Unknown chargesmean unknown risk

Understand your business exposure before it compounds.

Seeing a PERSHING BROKERAGE charge on your statement?

Common ways PERSHING BROKERAGE charges might appear on your statement

- PERSHING BROKERAGE

- PERSHING LLC

- PERSHING BROKERAGE PPD ID: 1132741729

- PERSHING ACH DEBIT

- PERSHING BROKERAGE TRANSFER

- PERSHING LLC PAYMENT

- PERSHING BROKERAGE JERSEY CITY NJ

What is Pershing Brokerage?

Pershing Brokerage refers to BNY Mellon | Pershing LLC, a leading clearing and custody firm that provides investment and financial services to broker-dealers, registered investment advisors (RIAs), and financial institutions. The descriptor “PERSHING BROKERAGE” or “PERSHING LLC” appears when clients transfer funds to or from an investment account, execute trades, or settle transactions. Learn more at pershing.com.

Common causes for Pershing Brokerage charges

- Electronic fund transfers (ACH debits or credits) between a bank and a Pershing brokerage account.

- Investment purchases, deposits, or withdrawals tied to a Pershing-managed portfolio.

- Automatic investment contributions or distribution payments from retirement accounts.

- Refunds, adjustments, or dividend reinvestment activities within a managed account.

Decoding Pershing Brokerage charge tags

- PERSHING BROKERAGE / PERSHING LLC identify the merchant as BNY Mellon | Pershing LLC.

- PPD ID: 1132741729 is the ACH identifier for Pershing’s brokerage fund transfers.

- ACH DEBIT / TRANSFER specify electronic bank-to-brokerage transactions.

- JERSEY CITY NJ denotes Pershing’s primary operations and corporate headquarters location.

- PAYMENT / WITHDRAWAL indicate account funding, investment purchases, or distributions.

What to do

if you

don’t recognize this charge

Spot, verify, and resolve suspicious charges in minutes.

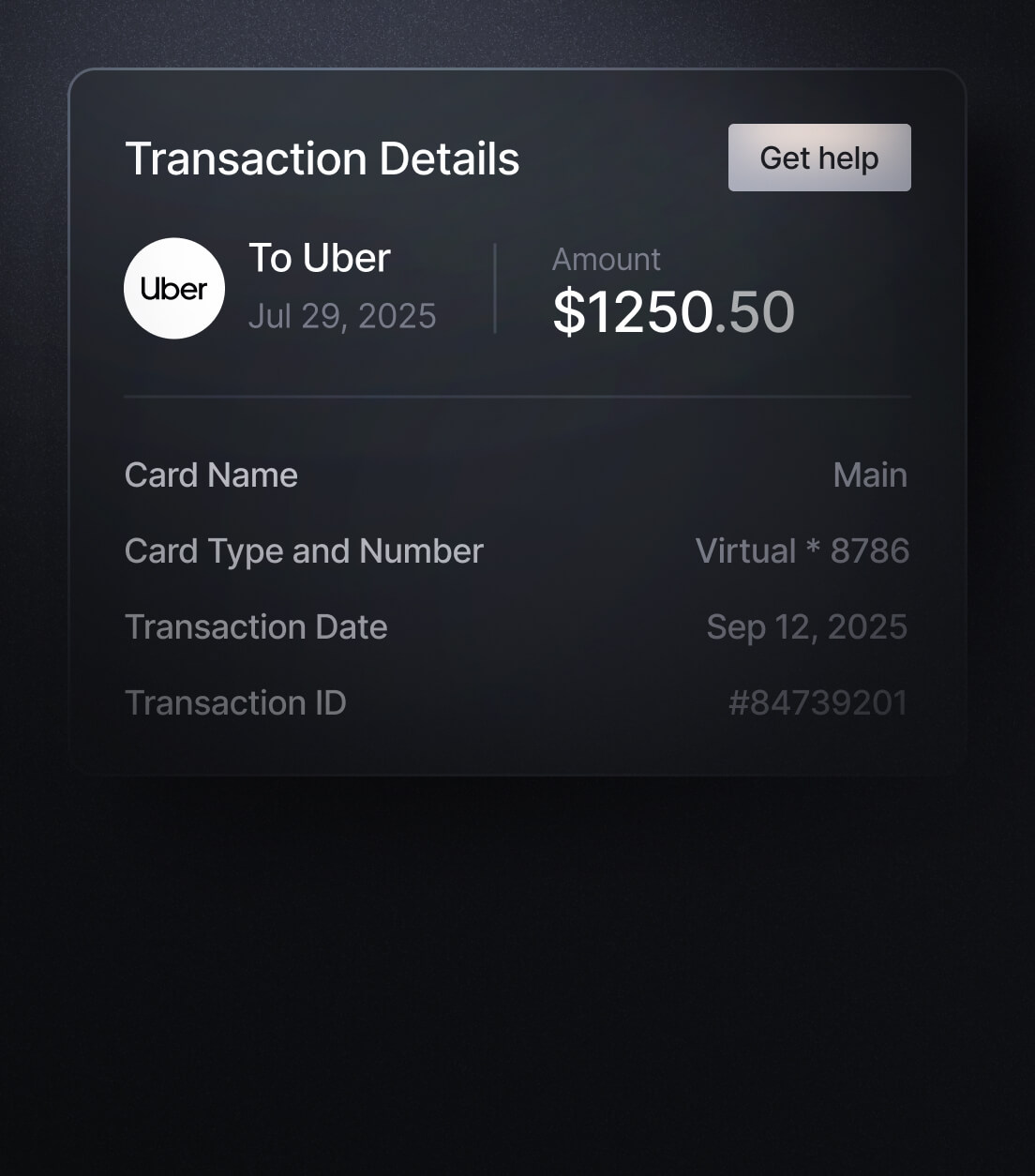

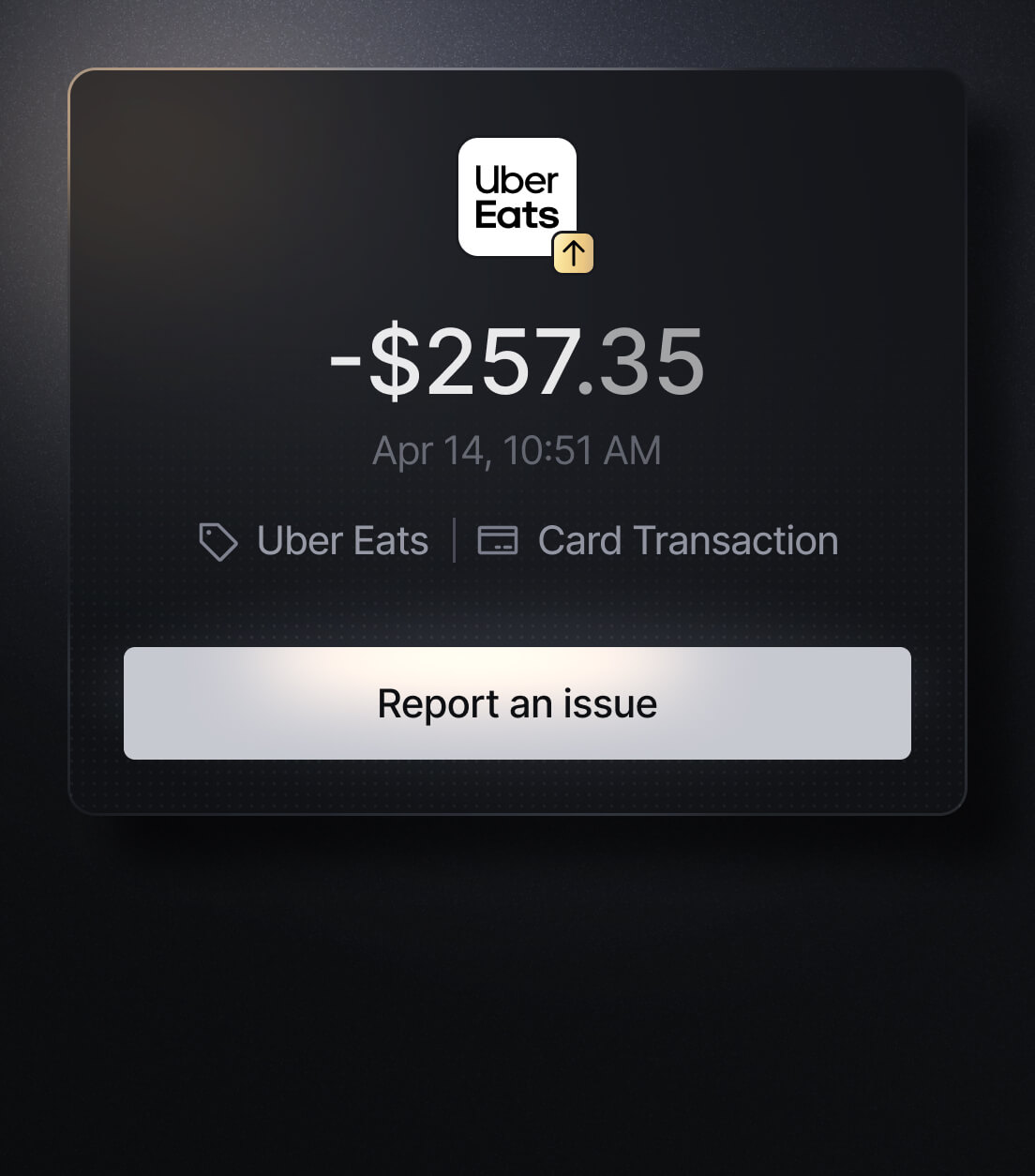

Easily Identify Every Charge with Slash

See exactly where, when, and how each charge occurred, complete with merchant names, payment types, and connected team cards with Slash’s detailed card logs and expense tracking tools.