KYC Requirements for Businesses: What Companies Need to Pass Modern Verification

As businesses increasingly operate online, handle digital payments, and work with customers across borders, verifying who you are doing business with has become a core operational requirement. Know Your Customer, commonly referred to as KYC, exists to help businesses confirm identities, reduce fraud, and comply with financial crime regulations. Yet for many companies, especially those outside of the financial industry, KYC can seem difficult to implement effectively.

KYC refers to the steps a business takes to verify the identity of its customers, clients, or counterparties before allowing certain activities to take place. These checks are designed to prevent money laundering, fraud, terrorist financing, and other financial crimes. While KYC requirements are most commonly associated with banks, they also apply to a wide range of industries, including fintech, real estate agencies, and luxury goods dealers.

Modern KYC programs go beyond simply collecting an ID. They combine identity verification, risk assessment, and ongoing monitoring to help businesses understand who they are working with over time. In this guide, we explain what KYC means for businesses, which industries are affected, what regulators expect, and how companies can implement practical and effective KYC processes. We’ll also demonstrate how Slash protects its customers’ personal and financial data through robust compliance checks and our commitment to SOC 2 Type II certification.

KYC meaning in business: Insights, benefits, and importance

Know Your Customer (KYC) refers to the mandatory processes businesses use to identify and verify their customers. These procedures help organizations assess risk, comply with regulations, and protect themselves from financial crime. At its core, KYC helps a business establish confidence that a customer is who they claim to be and that their activity aligns with legitimate business purposes.

KYC plays a critical role in preventing financial crime. Criminals often attempt to disguise their identities or use stolen or fabricated credentials to move illicit funds through legitimate systems. Without proper verification, businesses may unknowingly facilitate fraud, money laundering, or sanctions violations. Regulators therefore require KYC controls in industries where these risks are elevated.

A well-designed KYC program generally achieves three goals. First, it confirms customer identity using reliable documentation and data sources. Second, it allows businesses to assess customer risk by understanding how the customer is expected to use the service. Third, it supports compliance with financial regulations, helping businesses avoid fines, enforcement actions, and reputational damage.

To achieve these aims, KYC frameworks are typically built around three core components:

- Customer Identification Program (CIP): Defines how a business verifies identity during onboarding. This typically includes collecting government-issued photo identification, proof of address, tax identification numbers, and business registration documents. The objective is to confirm that the individual or entity exists and can be uniquely identified.

- Customer Due Diligence (CDD): Involves evaluating the risk associated with a customer relationship. This process considers factors such as the customer’s industry, expected transaction volume, geographic location, and ownership structure. For businesses, CDD often includes identifying beneficial owners who ultimately control or profit from the entity.

- Enhanced Due Diligence (EDD): An enhanced risk assessment process used for customers deemed high-risk. This may include politically exposed persons, customers operating in industries vulnerable to money laundering, or entities based in higher-risk jurisdictions. EDD often requires additional documentation, more detailed background checks, and closer ongoing monitoring.

KYC is closely related to Know Your Business (KYB). While KYC applies to individuals, KYB focuses on corporate entities. KYB processes verify that a business exists, identify its ownership and control structure, assess its risk profile, and confirm that it operates within applicable regulations.

Both KYC and KYB are foundational components of anti-money laundering (AML) programs. AML refers to the broader set of laws, regulations, and procedures designed to prevent criminals from disguising illegal funds as legitimate income.

7 types of businesses that need to run KYC checks

Not every business is legally required to conduct KYC checks. Requirements vary depending on industry, transaction size, customer base, and jurisdiction. Generally, businesses that handle money, high-value assets, or cross-border transactions face the most stringent obligations. Here are some of the industries that most commonly require KYC checks:

Financial institutions

Banks, credit unions, fintech companies, investment firms, and other financial services providers face the most stringent KYC requirements. Companies demonstrating advanced compliance capabilities, such as Slash, often maintain certifications like SOC 2 Type II, signaling a strong commitment to security and regulatory adherence. These certifications help demonstrate that organizations have controls in place to support KYC, KYB, and AML requirements. Slash also supports compliant use of stablecoins such as USDC, which meets regulatory standards for B2B digital asset transfers in jurisdictions like the European Union.⁴

Insurance agencies

Insurance companies must implement KYC processes to verify policyholders and beneficiaries. The insurance sector faces two particular forms of criminal activity that can be combatted with effective KYC screening: exploitation of high-value policies for the purpose of money laundering or the use of policies as vehicles for moving illicit funds.

Casinos and gambling companies

Casinos, online gambling platforms, and betting operations are considered high risk due to the ease with which funds can be converted into chips or bets and later cashed out. These businesses often apply enhanced due diligence to large or frequent transactions and monitor for suspicious behavior.

Luxuries dealers and pawn shops

Dealers in precious metals, stones, jewelry, art, and high-value goods must conduct KYC checks because these assets can store and transfer value discreetly. Pawn shops, which provide loans secured by personal property, face similar requirements.

Vehicle dealerships

Auto dealers selling vehicles above certain value thresholds must implement KYC procedures. Vehicles are assets that criminals can purchase with illicit funds and later resell to legitimize money. Dealerships verify buyer identities and addresses, assess the source of funds for cash purchases, report suspicious transactions to relevant authorities, and maintain records of all significant vehicle sales.

Travel agencies

Travel agencies arranging international trips or handling large financial transactions may need to verify customer identities and monitor for suspicious patterns. Criminals can use travel services to move funds across borders or facilitate other financial crimes. While requirements vary by jurisdiction, travel businesses may monitor unusual travel patterns that may indicate criminal activity or verify payment sources for high-value travel packages.

Real estate companies

Real estate transactions involve large sums of money and are frequently targeted for money laundering. Real estate firms may be required to verify buyers, sellers, and beneficial owners, especially for cash purchases or transactions involving complex ownership structures.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

What are the KYC regulatory requirements?

In the United States, KYC and AML requirements are primarily enforced by the Financial Crimes Enforcement Network, known as FinCEN, and the Financial Industry Regulatory Authority, or FINRA. Below is a brief overview of each of the three foundational regulations underpinning KYC due diligence for U.S. companies:

Financial Industry Regulatory Authority Rule 2090

FINRA Rule 2090, known as the "Know Your Customer" Rule, requires broker-dealers to use reasonable diligence to know and retain essential facts about each customer. This includes verifying customer identity using reliable documentation, understanding the customer's financial situation and investment objectives, assessing the customer's risk tolerance and investment experience, and maintaining accurate customer records.

Financial Industry Regulatory Authority Rule 2111

FINRA Rule 2111, or the Suitability Rule, protects investors by ensuring that financial professionals don't recommend inappropriate investments. This rule reinforces that broker-dealers have reviewed all the relevant information about customers to make accurate assessments of their financial situation and needs, which inherently requires a comprehensive KYC check to acquire all relevant information to make such a judgement.

The U.S. Financial Crimes Enforcement Network

FinCEN administers the Bank Secrecy Act (BSA), which establishes AML requirements for financial institutions. These requirements include maintaining a CIP, conducting risk-based CDD, monitoring transactions over time, and filing Suspicious Activity Reports (SARs) when necessary. FinCEN also maintains sanctions lists that financial institutions must screen customers against to identify individuals or entities subject to financial restrictions.

5 best practices for KYC and AML compliance

For businesses new to compliance concepts, KYC and AML can seem complex or difficult to operationalize. In practice, effective programs are built on a small number of clear principles. Here are five things your business should prioritize when implementing KYC-compliant policies:

Implement a customer identification program

A strong CIP ensures that you know who your customers are from the outset. Businesses typically collect government-issued photo identification, proof of address, tax identification numbers, and business registration documents. Some organizations implement additional safeguards using modern identity verification methods, such as biometric validation or document authenticity checks.

Conduct customer due diligence

CDD means understanding how a customer is expected to use your product or service. This may include evaluating their occupation or industry, expected transaction volume, geographic locations, and the source of funds. A risk-based approach allows businesses to focus compliance resources where they are most needed; lower-risk customers can move through streamlined processes, while higher-risk relationships should receive more scrutiny.

Maintain continuous monitoring

To comply with AML guidelines, businesses must monitor for suspicious customer activities. Monitoring programs track transaction patterns and flag unusual activity, regularly screen customers against updated sanctions lists, review customer profiles and update risk assessments periodically, and file SARs with FinCEN when appropriate.

Continuous monitoring of company funds with a secure, technology-driven financial provider like Slash can help businesses detect money laundering attempts, fraud schemes, and other financial crimes that may not be apparent during initial onboarding.

Meet reporting and compliance requirements

Businesses subject to AML regulations must maintain accurate records and report suspicious activity to regulators when required. Clear documentation supports audits and examinations and demonstrates that reasonable controls are in place.

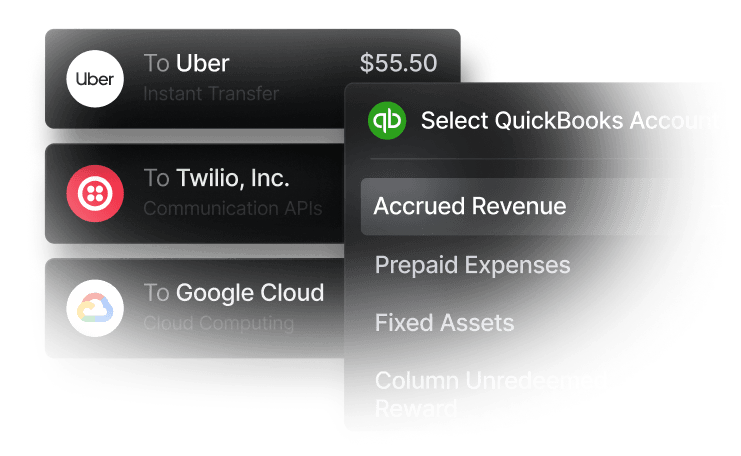

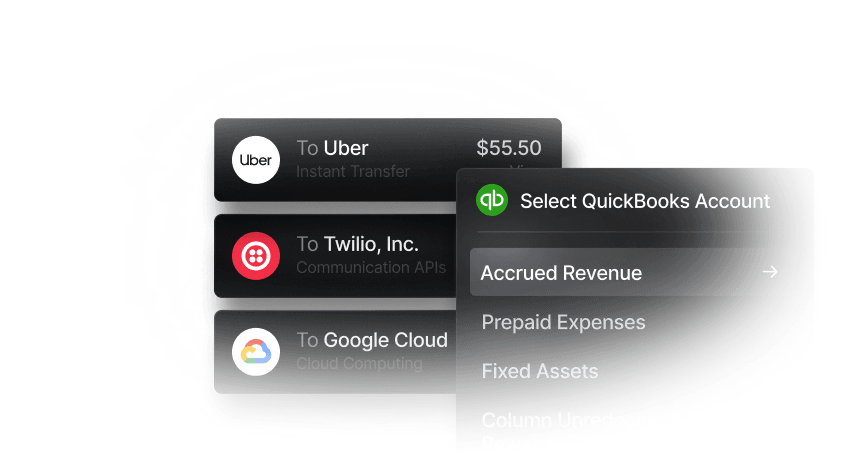

Centralizing transaction data and automating reconciliation and reporting through integrations with accounting systems like QuickBooks can streamline how a company maintains financial compliance. Platforms like Slash are designed to support this level of visibility and audit readiness.

Discover smarter capital management solutions with Slash

Operating a compliant business requires more than checking regulatory boxes. It requires secure systems, strong internal controls, and infrastructure built to support transparency, auditability, and risk management as a company scales.

Slash is a SOC 2 Type II certified financial provider, meaning it undergoes rigorous third-party audits to validate its security, availability, and data protection controls. Slash is also PCI DSS compliant, encrypts sensitive financial data in transit, enforces multi-factor authentication, and provides 24/7 customer support to help businesses resolve potential issues quickly.

Slash implements this enterprise-grade security into each of our products and services to support highly-compliant financial operations, including:

- Native crypto support: Slash supports holding, sending, and receiving USDC, a MiCA-compliant digital asset for business transactions.With stablecoin support, you can move money around the globe in minutes and bypass FX and processing fees from traditional banking networks.

- Flexible financing: Slash’s Working Capital financing is designed for growing businesses. Get a boost of liquidity when you need it by initiating a drawdown from your Slash dashboard, then choose between flexible 30, 60, or 90 day repayment terms.⁶

- Multi-entity support: Manage financial operations across subsidiaries or business units within a single, centralized platform.

- Accounting integrations: Sync transaction data directly with accounting software such as QuickBooks to simplify reconciliation, reporting, and audit preparation.

If your business needs a modern financial platform built with compliance, security, and scalability in mind, Slash provides infrastructure designed to support long-term growth. Learn more today at slash.com.

Apply in less than 10 minutes today

Join the 5,000+ businesses already using Slash.

Frequently asked questions

What happens if my business doesn’t make KYC checks?

Failing to implement adequate KYC processes can lead to serious consequences. Regulatory authorities may impose significant fines, revoke business licenses, or pursue criminal punishment. Beyond regulatory penalties, businesses risk reputational damage that can erode customer trust and strain relationships with banking partners.

Business Fraud Prevention: A Guide for Protecting Your Company

What is Aadhaar KYC?

Aadhaar KYC refers to identity verification using India’s Aadhaar system, which is a government-issued biometric identification program. Aadhaar KYC is specific to India and is separate from KYC frameworks used in the United States and other jurisdictions.

Can financial platforms help businesses meet KYC and AML requirements?

Financial platforms cannot replace a business’s responsibility to maintain its own KYC and AML program, but they can support compliance by providing secure infrastructure, standardized controls, audit-ready records, and tools that reduce operational risk. Providers with strong security certifications and transparent processes, like Slash, can make compliance easier to maintain and demonstrate.