The Best Expensify Alternatives for Businesses in 2025

Expensify's product has one clear objective: expense management. It handles the essentials well, capturing day-to-day spend from cards and bank accounts, organizing receipts, and syncing with major accounting systems. But once you move beyond these core functions, Expensify's limitations become more noticeable. As one of the older services in the market, Expensify hasn't kept pace with newer platforms that pair expense tracking with banking, treasury management, financing, and broader payment tools.

Managing expenses doesn’t happen in isolation. When your expense tool doesn’t sit alongside your payment systems, you can end up toggling between multiple dashboards just to understand where money is going. That’s why organizations may move away from expense-only tools and toward platforms that can offer a more complete financial stack, which can reduce friction and give teams greater control without adding unnecessary complexity.

In this guide, we break down the seven best Expensify alternatives available to businesses today. Some mirror Expensify's simplicity while offering more specialized workflows and automation. Others go further, consolidating expense management, payments, corporate credit cards, and treasury in one platform. Among them, Slash stands out as a leading option for companies that want more than basic expense tracking, offering stronger cashback, built-in crypto capabilities, broader payment rails, and a more accessible financial management software that scales with your business.¹﹐³﹐⁴

What to consider when comparing Expensify alternatives

Before we go over which expense management services outperform Expensify, we first need to understand how Expensify works. Below is an overview of Expensify’s products and services, explaining their primary use cases and possible limitations:

Expense tracking

Expensify connects debit cards, credit cards, and bank accounts to pull in transaction data. It also uses its SmartScan OCR product to scan and import receipt details from cash transactions. The tools tidy up expense reporting, but Expensify still lacks the seamless, native expense tracking you get from an all-in-one finance platform.

Corporate Cards

Introduced in 2019, the Expensify Card was the company’s attempt to keep pace with competitors by offering a charge card that links directly with their expense management software. However, the Expensify Card can’t draw directly from company funds without manual top-ups, making it less convenient than competitors. Cashback is also restrictive: the advertised 2% rate only applies after $250k in monthly card spend; otherwise, businesses earn just 1%.

Global Reimbursements

There’s a reason this section isn’t labeled “global payments.” Expensify’s payment features are built specifically for reimbursing employees and independent contractors, not for sending funds to vendors or managing B2B payments. Competitors like Slash support a wider range of rails, including global ACH, domestic and international wires via SWIFT, real-time networks like RTP and FedNow, and even stablecoins.

Integrations

Expensify syncs with accounting software like Quickbooks and Xero, with ERP systems like Oracle Netsuite, and with institutional banks to import business expense data. While it may be helpful, this capability is no longer a differentiating factor. These integrations can smooth out administrative work, but they won’t eliminate the friction of bouncing between multiple platforms. Plus, Expensify's ERP and HR connectivity is paywalled behind its Control subscription, which can be needlessly expensive for larger teams.

Travel and Expense Features

Expensify integrates with rideshare and travel apps, and it provides an in-app booking service for flights, hotels, rental cars, and transit. However, the proposed savings and travel options may feel limited due to missing partnerships with major providers like Delta, Enterprise, and IHG. Platforms that can automate travel and expense policy checks without restricting where you book, like Slash, may deliver more value.

The 7 best Expensify alternatives for 2025

Understanding Expensify’s strengths and weaknesses gives you a clearer picture of what modern finance platforms should deliver. Instead of focusing solely on receipts and reimbursements, the strongest alternatives automate global payments, simplify financial visibility, and reduce the number of tools your team relies on. Below, we break down the leading competitors and what each brings to the table:

Best overall: Slash

Slash is the strongest option for businesses that want to go beyond receipt capture and basic expense reports. Unlike Expensify, which focuses almost entirely on post-transaction reporting, Slash centralizes all your financial workflows. It combines spend management, global payments, corporate cards, cash flow tools, and even crypto capabilities in one platform.

Where Slash stands out:

- Business banking and treasury: Leverage customizable virtual accounts to separate cash flow. Place idle funds into high-yield savings accounts from BlackRock and Morgan Stanley that earn up to 4.1% annualized yield and integrate directly into the Slash dashboard.⁶

- Flexible financing: Boost your short term liquidity with Slash Working Capital, a tailored line of credit with 30, 60, or 90 day repayment terms.⁵

- Built-in crypto support: Send, receive, and convert USD-pegged stablecoins directly in-platform for fast, low-fee global payments. Support for USDC, USDT, and USDSL across 8 different blockchains.

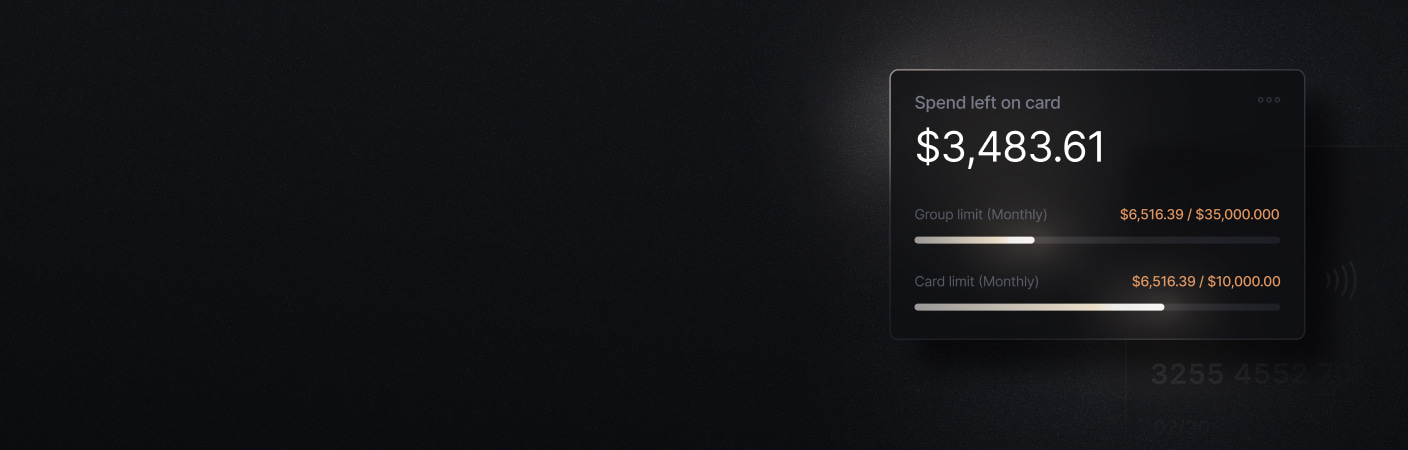

- Slash Visa® Platinum Card: Earn up to 2% cashback on card spend. Prevent maverick spending with customizable controls for individuals or entire teams; set rules by category, amount, and more.

- Broader accessibility: Non-U.S. companies can open Global USD accounts without needing a U.S. entity (unlike Ramp and Brex).

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

Best for automation-driven expense management: Ramp

Ramp is a modern expense management platform with strong automation capabilities. It includes corporate cards, AP tools, and basic banking features. Ramp offers a more unified workflow than Expensify, especially for teams that want automated controls and more robust policy enforcement; but, it comes with downsides of its own, like underwhelming rewards and narrow qualification requirements.

Ramp's key features include:

- Expense tracking: Corporate cards automatically capture spend, enforce employee-level controls, and feed data into Ramp’s analytics tools for visibility into companywide trends. Integrates with accounting softwares like QuickBooks, Xero, and more.

- AP automation: Ramp extracts invoice details using OCR, matches purchase orders, and routes approvals without manual processing—useful for teams looking to streamline payables.

- Global payments: Supports domestic ACH and international wires through the SWIFT network. Real-time payment capabilities are limited (Ramp can receive RTP payments but cannot send them), and the platform offers no crypto support.

Downsides: Ramp’s cashback tops out at 1.5%, which is lower than many competitors. It does not offer financing or credit flexibility and provides no crypto payment capabilities. Accessibility is also limited: only U.S.-registered companies that maintain significant cash balances qualify for the platform.

Best for startup financial operations: Brex

Brex is a financial management software that combines spend management, banking tools, and travel workflows. It offers more breadth than Expensify’s reporting-focused approach, but its design and qualification criteria largely cater to venture-backed companies—leaving many SMBs and international businesses without access.

Brex’s key features include:

- Rewards-earning corporate cards: Virtual and physical cards with configurable controls and automated receipt matching that tie directly into Brex’s budgeting features. Brex uses a points-based reward system rather than cashback, which has some travel and discount perks but can yield a lower effective cash value.

- Travel & expense: Integrated travel and expense tracking, policy enforcement, and visibility into employee bookings and travel spend.

- AP automation: OCR invoice capture, streamlined approvals, and vendor management tools to simplify payables. Also syncs with accounting systems like QuickBooks, Xero, and others.

Downsides: Brex’s points-based rewards often deliver less value than straightforward cashback (1 point = $0.006, or just over half of a cent). Qualification is restrictive, and requires either venture backing or high annual revenue ($1m+). Several of the platform’s features sit behind higher-cost plan tiers, which may limit accessibility for smaller teams.

Best for accounts payable automation: BILL

BILL (formerly Divvy) focuses on accounts payable and accounts receivable rather than broad financial operations. Compared to Expensify’s lightweight AP tools, BILL offers improved invoice workflows and vendor management. Still, it works best as a piece within a larger financial system rather than a standalone platform.

BILL’s key features include:

- AP/AR management: For accounts payable, BILL handled automated invoice processing, approval routing, purchase order matching, and vendor tracking. For accounts receivable, you can create and send invoices, track customer payments, and sync revenue data into accounting software for easier reconciliation.

- Spend controls: BILL Divvy Cards include spend rules tied to budgets or departments and real-time tracking of employee purchase activity.

- Expense management: Improved visibility across payables, receivables, vendors, and budgets, helping teams track obligations and cash outflows more accurately.

Downsides: BILL does not offer business banking or treasury accounts, so companies must rely on external banks for core operations. Its points-based rewards program can be less valuable than cashback, especially if spending doesn’t align with multipliers.

Best for HR and payroll connectivity: Airbase from Paylocity

Airbase is one of the most similar competitors to Expensify on this list, with one important caveat: Airbase is deeply integrated with Paylocity’s HR and payroll ecosystem. While it’s a natural fit for companies already using those systems, it may be an unwanted commitment since larger teams typically need dedicated HR and payroll systems. This makes Airbase a bit less dynamic in its usage compared to Expensify, which can be a tool for individuals and sole-propreitors.

Airbase’s key features include:

- Unified employee data: Native connection to Paylocity ensures employee profiles, roles, and permissions sync directly into spend and expense workflows.

- Expense tracking: Receipt capture, policy enforcement, and automated categorization help teams avoid manual data entry.

- Paylocity Card: Virtual & physical cards that feature role-based controls, spend limits, and real-time transaction views. It also features partnerships with Silicon Valley Bank and American Express for access to a traditional corporate credit card.

Downsides: Like Expensify, Airbase’s per-employee pricing can become expensive as teams scale. It lacks built-in banking or treasury accounts, requiring companies to maintain external accounts for cash flow and payment operations. It is also tied to Paylocity’s larger HR and payroll system, which can be more limited than Expensify’s broader third-party connectivity.

Best for mobile app expense tracking: Fyle

Fyle (recently rebranded as Sage Expense Management) offers a simple, mobile-friendly expense tool designed around quick receipt capture and accounting integrations. Its focus on ease of use makes it appealing to small business owners, and its native connection to Sage Intacct enables AI-assisted coding and reconciliation. However, the platform is fairly limited; it’s essentially a streamlined receipt system with higher-than-expected pricing.

Fyle’s key features include:

- Text-based management: Text-based expense capture: Employees can send receipt photos via text, email, or the Fyle mobile app. Fyle’s AI extracts the data and codes each expense to the appropriate general ledger account.

- Automated reconciliation: Fyle works best in conjunction with Sage Intacct, but it also can integrate with accounting systems like QuickBooks and Xero. Transaction data is matched to the correct business card, reducing manual review and accelerating the month-end process.

- Reimbursements: Supports ACH employee reimbursements within the U.S.—and not much payment support beyond that.

Downsides: Despite strong accounting connectivity, Fyle is a very basic expense tracking tool. Reimbursement capabilities are narrow, and the platform doesn’t offer vendor payments, cards, banking tools, or broader spend controls. Pricing is also steep for what you get: its lowest plan starts at $11.99 per user (minimum of 5 users), making the true entry point at least $59.95/month. The Business plan requires 10 users, bringing the minimum to $149.90/month.

Best for enterprise-scale travel and expense management: SAP Concur

SAP Concur is built for enterprises that require complex travel and expense structures, multi-entity governance, and deep integrations with ERP environments. Compared to Expensify, Concur provides stricter compliance, broader international capabilities, and more sophisticated T&E oversight.

SAP Concur's key features include:

- Enterprise integrations: Designed to fit into the SAP ERP system, streamlining how expense and AP information is managed and reported.

- Travel booking & compliance: Centralized booking tools provided by American Express Global Business Travel; automated policy checks, approval chains, and audit-ready spend documentation.

- Expense management: Structured expense creation, automated categorization, and configurable rules for complex corporate hierarchies.

Downsides: Concur does not offer a corporate card program, requiring separate providers for spend controls. It’s built as middleware, not a financial platform—meaning businesses must maintain independent banking, payment, and cash-management systems.

Choosing the best Expensify alternative for your business

With so many platforms offering some mix of expense tracking, payments, cards, and automation, the best choice ultimately depends on how your business spends and how much complexity you’re trying to eliminate. Before making a switch, evaluating each platform against the criteria below can help you determine which platform will support your workflows, not complicate them:

- Automated workflows: Seek platforms that can automate B2B payment executions, automatically route approvals, and capture every inflow and outflow with cards and accounts that live side-by-side. Integrations with QuickBooks and Xero can simplify month-end close, and syncing with ERPs like SAP or NetSuite can allow larger companies to tie expense management into existing workflows.

- Cash flow visibility: A unified platform should give you real-time visibility into cash flow, vendor payments, subscriptions, and employee spending. When data is scattered across multiple tools, it may lead to overlooked details or inconsistencies, which can undermine the value of a digital-first expense management system.

- Diverse payment capabilities: Your platform should handle far more than employee reimbursements. Prioritize systems that support domestic and international wires (via SWIFT or equivalents) and global ACH payment options. Real-time rails and crypto support provide even more flexibility for urgent domestic payments or low-cost cross-border transfers.

- Transparent terms and pricing: Expensify’s pricing can escalate quickly. It charges per employee per month: the Collect plan is $5/user but excludes essentials like ERP integrations, advanced reporting, and budgeting tools. The Control plan adds those features at $9/user, meaning a 20-person team pays $2,160 per year for capabilities that competitors include for free. Slash takes a simpler approach: the full platform is available on the free plan, while the $25/month Pro plan (per company, not per user) unlocks 2% cashback and unlimited free domestic transfers.

Making the right financial move with Slash

Switching from Expensify to Slash means moving from a tool that tracks expenses to a platform that actually runs your financial operations. Slash consolidates what used to require three or four separate services—expense management, business banking, corporate cards, and payment processing—into a single system that's easier to manage, more rewarding, and less expensive to maintain.

Direct comparisons make the contrast obvious: Slash gives you 2% cashback for a flat $25 per month, a fee you could easily offset with normal spending. Expensify only offers 2% cashback once your business spends $250k in a single month. Our payment options extend far beyond reimbursements: Slash supports domestic and international wires to over 160 countries, global ACH, real-time rails like RTP and FedNow, and even stablecoin transfers for fast, low-fee global payments. Non-U.S. companies can open Global USD accounts without forming a U.S. entity, an option competitors like Ramp and Brex don’t provide. And when you need short-term liquidity, Slash Working Capital offers flexible credit lines with 30, 60, or 90-day terms.

Discover how Slash can help your business automate, organize, and scale its financial operations at slash.com today.

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Frequently asked questions

Which software is primarily for invoicing but also tracks expenses?

BILL is the most specialized invoicing tool on our list, but most Expensify alternatives include invoice scanning and payment automation. Slash’s invoicing tool is coming soon; it will let you generate invoices using the contacts, accounts, and business information already stored in your Slash account. You’ll be able to manage customer payments in-app and streamline invoicing workflows with automated reconciliation of incoming funds and fast, low-fee crypto payouts.

How to Make an Invoice: A Guide to Creating Professional Invoices Quickly and Easily

Who is Expensify suitable for?

Expensify is a highly accessible platform with plans that cater to individuals and sole proprietors as well as large-scale enterprises. However, its feature set isn't universally suited for every business, as it lacks the full payment capabilities, quality corporate cards, credit products, and integrated business banking accounts from a provider like Slash.

What is unique about Slash?

Slash stands out by offering a Global USD account for non-U.S. companies, built-in crypto support for sending and receiving stablecoins, access to real-time payment networks like RTP and FedNow, working capital financing with flexible terms, and up to 2% cashback on corporate card spend—all without the restrictive qualification requirements found on competing platforms.