Expensify vs. Ramp vs. Slash: Key differences in modern spend management

Choosing the right spend management platform can transform the way your team handles day-to-day finances. The right software cuts countless hours of manual work, helps prevent unnecessary spending, and keeps your approval policies on track. When businesses start comparing their options, three names often rise to the top: Expensify, Ramp, and Slash. Each one can help you manage company spending, but they take very different paths to get there.

Most teams expect a spend platform to offer corporate cards, clear visibility into employee spending, accounting integrations, and the ability to move money across borders. Ramp and Slash build these features into a broader financial stack that can act as a replacement for traditional business banking. Expensify focuses more on connecting to your existing bank accounts and simplifying reimbursements and expense reporting. It might seem like a minor distinction, yet it can result in very different user experiences and limitations within each platform’s range of capabilities.

This guide breaks down how Expensify, Ramp, and Slash fit into a modern finance workflow. You will learn how their tools compare, where each platform excels, and what to expect from their financial products. It also highlights why many growing companies choose Slash, which pairs strong spend management capabilities with industry-leading cashback, native cryptocurrency support, diverse payment rails, flexible financing, and more.¹﹐⁴﹐⁵

What you need to know about Expensify, Ramp, and Slash

Before comparing these three platforms directly, it helps to understand what each one is designed to do. The sections below introduce Expensify, Ramp, and Slash individually and highlight what sets each platform apart:

What is Expensify?

Founded in 2008, Expensify has been around the longest of the three. Expensify is not designed to replace your business bank account; instead, it works as a third-party expense tracking tool that sits alongside your existing accounts and cards. This setup makes Expensify broadly accessible—even individual employees can use the app on their own—but it also means the platform remains somewhat separate from a company’s central financial workflows.

Expensify’s focus on expense management becomes a bit more complex with the introduction of the Expensify Card, a corporate charge card that automatically pulls funds from a connected business account to settle balances each day. The card is the only financial product Expensify offers. There are no built-in business checking or treasury accounts, which limits its ability to serve as a full financial platform.

Below is more information about Expensify’s key features and notable drawbacks:

- Expense tracking: Expensify’s core strength is its expense management workflow. The platform supports submissions, approvals, and reimbursements, and its Concierge AI monitors policy compliance or auto-categorize expenses. Expensify is also known for its SmartScan tool, which can quickly upload receipt details to the dashboard.

- Hard-to-reach cashback: The Expensify Card advertises up to 2% cashback, but this rate only applies once your company surpasses a monthly spend threshold of 250,000 dollars across all Expensify cards. Until then, you earn 1% on purchases.

- Limited payment options: Expensify supports ACH transfers for reimbursements and allows you to link credit cards, debit cards, or digital wallets (like Venmo) into the platform. Compared to other platforms, its lack of payment methods can be restrictive. Slash, for example, supports ACH, wire, SWIFT, blockchain payments, and card-based transfers.

- Global reimbursements: Expensify can reimburse employees in more than 140 currencies, but payments may incur FX fees and take longer to settle. Slash offers a faster alternative by enabling near-instant, low-fee USD-denominated global transfers using stablecoins.

What is Ramp?

Ramp is not a standalone expense management tool in the same way Expensify is. Instead, it manages business expenses as part of its broader business banking and corporate card interface. The platform combines expense controls, automation, and analytics with bank accounts and payment tools. This means the functionality is tightly integrated into Ramp’s financial products rather than available for individual use. Below is an overview of Ramp’s core features and some of its limitations:

- Corporate spending: Ramp supports B2B transfers through ACH, wire, and SWIFT. Its corporate charge card draws from affiliated Ramp business accounts, making it intuitive for businesses to track spending across different payment methods.

- Business banking: Ramp provides business bank accounts and treasury accounts that can be managed from the same interface.

- No cryptocurrency support: Ramp currently does not support sending or receiving stablecoins. For businesses and startups that want faster, low-cost payments outside traditional banking rails, this can limit flexibility and increase reliance on slower settlement methods.

- No built-in financing tools: Ramp does not offer a working capital financing product. Slash, on the other hand, provides flexible financing to strengthen short-term liquidity and allow businesses to choose 30, 60, or 90 day payment terms based on their needs.

What is Slash?

Slash is an all-in-one business banking platform built with powerful expense management capabilities. Like Ramp, it can serve as a complete financial infrastructure for your business, and like Expensify, it remains accessible for companies of any size that need better visibility and control over their expense tracking. Below is an overview of Slash’s core features and products:

- Slash Visa® Platinum Card: The Slash corporate charge card earns up to 2% cashback on all eligible spending without requiring unusually high monthly volume. From the dashboard, you can issue unlimited virtual cards, monitor spending in real time, and export clean transaction data directly into your accounting software.

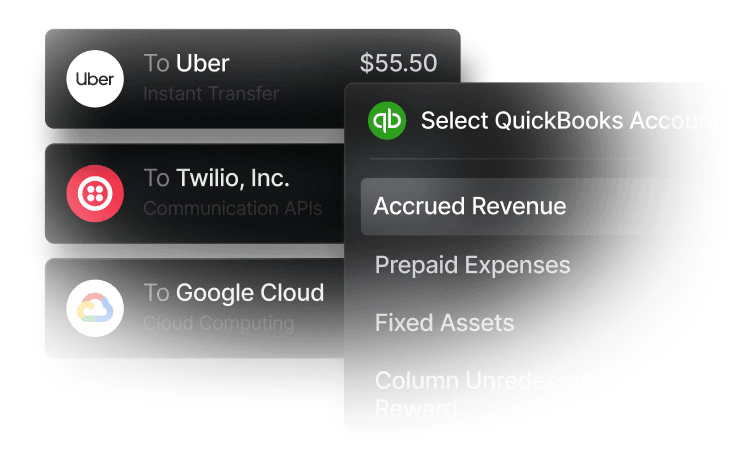

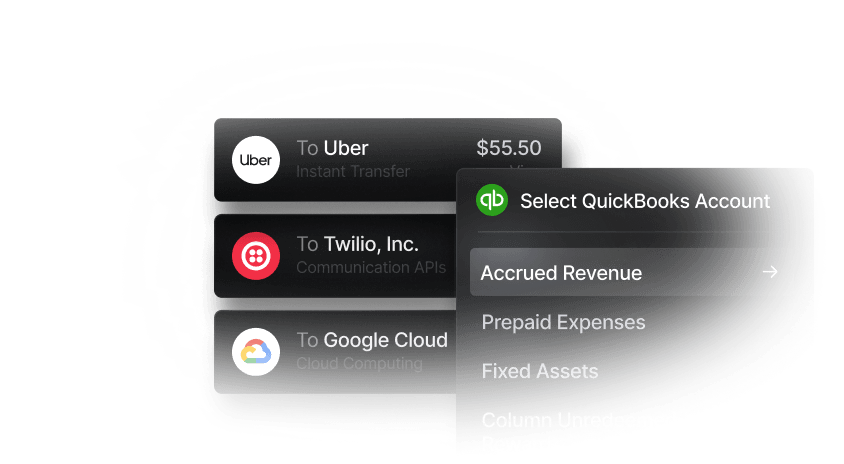

- Expense management: Slash gives you a clear view of your cash flow through its analytics dashboard. All spending activity is organized with expense reporting details on transfer methods, contacts, and recipients. Automatic expense categorization makes it easy to export your data into QuickBooks, which speeds up tax preparation, reconciliation, and spend analysis.

- Multi-entity support: Slash allows you to consolidate financial operations across subsidiaries, business units, or storefronts. All accounts flow into the same analytics environment, so you can review statements and monitor company-wide activity without juggling multiple platforms or logins.

- Flexible transfer options: Slash supports global ACH, domestic wires, and real-time rails such as RTP and FedNow. International transfers can be sent through the SWIFT network to over 180 countries. Businesses can also take advantage of blockchain rails by sending or receiving USD-pegged stablecoins like USDC, USDT, and USDSL for fast, low-fee global payments.³

- Working Capital financing: Slash provides a tailored line of credit directly within the dashboard. You can draw funds whenever you need additional liquidity and repay on flexible terms ranging from 30 to 90 days, helping you keep operations running smoothly without strict repayment schedules.

What Are the Pros and Cons of Using Expensify vs. Ramp vs. Slash?

Expensify, Ramp, and Slash at a Glance:

Top differences between Expensify and Ramp

Expensify, Ramp, and Slash all help companies manage spending, but each platform is built around a different core model. Expensify focuses on reimbursements and employee-submitted expense reports. Ramp prioritizes automation and card-driven controls through its integrated business banking platform. Slash brings both capabilities together while adding broader payment flexibility and a more complete financial infrastructure. These differences become clearer once you look at each platform's features side by side:

Automation and receipt workflows

Expensify relies mostly on manual receipt capture. Employees upload receipts through the app or email, and SmartScan extracts basic details before routing items for approval. This works well for reimbursement-heavy teams but creates more touchpoints at scale. Ramp automates much of this process. Its AI matches receipts to transactions, enforces policies in real time, and flags unusual spend, which reduces administrative work for finance teams.

Corporate cards and spending controls

Ramp, Expensify, and Slash have similar functionality between their corporate cards by allowing administrators to set compliance rules on spending and monitor activity across accounts. They all also categorize transactions and prepare spend data for exporting into accounting software. However, of the three, Slash is the strongest cashback earner, with up to 2% on spending right out of the gate. Ramp’s cashback is capped at 1.5%, while Expensify’s 2% is locked behind a high monthly spend threshold.

Reimbursement and payments

Expensify performs best in reimbursement-heavy environments. It supports ACH reimbursements, mileage tracking, per diems, and contractor workflows, making it a strong fit for companies where employees frequently pay out-of-pocket. Ramp and Slash are best when employees use their charge cards, which can eliminate the need for reimbursements with on-demand spending. Slash excels with its broader payout capabilities, giving businesses the ability to use RTP, FedNow, or USD-pegged stablecoins to pay vendors

Expense reporting and accounting

All three platforms help streamline expense reporting by automatically capturing transactions and categorizing them, which reduces manual work and supports more accurate tax filing, stronger compliance, and better audit readiness. Slash builds on this foundation with a direct QuickBooks integration; with Slash, you get cleaner, optimized data that flows directly into your accounting software. Once the data is in QuickBooks, you can utilize its AI-powered receipt organization and automated invoice matching tools to further speed up reviews and close.

Pricing models, usability, and overall value

Expensify can be cost-effective for individuals or very small teams thanks to its free plan, but its per-member pricing can become expensive as a company grows. The lower-tier Collect plan limits access to accounting integrations, admin controls, budgeting tools, and reporting, which may push businesses toward the Control plan, which can cost up to 36 dollars per member per month. Ramp and Slash both offer free plans and optional paid tiers without using a per-member pricing model. Because Slash provides stronger cashback than Ramp, it offers greater long-term potential to offset subscription costs and deliver more net value for businesses from card spend.

How to choose between Expensify, Ramp, and Slash

Instead of trying to figure out which platform is right for you based on a list of features, it’s more helpful to think about real-world scenarios or how each tool performs in practice. Below are several examples that highlight when Expensify, Ramp, or Slash is the strongest fit. For each scenario, we share the best choice and a short explanation of why it stands out.

You run a larger business with 50–100 employees, and most of your team pays out-of-pocket for daily expenses

Expensify is designed for reimbursement-heavy workflows, but its pricing model can become expensive for mid-sized companies. With 50 employees, you could pay between $450-$1800 per month just to access Expensify’s Control plan, and you would still lack deeper automation or dedicated business banking instruments. A better approach is onboarding employees to use virtual corporate cards through Ramp or Slash, which centralizes spending, strengthens transaction visibility, and eliminates most reimbursement management.

Best choice: Slash

Slash delivers comparable automation to Ramp while offering stronger cashback and full financial infrastructure. Issuing unlimited virtual cards allows you to eliminate out-of-pocket spending entirely while gaining deeper oversight at a lower long-term cost.

You need deeper visibility into company-wide spending across multiple entities

Expensify works well for handling personal expenses or small pockets of company spend, but it lacks the depth needed for multi-entity organizations or businesses with complex reporting structures. Ramp offers strong ERP integrations, which can be useful at the enterprise level; however, this may be complex for small teams, and requires additional configuration with a third-party platform. Slash’s multi-entity dashboard lets you manage subsidiaries, storefronts, and business units in one place, with consolidated analytics and shared visibility across accounts.

Best choice: Slash

If your financial operations span multiple entities, locations, or reporting structures, Slash multi-entity support provides the seamless consolidation of your account information. It’s a straightforward solution that empowers you to better manage your accounts without unnecessary complexity.

You’re a small business owner who regularly handles paper invoices, POs, or receipts

Expensify’s SmartScan OCR is highly effective for digitizing paper receipts and bringing them into your financial dashboard. While corporate cards that generate automated reports can create a more streamlined workflow overall, Expensify is still the strongest option when physical documents are part of daily operations. Its Concierge AI is purpose-built to process receipts, POs, and invoices in a way that other competitors do not fully match. Ramp does offer invoice tools, but they are geared more toward AP automation than the broader procurement and receivables cycle.

Best choice: Expensify

Digital-first platforms like Slash and Ramp help eliminate much of the manual work around paper, but if handling physical documents is unavoidable, Expensify remains the most optimized solution.

You operate ecommerce storefronts and pay overseas vendors

Expensify provides broad currency coverage for reimbursements, but it lacks diverse global payment rails and may not be able to keep up with the banking needs of a truly international business. Ramp supports international wires, but settlement times and banking fees can still create delays. Slash is the most cost-effective and reliable option for global commerce because it supports both traditional rails and blockchain rails. Sending USD-pegged stablecoins allows you to pay overseas vendors quickly with minimal fees and without relying on slow intermediaries.

Best choice: Slash

Crypto-enabled payments can reduce settlement delays, cut unnecessary bank charges, and help you maintain stronger vendor relationships across borders. You can also send international wire transfers to more than 160 countries through the SWIFT network for a standardized, bank-supported payment option.

You want a spend management platform that also consolidates banking, payments, and financial operations

Expensify focuses on expense reporting and reimbursements, not full financial operations. Ramp goes further by combining a corporate card with banking tools, but it lacks flexible financing and crypto capabilities. Slash unifies spend management with payments, banking, multi-currency support, real-time settlement networks, and working capital financing. For teams that want one platform to handle spend, transfers, analytics, and liquidity, Slash covers more of the financial stack.

Best choice: Slash

It offers the broadest mix of spend controls, global payment options, business banking tools, and flexible financing, making it the strongest single-platform solution for growing companies.

Making the right financial move with Slash

Expensify and Ramp each serve specific needs well. Expensify handles receipt-heavy workflows with reliability. Ramp delivers strong automation for companies prioritizing efficiency. Both are capable tools within their scope, but neither offers a complete financial solution.

Slash doesn't ask you to choose between expense management and financial infrastructure. It delivers both, along with capabilities neither competitor can match: a flat 2% cashback card, real-time and blockchain payment rails, multi-entity support, integrated working capital, and a unified dashboard that eliminates the need to juggle multiple platforms. You get full visibility and control without the operational overhead of stitching together separate systems.

For businesses scaling across borders, managing multiple entities, or outgrowing the rigidity of traditional banking, Slash provides the flexibility and speed required to operate without friction. The question isn't whether Expensify or Ramp can manage your expenses; it's whether your financial platform can support the full scope of your business’s growth.

Get more control, flexibility, and capability in one platform. Start at slash.com.

Apply in less than 10 minutes today

Join the 5,000+ businesses already using Slash.

Frequently asked questions

What company owns Expensify?

Expensify (EXFY) is a publicly traded company, so ownership is distributed among its shareholders. According to Yahoo Finance, major shareholders include Vanguard Group, BlackRock, and Acadian Asset Management.

Can you use Expensify for free?

Yes. Expensify offers a free plan with basic features such as SmartScan receipt capture and simple peer-to-peer payments. Most businesses, however, require a paid plan to access meaningful functionality. The Collect plan starts at $5 per member per month, while the higher-tier Control plan can cost up to $36 per member per month depending on the configuration.

Does Ramp support cryptocurrency?

No. Ramp does not currently support sending or receiving cryptocurrency. Slash, on the other hand, allows businesses to hold, send, and receive USD-pegged stablecoins across eight supported blockchains.