Simplify Your Business Finances with Smart Invoice Management

Managing invoices manually can work when you’re first starting out. You receive a few invoices from suppliers, send a few to customers, and keep track of payments without much trouble. As activity picks up, though, those same processes can start becoming harder to manage.

Implementing an invoice management system is a positive milestone. It means you have a growing customer base and more active business relationships, creating the need for tools that can keep pace with operations. But choosing the right management software takes some forethought: you’ll need to identify where delays tend to arise in your invoicing process and how well a new tool can connect with the rest of your financial stack.

In this guide, we’ll discuss how invoice management works, the common challenges businesses may face, and what to look for in an invoice processing solution. We’ll also introduce the Slash invoicing dashboard, which integrates with Slash’s broader financial management platform. With Slash, you can generate professional invoices, track payment status in one place, and accept multiple different payment methods spanning from bank transfers to cryptocurrency.⁴ Keep reading to learn how Slash can optimize how your business manages its invoices.

What is invoice management?

Invoice management refers to how businesses handle invoices, from creation to payment to recordkeeping. This management process may include generating invoices, receiving vendor invoices, routing them for approval, processing invoice-related payments, and storing documents for audit and reporting purposes.

Invoice management connects closely with the management of your business’s accounts payable (AP) and accounts receivable (AR). Keeping an organized record of invoices that you’ve received helps track the funds moving out of your business. Creating professional invoices and managing them effectively can contribute to faster payment collection times, fewer pricing disputes, and simpler reconciliation down the line.

Today, a wide range of electronic invoicing solutions exist to support the different workflows involved in AP and AR. Some business partners may still rely on paper invoices and physical filing systems, which is where OCR technology plays a role by reading invoices and extracting data into a centralized management system. Other invoices arrive as PDFs that can be uploaded for streamlined recording, receipt tracking, and purchase order matching. In more specialized cases, invoicing tools are built into dedicated vendor invoice management systems or accounts payable automation platforms, tailoring them to specific processes and operational needs.

Why effective invoice management matters for your business

Invoice management affects more than just how bills are sent and paid. It plays a role in how clearly a business tracks money coming in and going out and how efficiently financial tasks are handled day to day:

Streamlined accounts payable and receivable operations

Accounts payable covers what your business owes for goods or services, while accounts receivable reflects what customers owe you. Invoices support both sides by communicating pricing, taxes, discounts, and payment terms between two parties.

Simplified reconciliation process

Invoices also serve as a key reference point for internal accounting workflows, particularly during reconciliation. Reconciliation involves comparing transaction records across systems to confirm accuracy. When invoices and payment data are captured through automation instead of manual data entry, the process can be easier to streamline and far less time consuming, reducing the effort required to keep records aligned.

Avoiding late payments and strengthening vendor relationships

When invoices are scattered across email chains and filing cabinets, payments can be missed. An invoice tracking system that shows approval status, due dates, and payment progress helps keep invoices organized. Improved visibility can reduce delays, support timely payments, and help maintain more consistent vendor relationships.

Building a reliable audit trail

Beyond day-to-day accounting, keeping organized records of your invoices can support preparation for internal or external audits. This can be especially important for highly-regulated companies with formal procurement processes, since invoices document whether purchases were made through approved channels, vendors, and suppliers.

Enhanced cash flow visibility

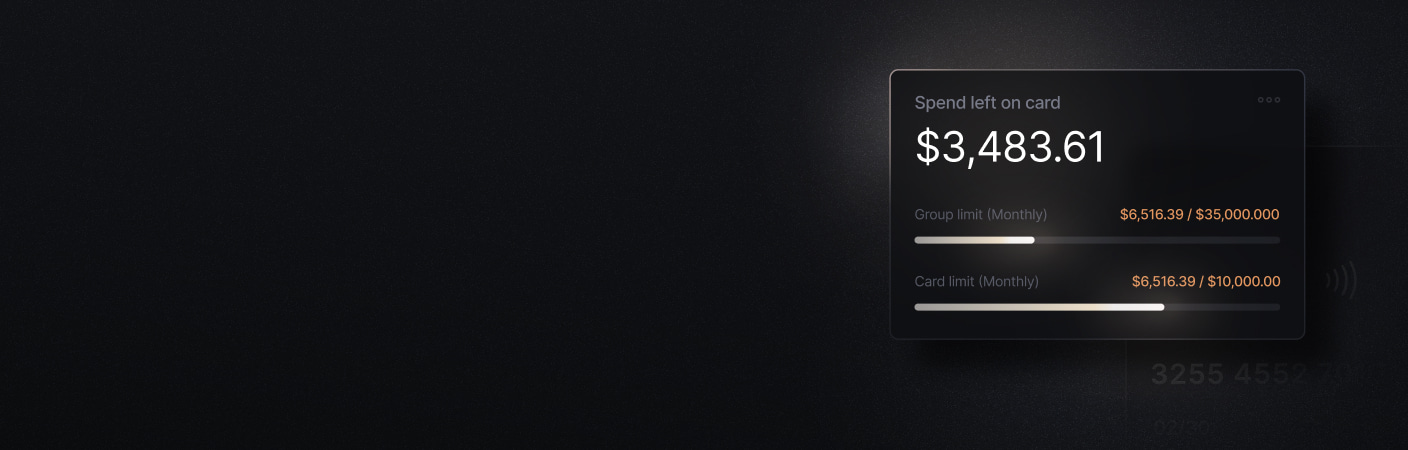

Understanding how outstanding invoices affect short-term payables and receivables can provide a clearer picture of your cash flow and overall financial position. For a more unified view of inflows and outflows across company cards, bank transfers, digital asset payments, and more, Slash’s analytics dashboard offers real-time visibility that can help finance teams plan around upcoming obligations.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

Breaking down the invoice management process

While workflows vary by business, invoice management usually follows a similar path from creation to payment. Below is an overview of how this process works when managed through the Slash invoicing dashboard.

1. Invoice creation and approval

To create an invoice in Slash, navigate to the invoicing dashboard and select New Invoice. From there, you’ll choose a recipient and select a receiving account. Slash will generate a professional invoice for you; all you need to do is add line items, set a due date, and apply any relevant taxes, discounts, or payment notes. Before sending the invoice, it’s important to review the details to confirm accuracy and avoid issues that could delay payment.

2. Sending invoices to clients

Once you select "Send Invoice", Slash formats the invoice and delivers it to your recipient by email. Invoices sent through Slash include built-in payment options, allowing customers to pay directly without needing to request additional instructions or links.

3. Tracking invoice status and payment due dates

After an invoice is sent, it will automatically appear in the invoicing dashboard alongside your other invoices. You can see whether an invoice is unpaid, paid, overdue, or voided at a glance, with the due date clearly displayed. As the payment date approaches, you can update the invoice memo or add reminders to help keep payments on track.

4. Payment processing

Slash supports multiple payment methods, including ACH transfers, wire transfers, and cryptocurrency payments. Cryptocurrency payments are handled using USD-pegged stablecoins like USDC and USDT. Funds received via stablecoins can be on- and off-ramped into cash natively within Slash, giving businesses flexibility in how they manage incoming payments.

5. Recording and reconciling transactions in accounting systems

Once a payment is received, the invoice status will update to “Paid” in the Slash dashboard. Receivables data is recorded automatically and reflected in your company’s cash flow analytics. When it’s time to reconcile, Slash can sync transaction data directly with QuickBooks, where you can match payments to invoices, purchase orders, and receipts without manual entry.

6. Creating a paper trail for audits

Invoices and payment records should be retained even after payment is complete. These records can be helpful during external compliance audits, internal reviews, or when resolving billing questions or disputes with customers later on.

Top challenges businesses face in invoice management

Before implementing invoice management software, your business may experience growing pains that signal it’s time to make a switch. The section below outlines several signs that may indicate a dedicated invoicing solution is worth considering:

Inconsistent invoice formatting

Creating a professional invoice using a word processor can be tedious. Adding a company logo can disrupt formatting; subtotals, taxes, or discounts may need to be calculated manually. Using an invoicing tool that generates invoices automatically can help standardize formatting and ensure calculations are handled consistently. Slash creates structured invoices for you, eliminating the need to manually adjust layouts.

Difficulty tracking invoices sent as PDFs

Sending invoices as PDF attachments isn’t foolproof. If a customer doesn’t use an invoice management system with OCR data extraction capabilities, the file may get buried in an email thread or saved without a clear reminder to pay. An invoicing system like Slash that embeds clear, built-in payment options can reduce friction for the recipient and present a more professional billing experience.

Errors from manual entry of invoice details

Typos, missed line items, or incorrect amounts can lead to payment delays and reconciliation issues. Manual entry is also time consuming as invoice volume grows. Slash’s integration with Quickbooks can minimize these issues, as the accounting platform can match invoices to purchase orders to catch errors quickly.

Handling outstanding and overdue invoices

Without a centralized view of invoices, it can be difficult to know which are unpaid, overdue, or already settled. The Slash invoicing dashboard provides a clear view of invoice status and due dates, helping teams stay organized and reducing the chance that invoices are overlooked.

Best practices for smarter invoice management

Smarter invoice management can result from applying a few consistent, well-defined practices within a single system. The steps below focus on improving how invoices are created, sent, and tracked as billing activity increases:

- Standardize invoice creation: Use a system that automatically generates invoice layouts and email copy to ensure consistent, complete billing. Slash creates structured invoices and formats invoice emails for you.

- Offer multiple payment options: Make it easy for customers to pay by supporting ACH, wire transfers, real-time rails, and USD-pegged stablecoins like USDC and USDT, with built-in payment processing handled directly through Slash.

- Track invoice status in one place: Slash’s invoicing dashboard shows the payment status of your invoices, helping AR teams see what’s outstanding and where follow-up may be needed.

- Reduce excessive follow-ups: Centralized tracking helps reduce unnecessary reminders and allows follow-up to happen only when it’s actually required.

- Keep invoice records organized: Storing all your invoices and payment records in a single system makes it easier to reference past billing, resend invoices, or respond to customer questions.

Leading platforms for automated invoice management

Invoice management tools tend to fall into one of two categories: platforms that treat invoicing as part of a broader financial operating system, or tools that focus on automating specific AP or AR workflows. Understanding how these platforms differ can help teams choose software that fits both their current needs:

Slash

Slash combines invoice processing with your entire financial stack so your invoice management process is tied directly to how money moves through your business. With Slash, you can streamline receivables by embedding payment processing into your invoices, while also supporting accounts payable through recurring, automated billing across multiple payment rails.

Key invoicing and financial management capabilities include:

- A dashboard for creating professional invoices, using stored recipient banking information to send them, and tracking payment status.

- Built-in payment options that allow customers to pay invoices directly via ACH, wire transfer, or USD-pegged stablecoins.

- Direct integration with QuickBooks for automatic transaction syncing and up-to-date bookkeeping, plus Plaid connectivity and data imports from Xero.

- Support for domestic real-time payments through RTP and FedNow, alongside international payments to 180+ countries via SWIFT.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

Intuit QuickBooks

QuickBooks is an accounting software that directly integrates with Slash, so you can export transaction data seamlessly between the two platforms. QuickBooks supports accounts payable processes with OCR capabilities that can capture and record invoice information, and recent additions like Intuit Assist introduce AI-powered tools for automated invoice generation and approval.

- Customizable invoice templates with automatic branding and professional design options.

- Recurring invoice automation for subscription-based or ongoing billing, with auto-send scheduling.

- Progress invoicing to bill clients in stages based on project milestones or percentage completion.

- Batch invoicing to generate multiple invoices from a single data entry step.

Xero

Xero is a cloud-based accounting software built for businesses that want accessible financial tools with strong automation. Through Plaid connectivity and data import features, Xero integrates directly with Slash, allowing Xero’s accounting and payment data to flow directly into Slash’s analytics and transaction records.

- Customizable invoice templates with flexible branding, color schemes, and layout options.

- Automated payment reminders that prompt customers as due dates approach.

- Multiple delivery options, including email and SMS, to improve reach and response rates.

- Online payment integrations with PayPal, Stripe, and major credit card processors for faster settlement.

BILL

BILL is an expense management platform built around AR and AP automation software, with a primary focus on handling invoice intake, routing approval workflows, and processing payments. While this approach may work for dedicated workflows around accounts payable and receivable, BILL offers fewer options for payment acceptance and more limited ways to connect invoices to a broader banking or financial setup compared to more integrated platforms.

- Supports invoicing processing and AP automation, but limits payment processing from invoice settlement to ACH and card payments.

- Does not offer treasury management, high-yield savings accounts, or capital financing products.

- Uses per-user pricing that can become costly as teams grow, with the Essentials plan at $49 per user per month and the Corporate plan at $89 per user per month.

Tipalti

Tipalti is a more complex invoicing solution designed primarily for larger organizations with heavy accounts payable and procurement needs. Tipalti is not a full banking platform, and it functions more like an ERP. Its core features center on invoice processing and approval workflows, with more advanced capabilities available only at higher pricing tiers.

- A supplier portal that allows vendors to submit invoice information directly, routing invoices through approval and payment workflows.

- Global payment options and multi-entity support available only through Tipalti Advanced, which starts at $199 per month.

- No support for real-time payment rails, native banking features, or cryptocurrency payments.

- A corporate card is available, but without an accompanying banking stack, making it harder to unify cash flow and spending data.

Optimize your invoice management with Slash

Invoicing shouldn’t be handled separately from the rest of your finances. Slash includes invoicing as part of its broader financial platform, which is designed to support complex, industry-specific workflows.

With Slash, you can create, send, and track invoices in the same place you manage all your financial activity. Invoices sit alongside card spend, payment acceptance, and automated financial processes, reducing the need to switch between tools. Slash provides real-time visibility into how money moves through your business, helping you monitor and manage cash flow more effectively.

Some additional ways Slash supports invoicing and broader financial workflows include:

- Money management built for flexibility: Separate your operational capital and treasury funds to organize cash flows or pool funds for distinct purposes. Manage multiple business entities, locations, or subsidiaries from a single dashboard, with consolidated reporting and clear visibility across accounts.

- Dynamic payment methods: Slash supports a wide range of payments, including global ACH, international wire transfers to 180+ countries via SWIFT, and real-time domestic payments through RTP and FedNow.

- Working capital financing: With Slash’s working capital loan, you can draw down funds directly inside the platform whenever you need extra liquidity and choose between flexible 30-, 60-, or 90-day repayment terms that align with your AP forecasts.⁵

- Native cryptocurrency support: Convert funds into USD-pegged stablecoins such as USDT or USDC to send transfers on the blockchain, offering an alternative payment method that can reduce costs and settlement times.

Apply in less than 10 minutes today

Join the 5,000+ businesses already using Slash.

Frequently asked questions

Can Slash automate accounts payable processes?

Slash supports accounts payable workflows by enabling scheduled and automated payments across multiple payment rails, reducing manual steps involved in paying vendors.

Top Accounts Payable Automation Small Business Solutions in 2025

What is OCR technology?

OCR (optical character recognition) technology reads text from documents like paper invoices or PDFs and converts it into structured digital data. This reduces manual data entry by automatically extracting key invoice details.

Does Slash integrate with ERP or accounting software?

Slash integrates directly with QuickBooks for automatic transaction syncing and supports data imports from Xero via Plaid. These integrations allow invoice and payment data to stay aligned with your accounting system, and ERP connections can be supported through exports or existing accounting workflows.