Understanding Cash Back: How You Earn Money Back on Purchases

Who doesn’t want to earn more cash? That’s the simple appeal behind cash back rewards, which have become one of the most popular credit card reward structures for business owners. Rather than tracking points or navigating complex redemption charts, cash back provides a straightforward return on everyday spending.

Cash back credit cards give you a portion of money back every time you swipe your card. Simple enough. Still, it’s not exactly obvious how it actually works under the hood. It’s fair to wonder if there’s a catch, or how issuers can afford to pay cash back at all. With a better understanding of how cash back credit card rewards programs are structured, it becomes easier to see where the value comes from and how cash back can be used effectively in your business.

In this guide, we’ll walk through how cash back rewards work, the different earning structures available, and what to look for when choosing a cash back card. We’ll also highlight the cash back earning power of the Slash Visa Platinum Card, which offers competitive cash back up to 2% cash back along with built-in tools to manage cards, control spending, and scale usage across teams.¹

The basics of cash back and how it compares to other rewards programs

During the 1980s and 1990s, credit card issuers rushed to offer competitive rewards programs as consumer credit card usage expanded. After Diners Club launched the first major rewards program in the mid-1980s using a points-based model, the then up-and-coming Discover brand differentiated itself by introducing the first cash back rewards cards in 1986.

Unlike other rewards programs that require you to track points or calculate redemption values, cash back is more straightforward. You earn cash as you spend, and you can redeem those cash rewards as a statement credit, direct deposit, check, or sometimes gift cards. Over time, cash back has evolved from flat-rate rewards to more dynamic structures, including rotating categories and elevated earn rates at grocery stores, gas stations, and select retailers.

Below is a high-level overview of the different reward structures applicants encounter when comparing credit card offers:

- Cash back: Pays back a percentage of each purchase in cash. Earning structures may be flat rate or tiered, with rewards typically redeemed as statement credits or direct deposits.

- Rewards points: Points-based rewards programs allow cardholders to earn points for every dollar spent. Those points can typically be redeemed for travel, merchandise, gift cards, or statement credits. Unlike cash back, points don’t always have a fixed value—how much they’re worth depends on how and where you redeem them.

- Rewards miles: Miles-based rewards are most commonly associated with travel credit cards. Instead of earning cash back, cardholders earn miles that can be redeemed for flights, hotel stays, or other travel-related expenses. The value of miles varies widely depending on the airline, travel partner, and redemption method.

How does a cash back card work?

Every time you swipe your credit card at a reader, there's a small fee paid by the merchant called an interchange fee. Credit card companies fund cash back by sharing a portion of interchange fee revenue with cardholders. Standard cash back rates of 1–2% are sustainable because issuers also earn revenue from interest, annual fees, and other sources. Card issuers also earn money from interest charges, annual fees, and other income sources, which helps offset the cost of paying cash back to cardholders.

Flat-rate cash back credit cards refer to cards that do not have category-specific earning bonuses. Instead, all transactions earn the same percentage, regardless of retailer or purchase type. This structure is beneficial because it removes the need to track categories, activate bonuses, or tailor spending habits, making rewards predictable and easy to manage across all types of spending.

Selective category earning works differently from the flat-rate model. Instead of offering the same percentage on all purchases, these cards provide elevated cash back at specific merchants or spending categories. Issuers can afford higher rates in select categories because:

- Certain types of purchases carry higher interchange fees, giving issuers stronger margins to support elevated cash back.

- Issuers may have commercial agreements with specific merchants or payment networks that subsidize higher rewards.

- Some category bonuses are subject to quarterly or annual spending caps, which limit how much cash back a cardholder can earn at the higher rate in order to help issuers control overall costs. Whenever you see cash back described as “unlimited,” it means you won’t be subject to a cap on earnings.

Cash back doesn’t apply savings automatically; instead, rewards accumulate until they’re redeemed. Depending on the issuer, there are several ways cardholders can redeem cash back:

- Direct deposit: Transfers earned cash directly into a linked bank account or toward the card balance.

- Statement credits: Apply earned cash back against purchases or outstanding balances on the card.

- Checks: Mailed to the cardholder and deposited into a checking account rather than applied to the credit card balance.

- Gift cards: More common with cash back cards tied to specific retailers, such as gas stations, grocery stores, or travel providers.

With the Slash Visa Platinum Card, businesses earn up to 2% unlimited cash back through a flat-rate rewards structure. The Slash Card is a corporate charge card, meaning balances are settled on a regular billing cycle rather than carried forward like a revolving credit card. Paired with built-in spend controls and centralized financial analytics, Slash allows businesses to earn consistent cash back while maintaining control over company spending.

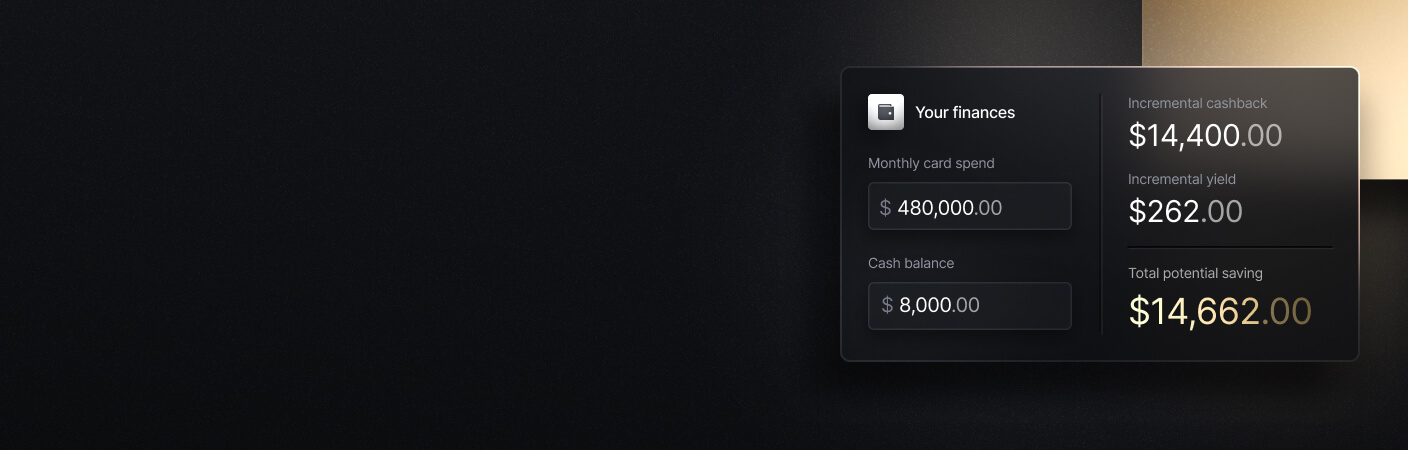

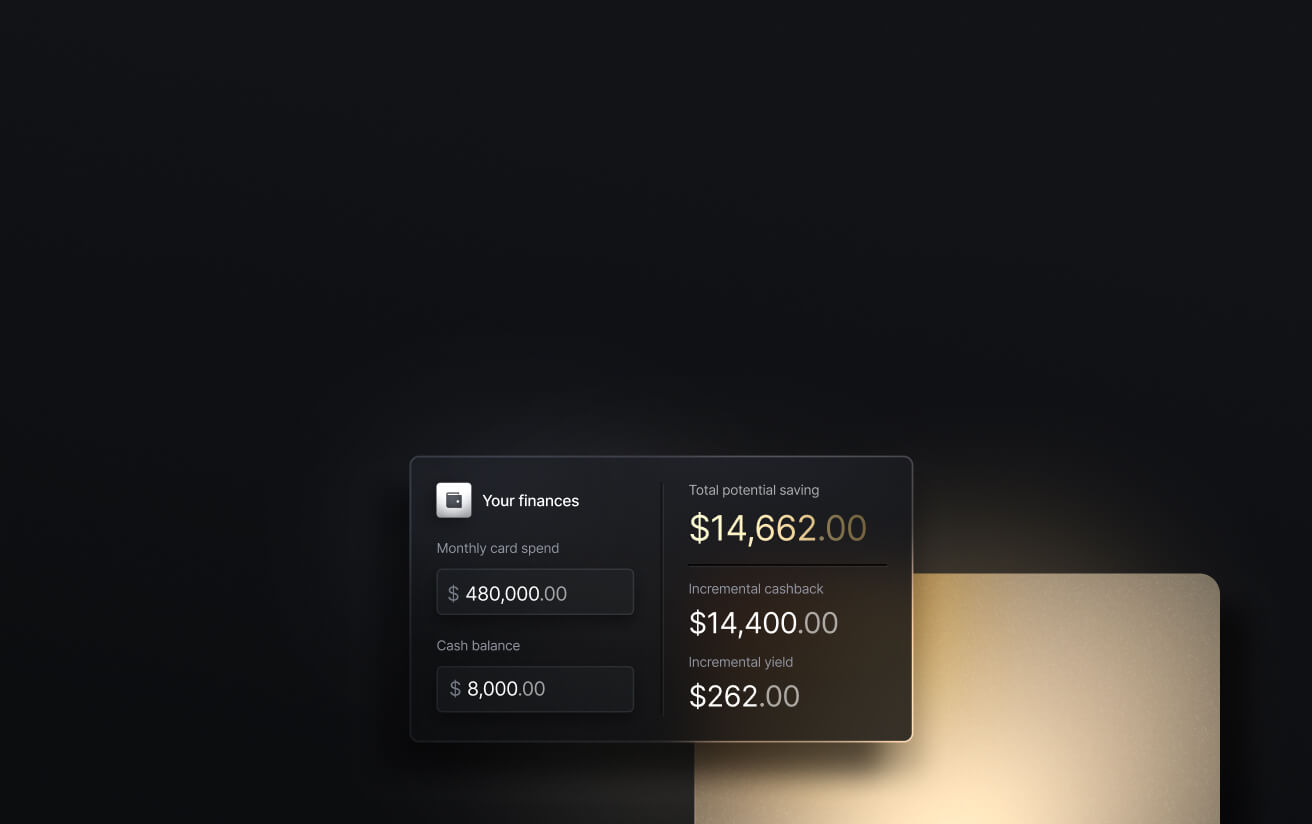

See the ROI behind your spend

Use this calculator to understand impact, then manage and track it all in Slash.

Advantages of cash back rewards

Choosing the right rewards structure for your business isn’t arbitrary. Cash back rewards can offer several advantages over points and miles programs, substantially increasing your rewards potential depending on your company’s typical spending patterns. Below are six key benefits of cash back earning structures:

Predictable, fixed-value rewards

Cash back rewards have a fixed dollar value, which means you always know exactly what you’re earning. Unlike points or miles, there’s no risk of devaluation or poor redemption value reducing your returns.

Flexible reward usage

Cash back can be used for virtually anything, whether that’s offsetting costs for online shopping, granting gift cards to your employees, or simply reducing your statement balance. This flexibility makes cash back rewards more practical for most spending habits.

Strong no-annual-fee options

Many cash back credit cards charge no annual fee while still offering competitive earning rates, so businesses can generate rewards without offsetting a recurring cost.

No blackout dates or availability restrictions

Cash back rewards aren’t tied to airline seats, hotel availability, or redemption calendars. You can redeem cash rewards whenever you choose, without restrictions.

Minimal spending optimization required

Cash rewards credit cards allow businesses to earn consistent rewards without tailoring purchases to specific categories or vendors. Even tiered cash back credit cards can be easier to manage than complex points-based structures.

Possible disadvantages of cash back rewards

Cash back is a highly effective and widely used rewards structure, but it isn’t always the best fit for every business. Depending on spending patterns and priorities, there are a few potential drawbacks to consider:

Fewer premium travel benefits

Cash back credit cards generally don’t include high-end travel perks such as airport lounge access, elite status, or airline transfer partners. These benefits are more commonly bundled with points and miles cards that carry higher annual fees.

Earnings limits on bonus categories

Credit cards that offer elevated cash back rates in certain categories often cap how much spending qualifies for bonus earnings. Once those caps are reached, additional purchases usually earn a lower base rate.

Less leverage for highly optimized travel strategies

Cash back delivers reliable, predictable value, but it doesn’t offer the same opportunity for leveraged redemptions through airline or hotel partners. Businesses that travel frequently and actively optimize reward redemptions may prefer points or miles programs for those specific use cases.

Comparing different cashback rewards structures

Not only should you consider choosing between points and cash back, but there are also several different cash back earning structures to evaluate. Each structure rewards spending differently; the right choice depends on how predictable your expenses are, how much optimization effort you want, and whether you value simplicity or higher category-specific returns:

Flat-rate cash back

Flat-rate cards earn the same rewards rate on all spending, regardless of category. These cards are typically uncapped, meaning every purchase earns cash back at the same rate.

Example: Slash Visa Platinum Card (up to 2% with no caps)

Why it works best: Flat-rate cash back is often the most efficient option for businesses with diverse or unpredictable spending. It requires no category tracking, no activation, and no optimization—every dollar spent earns the same return.

Tiered category cash back

Tiered cash back credit cards offer higher earnings in preset categories, such as dining, groceries, or travel bookings, with a lower base rate on all other purchases. These categories are defined by the issuer and usually remain consistent year to year.

Examples: Chase Freedom Flex, American Express Blue Cash Everyday

Downsides: Tiered structures can leave gaps in earning if your spending doesn’t align with the bonus categories. Many cards also impose spending caps on higher earn rates, which reduces the effective return once those limits are reached.

Rotating category cash back

Rotating category credit cards provide elevated cash back in one or more categories that change on a quarterly basis. Cardholders typically need to activate these categories each quarter to earn the higher rate.

Examples: Citi Custom Cash, Bank of America Customized Cash Rewards

Downsides: Rotating categories require ongoing attention and manual activation, and earnings are usually capped. If spending doesn’t line up with the active categories—or activation is missed—returns drop to the base rate.

Hybrid rewards structures

Hybrid rewards structures combine credit multiple cards from the same issuer to earn rewards in different ways. One card may earn cash back or points at a high rate on everyday spending, while another enables point redemption options. The cards work in tandem through value transfers, which varies in availability by issuer.

Examples: Chase Freedom Unlimited paired with Chase Sapphire Preferred

Downsides: Hybrid setups introduce complexity, often require multiple annual fees, and demand active reward management. While they can increase redemption flexibility, they’re less straightforward than pure cash back credit cards and may not suit businesses prioritizing simplicity.

Earn high cash back with Slash’s corporate charge card rewards

The Slash Visa Platinum Card is a corporate charge card that rewards your business spending with up to 2% cash back. Designed for modern finance teams, the card pairs straightforward cash back rewards with flexible, high-limit spending and granular card controls to keep company spending in check.

Slash cards link directly to our financial management dashboard, where you can issue unlimited virtual cards; set customizable spend controls by category, amount, or merchant type; and create card groupings by team or department to apply rules at scale. The application process is EIN-only, too, meaning there is no requirement to provide an SSN or trigger a hard pull on your personal credit score.

Beyond high cash back charge cards, Slash offers a full suite of business banking tools designed to help companies earn, save, and manage their money more effectively, including:

- Business banking: Establish separate virtual accounts for different funds, enabling better cash flow monitoring and budget allocation. Oversee multiple company subsidiaries or divisions through one unified interface, helping you maintain complete financial transparency across your entire operation.

- Accounting integrations: Sync transaction data with QuickBooks for simplified reconciliation, reporting, tax preparation, and more. Connect via Plaid to integrate with additional financial tools, or import data from Xero to enhance your accounting workflow.

- Native cryptocurrency support: Utilize USD-pegged stablecoins like USDT or USDC to send and receive payments, which can cut transaction costs and processing times by avoiding traditional banking rails.⁴

- Diverse payment options: The platform accommodates multiple payment methods—card transactions, global ACH transfers, domestic and international wire transfers to 180+ countries, and real-time payment networks like RTP and FedNow.

- Slash Working Capital financing: Withdraw funds on demand and select from 30, 60, or 90-day repayment schedules to manage cash flow gaps, make timely investments, or handle unexpected costs.⁵

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Frequently asked questions

Are cash back cards free?

Many cash back credit cards do not charge an annual fee, making them free to use. However, fees related to misuse like interest fees from missed payments, can still apply. The Slash Visa Platinum Card does not require an annual fee and earns 1.5% cash back on the free plan. Upgrading to Slash Pro for $25 per month unlocks 2% cash back along with lower bank transfer costs.

What are the Easiest Business Credit Cards to Get? Top Picks and How to Get Yours Approved

Can you get cash back with a credit card?

Yes, cash back typically refers to cash rewards generated from credit card spending. Charge cards, like the Slash Card, can also earn cash back. Generally, debit cards do not earn rewards on spending.