Capital One vs. American Express vs. Slash: Comparing Cards to Find the Best Fit for Your Spending

American Express and Capital One reflect two distinct phases of the credit card industry. American Express is a long-established corporate card brand known for pioneering charge cards and premium travel rewards that appeal to high-spending cardholders. Capital One entered the market later and built its reputation by using information technology and data-driven underwriting to create customized card offers for different customer segments, helping Capital One cards gain broad appeal among businesses and consumers alike.

For businesses, choosing between Capital One and American Express is ultimately about how well each card supports day-to-day spending and long-term growth. Corporate cards play a critical role in controlling expenses, earning rewards, and maintaining visibility across company spend. While both banks offer strong rewards credit cards, the effective value of those rewards can be diminished by outdated expense management tools or complex redemption options.

Newer platforms like Slash represent the next evolution of the credit card industry, defined by AI-powered monitoring, unified financial dashboards, and granular card controls.¹ In this guide, we’ll compare the top American Express and Capital One cards and evaluate how they stack up against Slash’s modern, high cash back charge card to help you identify the best option for your business.

What is American Express?

American Express is a legacy financial institution with roots dating back to 1850, and it has played a foundational role in shaping the modern credit card industry. A major milestone came in 1991 with the launch of Membership Rewards, one of the first points-based credit card rewards programs that allowed cardholders to redeem points across a wide range of travel, retail, and lifestyle categories rather than being locked into a single airline or hotel program.

Unlike most issuers, American Express operates as a monoline credit card company, meaning its business is centered almost entirely on card products and payments rather than traditional deposit banking. Amex also runs a closed-loop payment network, handling transaction processing internally instead of relying on shared networks like Visa or Mastercard. One downside of this closed network is more limited global acceptance compared to Visa or Mastercard products. The company does not operate physical bank branches, with account management handled digitally or by phone.

Today, American Express offers a range of business credit cards and charge cards, including:

American Express Business Platinum Card

The Business Platinum Card is American Express’s premier business offering, with its highest rewards-earning potential, most expansive perks, and a wide range of statement credits. Cardholders receive access to American Express Travel and concierge services, which can assist with travel booking, dining, entertainment, and other requests. The Business Platinum is a charge card, not a traditional credit card, meaning balances must be paid in full each billing cycle rather than carried forward and accruing interest. It also carries one of the highest annual fees for card membership in the industry, currently $695, and typically requires excellent credit (740+ FICO) to qualify.

American Express Blue Business Cash Card

The Blue Business Cash Card is one of Amex’s more accessible business credit cards. It has no annual fee, and applicants with good credit can often qualify. Instead of earning Membership Rewards points, the card offers cash back: 2% on the first $50,000 in eligible purchases each calendar year, then 1% thereafter. This makes it a straightforward option for businesses that prefer the ability to rollover balances and earn cash back over points-based rewards.

What is Capital One?

Capital One was founded in 1994 as a monoline credit card company. Unlike many banks at the time, which typically offered uniform pricing and terms across customers, Capital One built its early growth around information technology and risk modeling, using customer data to tailor card products, interest rates, and rewards to different segments. In 2005, the company expanded beyond cards into retail, branch-based banking, marking its transition into a full-service consumer and business bank.

Over time, Capital One has continued to grow through both organic expansion and large acquisitions. Capital One Travel, a rival to other travel portals from Amex and Chase, launched in 2021. In May 2025, Capital One acquired Discover, a move that has further strengthened its position in the card industry.

For businesses, Capital One is best known for a relatively small but popular lineup of rewards-focused cards, including:

Capital One Spark Business Cards

Capital One offers several Spark cards designed for different credit profiles and spending needs. The Spark 1% Classic is a starter card aimed at applicants with fair credit and earns 1% cash back. More competitive options, such as the Spark 1.5% Cash Select, Spark 2% Cash Select, and Spark 2% Cash Plus, are geared toward applicants with good to excellent credit and earn unlimited cash back ranging from 1.5% to 2%. Some Spark cards also earn Capital One Miles—the name of the bank's rewards points program—including the Spark 1.5x Miles and Spark 2x Miles cards.

Capital One Venture X Business Card

The Capital One Venture X Business card is Capital One’s flagship business offering. It is a charge card that earns Capital One Miles on purchases and is designed for businesses with significant travel spend. While it does not match the breadth of premium perks offered by the Amex Business Platinum, it includes valuable benefits such as travel credits and lounge access. The Venture X Business card currently carries an annual fee of $395, positioning it as a lower-cost alternative in the premium business card category.

What is Slash?

Slash is a fast-growing neobank, financial technology, and business management platform built for modern, digital-first companies. Designed to support global operators, startups, and high-growth businesses, Slash offers EIN-only account opening, fast approvals, and competitive cash back of up to 2%+.

Unlike traditional consumer-focused card issuers like Capital One and American Express, Slash is built specifically for business operations. The platform combines corporate cards, real-time expense tracking, and realistic spending controls with advanced features such as global USD accounts, stablecoin payments, and crypto-friendly workflows.

By focusing on operational flexibility instead of personal credit or lifestyle perks, Slash enables teams to manage spend, scale globally, and move capital efficiently—without the friction of legacy banking tools.

What Are the Pros and Cons of Using Capital One vs. American Express vs. Slash?

Capital One, American Express, and Slash at a Glance:

How do American Express and Capital One compare to Slash?

The Slash Visa Platinum Card is a more modern alternative to the top-of-the-line offerings from Amex and Capital One. The Slash Card is a cashback-earning charge card intended to optimize how your business manages its expenses, with modern features like spending rules, card controls, AI-powered monitoring, and encryption grade fraud protection. Here’s how the Slash card stacks up to the Amex Platinum and Capital One Venture X:

Rewards

American Express uses its Membership Rewards program, a points-based system that allows redemption for travel rewards, statement credits, gift cards, and select perks. Cards like the Amex Platinum earn up to 5x points on airline flights and prepaid hotels booked through Amex Travel, but most everyday business purchases earn just 1x point, which can dilute rewards value for companies that are not travel-heavy.

Capital One’s rewards vary by card. The Venture X Business card earns travel miles, with elevated rates of up to 10x on hotels and rental cars and 5x on airline flights booked through Capital One Travel, plus 2x miles on all other purchases. Spark cards, by contrast, generally focus on straightforward cash back rather than points or miles.

Slash cards earn up to 2% cash back on business spending with no category optimization, travel portals, or redemption tables required. Instead of maximizing rewards through travel portals or bonus categories, Slash delivers consistent, predictable value across all purchases.

Annual fees

American Express’s premium business cards come with some of the highest annual fees in the industry. The Business Platinum Card charges $895/year for the primary card, with additional employee cards costing an extra $400/year each. Some of Amex’s other non-premium options, like the Blue Business Cash Card, have no annual fee.

Capital One’s fees are more mixed. Several Spark cards have no annual fee, while the Spark 2% Cash Plus charges $195/year and the Venture X Business Card carries a $395 annual fee for card membership.

Slash offers its cards and core expense management platform for $0 by default, with cards earning 1.5% cash back at no cost. With the Pro subscription, businesses earn 2% cash back and gain access to unlimited free domestic ACH, wire transfers, and real-time payments via RTP and FedNow. Pro costs $25/month or $300/year and includes unlimited cards and full platform functionality, with no per-cardholder fees.

Redemption options

American Express allows points to be redeemed through Amex Travel, converted to statement credits or cash back, or used to purchase gift cards. Redemption values vary widely, typically ranging from roughly $0.007 to $0.01 per point depending on how points are used.

Capital One Miles can be redeemed through Capital One Travel, used to cover recent travel purchases on your statement, or redeemed for cash back and gift cards. Cash-back redemptions generally convert at a lower rate, often between $0.005 and $0.01 per mile depending on the method.

Slash eliminates the guesswork around rewards. Cash back is earned and realized directly, so businesses don’t have to navigate portals or time redemptions to get full value.

Card-related benefits

Premium Amex cards, such as the Business Platinum, include extensive travel perks like credits for Global Entry, TSA PreCheck, and CLEAR Plus; Uber Cash; access to Amex's Centurion Lounges, Delta Sky Clubs, and Priority Pass airport lounges; booking at Amex's hotel collection; elite status benefits such as Hertz Gold Plus membership; and more. Many of these benefits are delivered through a patchwork of statement credits and partner programs.

The Capital One Venture X Business card includes lounge access to Capital One Lounges; a $300 annual travel credit; booking at Capital One's hotel collection; credits for Global Entry or TSA PreCheck; Hertz Gold Plus membership; and more.

Account-related benefits

Slash focuses less on luxury perks and more on control, automation, and consistent value. Businesses can issue unlimited virtual cards for employee spending, subscriptions, or vendor payments directly from the dashboard. Admins can set spending limits, apply category-based rules, and manage controls at the individual or team level using flexible card grouping. All transaction data is captured automatically in the Slash dashboard, where businesses can view real-time spending analytics, receive alerts, and export clean data directly into QuickBooks for accounting.

While Amex and Capital One offer basic expense tools through their apps, they lack the unified infrastructure and depth of configurability available with Slash.

Drawbacks

American Express and Capital One cards can struggle to match the effective cash value offered by Slash. Points-based rewards can be difficult to optimize, redemption values vary, and high annual fees may outweigh the benefits for many businesses. Lower-tier cash-back cards may cap earnings below Slash’s up to 2% rate.

Capital One and American Express require excellent credit for account opening of their premium cards, which can be preventative for many applicants. And, regardless of rewards or accessibility, both institutions also lack the modern card controls and centralized financial infrastructure that platforms like Slash are built around.

How to choose the best alternative?

American Express’s Business Platinum and Capital One’s Venture X Business are both premium, points-earning charge cards designed for frequent travelers. Each offers a broad set of travel-focused perks, including lounge access, credits for expedited security programs, and elevated rewards for bookings made through their respective travel portals. For businesses with regular air travel, these cards can make time spent in airports more convenient and comfortable.

The American Express Blue Business Cash is a solid option for businesses that prefer cash back over points. It earns 2% cash back—up to an annual spending cap—and has some modern features like accounting integration. However, Slash offers more cutting-edge features and up to 2% cash back with no earnings cap. For businesses spending more than $50,000 per year across their cards, which is common for mid-sized and larger teams, the Blue Business Cash can leave meaningful rewards on the table.

In the end, managing employee spending is easiest with the Slash card. It’s the only card of the three that allows account administrators to customize employee spending, using preset rules and smart transaction categorization to prevent maverick spending. The Slash card doesn’t try to impress cardholders with exclusive perks; it saves your business time and money by automating compliance checks, streamlining expense reporting, and giving you detailed analytics about spending across your company.

Making the right financial move with Slash

Slash does a lot more than just issue corporate cards. Slash is a unified business banking platform built to simplify how your company manages its finances. Rather than juggling separate systems for cards, payments, and expense tracking, Slash centralizes these workflows in a single dashboard, reducing overhead and improving visibility.

The Slash Visa Platinum Card can support businesses at every stage, from early growth to large-scale enterprises. The EIN-only application process does not rely on a traditional personal credit check for account opening. Instead, Slash evaluates your company’s current financial position to determine eligibility and spending limits, making access to modern financial tools more practical for fast-growing teams that may not fit traditional underwriting models.

Alongside its corporate cards, Slash brings together essential payment and banking functionality in one platform, with features including:

- Diverse payment options: Send funds through the rails that best fit your needs: global ACH, domestic wires, international SWIFT transfers to 160+ countries, and real-time domestic networks like RTP and FedNow. This flexibility gives businesses more control over settlement speed and payment cost.

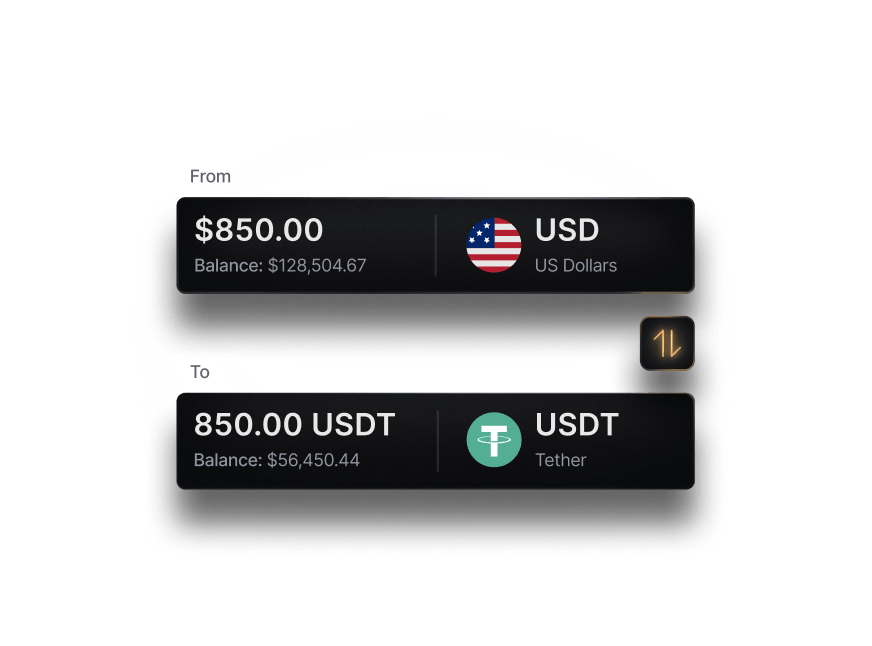

- Native crypto support: Hold, send, and receive stablecoins such as USDC, USDT, and USDSL across eight supported blockchains.⁴ You can also convert company funds into stablecoins using built-in on/off ramps. Crypto transfers are not subject to traditional banking timelines and can offer a fast, low-cost method for moving money—especially across borders.

- Working capital financing: Slash provides a flexible line of credit that can be drawn on whenever you need short-term liquidity.⁵ Unlike fixed 30-day card billing cycles from most credit cards, Slash Working Capital lets you choose 30, 60, or 90-day repayment terms.

- Treasury accounts: Open integrated high-yield savings accounts from BlackRock and Morgan Stanley directly within your dashboard. Earn up to 4.1% annualized yield, helping your idle cash work harder without adding operational overhead.⁶

- Powerful integrations: Slash connects cleanly with QuickBooks to streamline your month-end close. All card and payment data can be exported for easier reconciliation and more accurate, real-time expense reporting.

If you’re looking for a modern alternative to legacy business cards, explore Slash today to see how a unified platform can help your business spend smarter. Visit slash.com today to learn more.

Slash business banking

Works with cards, crypto, plus cards, crypto, accounting, and more.

Frequently asked questions

Is American Express the hardest card to get?

American Express cards are often perceived as harder to qualify for, especially premium charge cards that typically require strong credit profiles and higher spending capacity. Entry-level Amex cards, however, can be more accessible.

What are the Easiest Business Credit Cards to Get? Top Picks and How to Get Yours Approved

Can I use American Express cards as easily as Capital One?

Capital One cards generally have broader global acceptance because they run on the Visa or Mastercard networks. American Express acceptance has improved over time but may still be more limited in certain regions or with smaller merchants. The Slash card is accepted worldwide anywhere Visa cards are accepted with a low 1% foreign transaction fee.

Who are Amex and Capital One's hotel and airline partners?

Amex Platinum cardholders get hotel perks like complimentary membership with Hilton Honors Gold, Marriott Bonvoy Gold Elite, and access to Amex's partner hotel collection; for flights, Amex cardholders have access to Centurion Lounges, Plaza Premium access, Priority Pass membership, and statement credits for security expediting services.

Capital One Venture X cardholders do not get elevated hotel status, but they do get access to Capital One's Premier and Lifestyle hotel collections. Capital One Venture X card lets you transfer Capital One Miles to the Air Canada Aeroplan program, allowing you to book Air Canada flights and Star Alliance partners.

Are charge cards better than credit cards for businesses?

Charge cards can work well for businesses that pay balances in full each month and want higher spending flexibility. Credit cards may be a better fit for companies that prefer the option to carry a balance or need more predictable monthly payments.