Accounts Payable Automation for Small Businesses Guide

Small teams juggle a lot with limited resources. Without smart automation solutions, routine tasks can pile up, eat valuable time, and make it harder to manage cash flow. The right tools can help your business with financial and operational workloads by turning manual tasks into streamlined workflows with faster turnaround times, fewer errors and better overall efficiency.

There are a number of ways you can automate your business processes. One key method is through accounts payable automation. Accounts payable (AP) relates to your current liabilities and the money you owe to vendors, making it an essential value and financial process to your business. In this guide, we’ll focus on accounts payable automation: what it is, how it works, and how it can save your business time and energy.

What is accounts payable automation and why does it matter for small businesses?

Accounts payable (AP) refers to the money your business owes vendors or suppliers after procurement and receival of a good or service. AP is essentially the opposite of accounts receivable (AR) which reflects what customers and clients owe you after providing them with a good or service. Both are important values on your balance sheet, but can become complicated with invoice processing, approvals, and closing payments on-time.

AP is a current liability for your business, and is important to monitor, process correctly, and pay to suppliers within agreed-upon deadlines. Therefore, relying on manual processing can be risky, leaving your company vulnerable to costly errors and limiting the time you could be spending on other essential tasks. Automating solutions around accounts payable will help streamline the entire process by reducing manual labor in a number of areas:

Top accounts payable tasks you can automate

Automating AP streamlines repeatable, manual work, cuts errors, and gives you cleaner workflows. Some of the key areas where you’ll see automated benefits:

- Invoice matching. Using OCR (optical character recognition) and machine learning to pull data (vendors, dates, amounts, taxes, etc.) from digital documents, scanned paper invoices and receipts. Automated data entry can then process this information for you and speed up your reconciliation.

- Automatic reconciliation. Similar to invoice matching, automated reconciliation automatically categorizes your expenses for greater efficiency.

- Vendor relations. Auto-notify vendors when invoices are received, approved, or scheduled for payments. Oftentimes, you can also automate the process of invoice corrections, reminders, and the creation of forms and invoices for vendors.

- Approval routing. Automating approvals can screen matches for you, making the process easier. Automation can also be used to keep track of approvals. This comes in handy for audit trails or keeping track of approval history more generally.

- Payment scheduling. Automation lets you schedule send payments so you can optimize cash flow while ensuring you don’t miss important payment deadlines.

- Payment processing. Set terms and limit the amount of manual approvals you have to issue, making the job for approvers easier.

Top accounts payable challenges small businesses face

Headaches are common for small teams maintaining organizational workflows over invoices, vendor agreements, and more. Knowing what challenges to expect when dealing with accounts payable will help you better improve your automated AP workflow:

- Time-consuming manual data entry. Adding dates, amounts, taxes and more by hand is a common process with accounts payable. Luckily, OCR and other automated tools make this headache much easier. Cloud-based and digitized features additionally limit headaches related to storing and maintaining physical receipts or documents.

- Missed or delayed payments. Missing payments can accrue expensive fees, harm credit and vendor relationships, and impact your overall accounting workflow. Automating transaction schedules can save you from risking missed payments in the future.

- Lack of integration with accounting tools. When your accounting is separate from your accounts payable processing, it can leave you with a lot of manual work and messy bookkeeping. Financial management platforms like Slash¹ offer tools with built-in expense tracking, invoice processing and integration with accounting tools. With one dashboard, this streamlines bookkeeping and AP for your accounting teams to work easier.

- Difficulty managing cash flow. It can be common for bills to land unevenly, for approvals to stall, discounts to get missed, or last-minute payments to trigger fees. Automation centralizes invoices, surfaces what’s due when, and auto-schedules payments to hit at the right time. This will help you not only optimize cash flow, but also help you avoid late fees and potentially capture discounts.

Key benefits of automating accounts payable.

- Faster invoice processing and approvals. Automation may use OCR and machine learning to read digital and scanned physical paper documents for data extraction and storage.

- Fewer errors improved accuracy. Errors are expected. Automated tools can catch errors like duplicate entries, discrepancies, and fraud. Additionally, AP automation tools can be used to stop errors before they occur, offering standardized data capture and OCR or machine-learning based data matching from invoices, receipts and purchase orders.

- Better visibility into cash flow. Financial management systems like Slash offer dashboards where you can view current and upcoming obligations, payment deadlines and current cash flow statuses, giving you a clearer picture of where your cash is now and where it should be in the future.

- Stronger vendor relationships. Consistent, on-time payments and automated payment notices improve communication and reduce disputes, which can support better terms over time.

- Accounting integration. Two-way synchronization with the general ledger keeps vendor records, bills, and payments aligned and preserves a complete audit trail.

- Tangible ROI and long-term savings. Lower processing costs, fewer late fees, improved discount capture, and reduced work contribute to savings over time. The tangible results of AP automation can be seen in other ways:

Tangible results of AP automation

By reducing manual labor and shortening turnaround times, AP automation delivers a number of tangible benefits for your business. The below list are ways your company may see tangible benefits, leading to more time, money, and energy for your teams:

- Cut invoice cycle times by up to 80%. Automated routing, reminders, procurement, and invoice matching will decrease accounts payable processing time in all stages, from purchase order to invoice to receipt to approval to payment to happy vendors.

- Scale payables without growing your team. AP automation can translate to greater workload handling by same sized teams, saving you on labor costs.

- Time. With automation, AP processing gets easier, faster, and more efficient. Simply put, this translates to more time for you.

How to implement AP automation in your business

Step 1: Assess your current AP workflow

First, get a clean picture of your current process. To do so, it may be helpful to break down the steps in a typical accounts payable processing workflow:

- Intake: invoices may be delivered by email, PDFs, physically, or via another method. Identify where you are pulling from and where you are storing invoice data.

- Review: Check information, add PO, vendor information, project and more relevant information.

- Match: Match invoices to receipts or PO and flag any discrepancies.

- Approve: Sign-off of payments once all information has been entered and reviewed to be correct.

- Pay: Discern an optimized payment date and schedule or send correct payments then via supported transfers, typically ACH, wire, RTP or physical checks.

- Report: Store data for future audits and tax filing.

Step 2: Identify repetitive or error-prone tasks

If your team is missing payments, mismanaging matching, or struggling with another step in the process, it is important to identify where that is so you can move forward with the right automation.

Step 3: Choose software that fits your scale and integrations

There are a number of financial management and automation tools available for you. Slash is one option as a financial platform that integrates with accounting tools, offers invoice tracking, and easy ACH and wire transfers. Additionally, Slash’s one-dashboard design allows you to easily manage the different steps in your AP process, so you can identify your problem areas and implement the right automation where needed.

Step 4: Ensure team onboarding and training

Automation can only take your team so far. Finding the right people to monitor and manage AP and other financial processes is critical. Once you have your team assembled, equip them with the right tools and access so they can succeed. The effects will help your business reduce risk and avoid missed payments.

Step 5: Monitor performance and optimize regularly

It’s not expected that you’ll find the right solutions to your AP and other financial processes right away. Staying patient, continuously monitoring performance, and implementing new solutions where they arise, are excellent methods to stay on top of your finances and continue to optimize your workflow.

Get started with Slash today

Gain AP automation, accounting tools, real-time expense tracking, and much more

Best AP automation tools for small businesses

AP automation software can be very helpful. Luckily, there are a number of tools with integrated AP automation tools, here's an overview of some of the best picks available right now:

1. QuickBooks

Key Offers: an accounting system with bill management and payment processing options.

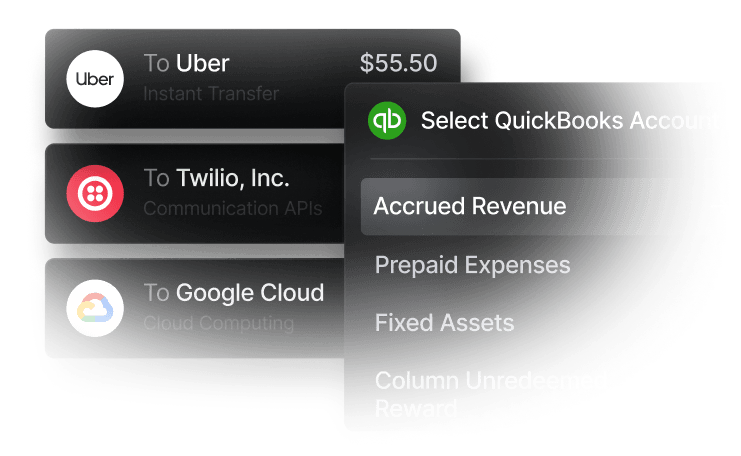

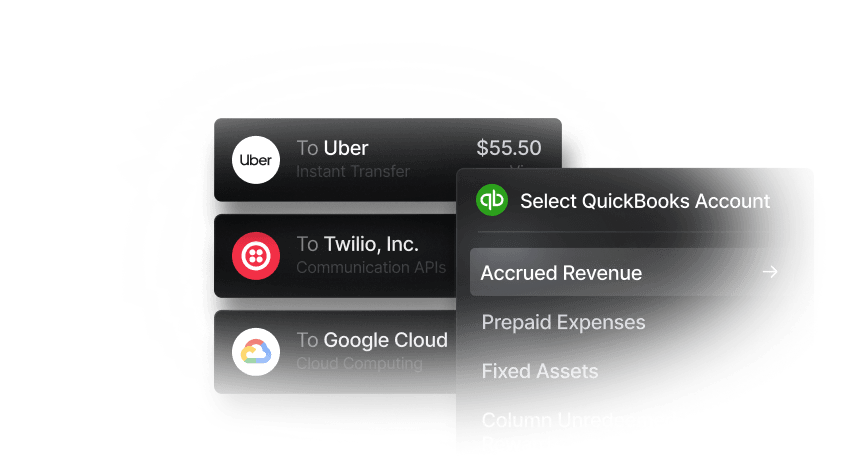

Invoice tracking, basic approvals, integrated with AP and AR tools like Quadient. Commonly supported by third party banking platforms like Slash offering Quickbooks integration with general financial management software.

2. Xero

Key Offers: accounting systems with bills, approvals, and automated data entry.

Fraud protection (duplicate detection, vendor validation), invoice tracking, integrated with tools and supported by third-party banking platforms such as Slash.

3. NetSuite

Key Offers: Full ERP system, AP management, cloud-based reporting.

Offers a wide range of financial services, including ERP and accounts payable software. The latter offers purchase order and invoice tracking, automated payments, and vendor records.

4. Slash

Key Offers: accounting integrations, corporate cards², expense tracking.

Accounting integrations with QuickBooks and Xero while also offering financial management software, automated expense tracking, stablecoin tools³, and banking support with Column, N.A.

$3k+ happy Slash customers

“Before Slash, our finance team juggled multiple platforms for on ramps, custody, and banking. Now everything lives in one place, saving us countless hours and eliminating errors.”

Max Segall, COO, Privy.io

Smart banking, simplified: Why choose Slash for automated AP

Slash is a financial technology platform designed to offer financial tools tailored to your industry. Slash’s key offers include accounting integrations, charge cards, detailed card logs and expense history tracking, and business accounts.

The financial platform is designed to make your money management and accounting tasks, like AP, faster, easier, and more automated. Here are some of Slash’s key features helping you work smarter and faster with automated tools:

- Expense management. On Slash’s dashboard, you can issue physical and virtual cards, set spend limits and merchant controls, and monitor transactions in real time with automated payment and fraud detection tools.

- Ways to pay. Automated and cloud based payment tools can let you authorize transfers via ACH, wire, RTP, and stablecoin on Slash’s dashboard.

- Accounting. Slash automates your AP process with better workflows and accounting integration tools. On the same dashboard, users can automate their approvals, schedule payments, track expenses, and duplicate data into your accounting page, integrated with QuickBooks. Together, Slash’s accounting software makes it easy to use and efficient.

For small businesses, entrepreneurs, diy accountants, or even CPAs, Slash can help you keep track of your books and complete tasks easier and with less concern for error.

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

¹ Slash Financial, Inc. is a financial technology company and is not a bank. Banking services provided by Column N.A., Member FDIC.

² The Slash Platinum Card is a Visa® charge card issued by Column N.A., pursuant to a license from Visa U.S.A. Approval is subject to eligibility. Payment of account balance is due in full daily. Monthly membership fees may apply. Card purchases may be eligible for cashback, see https://www.joinslash.com/legal/cashback-terms for more information.

³Cryptocurrency conversion, transfer, and custody services are provided by Bridge, not by Column, N.A. or Slash. Cryptocurrency is not custodied by any bank, is not FDIC-insured, may fluctuate in value, and is subject to loss. Terms and conditions apply.

Frequently Asked Questions

What is the difference between accounts payable and accounts receivable?

Accounts payable (AP) is the money your business owes to vendors and suppliers for goods or services received. It appears as a current liability on your balance sheet. Accounts receivable (AR) is the opposite—money that customers and clients owe you for goods or services you have provided. AR appears as a current asset.

What AP tasks can be automated?

Key AP tasks that can be automated include: invoice data capture and matching, three-way matching (purchase order, receipt, invoice), approval routing workflows, payment scheduling and processing, vendor payment notifications, and automatic reconciliation with accounting systems. Automation reduces manual data entry errors and speeds up processing times.

How much can AP automation reduce invoice processing time?

AP automation can cut invoice cycle times by up to 80% compared to manual processing. By eliminating manual data entry, automating approvals, and scheduling payments, businesses can process invoices in days rather than weeks. This speed improvement also helps capture early payment discounts and avoid late payment penalties.

What are the main benefits of AP automation for small businesses?

Key benefits include: faster invoice processing and approvals, fewer errors from manual data entry, better visibility into cash flow and outstanding liabilities, stronger vendor relationships through timely payments, seamless integration with accounting software like QuickBooks and Xero, and the ability to scale payables volume without adding headcount.