Brex vs. American Express vs. Slash: Which financial platform is better for your business?

It’s a David and Goliath matchup. On one side is American Express, the banking titan known for brand prestige, premium rewards, and its long-standing presence in global finance. On the other is Brex, a company emblematic of a new era of financial management, one where expense management shifts from spreadsheets to fully automated, digital-first platforms. For businesses exploring their next financial partner, the question is simple: which one delivers more value?

Choosing between these providers comes down to how your business prefers to manage money. But the reality is that neither fully meets the needs of modern companies on their own. Traditional issuers like Amex often lack the time-saving, cost-efficient tools found in newer platforms, while fintech options like Brex can fall short on rewards or be less accessible to a wider range of businesses.

In this guide, we break down the core features of both Brex and American Express, comparing their corporate cards, rewards structures, expense management tools, and more. We'll also highlight where each falls short and introduce competitors that may better match your operational needs. Ultimately, we'll show you how Slash brings together the best of both options: the modern automation and real-time controls of a fintech platform alongside the rewards-earning power and accessibility of premium charge cards like Amex.¹

Plus, Slash offers capabilities that neither Brex nor American Express provides: native cryptocurrency support for faster, lower-cost international payments, up to 2% cashback on spending with the Slash Visa Platinum Card, and the Slash Global USD Account that enables businesses outside the U.S. to hold and transact in dollars without needing a U.S. LLC or traditional bank account.³﹐⁴ Keep reading to learn why Slash delivers the most capability for your business.

What is Brex?

Brex is a financial technology company established in 2017 by Henrique Dubugras and Pedro Franceschi. In 2026, Brex entered into an acquisition agreement with Capital One, marking a shift in its corporate ownership structure. It carved out its niche by focusing on automation and digital expense management for startups and tech companies. Brex has since expanded to serve mid-market and enterprise firms with its financial management platform, with core features including:

- Brex Card: A corporate charge card with no personal guarantee that requires frequent balance payments. The card offers category-based rewards with multipliers on select spending, like rideshare and travel bookings made through Brex's platform.

- Brex Rewards: Brex’s rewards program is designed for tech and venture-backed companies, with point multipliers for software subscriptions or rideshare services. The redemption structure can be more complex than a flat-rate cashback structure, and bonus categories may not align with your business’s typical spending, especially for small and medium sized businesses (SMBs).

- Integrations: Brex connects with accounting tools, ERP, and payroll systems, to help automate transaction tracking and reconciliation.

- Expense management: Brex offers automation features for transaction categorization and spend policy enforcement to reduce manual back-office work.

Slash matches Brex on automation, accounting integrations, and real-time spend management, but it goes further with native support for making global payments with stablecoins like USDC and USDT. Through built-in on/off ramps, businesses can send USD-denominated payments over 8 different popular blockchain networks, which are often faster and more cost-effective than traditional banking rails. Slash’s Global USD Account also enables non-U.S. entities to hold and transact in stablecoins, as well as traditional rails like ACH and wire transfers.

On January 22nd, 2026, Capital One Financial Corporation announced that it had entered into a definitive agreement to acquire Brex. The deal is expected to close in mid-2026, after which Capital One will assume full ownership of the company and its products. At Slash, we’re committed to building modern financial infrastructure that isn’t constrained by traditional banks. That independence allows us to move faster and deliver higher-quality financial technology than legacy providers, which includes Brex.

What is American Express?

American Express (Amex) is one of the most established brands in U.S. banking and corporate finance. Founded over 175 years ago, Amex has evolved from a traditional financial institution into a global leader in consumer and business credit products. Some notable Amex features include:

- Business Charge Cards: Amex is the pioneer of the modern business charge card, where balances must be paid in full at the end of each billing cycle. With Amex’s Pay Over Time feature, charge cards like the Business Gold and Platinum can function similarly to a credit card, letting businesses carry a balance on eligible purchases when needed.

- Corporate Credit Cards: For businesses that prefer to carry a balance or need traditional credit, Amex also offers corporate credit cards with standard approval requirements, set spending limits, and straightforward reward programs.

- Amex Travel: Through Amex travel, some Amex cardholders may receive preferred hotel rates, flight upgrades, travel insurance, and unique partnerships with select hotels and travel brands. However, these benefits are usually reserved for premium, high-fee cards like the Business Platinum.

- Amex Rewards: Amex’s Membership Rewards points can be redeemed for rewards from partner brands or for booking through Amex Travel. Like Brex, rewards offerings may not align with your business’s typical spend categories or day-to-day needs; for companies with irregular spending patterns, a flat-rate rewards card may provide more value.

While Amex excels in rewards, brand trust, and customer service, its digital infrastructure falls behind more modern platforms like Brex or Slash. Businesses get less real-time insight, fewer automation options, and limited native tools for categorizing transactions or syncing with modern accounting software. Amex users may need to use additional third-party tools to fill these gaps, while Slash delivers out-of-the-box integration and seamless data-sharing with QuickBooks and Plaid.

What is Slash?

Slash is a modern business financial platform designed to combine the real-time automation of a fintech tool with the rewards and accessibility companies expect from a premium card issuer. Built for businesses of all sizes, Slash centralizes spend controls, payments, and cash-flow management into a unified dashboard. Slash’s features include:

- Slash Visa Platinum Card: With Slash's corporate charge card, your business can earn up to 2% cash back on purchases, improve employee spend management with configurable controls, and issue unlimited virtual cards for on-demand access to company funds.

- Slash Dashboard: Access diverse transfer options including global ACH, wires, real-time networks (RTP and FedNow), and SWIFT transfers to 160+ countries; track cash flow with real-time analytics broken down by recipient, transfer type, and contact; and unlock complete visibility across your stack with multi-entity support, which compiles account data, statements, and more from all of your subsidiaries.

- Cryptocurrency Support: Hold and send USD payments globally with Slash's native support for stablecoins like USDC, USDT, and USDSL. These cryptocurrencies are pegged to the US dollar, eliminating the volatility typically associated with crypto assets. Slash can on- and off-ramp your business funds into crypto, unlocking easy access to near-instant global transfers without traditional processing or foreign exchange fees.

- Real-time Integrations: Slash organizes spending data by category, location, and transaction details, then integrates seamlessly with QuickBooks Online to streamline reconciliation and invoicing.

- Global USD Account: Non-U.S. businesses can access cross-border USD payments through bank transfers and blockchain networks without needing a U.S. LLC, offering an accessible way to expand into new markets.

- Treasury & Working Capital: Hold idle cash in money market funds from BlackRock and Morgan Stanley to earn up to 4.1% yield. If your business needs additional funding, Slash's Working Capital offers flexible business financing accessible directly through your dashboard, with convenient 30, 60, and 90-day repayment terms that you can draw from whenever needed.⁵﹐⁶

With capabilities that span modern automation, global payments, and straightforward rewards, Slash delivers tools neither Brex nor Amex offer on their own. Keep reading to see how each platform stacks up head-to-head.

Comparing Brex vs American Express vs Slash

Brex and American Express both offer strong business card programs, but they serve different types of companies and workflows. Brex emphasizes automation and tech-focused spend tools, while Amex provides a broader selection of cards with well-established rewards and benefits. Comparing the two side by side reveals where each platform excels or and where businesses may encounter limitations:

Business cards

Both the Brex Card and Slash Visa Platinum Card are charge cards that integrate directly with their respective financial management platforms and offer rewards programs, though their structures serve different priorities: Brex focuses on category multipliers for tech and travel spending, while Slash offers straightforward 2% cashback on all purchases.

American Express offers a wider range of credit cards and charge cards, from entry-level options like the Blue Business Cash to premium products like the Business Platinum, with most cards requiring good to excellent credit to qualify. These cards vary significantly in rewards, fees, and features, with premium Amex cards carrying higher annual fees in exchange for elevated travel perks and Membership Rewards bonuses.

Expense management tools

Amex provides standard card management tools through its mobile and web app, allowing businesses to track recent transactions, review statements, check their credit score, and redeem rewards. While reliable, the experience mirrors traditional banking systems with limited automation. Both Brex and Slash take a more modern approach by routing card activity into a centralized platform, giving businesses real-time visibility into spending trends, team activity, and cash flow.

Integrations

Slash integrates with accounting tools like QuickBooks and Xero, shares expense data in real-time through the Slash API, and connects with Plaid to enable businesses to centralize financial activity across multiple bank accounts and fund Slash accounts from external sources.

Brex offers native integrations across finance, HR, and operations systems for syncing card activity with back-office workflows, though its platform may be better suited for larger organizations with complex tech stacks.

Amex provides basic accounting platform compatibility, but cardholders typically need to rely on third-party tools like Expensify or Concur to achieve the same level of automated financial insight that Slash and Brex deliver natively.

Rewards and travel programs

Amex is an industry leader in travel rewards, with long-standing partnerships with Delta Airlines, a strong Membership Rewards ecosystem, and premium benefits on cards like the Business Platinum. Brex offers point multipliers in select categories like rideshare and travel, though its program is comparatively more limited than Amex's.

However, both point-based rewards programs may not deliver meaningful day-to-day value if your company doesn't prioritize travel or tech spending heavily. Slash's straightforward 2% cashback for Slash Pro users can provide greater benefit by delivering reliable returns without navigating complex category restrictions or point redemption tables.

Accessibility

Brex primarily targets high-growth, venture-backed companies with strong cash balances and substantial revenue, which may make it less accessible for smaller businesses or those without significant financial backing. Amex offers cards across a broader range of business profiles, though most require good to excellent personal credit to qualify.

Slash is accessible to businesses of all sizes, from small businesses to large enterprises. Our application does not require a traditional credit check or SSn; instead, you'll need your EIN, articles of incorporation, and recent bank statements. For international businesses, you can access the Slash Global USD Account without a U.S. bank account or LLC—accessibility that neither Brex nor Amex can match.

Top alternatives to Brex and American Express

Although Brex and American Express each offer strong business card programs and financial tools, they aren’t always the best fit for every company. Brex’s enterprise-oriented requirements and complex rewards structure can be limiting for smaller firms, while Amex’s more traditional approach and limited automation tools may add extra operational work. Here are some other financial service providers to consider:

Slash

Slash delivers the best of both: smart automations for managing expenses and cash flow, along with a high-value rewards charge card. Designed for companies at any stage, Slash adds crypto-capable payments, flexible qualification criteria for SMBs, and dynamic tools that scale with your business.

Key features:

- The Slash Visa Platinum charge card earns up to 2% cashback on purchases, ideal for companies with irregular spending categories or those who want cash instead of perks or rewards.

- Native USDC and USDT on/off ramps for USD-denominated blockchain payments; built-in crypto wallets to hold and transfer digital assets; blockchain transfers are not subject to traditional processing or FX fees.

- Unified dashboard for card controls, payments, approvals, and cash flow visibility.

- Integrations with QuickBooks and Xero for accounting or Plaid for integrating third-party business accounts.

- Business banking functionality with transfers via global ACH, wires, RTP/FedNow, or SWIFT transfers to 180+ countries.

Ramp

Ramp takes an automation-first approach to spend management, using its corporate charge card as the foundation for tighter controls and smarter financial workflows. It’s built for teams that value efficiency and want software that actively reduces unnecessary spend.

Key features:

- 1.5% cashback on most purchases with the Ramp corporate credit card and partner rewards offers

- AI-assisted invoice tools and automated receipt matching

- Customizable spend limits, approval workflows, and policy enforcement

- Integrations with accounting platforms for transaction syncing

- Centralized visibility across departments and cardholders

Downsides: No crypto support, limited travel perks, no global account (available in 100+ countries).

Chase

Chase offers a broad suite of business credit cards backed by the reliability of a major banking institution. Designed for companies that want traditional credit, flexible rewards, and access to branch-based banking, Chase provides a familiar structure with dependable features.

Key features:

- Chase Ink suite cards can earn cashback and travel rewards; some offer introductory 0% APR options or balance transfers

- Access to Chase business checking, credit lines, and merchant services; less advanced card management and business financial tools than fintech competitors

- Rewards redeemable through Ultimate Rewards for travel or cash

- Integrations with Quickbooks Online; additional configuration required with NetSuite and other ERP systems.

Downsides: No advanced automation, limited real-time spend management.

Expensify

Expensify centers on simplifying time-consuming parts of expense management: receipt capture, reimbursements, and transaction organization. While many teams pair it with a separate business banking provider, Expensify does offer some supplemental spending capabilities with its charge card.

Key features:

- Mobile receipt scanning and automated expense categorization

- Employee reimbursement tools with approval routing

- Integrations with QuickBooks, NetSuite, and other accounting apps

- Optional Expensify Card for purpose-built transaction syncing

- Policy controls supporting compliance and audit preparation

Downsides: Limited banking tools, card designed mainly for reporting workflows.

WEX

Wex caters to industries where vehicle activity and fuel spend drive day-to-day operations. Its tools help businesses track usage, control costs, and manage fleet-related payments from one system built specifically for logistics-focused businesses.

Key features:

- Fuel cards for driver-level and vehicle-level spend control

- Reporting for fuel usage, route efficiency, and driver activity

- Tools for maintenance, tolls, and fleet-related payments

- Integrations with fleet management and logistics systems

- Network-based fuel pricing and discount programs

Downsides: Not designed for general corporate spend, limited rewards variety.

Making the right financial move with Slash

Choosing between Brex and American Express doesn't have to mean settling for either outdated tools or limited accessibility. Slash combines the modern automation and real-time expense management that made Brex popular with the rewards-earning power and broad accessibility that define American Express—all while adding financial capabilities neither platform can match.

With the Slash Visa Platinum charge card, businesses earn up to 2% cashback on all purchases without navigating complex category restrictions or point redemption tables. Unlike Amex's traditional banking tools, Slash delivers a unified dashboard with smart automations, real-time spend controls, and integrations with QuickBooks and Xero that can eliminate manual reconciliation work.

What sets Slash apart is its support for cryptocurrency. The platform offers native USDC and USDT on/off ramps, enabling USD-denominated blockchain payments that bypass traditional banking fees and processing delays. For international businesses, the Slash Global USD Account provides a game-changing solution: the ability to hold and transact in U.S. dollars without needing a U.S. bank account, something neither Brex nor American Express provide.

Whether you're a growing startup interested in Brex’s automation or an enterprise seeking Amex’s reliability, Slash can meet you in the middle. To learn more about Slash’s business banking solutions or corporate cards, visit slash.com.

Apply in less than 10 minutes today

Join the 5,000+ businesses already using Slash.

Frequently asked questions

Who is American Express’s biggest competitor?

American Express often competes most directly with large issuers like Chase and Capital One, especially for business credit cards and travel-focused rewards programs. However, fintech platforms like Slash are emerging as strong competitors by offering modern automation, real-time financial insights, native cryptocurrency support, streamlined expense management, and more.

Is it hard to get a Brex credit card?

Brex approval depends on a company’s financial profile—typically factors like revenue, cash balances, and funding—since the card doesn’t rely on personal credit checks. Slash offers an accessible application for SMBs that requires an EIN, articles of incorporation, recent bank statements, and proof of operation. Click here for more information about applying today.

Does Brex or Amex have better rewards?

Both Amex and Brex offer point-based rewards systems that cater to specific business types: Amex focuses on travel spending with premium benefits and airline partnerships, while Brex targets VC-backed startups and tech companies with elevated multipliers on software and rideshare purchases. With up to 2% cashback on purchases, Slash gives businesses dependable rewards that don’t fluctuate based on changing categories or spending trends.

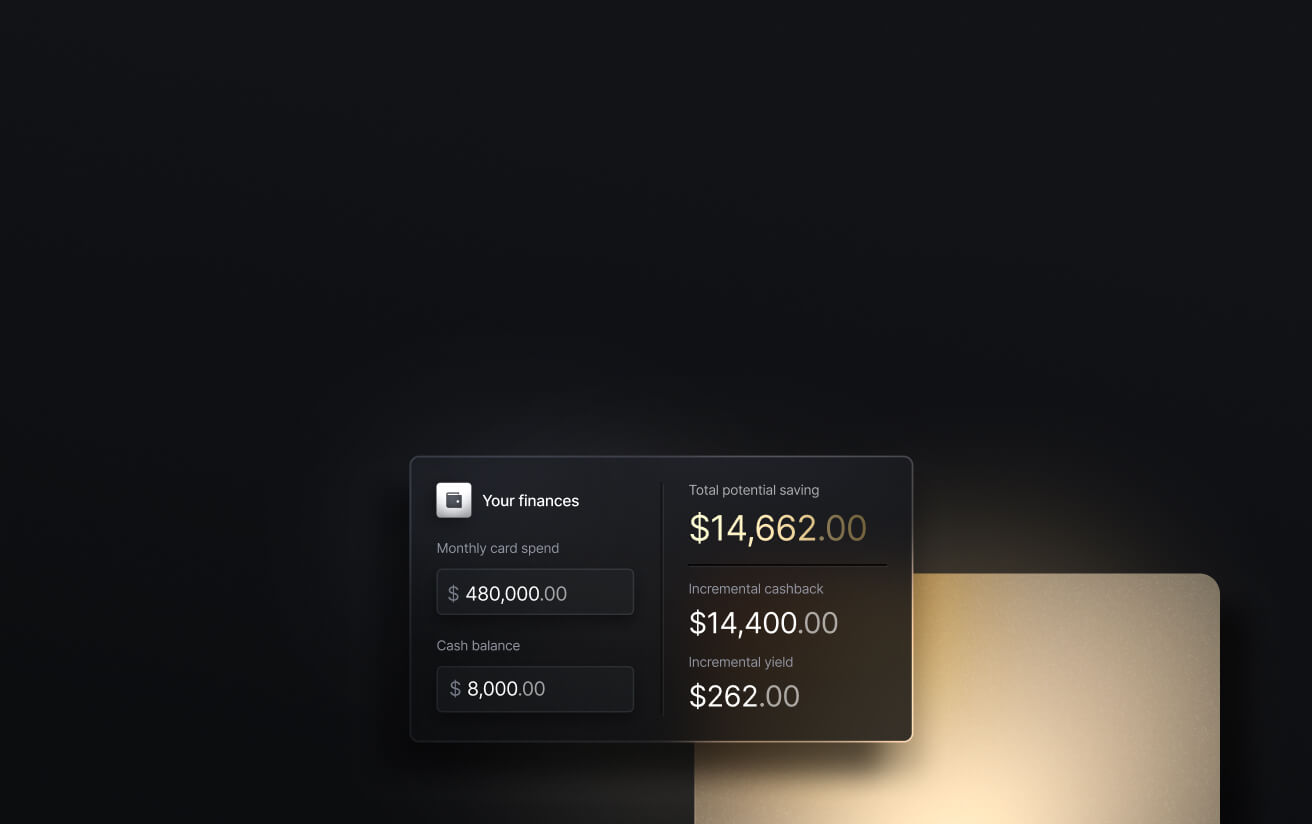

See the ROI behind your spend

Use this calculator to understand impact, then manage and track it all in Slash.

Does Slash support cryptocurrency payments?

Yes. Slash enables businesses to send and receive payments in USDC and USDT, two popular stablecoins pegged to the U.S. dollar. Blockchain-based payments can bypass traditional banking processing delays and foreign exchange fees, delivering a faster and more cost-effective solution for real-time or international payments.