Unknown chargesmean unknown risk

Understand your business exposure before it compounds.

Seeing a FIDELITY MONEYLINE charge on your statement?

Common ways FIDELITY MONEYLINE charges might appear on your statement

- FID BKG SVC LLC MONEYLINE

- FIDELITY MONEYLINE

- FIDELITY INVESTMENTS MONEYLINE

- FIDELITY BKG SVC LLC

- FID BKG SVC LLC PPD ID: 0368004600

- FIDELITY MONEYLINE TRANSFER

- FIDELITY MONEYLINE ACH DEBIT

- FIDELITY MONEYLINE WITHDRAWAL

What is Fidelity MoneyLine?

FIDELITY MONEYLINE refers to Fidelity Investments’ MoneyLine service, an electronic funds transfer system that allows customers to move money between their bank accounts and Fidelity brokerage or retirement accounts. The descriptor typically appears when deposits, withdrawals, or transfers are processed through Fidelity’s ACH network. These transactions are handled by Fidelity Brokerage Services LLC (FID BKG SVC LLC), a subsidiary of Fidelity Investments. Learn more at fidelity.com.

Common causes for Fidelity MoneyLine charges

- Transfers between your external bank and a Fidelity investment or retirement account.

- Automatic deposits for recurring investment contributions.

- Withdrawals or redemptions from brokerage or money market accounts.

- ACH transfers for settling trades or managing available cash balances.

- Automatic “sweep” transactions between linked Fidelity accounts.

- Refunds or corrections from reversed electronic fund transfers.

Decoding Fidelity MoneyLine charge tags

- FID BKG SVC LLC / FIDELITY BKG SVC LLC identify Fidelity Brokerage Services LLC, the transaction processor.

- MONEYLINE designates Fidelity’s internal ACH transfer and funds movement system.

- PPD ID: 0368004600 is the ACH company identifier used for Fidelity MoneyLine transactions.

- TRANSFER / WITHDRAWAL / ACH DEBIT indicate the direction and type of funds movement.

- INVESTMENTS / BROKERAGE suggest the transaction is linked to investment activity rather than purchases.

What to do

if you

don’t recognize this charge

Spot, verify, and resolve suspicious charges in minutes.

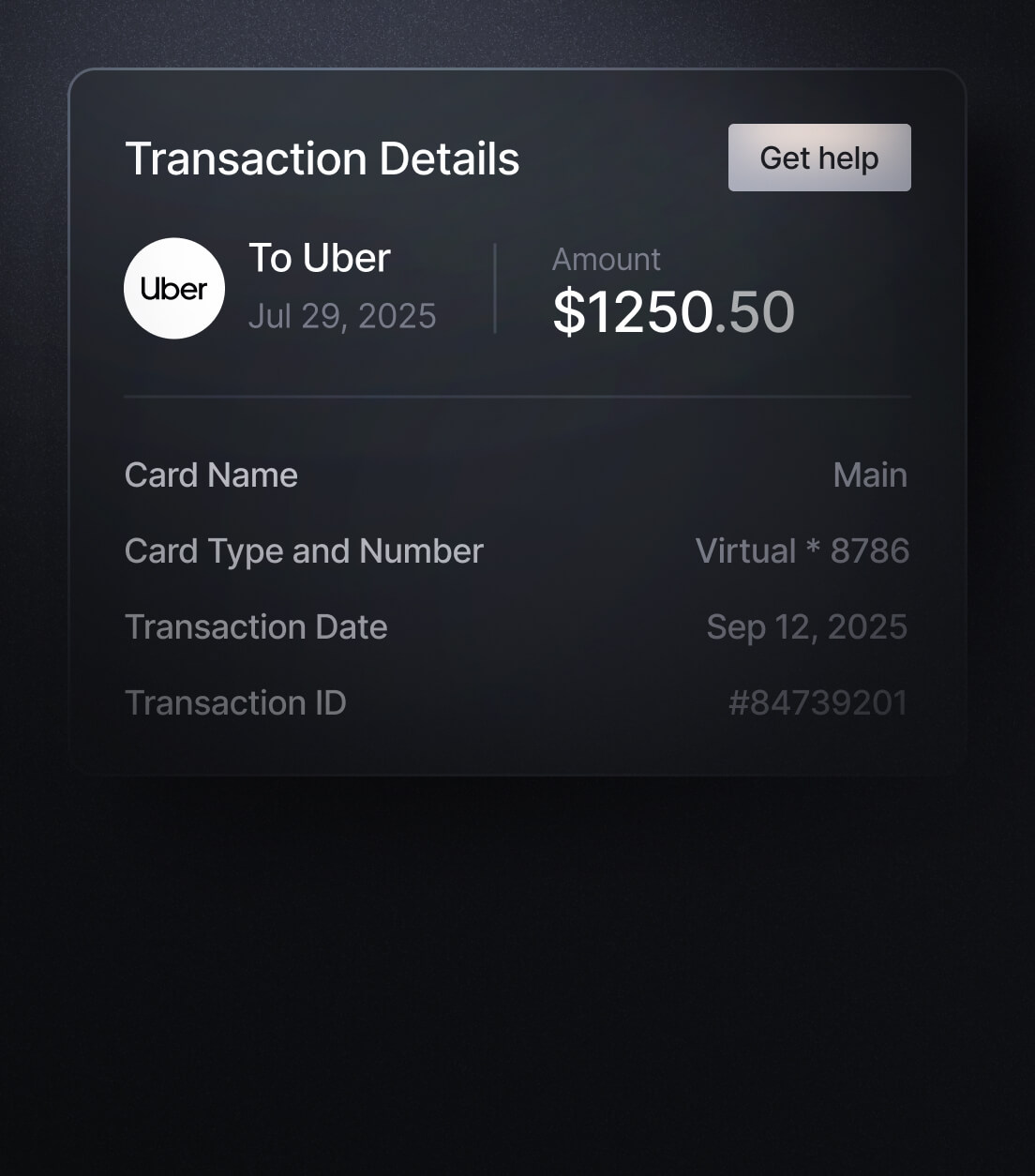

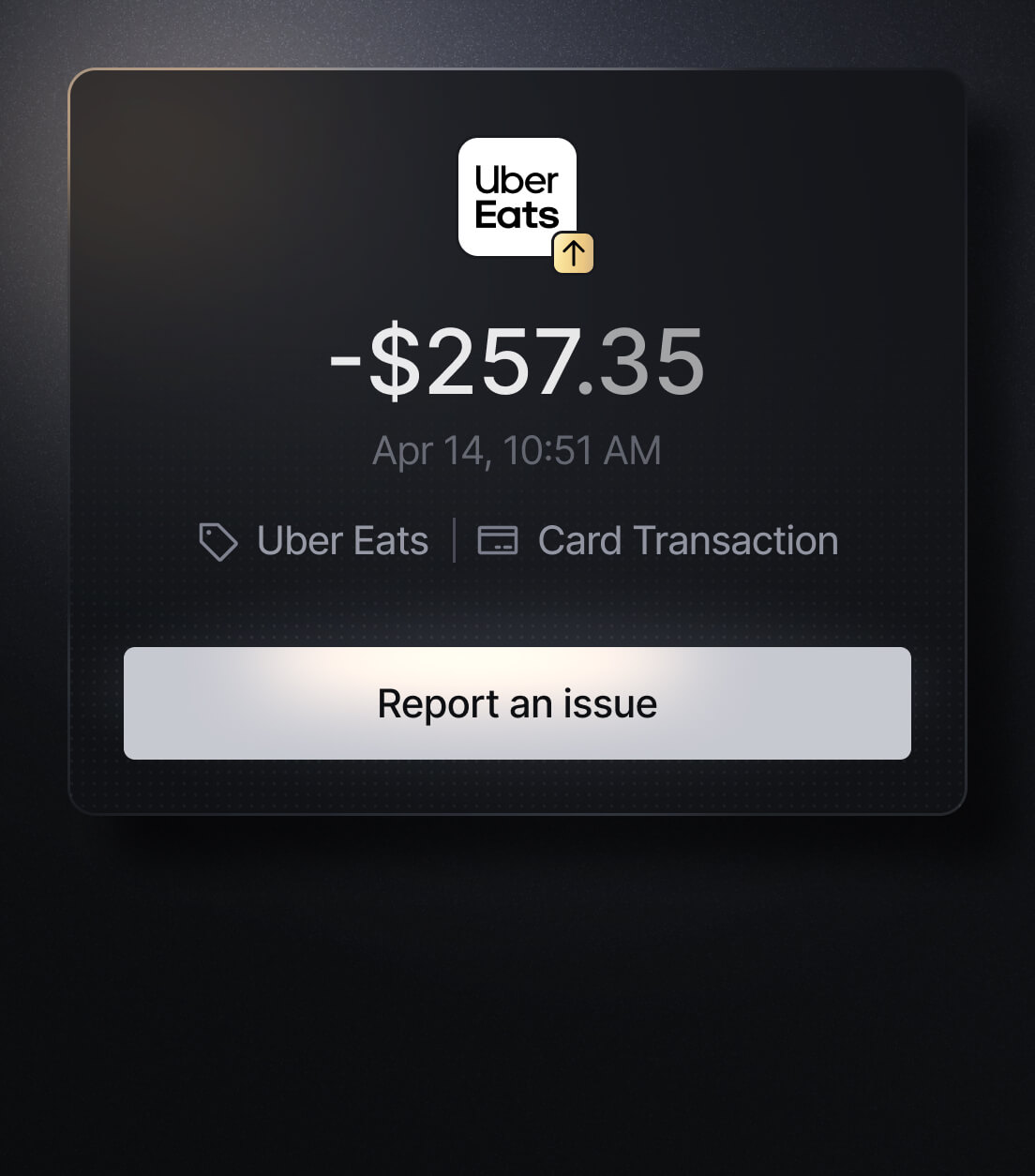

Easily Identify Every Charge with Slash

See exactly where, when, and how each charge occurred, complete with merchant names, payment types, and connected team cards with Slash’s detailed card logs and expense tracking tools.