Understanding Your AR Turnover Ratio and Improve Cash Flow

Accounts receivable turnover ratio is a helpful metric for evaluating how efficiently your business collects payments from clients. It’s calculated using your average accounts receivable balance, or the average amount customers owe after you’ve provided a product or service. By showing how quickly and reliably those receivables turn into usable cash, the ratio gives you a useful measure of your business’s effectiveness in collecting payments on invoices and managing customer credit.

Accounts receivable (AR) can feel complicated, especially for small businesses or sole proprietors without dedicated finance teams. In this guide, we’ll break down accounts receivable turnover ratio, why it matters, and set you up with the steps you need to calculate and manage your business’s credit collection.

What is the accounts receivable turnover ratio and why does it matter for your business?

The accounts receivable turnover ratio measures how quickly your business collects payments from customers for goods or services you’ve already provided. This metric indicates how effective your business is at turning outstanding invoices into usable cash.

This matters because money owed but not yet collected can hurt your business and withhold funds you could otherwise use to pay expenses, loans, or fund growth. By tracking your accounts receivable turnover, you can reevaluate your credit and collection practices and make changes to customer relations and payment terms where necessary.

How to calculate the accounts receivable turnover ratio

Your accounts receivable turnover ratio can be calculated with the turnover ratio formula. Calculations are based on two values: net credit sales and average accounts receivable. With these two metrics, you can quickly and simply compute your accounts receivable turnover ratio as net credit sales divided by average accounts receivable:

Account Receivable Turnover Ratio = Net credit sales / average accounts receivable

Let's break this down into steps:

Step 1: Identify net credit sales

Net credit sales refer to your total earnings on credit during a specific period of time (number of days, month, year). To calculate net credit, you’ll need to subtract any returns, discounts, or allowances from the revenue or gross value on all receivables in the specific period.

Example:

In 2024, your company made $12,000 in credit sales. Customers returned $2,000 worth of credit, and you didn’t offer discounts or allowances.

- Net Credit Sales = $12,000 (Gross Credit sales) – $2000 (Returns) – $0 (Discounts) – $0 (Allowances)

- Net Credit Sales = $10,000

Step 2: Calculate average AR (beginning + ending / 2)

Average accounts receivable (AR) refers to the average amount of money owed to your business in a specific period of time. To calculate, add together the beginning accounts receivable balance and the ending accounts receivable balance in a given period of time; then, divide by 2 to find the average.

Example:

At the start of 2024, your accounts receivable balance was $4,000. By the end of 2024, it had grown to $6,000.

- Average Accounts Receivable = ($4,000 Beginning Accounts Receivable + $6,000 ending Accounts Receivable) / 2

- Average Accounts Receivable = $5,000

Step 3: Apply the formula

Now that you’ve calculated your values, you can find your accounts receivable turnover ratio by dividing net credit sales by average AR.

- AR Turnover Ratio = $10,000 net credit sales / $5,000 average AR

- AR Turnover Ratio = 2.0

Step 4: Interpret the result with context

In this example, your result for AR turnover ratio was 2.0, meaning that, in 2024, your company collected receivables an average of two times. In context, this means that you are collecting credit invoices every 6 months on average.

What does a high or low AR turnover ratio mean?

Your AR turnover ratio tells you how efficiently your company is collecting its receivables. If this number is low, it means that you’re collecting invoices only a few times over a given period. For monthly collections, getting an AR turnover ratio of 1.0 to 2.0 may not be too bad, but over a year-long period, this could suggest that your company is not collecting quickly enough and should perhaps reevaluate credit and payment terms, invoice tracking, or relationships with debtors.

An average to high AR turnover ratio is dependent on the context of your specific business type and the period of time for which you are calculating. The value should, ultimately, be a useful tool in determining how often and efficiently you are collecting your extended credit and the effectiveness of policies, payment terms, and debtor relations that ensure you are receiving receivables at a timely rate.

Accounts receivable turnover ratio in days: what it tells you

It can be helpful to convert your accounts receivable turnover ratio into the number of days. This process follows a simple calculation and can help highlight how many days, on average, it takes your company to receive cash from debtors within a given period.

Accounts Receivable Turnover in Days = 365 Days / Accounts Receivable Turnover Ratio

Days Sales Outstanding (DSO) is another similar metric that can help gauge the efficiency of your financial management. DSO calculates the average number of days it takes to collect payment after the initial sale.

DSO = (Accounts Receivable / Total Credit Sales) x Number of Days in Period

DSO may also be referred to as the average collection period (ACP), a slightly different metric of the average time to collect receivables.

DSO, average collection period, and accounts receivable turnover ratio in days all measure how quickly a business collects payments from customers. They are essentially different ways of expressing the same idea. In all three cases, lower values are better because they indicate faster collections. By contrast, the accounts receivable turnover ratio prefers a higher number, since it shows receivables being collected more frequently.

Benefits and limitations of the accounts receivable turnover ratio

The accounts receivable turnover ratio can be a handy and beneficial tool for illustrating the efficiency of your business's cash flow and relationships with debtors. However, it’s not a catch-all tool for analyzing business functions or your financial management, so you should be aware of what the AR turnover ratio can and can't tell you. Here’s a breakdown:

Benefits of AR turnover ratio

- Check on cash flow. See how quickly money moves between you and your customers.

- Evaluate your own terms. A low turnover ratio can alert you to lackluster policies, enforcement methods, or payment terms that lead to poor client management and damage to your credit.

- How are your operations? AR turnover ratio can give you a general sense of how smoothly your business is operating and how quickly your receivables are turning into usable cash.

- Know your customers. A low turnover ratio may alert you to late-paying customers.

Limitations of AR turnover ratio

- Looking backward. AR turnover ratio is only determined by past earnings and balances, making it a difficult metric for predicting future cash flows.

- Variability. AR turnover ratios are not one-size-fits-all. Instead, each business type comes with different expectations that are not made immediately apparent by your ratio score.

- Outliers. If one customer pays a large sum late, this can affect the ratio and be misleading if evaluating generally.

Slash business banking

Works with cards, crypto, plus cards, crypto, accounting, and more.

Take control of your cash flow with smarter financial management with Slash

Accounts receivable turnover ratio is a helpful metric to gauge your company's financial management and ensure your credits are being reallocated to working capital. Not only a useful tool for you, but investors and other interested parties may use the accounts receivable turnover ratio metric to warrant operational changes or financial oversight of your company.

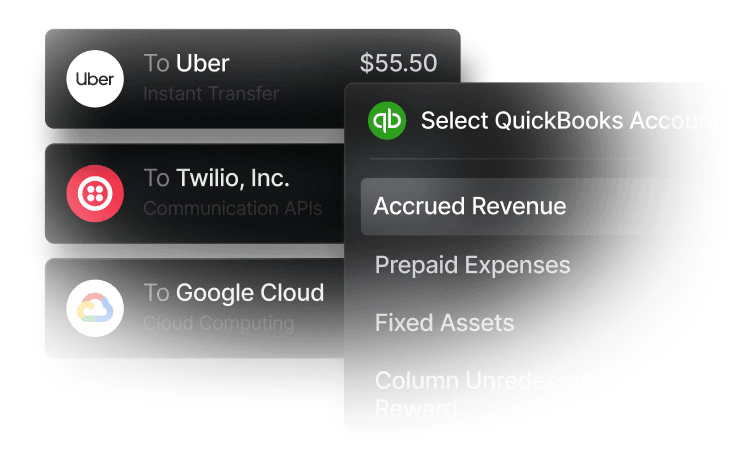

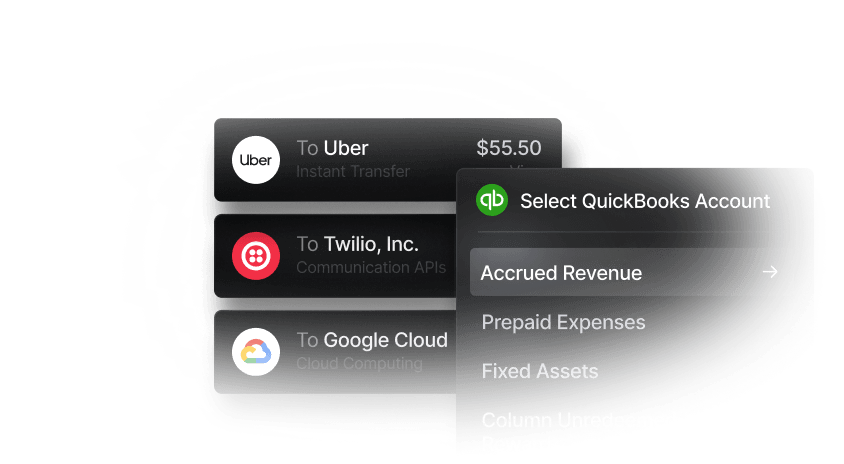

Slash is a banking platform¹ built for better financial management, offering a number of features to improve cash flow, business operations, and efficiency, without dividing your focus. Accounts receivable is one of the many features made easier with Slash through virtual accounts and future invoicing features.

Slash's virtual accounts let you separate cash flow to different routing and account numbers depending on the criteria that you set. In practice, you can set virtual accounts for each customer. If your accounts receivable turnover ratio is lower due to credit that's unpaid or sent past its due date, Slash gives you the tools to see exactly who caused this delay and when.

Coming in 2025, Slash will be offering extensive invoice features, allowing you to send and monitor invoices in real-time.

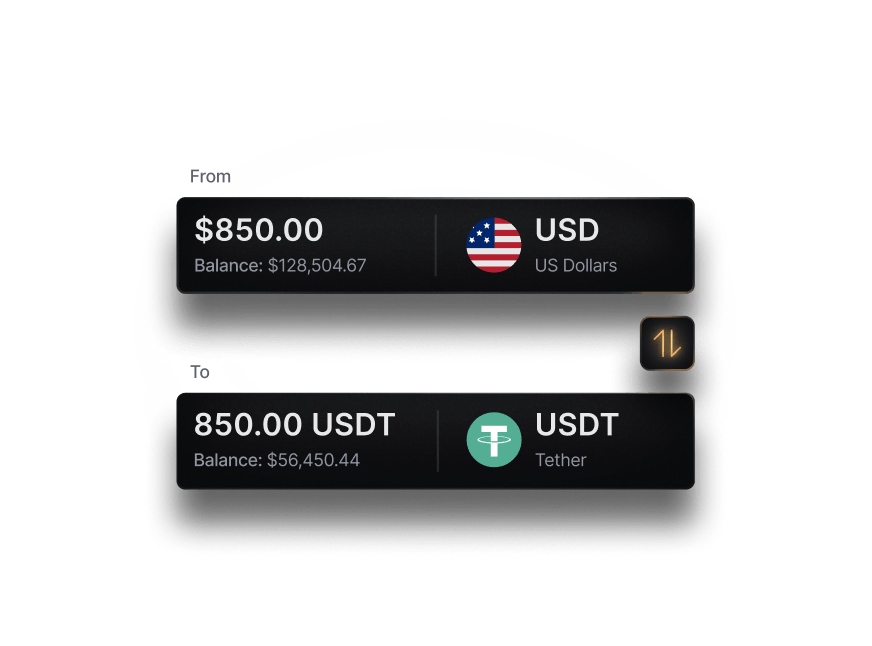

Slash doesn't stop there. Offering RTP, ACH, and wire transfers, multi-entity support, integrated accounting tools, and more for eligible users, Slash is built to help you optimize your financial management, improve cash flow, and grow your business.

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Frequently asked questions

What causes accounts receivable turnover to decrease?

Overdue, unpaid, and bad debt payments can harm your accounts receivable turnover.

How to improve receivable turnover?

You can improve receivable turnover through tighter policies and payment terms, improved customer screening, invoice management, or other methods that improve the average efficiency with which you collect debts.

What is a good AR/days ratio?

A good AR/days ratio is dependent on your specific business type. See the turnover ratio formula for days to assess your business.

What is bad debt?

Bad debt refers to receivables that are unpaid by debtors. Bad debt can harm your business's financial health and cash flow management, decrease profitability, and lower your accounts receivable turnover ratio. Maintain receivable management through professional relationships with customers with clear creditworthiness to limit bad debt.

How do overdue payments affect my turnover ratio?

Overdue payments will lower your turnover ratio, highlighting that your collection process is lacking efficiency and could use tighter policies to ensure debtors are paying by their due dates.

¹ Slash Financial, Inc. is a financial technology company and is not a bank. Banking services and deposit accounts provided by Piermont Bank, Member FDIC and Column National Association, Member FDIC.