QuickBooks Integrations: The Smartest Add-Ons to Simplify Business Banking

You might feel like your accounting system is already in good shape: your records are up to date, you've consulted a tax professional, and reconciliation feels manageable. But relying on an accounting tool by itself only scratches the surface of what's possible. The biggest time savings and most reliable financial data come from pairing your accounting software with smart financial management platforms that integrate seamlessly with QuickBooks Online.

QuickBooks Online (QBO) from Inuit remains one of the most widely used accounting platforms for small and medium-sized businesses. Its strength comes from its ability to integrate data from dozens of banking services and business tools. However, not all QuickBooks integrations are created equal. Some tools simply sync transactions, while others unlock advanced automations, more precise reporting, or industry-specific workflows that can transform how you manage your finances.

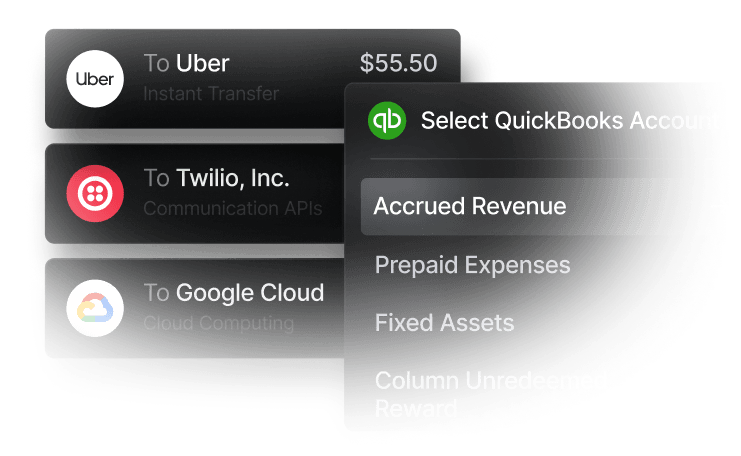

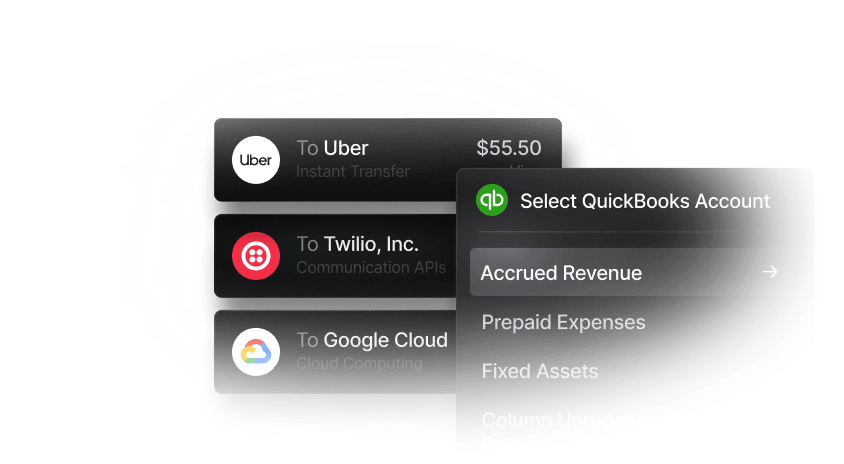

In this guide, we'll highlight the QuickBooks integrations with the strongest capabilities, whether your business needs a specialized financial solution or a full-fledged banking overhaul. We'll also explain how Slash acts as a modern financial platform that connects real-time analytics, expense management, and business banking directly with QuickBooks.¹ Through Slash's accounting tab, you can review detailed transaction data, set scheduled syncs with QBO, or use the Slash API for real-time data sharing across platforms.

With Slash and QuickBooks working together, you can spend less time fixing your books and more time running your business. Continue reading to learn more.

Why QuickBooks Integrations Matter for Modern Businesses

QuickBooks offers a broad set of capabilities, but its real impact depends on how your business uses it. For some teams, it complements existing workflows by categorizing expenses or generating basic reports. For others, QuickBooks serves as the backbone of more complicated financial management tasks like tax filing, budget management, and long-term financial planning.

At its core, QuickBooks is designed to save time, improve accuracy, and reduce the manual work that comes with managing company finances. When used effectively, it offers meaningful advantages in critical areas:

- Reconciliation: QuickBooks matches transactions and identifies discrepancies with minimal effort, ensuring your books always balance without hours of manual review.

- Tax filing: The platform keeps records organized and categorized, making tax season easier and helping ensure compliance with filing requirements.

- Invoicing: Automated invoice creation, payment reminders, and collection tools help you get paid faster while reducing administrative burden.

- Expense reporting: QuickBooks categorizes purchases, attaches digital receipts, and generates accurate profit and loss statements that inform business decisions.

QuickBooks is widely adopted not just for its built-in accounting features, but because it integrates cleanly with many targeted third-party tools. Modern financial platforms have made it easier to automate and manage specialized workflows; one service may focus on managing corporate travel expenses, while another handles payroll, benefits, and contractor payouts.

However, these platforms often operate in separate silos: cards in one system, payments in another, analytics in a third. If each tool stores and formats financial data differently, businesses can run into problems like mismatched categories, duplicate entries, or timing conflicts when syncing everything back into QuickBooks. This can create reconciliation chaos and reduce the accuracy of your financial reporting.

Slash stands out by combining business banking, expense management, and real-time financial insights into one unified system. Corporate cards, business checking accounts, and multiple payment rails—including ACH, wire transfers, real-time payments, and even stablecoin transactions—all feed into the Slash dashboard, where spend data is automatically organized and prepared for QuickBooks export.⁴ With Slash, your banking provider can help you generate cleaner data, produce fewer errors, and minimize time spent on reconciliation.

Top QuickBooks Integrations to Streamline Accounting in 2025

Below, we've curated a list of the best QuickBooks integrations to automate financial processes, ranging from full business banking suites to targeted workflow solutions:

Best Overall: Slash

Unlike competitors that focus on just one area, Slash combines business banking, corporate cards, expense management, and payment processing in one platform, all feeding directly into QuickBooks.

Key Features

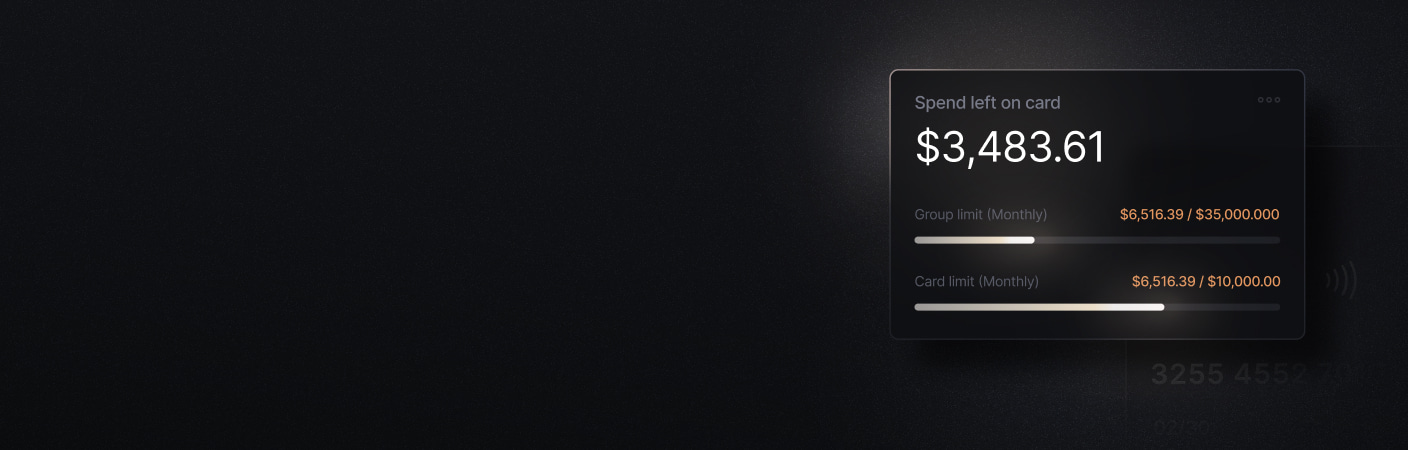

- Powerful corporate cards: The Slash Visa Platinum Card can earn up to 2% cash back on purchases. Manage employee spending without lifting a finger by setting preset spending rules, customizable limits, and real-time alerts and spend insights.

- Multi-rail payments: Vendor payments across ACH, wire transfers, real-time payment rails, and stablecoins (USDC, USDT, USDSL) can push into QuickBooks with consistent formatting. This is particularly valuable for businesses operating in the digital economy or making international payments.

- Multi-entity support: Each entity or sub-account can sync transactions cleanly, eliminating the confusion that comes with managing multiple businesses or storefronts.

- API-powered real-time sync: Every transaction is tracked and organized in real-time with complete details about the merchant, payment method, and category. Real-time data transfer through the Slash API provides accurate cash flow visibility without waiting for scheduled sync windows.

- Stablecoin accounting: Stablecoin payments and transactions can be recorded through the integration, a feature most competitors don't support.

Why Choose Slash: For businesses that want to eliminate the complexity of managing multiple financial tools, Slash offers the most complete solution. You get business banking, corporate cards, expense management, and advanced payment capabilities all designed to integrate with QuickBooks.

Best for AP and Bill Pay: BILL

BILL, also known as Bill.com, specializes in accounts payable management catered to businesses that handle high volumes of vendor payments and invoices.

Key Features

- Approval workflows: Customizable approval chains ensure proper oversight before payments are released, with automatic routing based on amount, vendor, or department.

- AR/AP automations: Offers built-in tools for capturing invoices, routing approvals, and processing payments.

- Built-in payment methods: BILL allows users to send payments with their platform via ACH, virtual cards, international wires and checks. However, unlike some competitors, it lacks on/off ramps for stablecoins.

Drawbacks: BILL comes at a high price compared to competitors, starting at $45/month for each user and ranging up to $89/month.

Best for Expense Reporting and Travel: Expensify

Expensify has built its reputation on simplifying employee expense reporting, with automation that reduces the administrative burden on both employees and finance teams.

Key Features

- SmartScan receipt OCR: Employees can photograph receipts, and Expensify automatically extracts merchant, date, amount, and category information with impressive accuracy.

- Mileage and per diem tracking: GPS mileage tracking and automated per diem calculations based on location can simplify reimbursement for travel expenses.

- Corporate travel workflows: Pre-trip approval workflows, corporate travel booking, and policy enforcement help control travel spending before it happens.

- Employee reimbursement automation: Once expenses are approved, reimbursements can be processed automatically through direct deposit or integrated with your payroll system.

Drawbacks: Expensify offers a corporate card but lacks access to business banking features like diverse transfer methods, checking, or treasury accounts. It's primarily focused on expense management and reimbursement.

Best for Payroll: Gusto

Gusto is a popular payroll platform for small and medium-sized businesses, offering full-service payroll with benefits administration and HR tools.

Key Features

- Automatic payroll calculation: Gusto automatically factors in hours worked, PTO, holidays, and other variables to calculate accurate paychecks every pay period.

- Tax liability mapping: Payroll taxes are automatically calculated, filed, and paid, with all the necessary forms generated for year-end reporting.

- Benefit deductions and wage categorization: Integrates with health insurance, retirement plans, and other benefits, automatically deducting premiums and categorizing wages correctly in QuickBooks.

- Employee self-service: Employees can access pay stubs, tax forms, and personal information through a self-service portal, reducing HR administrative work.

Drawbacks: Gusto's pricing can add up quickly. The simple plan starts at $49 per month plus $6 per employee per month, which becomes expensive as you scale. Additionally, while Gusto can sync with QBO for accounting, Inuit’s own competitor, QuickBooks Time, may be a better-integrated payroll solution.

Best for CRM and Billing: HubSpot

HubSpot is primarily known as a customer relationship management (CRM) platform, but its QuickBooks integration creates connections between sales and finance data.

Key Features

- Invoice and payment status sync: Automatically sync invoices created in QuickBooks with customer records in HubSpot, giving your sales team visibility into payment status.

- Deal and customer record connections: Link QuickBooks customers to HubSpot contacts and companies, creating a view of customer relationships and financial history.

- Quote automation: Generate quotes in HubSpot that can be converted to invoices in QuickBooks.

- Sales and finance data alignment: Ensure your sales team and finance team are working from the same customer data, eliminating discrepancies and miscommunication.

Drawbacks: HubSpot is designed for organizing customer financial data and managing the revenue side of your business, not for internal financial operations.

Best for Ecommerce Payments: Shopify

For businesses selling products online, Shopify offers a strong industry-specific workflow with its storefront-to-accounting integration.

Key Features

- Order, refund, and payout sync: Shopify transactions sync into QuickBooks, including sales, refunds, fees, and actual payout deposits to your bank account.

- Automated sales tax mapping: Shopify's built-in sales tax calculations flow directly into QuickBooks, ensuring accurate tax liability tracking by jurisdiction.

- Inventory count updates: Keep inventory values synchronized between your online store and your accounting records for accurate cost of goods sold.

- Revenue source tracking: Tie different revenue streams (online store, POS, marketplace sales) to the right income accounts in QuickBooks.

Drawbacks: Shopify is specifically designed for managing inflows and sales revenue, not for handling outflows like vendor payments, payroll, or operational expenses. You'll need additional tools for complete financial management.

Best for Payment Processing: EBizCharge

EBizCharge specializes in payment processing and collections, allowing businesses to accept customer payments for invoices, sales orders, and more directly through QuickBooks:

Key Features

- Multiple payment methods: Accept credit cards, ACH transfers, and eChecks with seamless posting to QuickBooks customer accounts.

- Invoice payment links: Add "Pay Now" buttons to invoices that allow customers to pay online with automatic reconciliation.

- Recurring billing: Set up automatic recurring charges for subscription or retainer-based businesses, with automatic invoice generation and payment processing.

- Payment gateway integration: Works with multiple payment processors, giving you flexibility in choosing your merchant services provider.

Drawbacks: EBizCharge focuses exclusively on incoming customer payments. It doesn't address outgoing vendor payments, banking needs, or full-fledged financial management.

How to Choose the Right QuickBooks Integrations for Your Business

Not every QuickBooks add-on will fit the way your business operates. For instance, you may want a highly specialized tool for a specific function, or you might be looking to overhaul your entire banking and accounting setup.

Before choosing an integrated platform, take stock of your core operations: the products or services you sell, where you sell them, the volume of transactions you handle, and whether you manage complex needs like global payments, multiple entities, or high-volume vendor payments. This analysis will help you determine whether you need a full financial stack or more targeted tools for managing specific functions like AP, CRM, payroll, or expense reporting.

No matter how you plan to use QuickBooks and its integrations, these criteria can help you evaluate your options:

- Integration depth: Examine how thoroughly the platform syncs with QuickBooks. Look for support for customizable categories, detailed metadata, two-way syncing (where changes in either system update the other), and real-time data transfer rather than scheduled batch syncs.

- Security and compliance features: Evaluate the platform's protections around data security, encryption, access controls, and regulatory compliance. Check whether it meets relevant audit standards, authorization requirements, and reporting regulations like SOC 2, PCI DSS, or industry-specific requirements.

- Automation level: Consider how much manual work the tool eliminates across expenses, payouts, transaction categorization, and reconciliation. Platforms that combine banking, payments, and expense management in one system can provide unified end-to-end automation.

- Scalability: Assess whether the platform can support your business as transaction volumes grow or operations become more complex. Can it handle new legal entities, international expansion, additional payment methods, or increased transaction volumes without requiring a platform switch?

- Cost structure: Understand the total cost of ownership, including monthly fees, per-user charges, transaction fees, and any premium features you might need.

For businesses seeking a comprehensive solution, Slash checks all these boxes. The platform offers:

- Quickbooks integration with real-time API connectivity and customizable data mapping

- Bank-grade security with encryption, multi-factor authentication, and regulatory compliance

- Powerful automation by combining banking, cards, and payments in one platform

- Built-in scalability supporting multi-entity operations, multiple payment rails, and growing transaction volumes

- Transparent pricing without hidden fees or per-user charges that become prohibitive as you grow

Most importantly, Slash is built specifically for the modern business that needs more than traditional banking but doesn't want to manage five different platforms to run their finances.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

The Future of QuickBooks Integrations and Modern Business Banking

The landscape of business finance is evolving rapidly. Traditional banking services are being unbundled and reimagined by fintech companies that can move faster and build more specialized solutions. With artificial intelligence accelerating financial operations and accounting platforms like QuickBooks centralizing data flows, the most successful businesses in this new environment won't necessarily be those using the most tools, but rather those using the right tools that work together seamlessly.

Several trends suggest where this evolution may be heading:

- Consolidation around unified platforms: Businesses may increasingly favor platforms that handle multiple financial functions while maintaining seamless QuickBooks integration, potentially reducing the complexity of managing numerous disconnected tools.

- Real-time financial data as standard: As API technology enables instant data synchronization, batch processing and daily syncs could become obsolete. Businesses could come to expect real-time visibility into their financial position for faster decision-making.

- Cryptocurrency and digital asset integration: As stablecoins and other digital assets become more common in business payments, accounting systems may need to evolve to support these transaction types natively.

- AI-powered automation: Artificial intelligence will increasingly handle tasks like transaction categorization, anomaly detection, fraud prevention, and predictive cash flow forecasting.

Slash is positioning itself at the forefront of these trends, combining modern banking infrastructure with advanced technology and seamless QuickBooks integration to create a financial platform built for the future of business. Learn more at slash.com.

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Frequently Asked Questions

What integrations work best with QuickBooks Online?

The best integrations depend on your specific business needs, but more comprehensive platforms that combine multiple functions tend to provide the most value. Slash’s integrations stand out because it combines business banking, corporate cards, expense management, and multi-rail payments (including stablecoins) in one platform with real-time QuickBooks sync.

How do QuickBooks integrations help automate accounting?

QuickBooks integrations eliminate manual data entry by automatically syncing transactions from various platforms directly into your accounting system. The best integrations also categorize expenses, match receipts, handle multi-entity accounting, and maintain real-time accuracy.

The Best Accounting Automation Software Tools in 2026

Can I integrate my bank directly with QuickBooks?

Yes, QuickBooks supports direct connections with thousands of financial institutions through bank feeds. However, Slash goes far beyond traditional bank integration by providing real-time sync, automatic categorization, multi-entity support, and modern payment rails including stablecoins.

What makes Slash's QuickBooks integration different?

Multi-entity support is not a default capability for most SMB platforms, but Slash natively handles multiple legal entities with clean syncs. Most traditional AP tools rely on scheduled syncs (hourly or daily), while Slash provides real-time cash flow visibility through API connectivity. Slash also generates proper accounting entries for stablecoin transactions, which most competitors don't support.