Comparing Top Brex Competitors for Spend Management and AP Automation

Brex helped redefine what modern corporate finance could look like. When it launched, its sleek dashboard, startup-friendly branding, and tech-first approach felt like a breath of fresh air compared to traditional banks. But the fintech landscape has changed, and Brex is falling behind the competition.

As strong as the platform is, its model comes with trade-offs: points-based rewards that don’t always deliver real value, eligibility requirements that can exclude smaller teams, and key features tucked behind paid tiers. These limitations matter even more now that competitors offer comparable (or better) functionality with broader accessibility or more cutting-edge financial tools.

Brex is still a solid fit for certain venture-backed startups, but businesses come in all shapes and sizes—and they need financial platforms that match the way they operate. In this guide, we break down the top Brex alternatives by category so you can quickly find the solution that fits your team’s size, structure, and financial priorities. And if you’re looking for the most complete, modern replacement for Brex’s banking, cards, payments, and rewards, you’ll see why Slash stands out as the strongest all-around option.¹

Why should companies explore Brex alternatives?

Brex is a business banking and financial technology company founded in 2017. Like many modern fintech platforms, Brex is a digital-first financial management solution with tools spanning expense reporting, accounts payable, travel booking, treasury, accounting automation, and more. Brex stands out in two notable ways: it uses a points-based rewards program (many competitors favor straightforward cashback), and it primarily targets high-growth startups, technology companies, and large enterprises.

On January 22nd, 2026, Capital One Financial Corporation announced that it had entered into a definitive agreement to acquire Brex. The deal is expected to close in mid-2026, after which Capital One will assume full ownership of the company and its products. At Slash, we’re committed to building modern financial infrastructure that isn’t constrained by traditional banks. That independence allows us to move faster and deliver higher-quality financial technology than legacy providers, which includes Brex.

What products does Brex offer?

Brex’s platform revolves around its centralized dashboard and integrations with accounting and ERP tools. While this ecosystem was once a differentiator, similar capabilities are now standard among many fintech competitors, making Brex a useful baseline for comparison throughout this guide. From the Brex dashboard, businesses can access:

- Brex Card: A corporate charge card that earns bonus points in select spending categories. Companies can issue virtual cards or physical cards with customizable controls and spending limits for employees.

- Payments: Support for ACH transfers, domestic and international wires (via the SWIFT network), and check payments.

- Banking and treasury accounts: FDIC-insured business accounts backed by a sweep network to increase coverage limits, along with optional high-yield treasury accounts for surplus cash.

- Brex Rewards and Travel: A points-based rewards program with redemption options for cashback, statement credits, and travel bookings.

- Accounts Payable Solutions: Uses OCR technology to capture invoice data and automatically routes payment information for approval.

Together, these products aim to streamline expense tracking, accounts payable solutions, and financial operations. However, as we’ll explore below, Brex’s approach comes with trade-offs that may impact suitability for certain businesses.

How does Brex’s rewards program work?

Imagine you run a small SaaS startup called Lynx. After years of using a 2% cashback card, Lynx switches to the Brex Card because the rewards sound perfect for a growing, tech-focused company: 7x on rideshare, 4x on Brex Travel, 3x on restaurants, 2x on software, and 1x on everything else. After a full year with Brex, here’s what Lynx’s $200,000 in annual card spend looks like:

- Cloud, software, and other subscriptions: $90,000

- Miscellaneous: $80,000

- Travel: $20,000 (mostly not booked through Brex)

- Meals and team events: $5,000

- Rideshare: $5,000

Not everything in these categories qualifies for bonus multipliers, so being generous, let’s assume $60,000 of the total card spend earns elevated points. Here’s a reasonable breakdown:

$5,000﹡7x on rideshare + $50,000﹡2x on software + $3,000﹡3x on restaurants + $2,000﹡4x on Brex travel + $140,000﹡1x on everything else = 284,800 Brex points

Seems pretty good—but what are those points actually worth? According to Brex, their cashback redemption rate is $0.006, or just over half a cent:

284,800﹡$0.006 = $1,708 in effective cash value with Brex

Now compare that to a 2% cashback card like the Slash Visa® Platinum Card for Pro Users:

$200,000﹡0.02 = $4,000 in effective cash value with Slash

Brex’s low redemption values and optimistic assumptions about bonus categories caused Lynx to miss out on roughly $2,500 in real rewards over the year. That’s the problem with rewards points programs: big point balances make cardholders feel like they’re earning more than they actually are, when in practice the value may fall short of direct cashback.

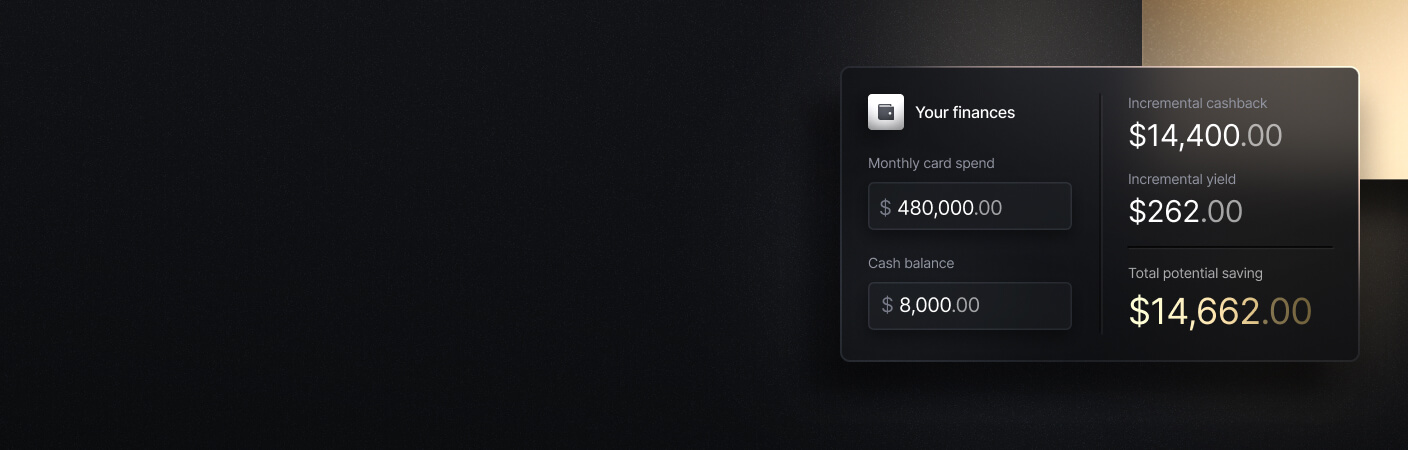

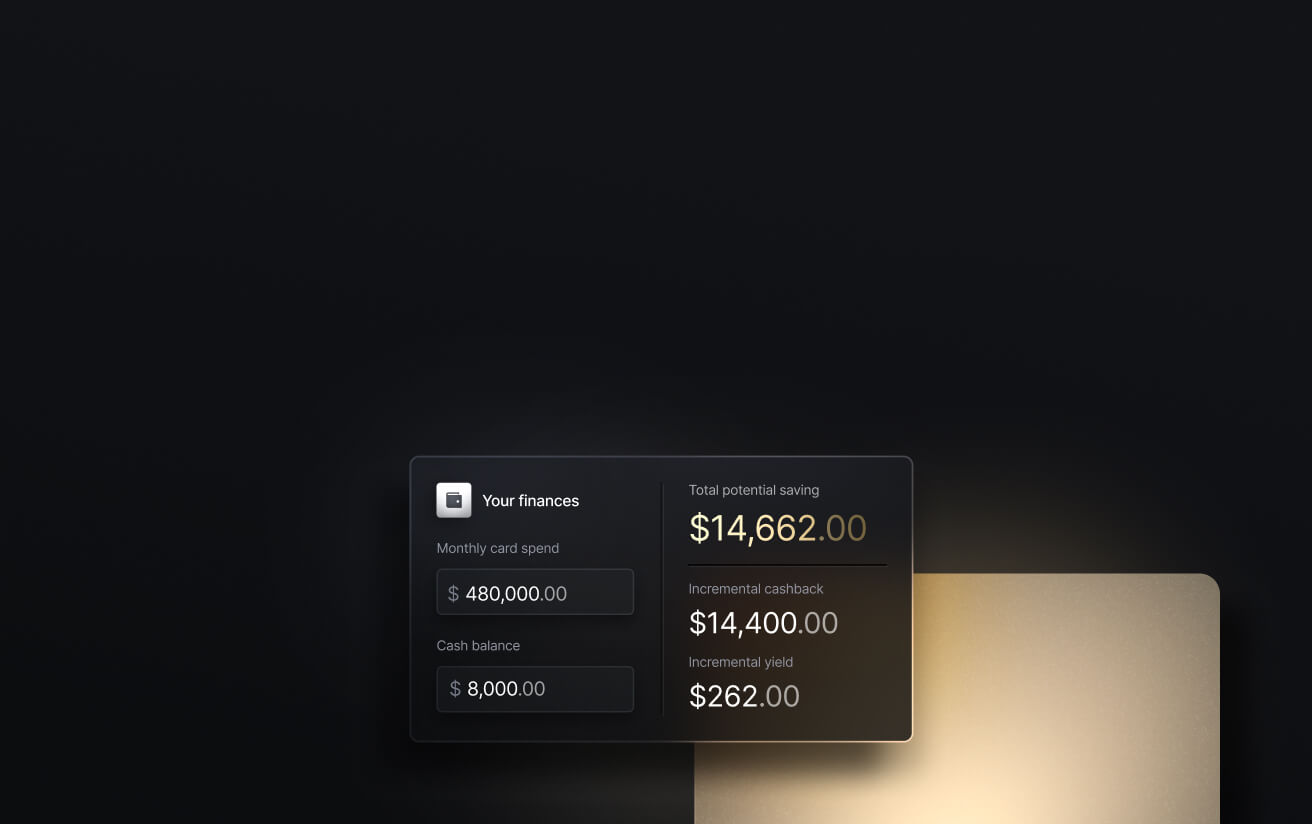

See the ROI behind your spend

Use this calculator to understand impact, then manage and track it all in Slash.

What are some of Brex’s other downsides?

While Brex offers a broad financial toolset, its platform comes with several limitations, especially for businesses outside the tech and startup space. Here are some additional hurdles businesses may encounter with Brex:

- Limited accessibility and paywalled features: Brex’s free Essentials plan does not include features like multi-entity support, full expense management capabilities, ERP integrations, or automated reviews. Smaller teams may find themselves upgrading sooner than expected for paywalled tools, while Slash provides full platform functionality on its free plan.

- Designed primarily for startups and enterprises: Brex’s underwriting, rewards structure, and product focus are built around venture-backed startups, tech companies, and large enterprises. Many small and mid-sized businesses may find the platform inaccessible, as Brex typically expects applicants to have significant VC backing or roughly $1 million in annual revenue.

- No crypto support yet: Brex’s crypto features remain in early access. Companies that rely on fast, low-fee global payments may need established stablecoin support—something Slash already offers with the ability to hold, send, and receive USD-pegged stablecoins like USDT, USDC, and USDSL.³, ⁴

- Points-based rewards reduce real value: Brex promotes high-point multipliers, but the categories don’t reflect how many companies actually spend; additionally, the redemption rate for points ($0.006 per point for cash) can dilute rewards value.

Who are Brex’s competitors?

Brex’s tech-first approach to business banking offers clear advantages over traditional institutional providers. However, its feature set is no longer unique in the broader fintech landscape; many competitors now match its core functionality while delivering stronger rewards, greater accessibility, or more specialized capabilities. Below, we’ve chosen 9 platforms, ranging from focused small-business tools to full enterprise management solutions, that may better fit your business’s needs:

Best overall: Slash

Who it’s for: Businesses of all sizes looking for a unified financial management solution.

Slash is a modern fintech platform that combines banking, treasury, corporate cards, payments, and capital financing in one stack to replace the patchwork of separate tools many companies use.

Key features:

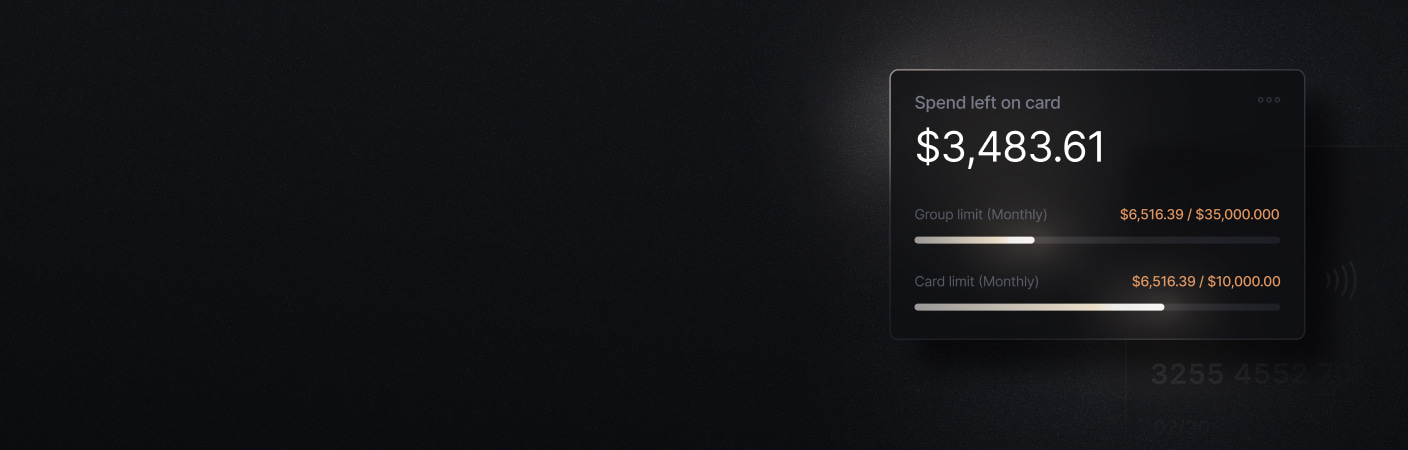

- Virtual and physical corporate charge cards earning up to 2% cashback, with customizable card groupings, spend controls, and automatic transaction data integration.

- Global ACH, domestic and international wires via the SWIFT network, and real-time payment rails (RTP, FedNow).

- Native support for USD-denominated stablecoins (USDC, USDT, and Slash’s USDSL) with built-in on/off ramps that enable businesses to hold, send, and receive stablecoins in-app.

- Global USD Account that lets non-U.S. businesses access Slash’s payment features, even without a U.S.-registered LLC.

- Working Capital financing is a tailored line of credit that you can draw from whenever you need; boost your short-term liquidity and choose flexible 30, 60, and 90 day payment terms.⁵

- Unified business bank and treasury accounts (with up to 4.1% annualized yield), multi-entity support, clean integrations with QuickBooks or Plaid, and more.⁶

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Best for invoicing tools: BILL

Who it’s for: SMBs that need AP and invoicing tools, but aren’t relying on it for complete business banking.

BILL (formerly Divvy) is primarily an AP and AR management software with additional features spanning expense management, virtual cards, and global payments.

Key features:

- OCR-based invoice data capture and receipt scanning for easy digitization of paper bills.

- Automated vendor payment routing (ACH, international wires, or checks) with vendor and payment data stored in a centralized dashboard.

- Optional charge cards for expense tracking, helping tie bill payments and company spending together.

Cons: BILL focuses on back-office payables and invoices. The card rewards are points-based with strict redemption rules and require high credit usage to be valuable.

Best for SMB expense management: Expensify

Who it's for: Individuals, freelancers, or small businesses that need a light-weight expense management solution.

Expensify is more of an add-on for expense and reimbursement tracking than a full financial operations platform. Unlike many competitors on this list, Expensify is available for individual use, making it highly accessible even without company backing.

Key features:

- Automatic linking with external bank accounts to fetch transactions for expense tracking.

- Receipt scanning and smart-categorization of expenses.

- Automated expense reports, reimbursement workflows, and integrations with major accounting software.

Cons: Limited payment and banking functionality. Pricing per user can make it expensive or impractical for larger teams.

Best for accounts payable automation: Tipalti

Who it's for: Mid-market to large businesses that handle complex global vendor networks.

Tipalti is built for companies with high payment volumes and complex vendor networks, offering robust compliance and multi-entity support that growing businesses need as they scale globally.

Key features:

- Global mass payment capabilities across 190+ countries.

- Tax compliance automation (1099s, W-9s, international tax forms).

- Multi-language supplier onboarding and vendor management portal.

Cons: Tipalti is primarily an accounts payable automation tool, not a banking platform, so businesses may need separate accounts for deposits, corporate cards, and treasury management. The platform may be expensive (plans range in price from $99-$199 per month) and overly complex for small businesses with simpler AP needs.

Best for institutional banking: American Express

Who it's for: Any size company looking for a more traditional business banking solution with multiple card offers.

American Express provides conventional business banking through established financial infrastructure, appealing to companies that prefer working with a legacy institution and want access to premium card benefits.

Key features:

- Amex Membership Rewards and Amex Travel.

- Exclusive perks, travel rewards, and travel booking offers through high-tier card membership.

- Multiple credit card and charge card offers for different credit scores and business types.

Cons: Lacks modern fintech features like real-time cash flow dashboards, automated payment workflows, integrated treasury, or diverse global payment rails.

Best for enterprise resource management: Oracle Netsuite

Who it's for: Large enterprises that need full ERP capabilities.

Oracle Netsuite is an enterprise resource planning system that includes financial management alongside inventory, CRM, and e-commerce capabilities; it’s designed for complex organizations managing multiple subsidiaries or business units.

Key features:

- Full ERP suite with integrated financial management.

- Multi-subsidiary and multi-currency consolidation.

- Financial reporting and analytics; revenue recognition and compliance tools.

Cons: NetSuite is an ERP, not a banking platform. Organizations still must manage separate bank accounts, payment processors, and cards. Implementation can be lengthy, expensive, and may require dedicated consultants.

Best for payroll and HR: Airbase from Paylocity

Who it’s for: Companies that want to consolidate expense management with an HR and payroll system.

Following Paylocity’s acquisition of Airbase, the combined offering brings together HR, payroll, and modern spend management onto a single platform.

Key features:

- Cashback-earning virtual cards (percentage not disclosed) and expense management provided by Paylocity.

- Guided Procurement workflows, such as budget mapping or multi-stage approvals.

- Native connection to Paylocity’s HR and payroll data.

Cons: Best suited for companies already using or planning to use Paylocity. Its per-employee, per-month pricing can also add up quickly for larger teams; while Paylocity doesn’t publish its own rates, third-party sources estimate costs in the $10–$20 range per employee each month. And like other non-bank platforms, it doesn’t function as a full replacement for a business bank account or treasury solution.

Best for SMB procurement: Spendesk

Who it’s for: European SMBs that want unified procurement plus spend management.

Spendesk is a comprehensive spend-management platform designed for European SMBs and mid-market firms. It combines procurement workflows, corporate and virtual cards, invoice and bill processing, budget tracking, and more.

Key features:

- Procure-to-pay workflows from intake through payment.

- Automated invoice processing and approvals.

- Budget tracking and real-time spend visibility alongside physical and virtual corporate cards.

Cons: No rewards from card spending. Spendesk doesn’t act as a full bank; it’s best understood as a spend and procurement management platform. While Spendesk added cross-border and multi-currency payments via Wise for many EEA/UK customers, that capability isn’t guaranteed globally.

Best for travel expense management: SAP Concur

Who it's for: Mid-market to enterprise companies with significant business travel that need specialized travel booking and expense reporting.

SAP Concur offers expense and AP management tools, but it is best as a T&E solution. The platform offers integrated booking tools and detailed travel policy enforcement for organizations with complex T&E needs.

Key features:

- Integrated travel booking (flights, hotels, car rentals).

- Automated expense report generation.

- Travel policy compliance and approval workflows.

- Integration with corporate travel agencies and TMCs.

Cons: SAP Concur is not a full-stack financial solution, and is best when paired with additional tools, which can limit your ability to unify data and cut down on subscription costs. It also lacks corporate card programs, financing options, and the real-time spend controls offered by modern fintech platforms.

How to choose the best Brex alternative for your business

Selecting the right Brex alternative comes down to understanding what your team actually needs from a financial platform. While Brex offers a broad set of tools, businesses may outgrow its structure, need different rewards, or require features Brex doesn’t prioritize. Here are the key factors to evaluate:

Accessibility and ease of use

Look for a platform your entire team can navigate easily. Evaluate how quickly you can onboard employees, issue cards, configure controls, and automate workflows without heavy setup or training. Some tools are built for large enterprises and can feel cumbersome for smaller companies, while others are lightweight but lack depth. Slash strikes a strong balance, offering enterprise-grade capabilities with SMB-friendly usability.

Business banking features

If you adopted Brex for its blend of business accounts, payments, and expense tools, you’ll want an alternative that doesn’t force you to piece together multiple systems. Many competitors specialize in narrow workflows (AP automation, expense management, or procurement), while others are overly complex to function as a primary banking stack.

Slash covers the same broad functionality as Brex, but improves on areas where Brex falls short, including reward value, accessibility, and support for modern payment rails like RTP, FedNow, and on/off-ramped crypto transfers.

Competitive rewards programs

If maximizing card value is a priority, flat-rate cashback tends to outperform category-based point systems in real-world use. Brex, Ramp, and BILL all promote cashback multipliers or point tables, but each has limitations: Brex’s low point redemption rate, Ramp’s 1.5% cashback cap, and BILL’s credit utilization requirements can all limit the value of your spend. Slash’s up to 2% cashback delivers predictable and consistently higher reward value than the competition.

Security and compliance

Security and compliance should be non-negotiable for any financial platform. Look for essentials such as PCI DSS compliance, strong KYC/AML controls, FDIC-insured accounts or equivalent protections, role-based permissions, audit trails, and vendor verification.

Slash adds additional layers through SOC2 Type II certification, tokenized virtual cards, and support for compliant digital assets like USDC (regulated under MiCA standards), making it suitable even for heavily regulated B2B environments. You should also evaluate whether the platform provides fraud monitoring, MFA/2FA, secure API connections, and granular admin controls to safeguard sensitive financial data across your organization.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

Start optimizing your business banking now with Slash

If you’re exploring Brex alternatives because you want a platform that brings more of your financial operations under one roof, Slash is built for exactly that. It replaces the scattered mix of tools most teams rely on and unifies banking, cards, payments, and treasury in a single, cohesive system.

Slash emphasizes clarity and usability—not point tables, restrictive eligibility, or features hidden behind paywalls. You get straightforward rewards and flexible tools that work for companies of any size without sacrificing depth. With Slash, you can centralize everything you need: FDIC-insured business banking with high-yield savings, corporate cards with granular spend controls and real cashback, and domestic or international payments through either traditional rails or blockchain.

And as your business grows, Slash grows with you. Cryptocurrency support and global payment capabilities give you the flexibility to operate across borders on your terms, while built-in spend management and accounting integrations keep everything organized without the administrative burden.

Make your next financial decision your best one. Get started with Slash today.

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Frequently asked questions

Who is Brex primarily targeting with their financial products?

Brex primarily targets venture-backed startups, technology companies, and large enterprises. Its underwriting, product design, and rewards structure are built around high-growth businesses with significant card spend and strong capitalization. This means many small or mid-sized businesses may find Brex inaccessible or misaligned with their operational needs.

Can I integrate Brex alternatives with my existing accounting system or ERP?

Yes. Most Brex alternatives on this list—including Slash, BILL, Ramp, Expensify, Tipalti, and Netsuite—offer clean integrations with major accounting systems like QuickBooks and Xero.

What Is Business Spend Management? Key Components Explained

Which alternatives are best suited for mid-market or enterprise companies?

Slash is the strongest all-around alternative for mid-market and enterprise teams that want unified banking, corporate cards, payments, treasury, crypto, and capital financing in one system. It supports multi-entity structures, advanced payments, global operations, and modern rails like RTP and FedNow.