Slash, Ramp or Brex: Which Corporate Card Is Best for Your Business in 2025?

As your business scales, so does the complexity of your financial operations. For many teams, managing this growing financial stack can quickly become overwhelming. In response, a wave of financial technology platforms has emerged, all built to streamline your corporate finances and, ultimately, to make your operational burden a lot lighter.

Finding the right platform can be a challenge; and with increasingly comparable solutions like Ramp, Brex, and Slash on the market, determining which platform best suits your business needs can be difficult to navigate.

Whether you’re launching a new venture or managing a well-established enterprise, your business comes with distinct financial needs. In this comparison, we’ll navigate this tough decision by evaluating Slash, Ramp, and Brex across key areas such as rewards programs, expense tracking capabilities, credit approval processes, and operational efficiency.

We’ll also highlight how Slash differentiates itself as an alternative to Ramp and Brex, offering features like fast approval processes, cash back rewards, and streamlined workflows that are industry-tailored for e-commerce brands, digital operators, and high-spend businesses.¹

What Are the Pros and Cons of Using Ramp vs. Brex vs. Slash?

Ramp, Brex, and Slash at a Glance:

Breaking down what sets Ramp, Brex, and Slash apart

What Is Ramp?

Ramp is a financial technology platform built for businesses who prioritize cost control. Ramp offers key features like up to 1.5% cash back on every purchase, integration with accounting tools, and specially designed tools for finance teams. Their Ramp card includes automated approvals, spending limits, and built-in expense tracking with real-time alerts.

Ramp caters to businesses looking to reduce overhead, tighten their budgets, and centralize spending across multiple departments.

What Is Brex?

Brex is a financial technology platform designed to scale for high-growth companies. The company has announced its acquisition by Capital One and is set to operate as part of a larger financial institution. Brex offers key features like a travel booking portal, multi-entity support, and real-time expense categorization. The Brex credit card includes customizable spending limits, a flexible rewards program, and integration with enterprise accounting tools.

Brex is well designed for VC-backed companies looking for a complex suite to manage multiple business accounts, while offering rewards points based on travel and employee spending.

What Is Slash?

Slash is a fast growing neobank, financial technology and business management platform focused on designing industry-tailored features for digital operators and global businesses. Offering EIN-only account opening, fast approval, and competitive up to 2% cash back, Slash is a fast-moving company built for ambitious modern businesses.

Unlike Ramp and Brex, Slash doesn’t overcomplicate financial management with unnecessary tools or rigid approvals. Rather, Slash’s platform is built around user’s realistic spending controls with real-time, detailed card expense tracking, crypto and stablecoin transactions and global USD.³︐⁴

Ramp vs. Brex vs. Slash on Rewards Programs?

Ramp

Ramp takes a straightforward approach to rewards, offering a flat up to 1.5% cash back on all transactions – no category specifications or rotating offers. With the Ramp card, cardholders receive cashback rewards as statement credits.

Ramp stands out for their appeal to financial teams looking for consistency and tailored rewards, including perks with accounting and operations companies such as Gusto and Quickbooks.

Brex

The Brex credit card includes a category-based rewards program currently offering cardholders 4x on Brex Travel, 7x on rideshare, 3x on restaurants, and 2x on software (US merchants).

The Brex credit card is flexible, but calculating your reward value, especially across departments, can be a tricky process for many users.

Slash

Slash offers a unique blend of flexible and industry-specific rewards. With their flat, competitive up to 2% cash back rewards, cardholders earn on common expenses for modern businesses, including cash straight to your business account on software, media and e-commerce spending.

With a clean, easy design and simple rewards structures, Slash's rewards offer the best bet for flexible, everyday business expenses.

Summary: Brex is suitable for teams optimizing travel-related perks and points; Slash emphasizes straightforward cash back on eligible purchases

Ramp vs. Brex vs. Slash on Expense Tracking?

Ramp

Ramp's platform includes built-in automated expense tracking, receipt matching, and policy enforcement. Ramp's AI and automated software flags for suspicious transactions and duplicates, great for financial teams looking for clarity.

Brex

Brex offers quality expense tracking with AI to automatically categorize spending, match receipts and route approvals. Brex's platform is ideal for teams with complex budgets and distributed spending.

Slash

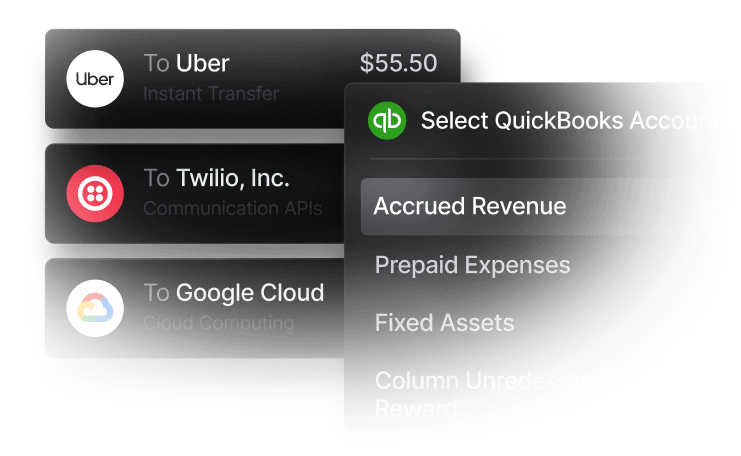

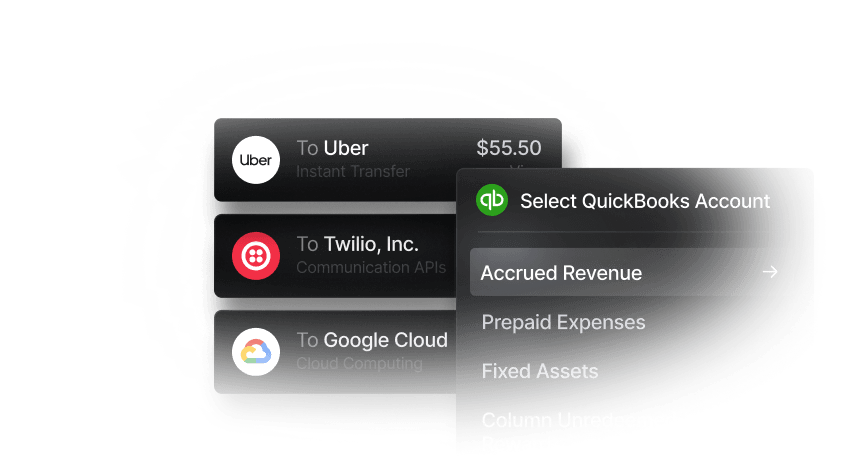

Slash stands out for its customizable expense tracking. Users can set per-merchant limits, approval restrictions, and see detailed transaction logs in real-time. Compared to Ramp and Brex, Slash offers the most streamlined expense tracking that's easily synced to a user's accounting tools.

Summary: Choose based on needs: AI automation (Ramp/Brex) vs. granular merchant controls and real-time logs (Slash)

Ramp vs. Brex vs. Slash on Travel and Global Spending?

Ramp

Ramp offers a native travel portal with policy controls and bookings. Ramp’s integrated booking portal (Ramp Travel) includes policy controls.

Brex

Brex offers a travel booking portal and international spending support. Users can redeem Brex points for statement credits, travel perks or, on some plans, transferred to partners.

Slash

Slash cardholders receive a competitive up to 2% cash back with any airline or hotel expenses. Slash is also one of top in the market for global spending perks, being the only service to offer global USD with other crypto and stablecoin features.

Summary: Brex is equipped for a points-and-perks travel portal; Slash emphasizes cash back on eligible travel and crypto-adjacent workflows for cross-border needs. Ramp also provides a travel portal but focuses on cash-back rather than point redemptions.

Ramp vs. Brex vs. Slash on Accounting and Integrations?

Ramp

Ramp's integrated accounting with Xero, Quickbooks, and NetSuite offer automated GL mapping, policy sync, and real-time reporting. By design, Ramp serves finance teams looking for minimal manual entry and stable, clean books.

Brex

Brex offers integrated accounting with a number of services including Xero, Quickbooks, and NetSuite. Brex's multi-entity and detailed spend control features highlight their enterprise focus.

Slash

Slash's accounting tools are integrated with Quickbooks, with new integrations currently in development. Slash's tools are optimized for easy, reliable accounting. In one dashboard, Slash streamlines multi-entity accounting tools and offers fast transaction export, import and categorization.

Summary: Ramp/Brex suit complex enterprise environments; Slash focuses on streamlined workflows and QuickBooks integration.

Ramp vs. Brex vs. Slash on Credit Limits and Approvals?

Ramp

Ramp bases credit approvals on business health rather than personal credit. Cardholder limits are determined by business cash flow, balance sheets, and prior transactions. Ramp's key credit and approval offerings are based in conservative and predictable finances.

Brex

Brex refers to company revenue, funding, and venture capital history to determine user credit limits. The Brex Card is often favored by VC-backed companies with high spend and strong capital reserves, but this can be challenging for small business and startups.

Slash

Slash's approval process is highlighted by simplicity and often same-day speed. Applicants are evaluated on bank statements, cash flow, and business health rather than requiring a personal credit check. Credit limits are based on recent revenue and payment activity rather than venture funding.

Summary: Slash may be a good fit for startups and high-spend companies seeking fast, data-driven decisions.

Ramp vs. Brex vs. Slash on Cross-Border Payments and Crypto Rails?

Ramp

Ramp doesn’t support crypto payments or cross-border stablecoin rails. All payments are conducted through traditional banking channels, but Ramp does offer global features including local currency reimbursements.

Brex

Brex supports international payments in multiple currencies, but only through standard financial systems. There is no built-in crypto or stablecoin functionality for sending or receiving funds.

Slash

Slash offers native crypto integration⁵, meaning users have access to integrated tools to pay and receive funds from overseas contractors and vendors in stablecoin. Slash’s built-in stablecoin tools and global USD workflows are not available on Ramp or Brex.

Summary: Slash is oriented toward crypto-adjacent workflows for global businesses.

Ramp vs. Brex vs. Slash Summary

Each platform brings its own unique features, from rewards programs to approval requirements and automated management tools. Let’s take a look back at each platform, what they provide, and what they skip to help you decide which is the best fit for your business.

What is Ramp?

Ramp is designed for finance teams that prioritize cost and spending control. Some of their key features include 1.5% flat cash back, built-in expense tracking, automated approvals, and real-time reporting. However, their services miss out on points-based travel redemptions and have no built-in crypto or stablecoin payment rails.

Ramp’s Pros:

- Up to 1.5% cashback on all spend

- Expense tracking with automation features including receipt matching

- Xero and Quickbooks accounting tool integration

- Specially design tools for finance teams

Ramp’s Cons:

- May not be eligible for points-based travel perks and rewards

- Credit limits and eligibility vary by applicant profile. May be low credit limits for startups and young businesses

What is Brex?

Brex is designed for high-growth, well-backed companies with a focus on travel rewards and accounting integration tools. Startups and smaller businesses, however, may struggle with their business banking platform, with its difficult account opening process, complex platform, and often confusing point-based reward system.

Brex’s Pros:

- Customizable category-based rewards structure

- Strong travel booking tools and perks on airlines, hotels, and lounges

- Deep integrations with enterprise tools including NetSuite and Xero

- Multi-entity support

Brex’s Cons:

- Rewards structure can be challenging to track

- Feature-rich platform ill suited for startups and smaller teams

What is Slash?

Slash is the youngest platform of the three and designed with fast-growth in mind. Their key features include easy, EIN-only account opening with fast approval, high cash back rewards, and automated management tools. Being the youngest, however, Slash is still catching up in notoriety and feature roll outs.

Slash’s Pros:

- Fast EIN-only account opening with no personal credit check or gaurantee

- 2% cash back on eligible spending

- Crypto and stablecoin services

- Built for modern business, including e-commerce, digital operators and global teams

Slash’s Cons:

- Lowest brand visibility

- No bill pay or native reimbursements

Beyond the Duo: Why Slash Offers a Tailored Approach

For finance teams looking for a clean, automated solution, Ramp is your best option. They’re predictable cash back and real-time cost control make it a great choice for lean teams with sharp CFOs.

If your business is looking for travel perks, point-based rewards, and accounting enterprise integrations, Brex is a great choice. They’re built for ventures with pre-established, complex finances and high budgets.

But looking beyond the two, Slash is the most viable for more modern businesses. While Ramp and Brex both lack infrastructure built for startups and fast-moving businesses, Slash offer fast approval, high cash back rewards and integrated crypto and global USD account. Slash’s streamlined business banking tools, multi-entity dashboard and intuitively designed platform, make it the most versatile tool with benefits for the most businesses on the market today.

Final Verdict

Slash is the best overall platform for modern business. With tools tailored to how businesses today operate both digitally and globally, founders are choosing Slash to help manage their corporate spending, get fast approval and competitive rewards on credit cards, and access global USD and crypto capabilities that Ramp and Brex simply don't offer.

Apply in less than 10 minutes today

Join the 5,000+ businesses already using Slash.

Frequently Asked Questions

What should I know about Ramp and Brex?

Ramp and Brex are two financial technology companies that provide business cards and integrated financial management services, also offering perks and rewards based on cardholder spending. Slash is a similar service with competing features.

What are the key differences between Brex and Ramp?

Ramp offers clean, automated financial services best for lean teams seeking tight financial control. Brex offers travel rewards and enhanced enterprise integrations great for ventures with complex financial volumes.

How do rewards differ between Ramp, Brex, and other solutions like Slash?

Ramp, Brex and Slash each offer different rewards and finding the best fit may be determined by what you’re looking to optimize. If you’re seeking a program with flexible points rewards, Brex is the best fit. Most companies, however, typically look for pure cash back. Both Ramp and Slash offer this feature with Slash offering the highest amount of the three at up to 2% cash back.

Can I use a business card without a personal credit check?

Yes. Ramp, Brex and Slash offer business cards with EIN-only approvals, so no personal credit check or guarantee required.

What if I want to pay vendors or contractors?

Ramp, Brex, and Slash all support vendor payments, with Slash offering extended payment options for global teams including crypto and off-ramping features.

What service best integrates accounting tools?

Ramp, Brex and Slash all offer premium accounting tools. Slash integrates with external tools like Quickbooks, Xero, and Plaid.

Which platform is best for startups and early-stage businesses?

Slash may be the best option for startups and early-stage businesses, as it is designed specifically with the needs of these businesses in mind. Ramp is a good choice for growing businesses. Brex is best for well-funded and established enterprises.