited for fraud and risk prevention, with NACHA capping transactions at $1 million.

How ACH Transfers Work

ACH transfers can be initiated in several ways: through your bank’s online or mobile app, via fintech platforms that connect to your account (such as Venmo or Slash¹), or through automated payment arrangements like subscriptions or mortgage payments.

When you send money, such as paying a vendor, an ACH credit moves funds from your bank account to the recipient’s account. When someone else collects money from you, such as for monthly rent, an ACH debit withdraws the specified amount from your account. In both cases, the originating bank or payment provider submits the transaction to the ACH network, which processes it in batches along with many others before settling the funds.

Each batch is then reviewed for accuracy, authorization and fraud prevention; a process that typically takes 1-3 business days, and usually doesn’t require additional processing fees. Though, banks and other service providers often offer same-day ACH, a speedier but more expensive process.

ACH Transfer Fees

ACH transfer fees are subject to the bank and service you are using. In general, you can expect ACH transfer fees to remain fairly low, ranging from a few cents to a small percentage on each transaction. In some cases, providers may charge additional fees depending on the risk of your transaction, return payments, or if you opt in to same-day ACH, which is a faster but more expensive process than standard ACH.

Ask your bank or provider for details on any applicable fees. With Slash, standard ACH transfers are free, while same-day ACH transfers carry a flat $1 fee.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

Example ACH Transfer:

If you are banking with a financial platform such as Slash, you can initiate ACH transfers directly from your account dashboard. For example, if you’re needing to run payroll, you can upload your employee’s individual bank account and routing numbers, specify each payment amount, and schedule the transfer date. ACH’s automated capabilities will ensure that the same bi-weekly, monthly or quarterly payments pull from your account and enter your employee’s account within 1-3 business days.

ACH transfers can also be used for everything from paying vendors to collecting customer payments, all of which can be initiated or received right from your Slash dashboard.

What is a Wire Transfer?

A wire transfer is another form of electronic transfer, differentiated in part by its speed and ability to move cash internationally. Unlike credit cards or ACH transfers, wires are sent directly from your bank account over dedicated payment rails, such as Fedwire for domestic transfers and SWIFT for international transfers.

Each wire transfer is processed as an individual transaction rather than in batches, meaning funds often arrive from sender to recipient within hours. This speed involves a number of fast-moving intermediaries, reflected in higher fees per transfers. Wire transfers typically have no set cap on the amount you can send, but are irreversible once complete, often making it a favorable transfer method for high-value, high-priority transactions.

How Wire Transfers Work

Wire transfers are electronic payments sent from your bank account and processed through systems like Fedwire for domestic transactions and SWIFT for international transfers. The transfer is processed in real-time and undergoes a number of intermediary processing checks including anti-money laundering reviews and foreign exchange conversions for international transfers. Recipients receive your transfer within a few hours.

Wire Transfer Fees

Wire transfer fees are subject to the bank and service you are using. In general, you can expect wire transfer fees to be fairly high relative to ACH transfer fees, ranging from $15-$30 on domestic wire transfers and $30-$50 on international wires. The exact amount may vary depending on the amount you are transferring, intermediary fees, and foreign exchange fees.

Ask your bank or provider for details on any applicable fees. With Slash, domestic wire transfers are $0-$6, while international wires carry a flat $25 fee.

Example Wire Transfer:

If you are banking with a financial platform such as Slash, you can initiate wire transfers directly from your account dashboard. For example, if you have a critical payment due or need to secure a last-minute deal, whether domestic or international, you can transfer the funds straight from your dashboard. The wire can then be processed and received as quickly as a few hours, meaning money transfer won’t get in the way of you closing your deal by the end of the day.

Slash business banking

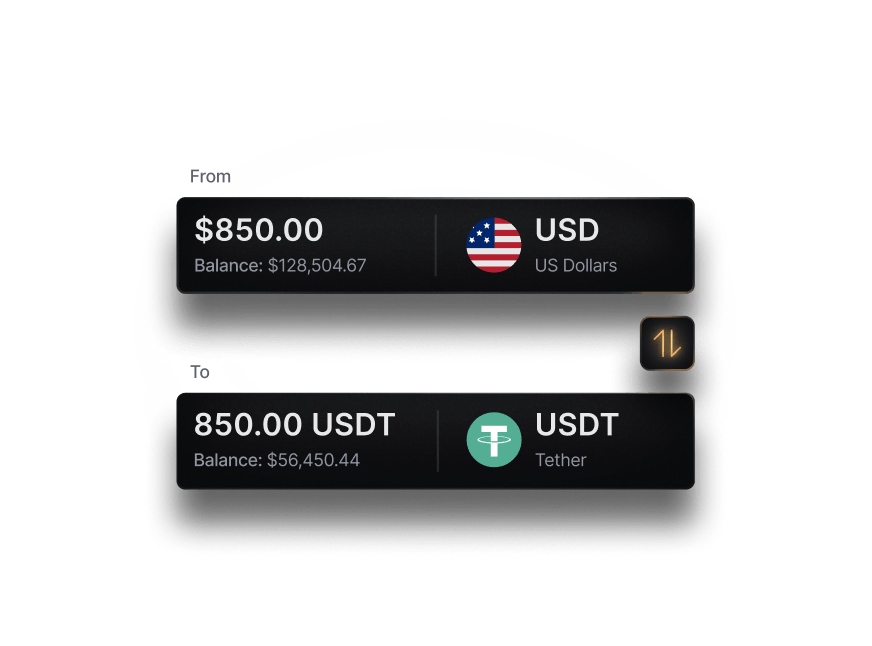

Works with cards, crypto, plus cards, crypto, accounting, and more.

ACH vs. Wire Transfer: What’s the Difference?

When transferring your money, your choice often comes down to speed, cost, and recipient location. ACH transfers are usually slower but lower cost while wire transfers are much faster, even internationally, but for a higher cost. Here’s a breakdown of what to choose, when:

Transfer speed: ACH Transfers vs. Wire Transfers

Wire transfers are often faster than ACH transfers.

Both ACH transfers and wire transfers are forms of electronic funds transfer, making them generally faster money sending and transfer options than physical transactions. However, between the two, there are significant differences in speed. ACH payments are processed in batches and only processed on weekdays whereas wire transfers are processed individually and are not as limited on days a week they can be received. For this reason, ACH transfers are much slower than wire transfers, usually taking 1-3 days while wire transfers can take just a few hours.

Cost

ACH transfers are often cheaper than wire transfers.

Wire transfers require much more resources for processing your money than ACH payments, reflected in higher fees per transaction. ACH transfers are generally very low cost per transaction, but can be higher depending on if you are using same-day ACH.

Frequency

ACH payments can be more frequent, more easily.

ACH transfers offer the ability to easily have recurring payments, with automated pull features. Wire transfers aren’t built for recurring payments and are much more permanent once processed, making them higher risk than ACH and unsuitable for automatic payments. ACH transactions are generally easier, with lower fees and fewer resources to carry out their processing. Therefore, ACH transfers including direct deposits are frequent forms of money sending.

Transaction size

Wire transfers allow you to transfer larger amounts of money than ACH.

ACH runs through NACHA and other regulatory intermediaries, requiring limits on the amount that can be transferred. Wire transfers are conversely not governed by NACHA and do not have any exceptions or caps on transaction amounts.

Geographical usage

Wire transfers let you send money internationally, while ACH transfers are primarily used to send money domestically.

The ACH electronic payment network includes US banks and credit unions as well as international financial institutions (IAT). Wire transfers, however, run through third party rail systems that have international and domestic capabilities, depending on which rail you are processing your money through.

Which is More Secure: ACH Transfer or Wire Transfer?

Both ACH and wire transfers are generally very secure systems to send your money through. However, there are key differences in the ability to reverse payments and protections attached. ACH transfers like direct deposits are regulated by NACHA and capped in transferable sending amount, limiting risk of high-value loss for senders. Wire transfers are processed quickly by Fedwire and other rail systems and, therefore, are unable to be reversed, meaning that once your money is transferred out of your bank account, it is gone.

Is ACH or Wire Transfer Better for B2B Payments?

Both ACH and wire transfers are well-equipped for B2B payments, but one may work better than the other depending on the nature of the specific transaction.

For example, if you are electronically transferring funds to an international bank, also know as remittance transfers, then an ACH transfer simply will not be available. International wire transfers, therefore, are best for international B2B payments.

If you are on a fast deadline for sending a payment, wire transfers will offer you the speed and security to quickly transfer funds either domestically through Fedwire or internationally. Same-day ACH transfers are also available, but are not guaranteed to be as fast as wire transfers.

For electronically transferred funds and payments to other domestic banks that don’t need to be received immediately, then ACH transfers may be better, as they offer the cheapest option.

How Slash Simplifies Business Payments

Whether you’re looking to international wire funds through remittance transfers, automate your payroll through ACH, or electronically transfer funds in other ways, your Slash dashboard is built with all the necessary capabilities to do so. Slash supports regular and same-day ACH transactions, international wire transfers, domestic wire transfers and more money sending options all on your Slash dashboard.

For more information on ACH transfers, wire transfers, and electronic funds transfers with Slash, visit slash.com/en and navigate to "moving money".

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Frequently Asked Questions

Does ACH take longer than wire transfers?

Often times, yes. ACH transfers are approved by banks through a batch-based system, meaning the process is typically longer, typically taking 2-3 business days, but depends on the form of ACH transfer you are using.

Is routing the same for ACH and wire?

In most cases, yes. Both ACH and wire transfers are electronic funds transfers from one bank to another. This means that you can use similar or the same bank account and routing numbers for both processes.

ACH Routing Numbers Explained: How They Work and Where to Find Yours

Is bank transfer the same as a wire transfer?

Bank transfers, like direct deposit, can be used to refer to ACH transfers. As clarified in this article, ACH transfers and wire transfers are not the same thing, but actually vary significantly based on international capabilities, fees, and processing speed.

What are the disadvantages of ACH transfers?

Key disadvantages of ACH transfers can be processing speed (often taking 2-3 business days) and limits on transferable cash and international transactions.