Vendor Onboarding Best Practices: Building a Compliant and Scalable Supplier Workflow

Many finance teams can pinpoint the exact moment vendor onboarding becomes a problem: when your supplier network grows beyond what spreadsheets and email chains can handle. What starts as a manageable process for five or ten vendors turns chaotic at fifty, with potential issues like missing compliance documents, inconsistent vendor records, and extended activation timelines becoming more common.

Companies that proactively build structured onboarding workflows can avoid these growing pains entirely. They can onboard new vendors quickly and consistently, maintain organized compliance records that withstand scrutiny, create clear accountability across procurement, finance, and legal teams, and establish payment processes that work reliably at scale. The difference between a functioning vendor network and a dysfunctional one often comes down to whether onboarding was treated as a priority or an afterthought.

In this guide, we'll break down what vendor onboarding entails, identify the most common challenges companies face, and provide actionable best practices for building a compliant and scalable supplier workflow. You'll also discover how Slash's business banking platform can streamline vendor payments through faster cross-border transfers, flexible payment rails, and enhanced visibility over company finances—helping you improve the end-to-end vendor management process from onboarding through to your ongoing payment operations.¹

What is vendor onboarding? Key insights and importance

Vendor onboarding is the structured process of integrating new suppliers into your business operations, from initial contact through to the first transaction. The onboarding process usually encompasses:

- Collecting required documentation

- Verifying credentials

- Researching industry regulations

- Setting up payment information

- Establishing contracts and service level agreements (SLGs)

- Configuring access to any necessary systems or portals

Vendor onboarding is only one phase of the vendor lifecycle, which also includes selection, contracting, performance management, renewal, and offboarding. Each phase builds on the previous one, but onboarding sets the tone for the entire partnership. A smooth onboarding experience demonstrates an organization's professionalism and operational maturity, while a disorganized process can erode trust before the partnership even begins.

The importance of effective vendor onboarding extends beyond efficiency, too. Proper onboarding can better ensure regulatory compliance, reduce financial risk, improve payment accuracy, and create clear accountability across teams. For companies managing dozens or hundreds of suppliers, a standardized onboarding workflow can lay the groundwork for long-term success.

4 common challenges in the vendor onboarding process

Vendor relationship management

Managing vendor relationships effectively requires coordination across multiple touchpoints throughout the vendor lifecycle. Strong vendor relationship management involves negotiating favorable contract terms, establishing clear performance expectations, maintaining open communication channels during onboarding, and nurturing the partnership over time. When onboarding processes are unclear, it can damage the supplier relationship from the start; vendors may feel frustrated by repetitive information requests, delayed responses, or unclear next steps, which can lead to strained partnerships or even lost opportunities with high-quality suppliers.

Verifying vendor certifications

Depending on your industry, vendors may need specific certifications or credentials before they can do business with you. ISO standards like ISO 9001 for quality management or ISO 27001 for information security are common requirements across many sectors. Industry-specific credentials might include SOC 2 compliance for technology vendors, OSHA certifications for construction suppliers, FDA registrations for food and pharmaceutical vendors, or ITAR compliance for defense contractors. Plus, keeping track of expiration dates or renewal requirements can add another layer of complexity.

For businesses seeking highly compliant payment infrastructure to match their vendor standards, Slash follows regulations like KYC, KYB, AML, and maintains SOC 2 Type II certification to protect customer funds and ensure secure transactions.

Overseas supplier management

Acquiring goods from overseas can sometimes give you access to better prices or specialized materials unavailable in your region. However, along with this comes more complex requirements for compliance, foreign currency transfers, and supplier relationship management that aligns with both countries' regulations, languages, and cultures. International vendors may require different tax documentation, adhere to varying data privacy laws, operate across different time zones, and expect payment in their local currency.

Slash can simplify cross-border transactions with support for diverse payment rails, including SWIFT network wire transfers to 180+ countries or native support for fast, cost-efficient USD stablecoin transfers.⁴

Procurement

Procurement oftentimes is the initiating action of the vendor lifecycle. Procurement refers to the strategic end-to-end process of sourcing and acquiring goods and materials for your business. For smaller businesses, procuring goods from suppliers may be as simple as calling up a warehouse in town. Large enterprises, on the other hand, regularly rely on ERP systems to assist in sourcing materials from around the world in a manner that's compliant, efficient, and reliable.

Procurement challenges during onboarding may include coordinating between multiple stakeholders who each have different priorities, integrating new vendors into existing procurement systems without disrupting workflows, managing approval hierarchies that can delay vendor activation, or maintaining accurate vendor data across disconnected platforms.

Slash business banking

Works with cards, crypto, plus cards, crypto, accounting, and more.

How to improve the vendor onboarding process: 6 best practices

Building a compliant and scalable vendor onboarding workflow requires a combination of clear processes, modern technology, and dynamic collaboration. The following best practices can help you create a system that works for all types of vendors and suppliers while maintaining the control and oversight your business needs:

1. Create a standardized onboarding checklist

A comprehensive onboarding checklist ensures consistency across all vendor relationships and reduces the risk of missing critical steps. Your checklist should include:

- Basic vendor information: Legal business name, tax identification number, business address, contact details for accounts payable and any other relevant information to the partnership.

- Legal and compliance documentation: 1099, W-9, or W-8 forms for tax purposes, certificates of insurance, business licenses, industry-specific certifications, and proof of compliance with relevant regulations.

- Financial and payment setup: Bank account information for ACH, wire, or other transfer methods, preferred payment terms and methods, and currency preferences for international vendors. If using Slash for payments, consider implementing stablecoins for payments at this stage, especially if dealing with vendors overseas.

- Contractual agreements: Draft outlines of purchase orders, non-disclosure agreements, and service level agreements.

- System access and integration: Organize portal credentials, ERP or procurement system setup, communication preferences, and escalation contacts.

2. Ensure compliance with relevant industry regulations

Compliance requirements vary significantly by industry, but every business must verify that vendors meet applicable regulatory standards before beginning work. Financial institutions must confirm vendors adhere to banking regulations and anti-money laundering requirements; for instance, Slash is a Soc 2 Type II compliant platform that follows all necessary KYC, KYB, and AML regulations for domestic and international payments. Healthcare companies should verify HIPAA compliance for any vendor handling protected health information. Government contractors may ensure suppliers meet federal acquisition regulations and security clearance requirements where applicable.

3. Set up a vendor management system

A centralized vendor management system can transform onboarding from a manual, error-prone process into a streamlined workflow that scales with your business. Some modern vendor management systems offer features like multi-language vendor portals that accommodate international suppliers, automatic compliance enforcement with built-in checks, procurement assistance through integrated requisition and approval tools, and more.

4. Emphasize clear ownership among stakeholders

Onboarding new vendors can involve multiple different teams: procurement, finance, legal, security, IT, operations. It's important to define each team's relationship with new vendors by establishing approval workflows and centralizing communication so multiple teams can manage vendors without duplicated efforts.

5. Draft comprehensive service level agreements

Service level agreements outline the expectations around performance, uptime, delivery timelines, and accountability. A well-crafted SLA protects both parties by establishing measurable standards that govern the partnership and provide a framework for resolving disputes. Key elements of an effective SLA may include:

- Specific performance metrics and targets

- Delivery schedules and lead times

- Quality standards and acceptance criteria

- Response times for support requests or issue resolution

- Consequences for failing to meet agreed-upon standards

- Procedures for reporting, escalation, and review.

6. Automate manual workflows

Once vendors are onboarded, relying on manual processes for sending payments, recording transactions, and documenting invoices can increase the likelihood of errors in the vendor management chain and slow down processes that could otherwise be optimized.

Slash enables businesses to unlock a host of automations for managing vendor payments, while providing tools to increase the accuracy of transaction records and enhance visibility across your financial operations. Some capabilities enabled by Slash that can streamline your vendor management include:

- Scheduled payment automation: For recurring vendor payments, you can schedule transfers on any of Slash's available rails to eliminate manual processing and ensure timely payments every cycle.

- Virtual accounts: Silo different cash flow channels across different teams and entities using multiple virtual accounts, which can separate money pools for improved visibility and control over vendor-related spending.

- Real-time payment tracking: Monitor all outgoing vendor payments in real time, track payment statuses, and maintain complete visibility over cash flow to prevent surprises and improve forecasting.

- Invoice management: Rolling out now, Slash will enable users to generate invoices from their stored contact information and manage outstanding invoice payments from within the Slash dashboard.

Discover smarter supplier management solutions with Slash

While Slash is not a standalone vendor onboarding or procurement tool, it is a comprehensive business banking platform that can significantly improve the payment side of vendor management. Once vendors are onboarded, Slash makes it easier to pay them quickly, cost-effectively, and with greater visibility over your company's outgoing cash flow.

Slash offers diverse payment options and financial tools designed to simplify vendor payment operations:

- Diverse payment methods: Access global ACH transfers, international wires to suppliers across 180+ countries, and real-time payments via RTP or FedNow. Enable controlled daily spending with the Slash Visa Platinum Card, which can generate up to 2% cashback on spending. Choose the most efficient rail for each vendor based on location, urgency, and cost considerations.

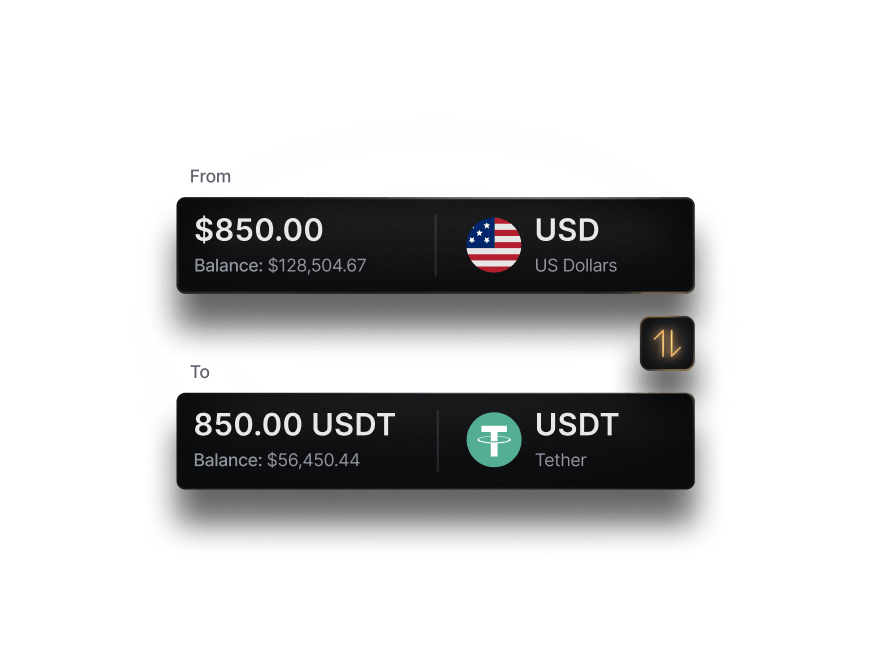

- Native cryptocurrency support: Access the most efficient and cost-effective transfers possible with transfers using USD-pegged stablecoins USDC or USDT. This can be particularly valuable for companies managing a global supplier base with varying payment requirements. Native crypto support bypasses traditional processing and foreign exchange fees while delivering faster settlement times.

- Real-time analytics: Synchronized payment information can enable finance teams track spending across vendors, monitor payment statuses, and maintain tighter control over company finances with our comprehensive analytics dashboard.

- Integrated accounting: Connect seamlessly with QuickBooks, reducing manual reconciliation work and ensuring accurate financial records across all vendor transactions.

- High-yield treasury accounts: Put idle cash to work through integrated money market funds from BlackRock and Morgan Stanley, earning up to 4.1% annualized yield while remaining accessible for vendor payments when needed.⁶

By streamlining the payment process and improving financial visibility, Slash helps companies enhance their vendor management operations. Learn more by visiting slash.com today.

Apply in less than 10 minutes today

Join the 5,000+ businesses already using Slash.

Frequently asked questions

How do vendor onboarding tools simplify the onboarding process?

Vendor onboarding tools typically offer tools to centralize documentation, automate compliance checks, and provide visibility across stakeholders. They can reduce manual work and create consistency across different company teams.

How long does it typically take to onboard new vendors?

Onboarding timelines vary based on complexity and compliance requirements, ranging from a few days for simple relationships to several weeks for complex suppliers

What payment methods work best for international vendor payments?

International vendor payments work best when you have multiple rail options to choose from. SWIFT wire transfers offer broad global reach, while USD stablecoins like USDC or USDT can provide faster, more cost-effective alternatives that bypass traditional banking fees and foreign exchange markups. Platforms like Slash support both methods, giving you flexibility to select the optimal payment rail for each vendor based on their location, preferred currency, and urgency requirements.