Understanding the Expense Recognition Principle: Why It Matters for Businesses

Some accounting rules only draw attention to themselves when something goes wrong. Expense recognition is one of them. It may seem minor, but expense recognition directly affects how you’re taxed, how compliant your reporting is, and how clearly your financials can be understood.

The timing of expense recognition determines when deductions apply, which can shift tax liabilities from one year to the next. Expense recognition is closely tied to the matching principle—one of the core accounting standards required under both U.S. GAAP and international financial reporting rules. Failing to recognize expenses in the correct period can lead to inconsistent monthly reports and unexpected profit swings, too, making it harder to tell whether performance gains are real or just timing-related.

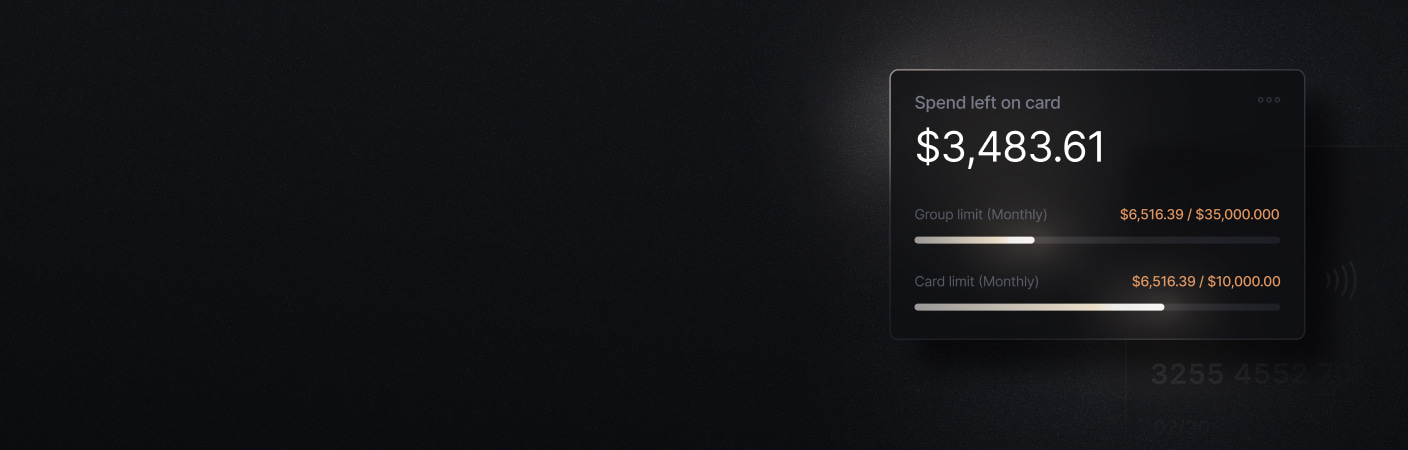

In this guide, we’ll explain how the expense recognition principle works, when expenses should be recorded under accrual accounting, and how different types of costs are matched to revenue. We’ll also explore common challenges businesses face when applying the principle in practice—and how Slash can address these challenges by automating transaction capture, integrating with accounting systems, providing real-time insight into your company’s financial health, and more.¹

What is the expense recognition principle and how does it work?

The expense recognition principle is an accounting concept that ensures expenses are recorded in the same period as the revenues they help generate, regardless of when cash actually changes hands. Recording related revenues and expenses together creates a more accurate financial picture of a company's profitability during any given period, preventing your business from artificially boosting profits or misreporting during tax season.

Expense recognition is directly related to the matching principle, which is one of ten accounting standards mandated by the Generally Accepted Accounting Principles (GAAP) in the United States. It’s also required under the International Financial Reporting Standards (IFRS) used in over 140 countries worldwide.

When is an expense recognized?

Under the matching principle, expenses are recognized on an accrual basis, meaning they are recorded when they are incurred—not when payment is made. Incurred, in this context, means expenses are recognized when a payment obligation is created or when a benefit is consumed.

For example, imagine your company receives a $10,000 invoice for marketing services performed in December, but you don’t pay it until January. To abide by the expense recognition principle, you would record the $10,000 expense in December (when the service was provided and helped generate December’s revenue), not in January when the bill is paid.

Accountants use three different approaches to match expenses with revenue. The method used depends on whether the expense is a product cost (directly tied to production) or a period cost (related to general operations rather than specific sales):

- Direct association of cause and effect: This method links specific expenses directly to specific revenues. The clearest example is cost of goods sold (COGS). If you sell a product for $100 that cost $60 to produce, you recognize the $60 expense in the same period as the $100 in revenue.

- Systematic and rational allocation: When an expense benefits multiple accounting periods, it’s allocated over time. Depreciation is the most common example. If you purchase a $120,000 delivery truck expected to last 10 years, you would expense $12,000 per year instead of recording the full cost upfront.

- Immediate recognition: Some expenses support overall business operations, but they don’t have a clear one-to-one relationship with specific revenue. Rent, payroll, and office supplies fall into this category and are simply recognized in the period incurred.

Slash can help ensure that your expenses are recognized at the right time by automatically capturing transaction details across all your company’s cards and payments, minimizing the need to rely on manual receipt collection or delayed invoices to verify timing.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

Impact on cash-basis vs. accrual-basis accounting

The expense recognition principle can affect when taxes are paid or deductible depending on your accounting method. While it generally doesn’t change the total tax owed over the long run, it can shift tax liabilities between years, ultimately affecting cash flow projections and tax planning.

Cash-basis accounting records income and expenses only when cash changes hands and does not recognize accounts payable or receivable on financial statements. While it’s simpler to manage and offers some tax flexibility, it can distort analysis of financial health, showing profits or losses that don’t reflect underlying business activity. Under this method, expenses are generally not recognized on an accrual basis for financial reporting purposes.

The expense recognition principle applies specifically to accrual accounting, where expenses are recorded when incurred rather than when paid. If services are received in December but paid in January, the expense is recognized in December, aligning costs with the period they relate to. This approach provides a more accurate picture of financial performance, but it generally reduces the ability to shift deductions between periods based solely on payment timing.

Here’s how it looks in practice. Consider a company with $50,000 in unpaid expenses from December:

- Accrual accounting: Deducts the full $50,000 on last year’s tax return, even though payment occurs in January.

- Cash accounting: Cannot deduct the expenses until the next year, resulting in higher taxes last year and lower taxes next year.

Under the consistency principle, businesses are expected to apply the same accounting method (whether that’s cash or accrual) consistently across reporting periods. This ensures financial statements remain comparable over time and prevents businesses from switching methods to manipulate reported income or tax outcomes.

Expense recognition principle vs. revenue recognition principle

Expense recognition and revenue recognition represent two sides of the same coin, working together to fulfill the requirements of the matching principle. Below are their definitions side by side to highlight how they compare and contrast:

- Expense recognition principle: Expenses should be recognized on the income statement in the period they are incurred, regardless of when cash is paid.

- Revenue recognition principle: Revenues should be recognized on the income statement in the period they are realized and earned, not necessarily when the cash is received.

While both principles aim to align financial activity with the correct reporting period, they are applied differently under the conservatism principle. Expenses and liabilities are recognized as soon as they are probable, even if some uncertainty exists. Revenues and assets, by contrast, are recognized only when they are realized or reasonably certain.

Together, these principles ensure that revenues are reported alongside the costs required to generate them, reducing the risk of distorted profit reporting caused by timing differences in cash flows.

5 examples of expense recognition: Choosing the right matching method and recognition window

The examples below illustrate how different types of expenses are recognized under accrual accounting, along with the matching methods accountants use to ensure financial statements accurately reflect business activity:

Office rent and utilities expenses recorded monthly

Office rent and utilities are ongoing operating expenses that support day-to-day business activities rather than any specific product or sale. Because these costs benefit the business evenly over time and don’t have a direct link to revenue generation, they’re treated as period costs.

Cost type: Period cost

Matching method: Immediate recognition

When to recognize: In the month that the rent and utilities apply

Employee payroll and benefits matched to the period worked

Employee wages, salaries, and benefits are incurred as employees perform their work. Even if payroll is processed after the work period ends, these costs are recognized in the period the labor was provided because that’s when the economic benefit was received.

Cost type: Period cost

Matching method: Immediate recognition

When to recognize: In the period the employee work is performed, regardless of when payroll is paid

Software subscriptions allocated to the relevant month

Software subscriptions provide access to tools and services over a defined time period, typically billed monthly or annually. Because the benefit is consumed over time, the cost is recognized gradually rather than all at once.

Cost type: Period cost

Matching method: Systematic and rational allocation

When to recognize: Monthly, over the subscription period the software is used

Cost of goods sold recognized when inventory is sold

Cost of goods sold represents the direct costs associated with producing or purchasing inventory. These costs are initially recorded as assets and only recognized as expenses when the related inventory is sold and revenue is recognized.

Cost type: Product cost

Matching method: Direct association of cause and effect

When to recognize: In the same period the inventory is sold and the related revenue is recognized

Prepaid expenses amortized over the service period

Prepaid expenses occur when a business pays in advance for goods or services that will be received in future periods, such as insurance or rent. These costs are first recorded as assets and then expensed over time as the benefit is consumed.

Cost type: Period cost

Matching method: Systematic and rational allocation

When to recognize: Gradually, over the period the prepaid service is received

Common challenges and best practices for applying the expense recognition principle

Even businesses that understand accrual accounting in theory can struggle to apply the expense recognition principle consistently in practice. The sections below outline some of the challenges businesses may encounter when applying the principle, along with best practices for maintaining accurate, consistent expense recognition across reporting periods:

Common challenges

Understanding when an expense should be recognized under accrual accounting. Your team may struggle to determine whether an expense should be recorded when it's incurred, when it's paid, or allocated over time. This is especially common for subscription services, prepaid expenses, and accrued payroll.

Handling timing differences between cash activity and expense recording. Cash may change hands in a different period than when an expense is actually incurred. Without clear visibility into payment timing, expenses can easily be misclassified into the wrong month. Slash records transaction activity in real time, giving finance teams clearer visibility into timing even when settlements or reimbursements happen later.

Managing multi-entity or cross-border transactions. Companies with multiple subsidiaries or international operations must track expenses across legal entities, currencies, and jurisdictions. Slash’s multi-entity support allows businesses to track expenses across multiple legal entities in one unified dashboard, which can make it easier to recognize expenses across your organization.

Reconciling prepaid expenses and accruals. Prepaid insurance, annual software contracts, and accrued liabilities require ongoing tracking and allocation. Manually managing these schedules increases the chance of missed adjustments or double-counted expenses.

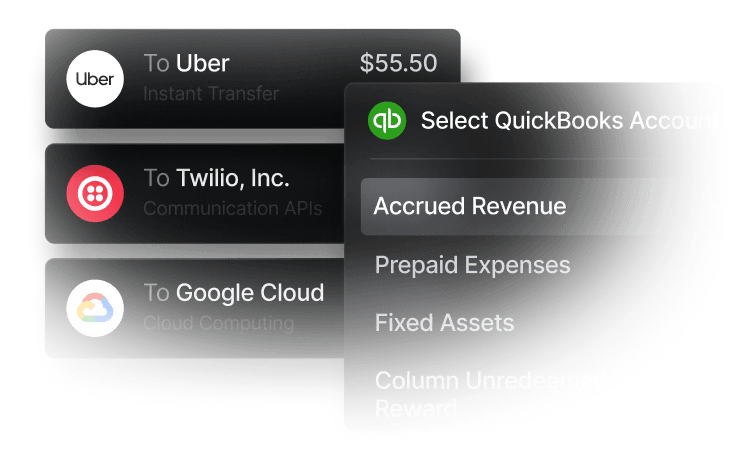

Ensuring consistency across reporting periods and financial statements. Inconsistent expense categorization or delayed data entry can distort month-over-month comparisons and financial statements. Slash automatically categorizes your expenses across your company cards and payments; categorized transaction data flows directly into QuickBooks, helping maintain consistent recognition and reporting across periods.

Best practices

Establish clear internal policies aligned with accounting standards. Define when expenses should be recognized based on your accounting method, how prepaid costs should be amortized, and how accruals are recorded. Clear policies can reduce the need to make judgment calls, improving consistency across your books.

Use automated tools to reduce manual timing errors. Slash’s corporate cards and payment rails automatically capture transaction data the moment they're used, ensuring expenses are logged in real time and centralized in one system. This can eliminate your reliance on receipts and invoices to verify timing.

Reconcile accounts frequently to detect mismatches early. With Slash’s QuickBooks integration, transaction data syncs directly into your accounting system. This can make it easier to reconcile expenses, review accruals, manage invoices, and prepare for tax filing without duplicating work across platforms.

Standardize how prepaid and accrued expenses are tracked. Using consistent categories and workflows for prepaid expenses ensures they’re allocated correctly over time. With Slash, you can preset expense categorization rules so transactions are logged correctly from the start, minimizing the need for manual reclassification or cleanup later.

Train staff on accrual-based accounting and documentation. Automated systems can reduce complexity, but training ensures your team understands why expenses are recorded when they are. Providing guidance on documentation, timing, and categorization can help keep expense recognition consistent as teams grow and responsibilities shift.

Simplify expense recognition with Slash

Slash can take the guesswork out of expense recognition by bringing all of your company's transactions into a single dashboard that updates in real time. You can track inbound and outbound payments, organize expenses by status or time period, and categorize spending by vendor or expense type. Ultimately, automating your expense tracking can make it easier to understand when expenses are incurred and how they should be recognized.

Slash can also help streamline your accounting processes by integrating seamlessly with QuickBooks. You can export all of your transaction data from Slash into your accounting platform, which saves you from needing to manually input everything across systems—a process that can be error-prone and time-consuming. QuickBooks allows you to toggle between cash-basis and accrual-basis reporting, too, making it simple to apply different recognition parameters based on your business’s structure.

But Slash doesn’t just help you apply a single accounting principle. Slash modernizes how your business manages spending, payments, and financial operations with features like:

- Business banking built for flexibility: Open multiple virtual accounts to separate operating funds, reserves, or project budgets, giving teams clearer visibility into cash flow. Manage multiple business entities, locations, or subsidiaries from a single dashboard, with consolidated reporting and clear visibility across accounts.

- Accounting integrations: Sync transactions directly with QuickBooks to keep books up to date automatically. Slash also connects through Plaid and supports data imports from tools like Xero, making it easier to fit into existing accounting workflows.

- Slash Visa® Platinum Card: A corporate charge card that earns up to 2% cash back on company spending, with configurable spending rules, card controls, AI-powered monitoring, and encryption-grade fraud protection.

- Diverse payment methods: Slash supports a wide range of payments, including card spend, global ACH, international wire transfers to over 180 countries via SWIFT, and real-time domestic payments through RTP and FedNow.

- Native cryptocurrency support: Convert funds into USD-pegged stablecoins such as USDT or USDC to send transfers on the blockchain, offering an alternative payment method that can reduce costs and settlement times.⁴

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Frequently asked questions

What types of expenses must be recognized on an accrual basis?

An expense should be recorded when the business receives the good or service, not when the bill is paid. This keeps expenses aligned with the period they actually relate to.

The Complete Guide to LLC Expenses and Tax Deductions

How do prepaid expenses differ from accrued expenses?

Prepaid expenses are costs you pay for upfront and then expense gradually as you receive the benefit, such as annual insurance or software subscriptions. Accrued expenses are costs you’ve already incurred but haven’t paid yet, like wages earned by employees before payroll is processed.

Can expense recognition affect audits or financial reviews?

Yes. If expenses aren’t recorded in the correct period, financial statements can be misstated. Auditors and reviewers often focus on expense timing because it affects reported profit and compliance with accounting standards.