Understanding APR: The Key to Smarter Loans, Credit, and Business Finance

Were you any good at middle school math?

If you answered yes, congratulations; you’re one step closer to understanding APR! But if you answered no, welcome to the club. Most business leaders (and, honestly, most people I know) still struggle with the same thing they did in middle school: fractions, percentages, and the kind of math that sneaks into your life long after you graduate 8th grade.

The main culprit? Interest rates and fees. Whether it’s a mortgage loan, a business loan, a credit card, or another borrowed sum, interest rates and fees can quietly eat into your finances if you don’t understand how it works.

That’s where Annual Percentage Rate, or APR, comes into play.

APR takes the messy, middle-school-math-world of borrowing, interest, and fees, and boils it down to one clear number, concisely describing the amount you’ll really pay for borrowing money. Rather than dealing in complicated fractions or adding up separate fees, APR shows you what you’ll pay for what you borrow, without needing a math degree.

In this guide, I’ll break down what APR means for you, why it matters, and how understanding it can save you and your business from overpaying.

What is APR and Why Does it Matter?

APR (Annual Percentage Rate) is a key metric to review when you or your business applies for a loan, mortgage, or credit card. Borrowing always carries costs. Those costs are typically the stated interest rate plus certain lender-imposed fees and other required charges. Because these components can be hard to evaluate separately, APR consolidates them into a single, annualized percentage of the amount financed, showing the standardized cost of credit.

Why APR Matters

APR standardizes loan costs across lenders and products, making side-by-side comparisons straightforward. By reflecting both the interest rate and eligible fees, APR provides a transparent, comparable figure, allowing you to more accurately estimate which loan is best for you and your business and potentially saving you thousands of dollars.

APR vs. Interest Rate: Understanding the Real Cost

When your business applies for a loan or new credit cards, you’re required to weigh several factors. One of the most important factors to consider is interest, or the amount you pay on the outstanding principal (the portion of your loan you still owe on the original loan amount). Interest rate takes interest a step forward, presenting the nominal annual percentage applied to that principal amount. Essentially, this is the calculated percentage of interest you will pay annually.

However, the interest rate alone rarely shows the full cost for borrowing money. Many lenders include additional charges such as origination fees (the fee for opening the loan) that can materially affect what you pay.

Because interest rates don’t encompass all the fees applicable to your loan, lenders often disclose Annual Percentage Rate (APR). APR is the standard, annual cost of borrowing that combines the interest rate with eligible fees. APR and interest will both give you an overview of what you as a borrower will pay, but APR gives you a clearer picture that goes beyond interest rates alone, giving you the power to make better lender-to-lender comparisons of the true cost of borrowing money.

How Does APR Work?

APR combines the stated interest rate together with certain lender fees (origination, discount points, other annual or monthly fees) and expresses the annual cost of credit or loan as a single percentage of the amount borrowed. APR is designed to show the most real cost of a loan, not just the nominal interest rate. Here’s an example:

Let’s say you’re comparing two business loans for the same amount and term length:

- Lender A: 7% interest, high origination fee.

- Lender B: 9% interest, low origination fee.

Even though 7% looks cheaper, once you annualize the upfront fee over the loan term, Lender A’s APR may be higher. That is, the offer with the higher interest rate can actually still be the lower total-cost option if its fees are lower.

Looking at interest rates alone can help you understand how periodic interest will accrue on principal loans, but APR will assist in offering side-by-side comparisons on similar loans, especially when fees differ.

How is APR Calculated?

APR is calculated based on the nominal interest rate and eligible charges or fees. This calculation can be complicated depending on the type of loan you are opening.

For closed‑end loans (e.g., term loans, mortgages), APR is the interest rate that exactly discounts the loan’s scheduled payments back to the amount you receive after prepaid finance charges. Lenders compute this using an internal‑rate‑of‑return method; you don’t need to do the math.

For revolving loans, such as credit cards, balances may vary and interest accrues on an average daily or monthly balance. APR is calculated with reference to periodic rate by periods per year, with certain fees also included. Here’s a better look: Card APRs are typically variable (index + margin). If you pay your statement balance in full by the due date, you generally won’t incur interest on purchases due to the grace period.

APR = Daily Periodic Rate × 365 × 100% or APR = Monthly Periodic Rate × 12 × 100%

Calculating APR can be complicated. Luckily, lenders are mandated to disclose their APR for consumers following the 1968 Truth in Lending Act (TILA). Lenders must disclose APR for consumer‑purpose credit under federal law. Many commercial‑purpose products are federally exempt, though some states require standardized cost disclosures for small‑business financing. APR calculators are also often available online and through banking platforms.

Types of APR for Business Owners

Different types of APR reflect different types of loans and financial products you and your business leverage. Most common, these differing types of APR include credit cards, mortgages, and loans.

Credit Cards

Depending on the type of credit card you open, different pay periods, and fees or other charges, APR can be different depending on what credit card you go with.

- Purchase APR: APR calculated on the rate of interest on typical, everyday card purchases. This APR cost won’t be applied to you if you pay your card statement in full every month or before your agreed upon due date.

- Intro/Promo APR: temporary rate on purchases. Will revert to the original APR when the promotional period is over or, in some cases, when you miss a payment.

- Balance Transfer APR: APR applied to transferred balances from one card to another. Balance Transfer APR applies to amounts you transfer, often with a transfer fee. Promotional 0% periods may apply; pay the transferred balance by the promo deadline to avoid interest

- Cash Advance APR: Cash advances typically carry a higher APR, a cash‑advance fee, and no grace period. Interest begins accruing right away.

- Penalty APR: If you violate your card terms (e.g., pay late), a higher APR may apply as outlined in your cardholder agreement.

- Charge Cards: An option for avoiding APR or other interest charges is to use corporate charge cards rather than credit cards. Charge cards require payment in full by the due date (often monthly), so you don’t pay revolving interest on standard purchases when you pay on time. If you enable installment/financing features, those amounts are subject to an applicable APR. There may be applicable fees; for more information, see a financial platform with this feature like Slash.¹

Loans

Unlike APR on credit cards, which is dependent on revolving spending and on-time payments, loan APR is a standardized cost for borrowers on fixed-term debts.

- Fixed APR: A predictable APR, fixed to the rate of the entire loan term.

- Variable APR: the APR value may move up or down depending on interest rate benchmarks. This may be beneficial if you plan to pay off your loan quickly.

- Introductory APR: a temporary promotional period at the start of the loan, offering lower APR for time period.

Your business may also contend with mortgage loans, which pay off in a process similar to other loan payments. It is important to note the difference between forms of APR to ensure that you are calculating your anticipated payments correctly and choosing the best lender option for you and your business.

Tips for Managing APR Effectively

It is best to review APR before opening a loan, mortgage, or credit card. Forms of APR (fixed, variable) and loan types change your total costs and affect how much you should expect to pay. Here are tips to manage APR on both credit cards and loans:

How to Manage APR on Credit Cards

- Pay in full, on time: When you pay your card in full, you don’t pay interest. Using auto-pay features can help ensure you pay off your statement balance on time.

- Be mindful of credit: Paying off your credit card on time will not only ensure you don’t pay interest, but will also help improve your credit. Keeping your credit utilization low and paying on time can support a stronger credit profile, which may help you qualify for better rates.

- Choose cards wisely: Choose cards that match your needs (such as a corporate charge card (no revolving interest when you pay in full)), or a credit card with rewards or intro APR offers.

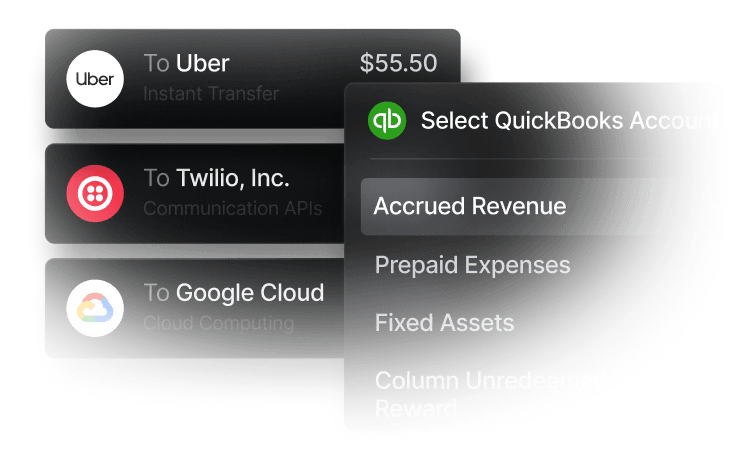

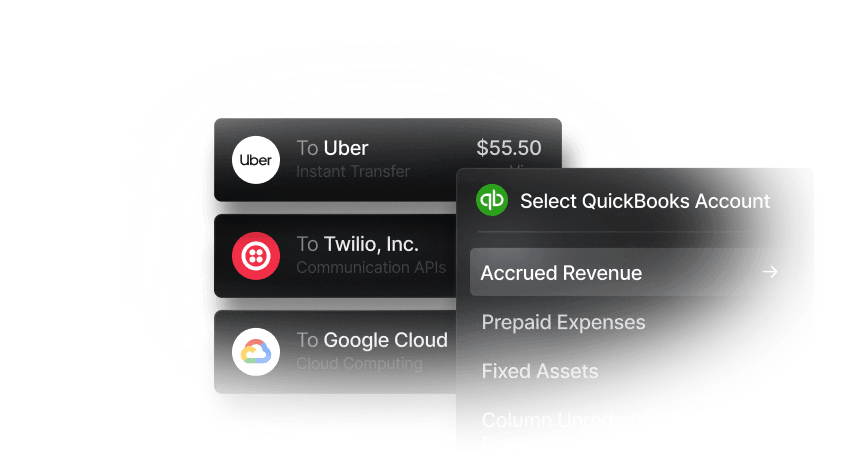

How Slash Helps You Make Smarter Financing Decisions

Understanding APR (Annual Percentage Rate) is key to smart borrowing. APR rolls interest and required fees into one comparable number so you can easily judge the true cost of borrowing money between lenders.

If your goal is to limit APR exposure, a corporate charge card can help. Slash offers a charge card model built for businesses that want transparent, tailored controls and rewards; no revolving interest on standard purchases when you pay in full each statement. You still get corporate-card perks, including competitive 2% cash back on eligible spend, without carrying a balance.

Annual Percentage Rate (APR) is a really important tool to understand for your business’s success, beyond interest rates alone. APR can be a tricky topic to handle, and finding the right business banking platform can seriously assist with the burden. See more about Slash’s business banking² and charge cards to learn more on how it can support your spending and business growth.³

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Frequently Asked Questions

How do you avoid paying APR on a credit card?

Avoid interest by paying your statement balance in full and on time. (Other fees may still apply.) Or get a charge card that must be paid in full on a given cadence.

How to Compare APR Offers?

Compare offers by what the total APR value is. For loans with the same amount and term, a lower APR usually means lower cost. If terms differ (variable rates, prepayment options, fees), compare total costs too.

What is a good APR?

APR is not one-size fits all. Instead, it is dependent on the type of loan you're opening, the term length, and lender-specific fees or promotions.

What is the difference between APR and APY?

APR and APY are similar acronyms, but this can be misleading. APR applies to borrowing and generally doesn’t include compounding; APY applies to deposits and reflects compound interest on your earnings.

¹The Slash Platinum Card is a Visa® charge card issued by Column N.A., pursuant to a license from Visa U.S.A. Approval is subject to eligibility. Payment of account balance is due in full daily. Monthly membership fees may apply. Card purchases may be eligible for cashback, see https://www.joinslash.com/legal/cashback-terms for more information.

² Slash Financial, Inc. is a financial technology company and is not a bank. Deposit accounts provided by Piermont Bank, Member FDIC and Column National Association, Member FDIC.

³ Learn more about Slash’s financial services at slash.com