How to Cut Costs in Business: A Smart Guide for Modern Operations

Looking to slash your expenses? In this economy, it’s no mystery why: inflation, rising overhead, and shrinking margins are making it harder to grow without hurting your cash flow. But blindly cutting your budget won’t get you far.

You need long-term financial planning, sharper efficiency, and smart cost-cutting that optimizes your operations and increases profitability. Luckily for your business, there are available tools to help cut business expenses and free up cash flow. In this guide, we’ll highlight Slash¹ as an instrumental banking platform for smarter cash flow management and effective cost cutting, with key features like 2% cash-back on eligible card spending², 1.89% APY on savings accounts³, and built-in expense management.

Ahead, you’ll find effective strategies to cut business costs in ways that are both sustainable and strategic, allowing your business operations to thrive in this modern business climate.

Cutting costs the smart way

If your business is struggling with profitability and overburdened by unnecessary overhead, cost cutting is a no brainer. However, cost cutting can be a difficult process, especially when simple fixes are more harmful than they seem.

Where intentional and effective cost cutting can set your business up for long-term success, greater operational efficiency, and consolidated workflows, the wrong cuts can take reactive routes, offering only short-term cost cuts but unnecessary future headaches.

When reducing business costs, the key to truly optimized cash flow is to preserve value and productivity. Yet, many businesses fail at this; instead, narrowly focusing on cutting out resources and labor costs without considering data that could reveal deeper inefficiencies or overlooking employee impact on optimized operations.

There are myriad ways to go about cutting costs in a smart and efficient way for your business. Let’s break down how you can cut without harming your bottom line.

Proven ways to reduce costs without hurting performance.

Cost reduction isn’t one size fits all. Rather, savings can come from multiple angles and target different areas of your business budget:

- Operational Savings. Reduce day-to-day expenses: trimming operational costs, negotiating with suppliers, streamlining infrastructure, and cutting down on materials waste.

- Strategic Savings. Like investing in operational tools or making upfront changes that may feel small now but compound into bigger returns later.

- Financial Savings. Sharper money management and budgeting practices so you can cut unnecessary costs while improving overall efficiency.

Considering operational, strategic, and financial savings together gives you a more complete view of your business spending, allowing you to make smarter decisions on where to cut costs. Relying on just one type of cost cutting can undercut value and slow productivity, while combining all three helps you reduce expenses without harming day-to-day operations. The techniques ahead take that approach, offering ways to trim costs while keeping your business strong.

Slash business banking

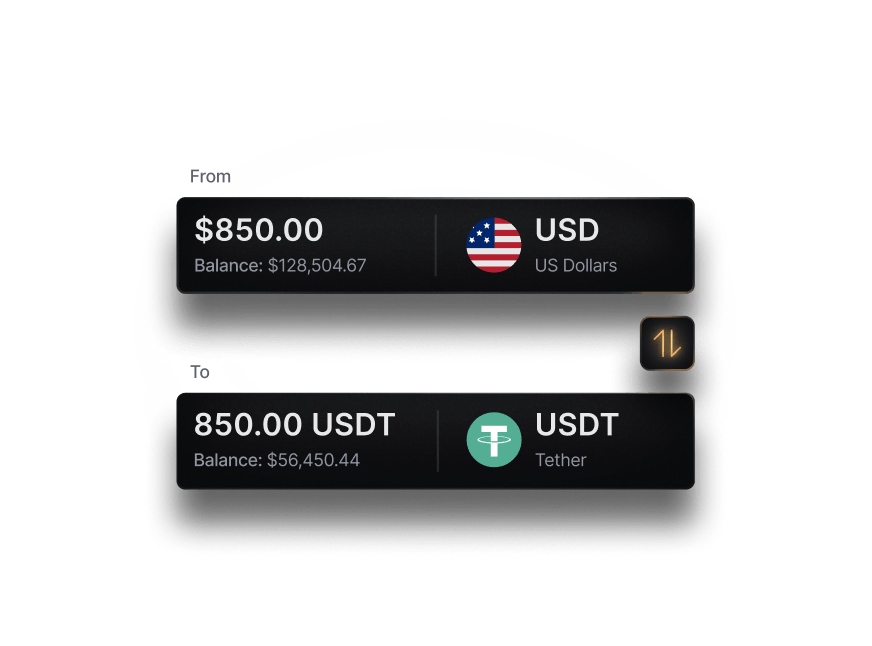

Works with cards, crypto, plus cards, crypto, accounting, and more.

Automate financial tasks like AP/AR and payroll

For recurring expenses and financial tasks like AP/AR, payroll, some vendor payments and more, implementing automated solutions can reduce the need for manual labor. This lets you save on labor and infrastructure costs and improves your team’s overall efficiency and productivity by streamlining workflows.

Switch to business banking with no hidden fees

Business banking through platforms like Slash offer you financial saving solutions with expense tracking, integrated accounting, and detailed card logs without hidden fees. Business banking tools let you manage and analyze spending to improve strategic savings.

Use high cashback corporate cards

Using high cashback cards on business expenses is an easy way to optimize on your business’s necessary spending. Slash offers 2% cash back on eligible transactions and, with built-in card logs, your business can track where you're spending most in real-time, without needing a time-consuming and labor intensive audit.

Streamline tools and centralize expenses

Cost savings can easily come from reducing the number of financial management tools you are using. Slash’s all-in-one dashboard with integrated support for accounting, treasury, savings and checking is a great alternative to traditional methods: saving you from opening numerous accounts, accruing potential fees, and spending on inefficient labor.

Negotiate better rates with vendors or suppliers

Contracts and payment terms can often contribute to expensive overhead costs. Invest in your business relationships now, for better relationships with vendors and suppliers that can lead to lower expenses later.

Outsource non-core functions

Outsourcing labor on non-core functions can reduce costs on office space, hiring costs, and other resources. While cutting employees can seem an easy cost saving method, it's important to consider the impact on office morale and productivity

Switch to digital receipts and cloud-based expense management

Cost reduction can come from cutting office expenses. Switching to digital infrastructure can offer long-term savings.

Identify where your business is overspending

The most common and easiest way to cut business costs is to target overspending. To flush out overspending, a recommended method is to conduct a cost audit or a procurement of your finances and expenditure history, paying particular attention to hidden or unnecessary expenses across tools, subscriptions, operations, and financial fees. Some common occurrences of overspending:

- Duplicate or outdated software tools. Cut out unused tools for easy savings and improved efficiency.

- High transaction or banking fees. Eliminate waste by switching to banking platforms with low fees and transparent pricing on ACH, wire transfers and other transactions.

- Manual processes that could be automated. Save on labor and hiring costs by automating tasks.

- Poor visibility into spending across teams. Implement strategic financial management with tools like Slash to analyze spending and reduce waste.

How Slash helps you cut costs and improve financial control

Slash is a banking platform built to help businesses eliminate wasteful spending and strategically reduce costs through a number of key financial management features:

- Zero-fee banking. You can access Slash's banking services (including checking and savings accounts), which are provided by our partner Column N.A., Member FDIC, for as little as $0/month.⁴

- Real-time transfers. Send money to clients and vendors quickly, without paying hidden fees.

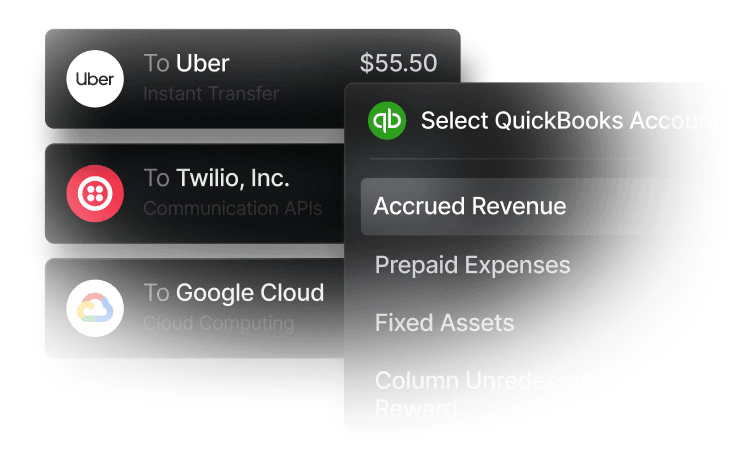

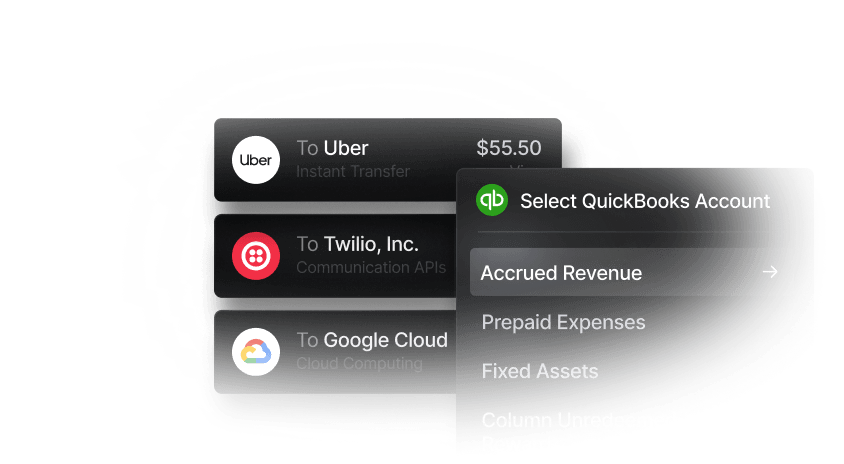

- Accounting integrations. Slash integrates with QuickBooks and Xero to give you enhanced accounting tools for better financial management, auditing and more.

- Competitive cash-back. Slash offers 2% cash back on eligible spending for Pro users.

- Detailed card logs and expense tracking. See exactly how your employees are spending business cash and when, eliminating unnecessary spending at the source.

Slash isn’t simply built to help you manage finances, it’s designed with your savings in mind. With the level of financial understanding Slash provides, your business will more easily cut costs, improve operational efficiency, and reduce overhead.

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Frequently Asked Questions

How to analyze business spending?

You can analyze business spending, conduct in-depth financial audits, and more through your Slash dashboard. Slash optimizes financial management with features like detailed cards logs, expense tracking, and integration with accounting features like QuickBooks and Xero.

Treasury Management Solutions for Businesses: Choosing Between Full TMS and Banking-Led Platforms

Top Expense Tracking Software Picks for Businesses

Can you reduce cost through supplier discounts?

Yes, finding discounts on materials is an effective strategy for reducing costs. However, some discounts are only short-term, and it's important to consider long-term implications before paying for new services.

Top crypto affiliate programs to explore in 2026

What are strategies for cutting labor costs?

Outsourcing labor or implementing automated tools in your business's operations may reduce the need to hire new employees.

Hiring an Accountant for Small Business: What to Know First

¹ Slash Financial, Inc. is a financial technology company and is not a bank. Banking services provided by Column N.A., Member FDIC.

² The Slash Platinum Card is a Visa® charge card issued by Column N.A., pursuant to a license from Visa U.S.A. Approval is subject to eligibility. Payment of account balance is due in full daily. Terms, conditions, and fees apply; see slash.com/legal. Card purchases may be eligible for cashback, see https://www.joinslash.com/legal/cashback-terms for more information.

³ Interest rates advertised are accurate as of 01.01.2025. Deposits of $10,000 to $1,000,000 earn 32.75% of EFFR and deposits greater than $1,000,000 earn 43.6% of EFFR. Effective Federal Funds Rate (“EFFR”) is reported by the Federal Reserve Bank of New York and available at Effective Federal Funds Rate. Interest rate is subject to change at any time before and after the Slash Platinum Savings Account is opened.

⁴ Other fees may apply. For plan options, see slash.com