Unknown chargesmean unknown risk

Understand your business exposure before it compounds.

Seeing a LEAD BANK SELF LEND charge on your statement?

Common ways LEADBANKSELFLEND charges might appear on your statement

- LEADBANKSELFLEND CC PMT

- LEADBANKSELFLEND CC PMT PPD ID: 6440255510

- Direct Debit: LEADBANKSELFLEND, CC PMT

- LEAD BANK SELF LEND PAYMENT

- LEAD BANK SELFLEND CC PAYMENT

What is Lead Bank Self Lend?

Lead Bank Self Lend refers to a credit-builder or lending program managed by Lead Bank (in partnership with Self Financial) that posts onto your credit card or account. Transactions labeled “LEADBANKSELF LEND” typically reflect payments or charges associated with that program. Learn more at lead.bank.

Common causes for LEADBANKSELF LEND charges

- Credit builder payments, contributions, or fees billed to your card.

- Automatic monthly payments for the Self / Lead Bank credit builder loan.

- Refunds or reversals tied to adjustments or canceled contracts.

- Late or overdraft related adjustments, depending on account terms.

Decoding LEADBANKSELF LEND charge tags

- LEADBANKSELFLEND indicates the Lead Bank & Self Financial credit builder / lending service.

- CC PMT denotes that the charge is a credit card payment transaction.

- PPD ID: 6440255510 is a standard electronic payment identifier.

- Direct Debit / CC PAYMENT suffixes describe how your payment was processed (card vs debit).

What to do

if you

don’t recognize this charge

Spot, verify, and resolve suspicious charges in minutes.

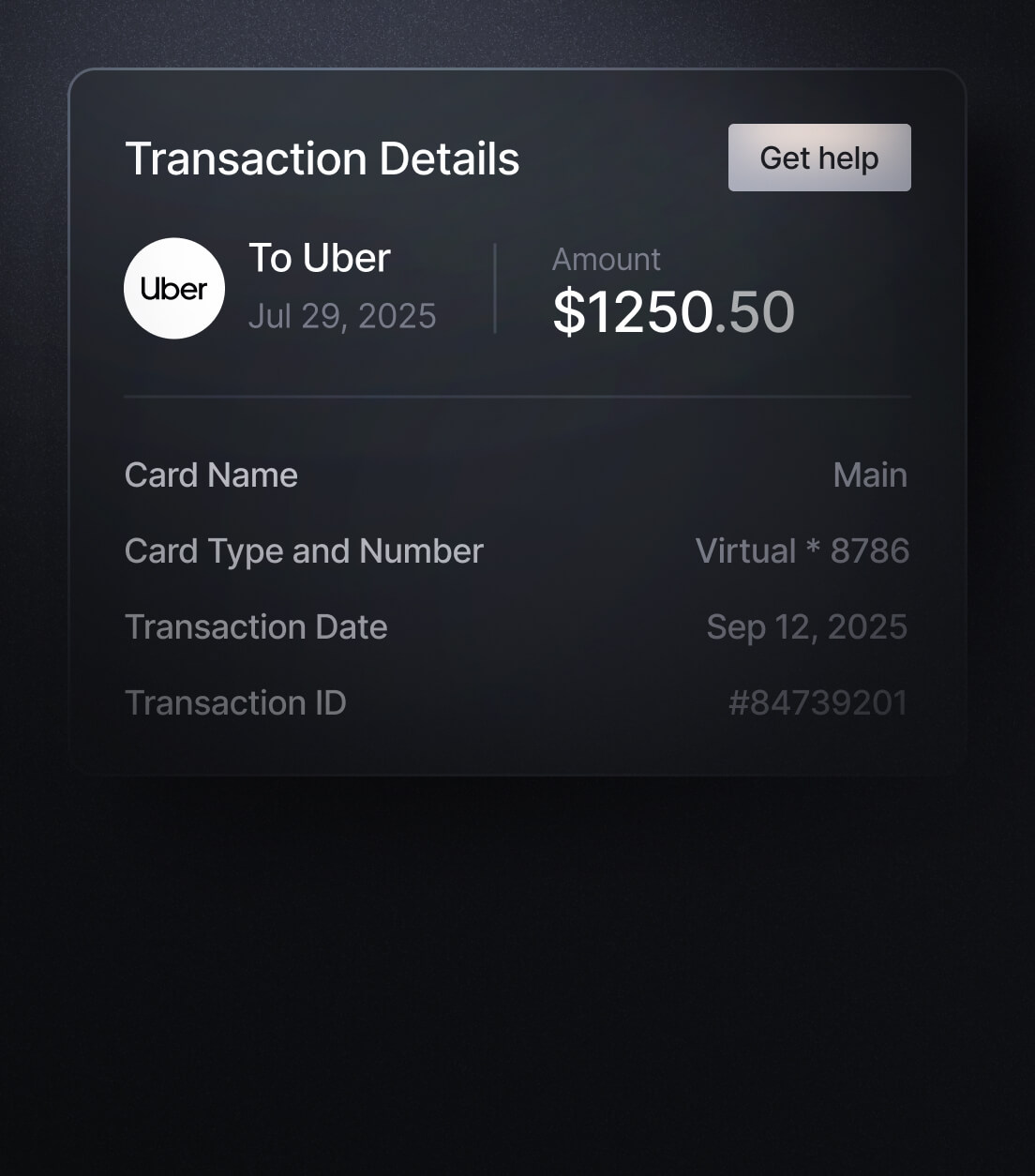

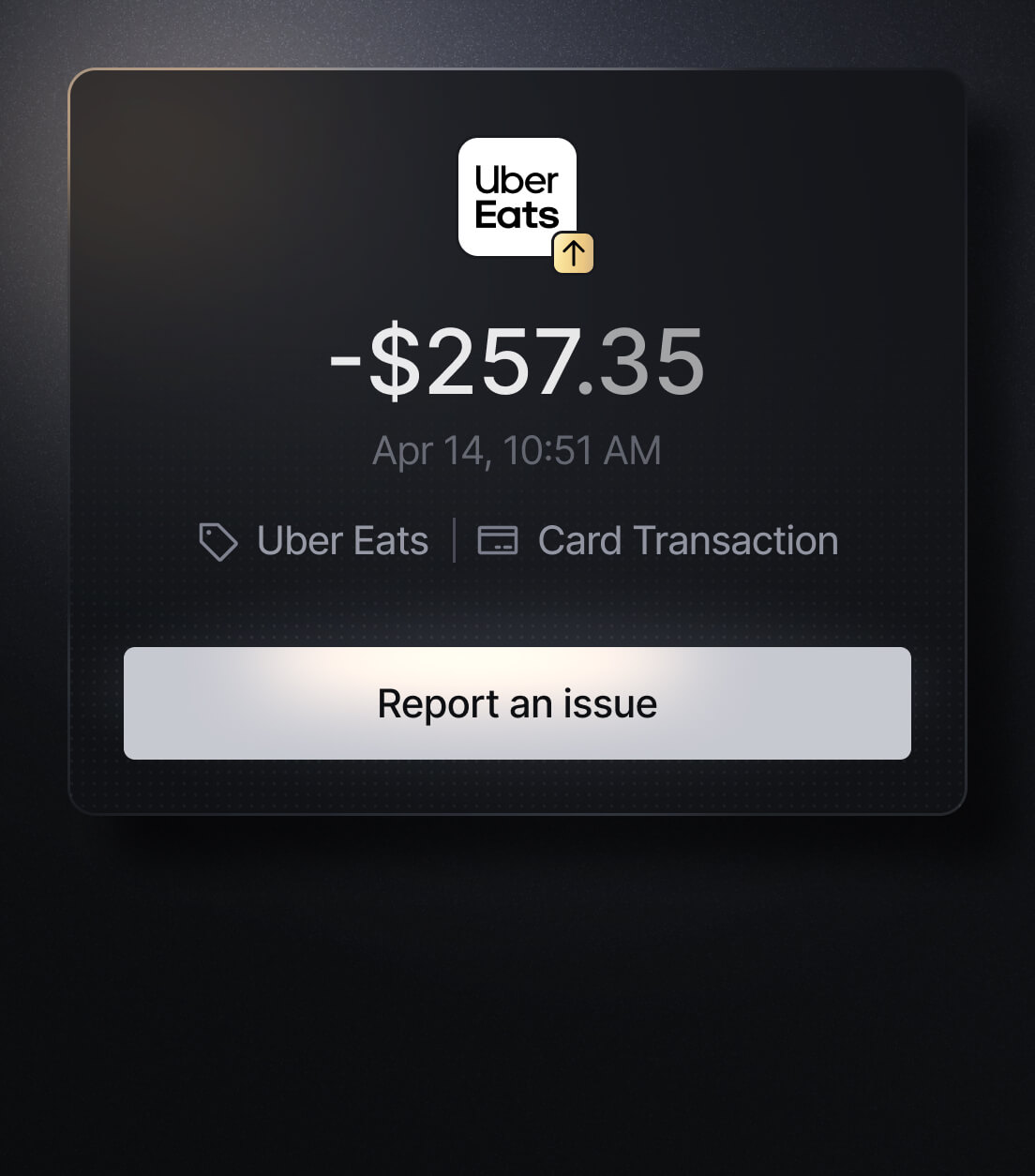

Easily Identify Every Charge with Slash

See exactly where, when, and how each charge occurred, complete with merchant names, payment types, and connected team cards with Slash’s detailed card logs and expense tracking tools.