How to Manage Cash Flow Effectively for Business Growth

Just like the moon and the tides, your business runs on a cycle: money in, money out. It’s the rhythm of cash flow, and when it’s in balance, it can power steady operations and sustainable growth.

But unlike the pull of the tides, cash flow can be unpredictable. One month, you may have surplus funds sitting in your account, ready to reinvest. The next, despite strong sales and healthy margins, you’re short on cash to pay suppliers because customer invoices haven’t cleared. Even profitable businesses can be capsized when timing works against them.

It’s the paradox that keeps small business owners awake at night: you can be profitable on paper while simultaneously running out of cash. Without disciplined cash flow management, even a promising company can start taking on water.

In this guide, we’ll break down what cash flow management is, why it matters, and how to strengthen your cash position to support long-term growth. We’ll also explore how Slash provides real-time visibility into cash flow, built-in AP and AR management tools, and flexible financing and treasury options that help you maintain liquidity when you need it most.⁵, ⁶

What is cash flow management?

Cash flow management is the process of tracking, analyzing, and optimizing the movement of money into and out of your business. It involves monitoring inflows from customers and other revenue sources while controlling outflows for expenses, bills, and other financial obligations. Effective cash flow management ensures you have enough liquidity to support operations in the short-term while maintaining the long-term financial stability needed to support growth.

In practice, managing cash flow requires consistent attention to several core processes, including:

- Forecasting future cash positions through cash flow projections to anticipate shortfalls or surpluses.

- Timing payments strategically to optimize working capital and maintain positive cash flow.

- Monitoring accounts receivable to ensure customers pay invoices promptly and accounts payable to balance vendor relationships with liquidity needs.

- Maintaining adequate cash reserves for emergencies and unexpected expenses.

- Analyzing cash flow statements to understand patterns in operating cash flow.

Slash brings these processes into a single, unified system. Its analytics dashboard provides clear visibility into upcoming payment obligations and your real-time cash position. Slash also supports diverse payment options, including global ACH, wires, real-time payments, and crypto, giving you greater control over how and when funds leave your account.¹, ⁴ Integrated high-yield treasury accounts earn up to 3.84% annualized yield, helping your business put excess cash to work while keeping it accessible on short notice.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

Understanding the role of AP in cash flow management

Accounts payable plays an important role in cash flow management because it controls both the timing and amount of your outflows. Every invoice you receive creates a future payment obligation, and how you manage those obligations directly affects your short term cash position.

Strategic payment timing is one of the most effective ways to strengthen your cash flow. When you negotiate favorable payment terms with suppliers, such as net 60 instead of net 30, you effectively create an interest-free loan that allows you to hold onto funds longer. This extended timeline gives you more flexibility to collect from your own accounts receivable before money needs to leave your bank account. Many vendors also offer early payment discounts (such as 2/10 net 30), which can improve your financial position if you have sufficient cash on hand to take advantage of them.

Conversely, delays in processing accounts payable can damage both your cash flow and business relationships. Late payments can result in penalties, strained vendor relationships, or loss of favorable payment terms. Likewise, paying bills too early when you haven't collected from customers can create unnecessary cash shortfalls. The key is finding the right balance: paying obligations on time while maximizing the strategic use of your capital.

Examples of cash flow management in practice

To understand how different cash flow management strategies can impact small businesses, let's examine two contrasting scenarios that illustrate different cash positions and their consequences:

The short cash scenario

Imagine a growing retail business that's experiencing strong sales but struggling with liquidity. The company carries $150,000 in inventory to meet customer demand, and customers take an average of 60 days to pay their invoices, creating $200,000 in outstanding accounts receivable. Meanwhile, suppliers require payment within 30 days for new inventory purchases.

This timing mismatch creates a problem: the business has tied up $350,000 in inventory and receivables, but cash outflows for accounts payable are due much sooner than the corresponding inflows from customers. Despite generating revenue and appearing profitable on paper, the company doesn't have enough cash on hand to pay bills, cover expenses, or invest in growth opportunities.

Here are some ways the retail business can get out of this bind:

- Renegotiate payment terms with suppliers to extend from net 30 to net 45 or net 60, better aligning outflows with customer payment cycles.

- Optimize inventory management to reduce the amount of cash tied up in unsold goods/

- Consider short term financing such as Slash Capital to bridge the gap between when you pay suppliers and when customers pay you.

- Improve cash flow forecasting to anticipate shortfalls and plan proactively rather than reactively.

The extra cash scenario

Now consider a consulting business that has successfully aligned its cash management practices. Clients usually pay invoices within 15 days due to accessible electronic payment options and incentives for prompt payment. The business maintains lean operations with minimal inventory needs and has negotiated net 45 payment terms with its key vendors for software, supplies, and other expenses.

This alignment creates positive cash flow: inflows arrive quickly while outflows are deferred, resulting in a growing cash reserve. The business consistently has surplus funds available, which opens up strategic opportunities that weren't possible when operating on tight margins.

Here are some of the opportunities available to the consulting business due to their effective cash flow management:

- Invest in growth initiatives such as hiring additional staff, expanding service offerings, or entering new markets.

- Build substantial cash reserves to weather economic downturns or unexpected business challenges.

- Negotiate better terms with suppliers from a position of financial strength, and take advantage of early payment discounts to reduce operating costs.

- Maintain financial health that makes the business more attractive to lenders, investors, or potential buyers.

Effective techniques for enhancing cash flow management

Strengthening how your business manages cash flow is a learnable skill. With the right systems and habits in place, you can improve your liquidity and make more confident financial decisions. Here are some practical strategies and processes to help you build a more stable and predictable cash flow cycle:

Create a rolling cash flow forecast

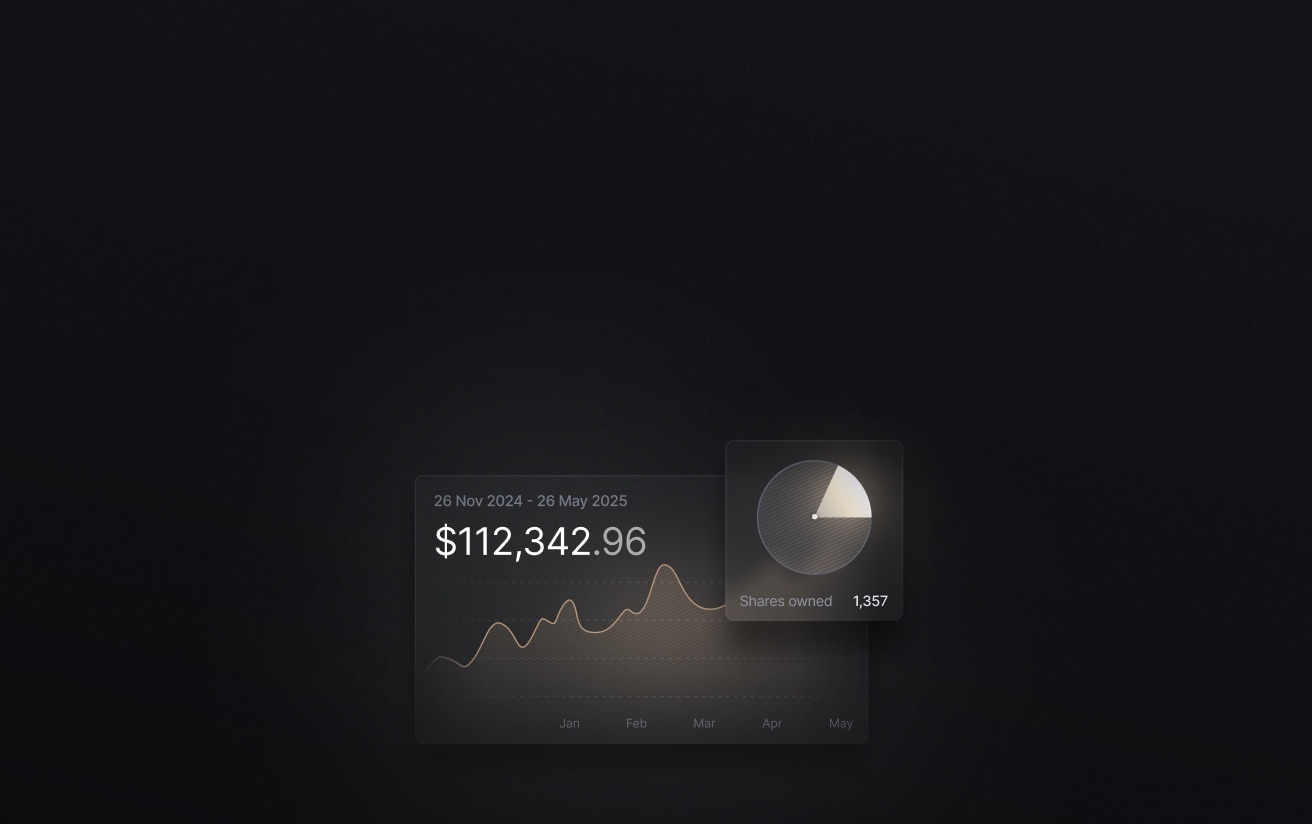

A rolling cash flow forecast is an ongoing projection that looks several weeks ahead at your expected inflows and obligations, updating as new information becomes available. Instead of relying on a fixed annual budget, a rolling forecast helps you identify potential cash shortfalls early and spot periods when excess funds may be available. Slash’s analytics dashboard can make forecasting easier by providing real-time visibility into balances, upcoming obligations, and payment activity in one place.

Monitor key cash flow metrics regularly

You can't optimize what you don't measure. Regularly tracking key metrics can help you spot early warning signs of impending issues and helps you analyze the effectiveness of your cash management efforts:

- Operating cash flow: Measures cash generated from core business operations.

- Cash conversion cycle: Shows how long it takes to convert inventory and receivables into cash.

- Current ratio: Current assets divided by current liabilities; indicates your ability to meet short term obligations.

- Days sales outstanding (DSO): Tracks how long it takes to collect accounts receivable.

- Days payable outstanding (DPO): Shows how long you take to pay accounts payable.

- Cash runway: Reveals how long your current cash reserves will last at the current burn rate.

Use technology to consolidate multi-entity positions

If you operate multiple entities, divisions, or bank accounts, getting a clear picture of your overall cash position can be challenging. With Slash, you can consolidate financial data across multiple entities to provide a unified view of your total liquidity, helping you identify opportunities to move funds where they're needed most.

Automate AP and AR processes to reduce errors and delays

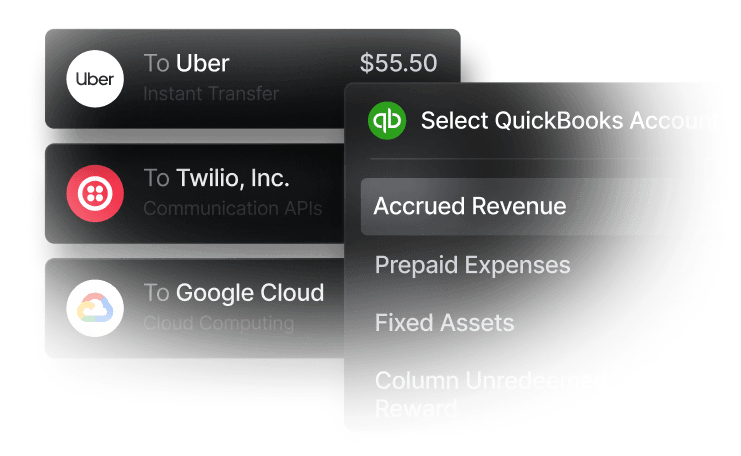

Manual processing of invoices, payments, and reconciliations can be time-consuming and prone to errors. Automated systems streamline these workflows and provide real-time visibility into your cash position. With Slash, you can embed payment links for cards, ACH, wires, and crypto directly into invoices to accelerate collections, while syncing transaction data with QuickBooks to simplify reconciliation and reporting.

Align payment terms with revenue cycles

One of the most effective cash management strategies is ensuring your payment terms with customers and vendors are properly aligned. Clear, consistent terms keep accounts receivable moving by setting expectations and holding customers accountable for paying on time. At the same time, negotiating vendor terms that match your revenue cycle makes expenses more predictable, helping you forecast cash needs and ensure funds are available when bills come due.

Frequent obstacles in cash flow management

Even if you understand the fundamentals of cash flow management, practical challenges can still create problems. If you encounter the following problems, it may be a sign that you need stronger processes, better visibility, or more modern financial tools to maintain control over your liquidity:

- Late or missing customer payments: When customers pay late, expected cash inflows are delayed. This can leave you without enough liquidity to cover short-term expenses.

- Poor expense tracking: If expenses are not tracked consistently, it becomes difficult to understand your true cash position. Inaccurate records can lead to overspending or missed payments.

- Manual reconciliation errors: Manual processes increase the risk of duplicate payments, missed invoices, or incorrect balances. These errors reduce confidence in your financial data and make forecasting harder.

- Seasonal revenue fluctuations: Some businesses generate uneven revenue throughout the year. Without planning ahead, slower months can create predictable but avoidable cash shortages.

- Improper payment terms: If customers are given long payment terms while vendors require quick payment, cash can leave faster than it arrives. This mismatch increases pressure on working capital.

- Lack of accessible financing: When short-term funding is not available, temporary cash gaps can disrupt operations. Access to flexible financing can help bridge timing differences between inflows and outflows.

Optimize your business’s cash flow with Slash

Improving cash flow starts with better financial infrastructure. The right platform should give you clear visibility into your position, help you move money efficiently, and support forward planning. Whether you're managing accounts payable, tracking receivables, or forecasting future needs, Slash gives you the tools to make informed decisions based on accurate, up-to-the-minute data—not guesswork.

Slash brings these capabilities together in a unified platform built to help small businesses maintain control over their finances. Here’s how Slash can help you actively optimize cash flow:

- Real-time analytics dashboard: Get clear visibility into your balances, cash flow trends, and upcoming payment obligations so you always know where you stand and can plan ahead.

- Streamlined AP/AR management: Automate accounts payable and accounts receivable workflows to reduce manual errors, remove bottlenecks, and support timely payments in both directions.

- Professional invoicing: Generate invoices using stored contact and banking information, and get paid faster by embedding payment links that support credit cards, ACH, wires, and crypto.

- High-yield treasury accounts: Put surplus funds to work earning up to 3.84% annualized yield while keeping your cash accessible when you need it.

- Capital financing: Access additional liquidity to bridge short-term gaps or support growth, with flexible drawdowns and 30, 60, or 90-day repayment terms aligned with your revenue cycles.

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Frequently asked questions

What are the four types of cash flows?

The four main types of cash flows are operating, investing, financing, and free cash flow. Operating cash flow comes from core business activities, investing cash flow relates to asset purchases or sales, financing cash flow reflects debt and equity activity, and free cash flow represents the cash remaining after capital expenditures.

How do you calculate cash flow?

Cash flow is typically calculated by subtracting total cash outflows from total cash inflows over a specific period. Businesses often use a cash flow statement or rolling forecast to track this consistently and monitor whether operating activities are generating positive net cash flow.

Cash Flow Management: A Guide for Making Smarter Business Decisions

What are the five rules of cash flow?

While frameworks vary, five common rules include accelerating receivables, controlling expenses, aligning payment terms, maintaining cash reserves, and forecasting regularly. Together, these practices help businesses reduce timing gaps and maintain steady liquidity.