Do I need an accountant? How to decide and find the right accountant for your business

If you’re a small business owner juggling growth, increasingly complex finances, limited time, or simply struggling with a lack of accounting expertise, it may be time to bring an accountant on board.

Accountants do far more than file taxes. For many businesses, accountants are strategic partners who help optimize cash flow, reduce financial risk, and support long-term growth. Beyond compliance, a good accountant can give you sharper insight into your numbers and play a key role in decision making.

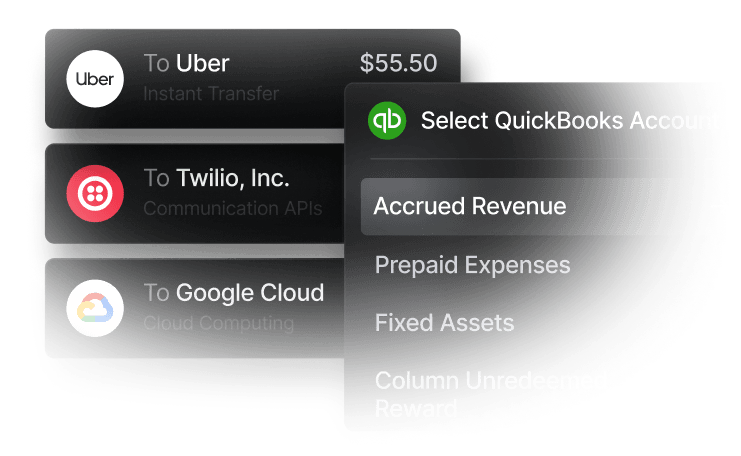

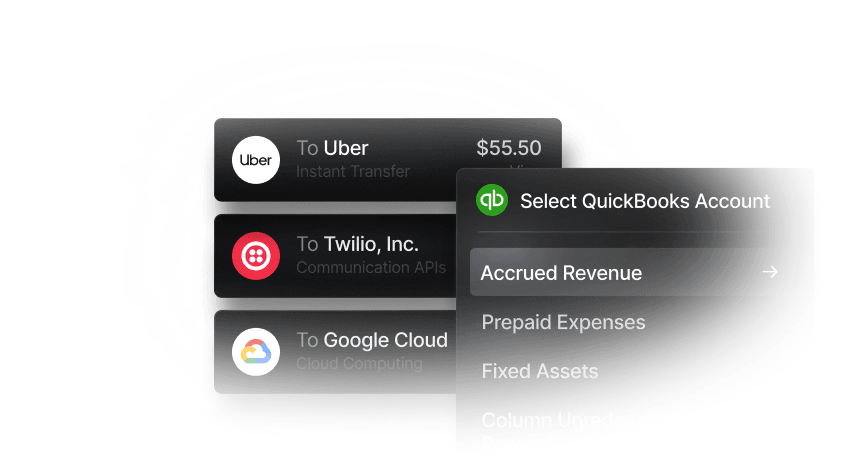

In this guide, we’ll walk you through what accountants do, when it makes sense to hire one, and how to choose the right fit for your business. We’ll also highlight how Slash makes onboarding an accountant a seamless process: with financial management tools like real-time cash-flow and expense tracking to accounting integration with QuickBooks and Xero, Slash gives your new accountant the necessary tools to dive in quickly and manage your finances from one easy-to-use dashboard.

What does an accountant do for a small business?

Accountants offer many ways of supporting small businesses, offering bookkeeper services and contributing to strategic planning, managing income and expenses, and long-term company growth:

- Bookkeeping. A key role for any accountant is maintaining accurate financial records on transactions including sales, expenses, invoices, and payroll. Effective bookkeeping ensures you have a clear view of your present, day-to-day financial status.

- Financial reporting. Financial statements are essential for gaining a clear understanding of your finances and can be especially useful when dealing with investors or lenders. Accountants are bookkeepers, and prepare relevant documents such as balance sheets and cash flow statements to help you spot trends, risks, and financial opportunities for your business.

- Tax filing. Accountants handle tax preparation and compliance, meaning they calculate deductions and ensure accurate tax filing, potentially saving your company money on costly mistakes and penalties.

- Strategic planning. Accountants may serve as financial advisors, analyzing financial data and identifying inefficiencies where applicable.

Differences between an accountant and a CPA

Accountants and CPAs are both financial professionals, and you may hear the terms used interchangeably, though they’re not the same thing.

An accountant is a professional trained in bookkeeping, managing income and expenses, and taxes. Many accountants hold degrees in accounting or finance and can be invaluable for organizing your business finances, preparing statements, and supporting your team’s financial growth and future business plans.

A CPA or Certified Public Accountant is an accountant who has taken further education and training to meet licensing requirements and pass the CPA exam. The certification gives CPAs authority beyond accountants, including the ability to perform specialized tasks like auditing financial statements, offering assurance and tax law services, and representing clients before the IRS.

For many small businesses, an accountant can manage the necessary tasks to keep your business running smoothly. For more complex enterprises and highly regulated businesses, a CPA may be worth the investment to ensure all of your bases are covered.

When do you need to hire an accountant?

It may seem obvious that you should hire an accountant once your business finances become overwhelming. But waiting until you’re in trouble can cost you more time and money. Being proactive and looking for an accountant before you’re faced with extensive burden is a smart approach.

Here are some common triggers that may signal it’s time to hire an accountant:

- Preparing for tax season. If you’re worried about staying IRS compliant and filing your taxes correctly, it may be smart to hire an accountant rather than face this burden yourself.

- Expanding operations. Adding more employees to payroll, increasing production, opening new locations, and more will add significant financial stress on your business. Accountants can ease that burden and may also help you strategically plan for future business development.

- Complicated finances. Guides can be helpful resources for complicated financial loads, but may not give a full picture if you don’t have a background in accounting. Hiring financial professionals can help you ease beginner confusion, even if you’re using tools like Slash that make it easier.

Benefits of hiring an accountant

There are a number of tangible benefits of working with a qualified accountant. Some of the key ways your company may benefit:

- Reduced tax burden. Accountants can help ensure you file business and payroll taxes accurately and avoid penalties, fines, or legal action from misfiled tax returns.

- Better financial forecasting. As a financial professional tracking assets, expenses, transactions, and more, accountants become strategic partners in advising financing, investment, and forecasting financial partnerships and markets.

- More time to focus on growth. Hiring a professional accountant can help with finances as your business scales. Trained to handle complicated bookkeeping, taxes, income and expenses, and financial strategy, an accountant for your business ultimately means you can spend less time managing your finances and more on your company’s growth.

How to find and hire an accountant for a small business

Finding and hiring an accountant can be a tricky and time consuming part of the process if you don't have the steps to do it successfully. But finding the right one will have so many great benefits that will lead to better success for your business.

Finding the right accountant should mean finding the right fit for your business. Reevaluating your business and assessing your goals can be a good starting point:

Step 1: Define your business’s accounting needs

It’s important to first understand your own business needs. Are you a small or medium sized business? Do you plan to expand your business operations? What markets are you operating in? Where are your revenue streams? Where is your financial strain? What sort of things are you hoping an accountant may assist you with?

Identifying your own needs will help you identify what gaps an accountant can fill, thus what sort of accountant you’ll need:

Step 2: Decide the type of accountant to hire

Depending on your unique business needs and what sort of support you are looking for, you can expect to look for a different accountant type. These types are often differentiated by budget complexity, business size, growth plans, or accountant’s terms:

- Freelance Accountant. Typically service more than one client and use accounting tools for more efficient processes, such as QuickBooks with financial management software like Slash. Commonly paid per project and offer flexible and broad accounting knowledge.

- Accounting firm. A company that provides accounting services to businesses, typically offering more than one financial professional in assisting with your accounting.

- In-house accountant. An accountant which you hire and only serves your company. Can mean closer understanding of your business’s needs and finances.

Still curious what type of accountant is best for your business? Consider looking for financial tools your accountant is trained on. If you’re using Slash, financial management and accounting software integrated accounting tools like QuickBooks and Xero, make it easy for all types of accountants to quickly learn your finances, join your team, and help your business grow.

Step 3: Start your search

Don’t worry, the right accountant is out there. Knowing where it’s best to look, though, is a very helpful step in finding them:

- Ask for referrals from other small business owners. Your network is a powerful tool in finding qualified new-hires. Asking industry peers can be helpful in finding talent and help you vet applicant’s credibility head on.

- Use directories. AICPA and other CPA or accountant directories offer lists of certified applicants.

- Search on LinkedIn or accounting specific platforms. Business and social networking sites like LinkedIn may help promote job postings, and give you a view into applicant’s work history and connections.

- Post on job boards or freelance marketplaces. Indeed, Glassdoor, and other online job boards are such tools in promoting your search to interested applicants.

If your search is difficult at first, don’t give up! The right accountant may be somewhere you haven’t looked yet. Small businesses attract new hires in a number of creative ways from college job boards, marketing, or by growing your network in other areas of your business.

Step 4: Evaluate credentials and expertise

When you open up a job search, expect to receive a lot of different resumes. You should have a good idea of what you’re looking for before beginning your review:

- Licenses (CPA certification, if needed). To look for if your anticipated accounting tasks include CPA-provided services like IRS representation.

- Years of experience with small business. Assess whether your applicant has relevant experience to the role. If only for a short term, do they have other experiences that would help prepare them for your business’s scale?

- Familiarity with industry-specific requirements. The business accounting tools, infrastructure, and language of your industry can be difficult to understand for those inexperienced. Ensuring your accountant has working knowledge of your industry will set them up to better help your business.

- Comfort with digital tools like cloud accounting software. Knowing the tools you use can help you find helpful new hires. If you’re managing finances with Slash, accountants with QuickBooks or Xero knowledge will find familiar tools, saving you from taxing onboarding.

Step 5: Interview and assess fit

Create a shortened list of applicants who match the suitable criteria for your business. Prepare to ask them a few questions to get to know them better. Whether it be verifying information or getting a better sense of industry experience, asking questions can give you a better sense of the applicant’s potential fit at your company. Some helpful questions to ask:

- What services do you offer and what’s included? What tools

- What experience do you have with businesses like mine? Small or large business? In your industry?

- What’s your communication style and availability?

- What accounting software do you use? What accounting system do you use?

- How do you structure your fees (hourly, retainer, project-based)?

Step 6: Run a reference and performance check

After the interview process, follow up further with references or contacts provided by your candidate. This will let you ensure that all information provided by the applicants can be backed up and is correct. When speaking with references, it is helpful to verify key things going beyond what you may learn in an interview:

- Timeliness. A difficult thing for your candidate to properly assess themselves. Asking references for timeliness will give you an accurate picture of your future accountants ability to get work completed on-time.

- Accuracy. Make sure that what your applicant says is not fabricated. This can be emblematic of how your accountant will perform and act, even in more general areas of their work.

- Responsiveness. To assess how well you will be able to work with your accountant, a good thing to consider is their responsiveness, or how well they take and adapt to feedback.

- Complexity. What level of understanding does your accountant have? Can they match the level of complexity expected for your business?

Step 7: Set clear expectations before hiring

For both your accountant and your success, setting clear expectations will keep you both on track and on the same page. This may preeminently manage potential disagreements or discrepancies.

3k+ happy Slash customers

“Before Slash, our finance team juggled multiple platforms for on ramps, custody, and banking. Now everything lives in one place, saving us countless hours and eliminating errors.”

Max Segall, COO, Privy.io

How Slash helps your accountant (and your business)

Hired the right person? Great! Slash can help you both get started and grow your business, with clear communication between you and your accountant. In an all-in-one dashboard, you can manage nearly all elements of your business finances. From bank accounts¹ to corporate cards² to integrated accounting tools to even access to stablecoin and crypto rails³, Slash gives you granular control of all elements of your financial stack and lets you and your accountant operate in the same place, so that you can communicate efficiently and you manage your finances smoothly.

Decided not to hire? Slash can continue to help with your finances even if you don’t hire an accountant. Slash’s features included accounting tools and integrations with QuickBooks and Xero as well as access to banking services with Column N.A., corporate cards with 2% cashback on eligible spending, access to Global USD through stablecoin, and more tools and software built to give you comprehensive, total control of your business’s finances.

Whether onboarding your accountant or going alone, Slash will help with business accounting with:

- Direct integrations with QuickBooks and Xero.

- High-yield checking and savings accounts.

- Corporate cards with built-in expense tracking.

- Centralized financial tools across multiple entities.

Start with Slash before you onboard and track your financial management with unprecedented levels of control, tools and more at slash.com.

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Frequently asked question

How much does it cost to hire an accountant?

This value differs case by case, potentially depending on what type of accountant you’re looking to hire, their experience level, and more. Use job boards or personal networks to assess what typical pay ranges are based on the accountant you are seeking.

Do you need an accountant if you’re self-employed?

If you are running a business whether small or large, it’s important to consider an accountant as a professional who can assist with your business finances.

Are small business accountants the same as financial advisors?

No. While small business accountants may serve as financial advisors, the two can refer to different financial professionals.

What is common business accounting software?

QuickBooks live, QuickBooks online, and Xero are common for basic bookkeeping, accounting and CPAs. See Slash integrations with these features.

What is small business accounting?

Small business accounting can mean different things including the correct methods of financial management, planning, tax filing, and more for businesses with a relatively small employee count or market.

¹ Slash Financial, Inc. is a financial technology company and is not a bank. Banking services provided by Column N.A., Member FDIC.

² The Slash Platinum Card is a Visa® charge card issued by Column N.A., pursuant to a license from Visa U.S.A. Approval is subject to eligibility. Payment of account balance is due in full daily. Monthly membership fees may apply. Card purchases may be eligible for cashback, see https://www.joinslash.com/legal/cashback-terms for more information.

³ Cryptocurrency conversion, transfer, and custody services are provided by Bridge, not by Column, N.A. or Slash. Cryptocurrency is not custodied by any bank, is not FDIC-insured, may fluctuate in value, and is subject to loss. Terms and conditions apply.