Should You Outsource Accounts Payable? A Practical Guide for Making the Right Decision

If your finance team is drowning in unpaid invoices, struggling to meet your vendors’ needs, and falling behind on data entry tasks, you may consider outsourcing your accounts payable management to a third-party provider.

The benefits of outsourcing may seem obvious at first: less work for your team, no hiring additional staff, and access to specialized AP expertise. However, before you commit to paying for an outsourced accounts payable service, it's worth knowing what you're getting yourself into. Outsourcing your accounts payable processes comes with tradeoffs: reduced control over your finances, an intermediary between you and your suppliers, and high processing costs for work that can often be handled in-house with the right tools.

Exploring alternatives might deliver better long-term results. Implementing an in-house financial software like Slash can help you streamline accounts payable processes without losing control over your finances. With Slash, you can schedule recurring payments, get real-time insights into your cash flow, and access modern global payment rails to help you save money and meet your vendors' preferences.¹ Understanding the real differences between outsourcing services and automation software can help you make the right decision for your business needs and set your finance team up for sustainable success.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

What is accounts payable outsourcing? Definition and key benefits

Before discussing accounts payable outsourcing, it helps to define accounts payable itself. Accounts payable (AP) refers to the short-term obligations a business owes for goods and services it has received. For example, if you submit a purchase order for $10,000 worth of manufacturing materials from a supplier, that $10,000 is recorded in accounts payable until the invoice is paid off.

Accounts payable is the counterpart to accounts receivable (AR). While AP represents money flowing out of your business, AR represents money flowing in. Accounts receivable consists of short-term amounts owed to your company by customers for goods or services delivered but not yet paid for.

Accounts payable outsourcing involves contracting with a third-party service provider to manage some or all of your business’s AP functions. These providers typically handle tasks such as:

- Invoice processing

- Payment processing

- Invoice coding and data entry into accounting systems

- Vendor management on behalf of your organization

When you outsource these tasks to an AP service provider, they essentially become an extension of your finance team, overseeing day-to-day invoice processing and vendor payments in line with your approval workflows and internal controls.

Efficient AP workflows help ensure vendors are paid on time, purchase orders and invoices are properly matched, and expense tracking remains accurate. While outsourcing is one way to address these needs, many teams can also resolve AP strain by improving internal processes or adopting AP automation tools that reduce your team's workload without handing off control.

Comparing accounts payable outsourcing vs. accounts payable automation

Outsourcing has its benefits for certain organizations, particularly those with complex compliance requirements or extreme transaction volumes. However, it's not always the right fit for every business. Before committing to an outsourcing provider, it can be helpful to understand how outsourcing compares to automation software before evaluating which option is right for you:

Cost Comparison

The biggest consideration, and one of the most prohibitive, is cost. AP outsourcing can be pricey, and you're paying for tasks that can often be handled in-house. Many AP outsourcing companies charge monthly service fees that can range from hundreds to thousands of dollars per month. You also may be charged a fixed price per invoice, which can exceed $10 per invoice processed.

Compare that to an automated AP solution like Slash. Included on the free plan, you can generate professional invoices, manage outstanding invoices by status, and keep track of your payments with scheduled sends and transaction capture. On the Pro plan for just $25/month, your business can send and receive unlimited domestic ACH, wires, or real-time payments for no additional cost.

Control and Oversight

When you outsource your AP, you're entrusting a third-party to uphold your company policies and manage your vendor relationships without any direct control over the process. While outsourcing providers are trained to meet your AP needs, there's no real guarantee that you can resolve issues easily without direct oversight. If a vendor has a question about payment timing or disputes an invoice, they'll need to go through your service provider rather than speaking directly with your team. This can create delays and can strain relationships with key suppliers.

Scalability

Due to the high costs associated with outsourcing AP processes, these services are generally intended for larger companies with the balances to support a specialized service or highly regulated industries that need expert procurement support.

In other words, outsourcing your AP isn't a service that will help you grow your business from the ground up; rather, it's more for businesses that have already reached a mature growth stage. Slash, on the other hand, is an AP automation solution intended to scale along with your business. It's accessible for companies at any growth stage, whether you're handling 50 invoices per month or 5,000.

Implementation Timeline

Depending on the scale of your operations, taking on a third-party to manage your accounts payable can take weeks to months. You'll need to provide detailed documentation of your current processes, train the outsourcing team on your specific workflows and approval hierarchies, migrate vendor data, establish communication protocols, and conduct test runs before going live. This transition period can disrupt your normal payment cycles and require significant involvement from your finance team.

In contrast, an AP solution like Slash can be implemented much more quickly than an outsourcing arrangement. Slash offers an intuitive interface for finance teams, integrates with common accounting systems, and enables payment automation without a lengthy onboarding process.

Financial Visibility

Need to know which invoices are being processed this week or when a specific vendor payment will go out? Want to check whether a disputed invoice has been resolved? You'll have to contact your service provider and wait for a response. This lack of immediate insight can make cash flow planning difficult and leaves you dependent on scheduled reports or manual inquiries.

Slash gives you real-time visibility into every aspect of your finances. You can see outstanding invoices, scheduled payments, transaction history, and cash flow projections at a glance from your dashboard. No need to contact anyone or wait for updates; all your financial data is available whenever you need it.

Slash business banking

Works with cards, crypto, plus cards, crypto, accounting, and more.

Advantages and disadvantages of outsourcing accounts payable

When evaluating whether to outsource accounts payable, you should consider how an outsourced AP service provider will impact your business processes, vendor relationships, and overall finance operations.

The benefits of outsourcing can include reduced workload for your internal team, access to specialized expertise in invoice processing and vendor management, and the ability to handle growing transaction volumes without hiring additional staff. However, outsourcing also can introduce significant tradeoffs around control, data security, processing costs, and your ability to maintain visibility into cash flow:

Benefits of outsourcing accounts payable

- Access to specialized expertise: Outsourcing companies employ trained AP professionals who understand best practices, compliance requirements, and industry-specific regulations that your internal team may lack.

- Focus on core business activities: Outsourcing routine AP tasks allows your existing team to concentrate on strategic initiatives like financial planning, analysis, and business development.

- Reduced need for internal staffing: You can avoid the costs and complexity of hiring, training, and managing additional finance staff to handle growing invoice volumes.

- Established vendor networks: Some outsourcing providers have existing relationships with payment processors and vendors that may facilitate smoother transactions.

Downsides of outsourcing accounts payable

- High fees and processing costs: Monthly service fees, per-invoice charges, and additional costs for rush payments or special requests can quickly exceed initial estimates and make budgeting difficult.

- Loss of direct control: You surrender oversight of critical financial processes, making it harder to enforce company policies, respond to exceptions, or adjust workflows quickly. Plus, adding an intermediary between you and your suppliers can slow communication and create friction with business partners.

- Data security and privacy risks: Sharing sensitive financial information, bank account details, and vendor data with an external provider increases your exposure to potential data security breaches, fraud, or misuse.

- Limited real-time visibility: You'll lack immediate insight into payment status, outstanding invoices, and cash flow, requiring you to request updates from your service provider instead of accessing information on demand.

- Lengthy implementation process: Onboarding an outsourcing service can take weeks or months, requiring extensive documentation, training, and process mapping before going live.

- Reduced organizational knowledge: When AP functions move outside your company, your team loses familiarity with payment patterns, vendor preferences, and process nuances that inform better financial decisions.

- Obligations and switching costs: Long-term service agreements can lock you into arrangements that no longer serve your needs, and transitioning to a new provider or bringing functions back in-house is time-consuming and expensive.

Outsourcing accounts payable: How to decide is it fits your business

Outsourcing accounts payable makes the most sense for a specific subset of businesses:

- Large enterprises processing tens of thousands of invoices monthly across multiple countries and currencies may benefit from the specialized infrastructure and global reach that established outsourcing providers offer.

- Companies in highly regulated industries like healthcare or government contracting might require the compliance expertise that dedicated AP service providers bring.

- Businesses undergoing major transitions (mergers, acquisitions, or system overhauls) may also find temporary outsourcing valuable to maintain operations during periods of significant change.

For the vast majority of small to mid-sized businesses, outsourcing simply isn't the right choice when modern automation tools exist. If your primary concerns are reducing manual data entry, improving payment accuracy, maintaining better cash flow visibility, or scaling your AP processes as you grow, automating accounts payable processes can deliver these benefits without the drawbacks of outsourcing.

Solutions like Slash offer efficiency improvements without sacrificing control over your without sacrificing control over your finances, vendor relationships, or pricing transparency as your business scales.

Streamline your accounts payable processes with Slash

Whether you're a startup processing your first vendor payments or an established business managing hundreds of invoices monthly, Slash is designed to be accessible at any stage of your growth journey.

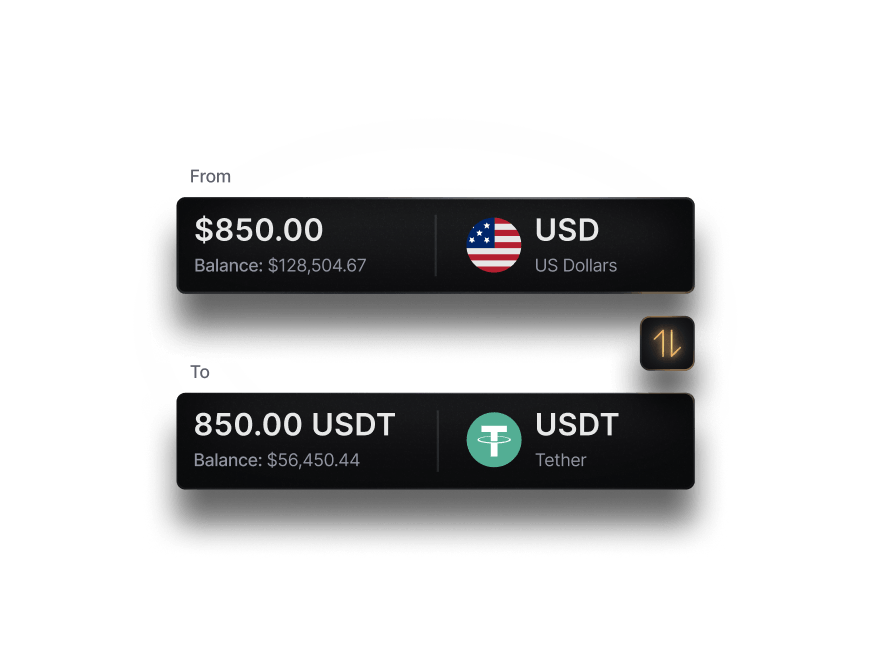

The Slash platform can automate accounts payable processes with features like scheduled payouts that ensure vendors are paid on time, every time. Comprehensive invoice management tools organize outstanding invoices by status so you can stay on top of every outstanding payment. With global payment capabilities spanning multiple currencies and payment rails, including native cryptocurrency support, Slash speeds up processing times while cutting transaction costs.⁴ With Slash, you can unlock the efficiency of outsourcing AP without surrendering control of your finances.

Beyond streamlining accounts payable, Slash offers a complete suite of financial management tools to support your business:

- Diverse payment methods: Send and receive payments in the way that works best for you and your suppliers, both domestically and globally. Slash supports global ACH and wire transfers via the SWIFT network to 180+ countries, real-time rails like RTP and FedNow, and cryptocurrency payments using USD-pegged stablecoins across eight supported blockchains.

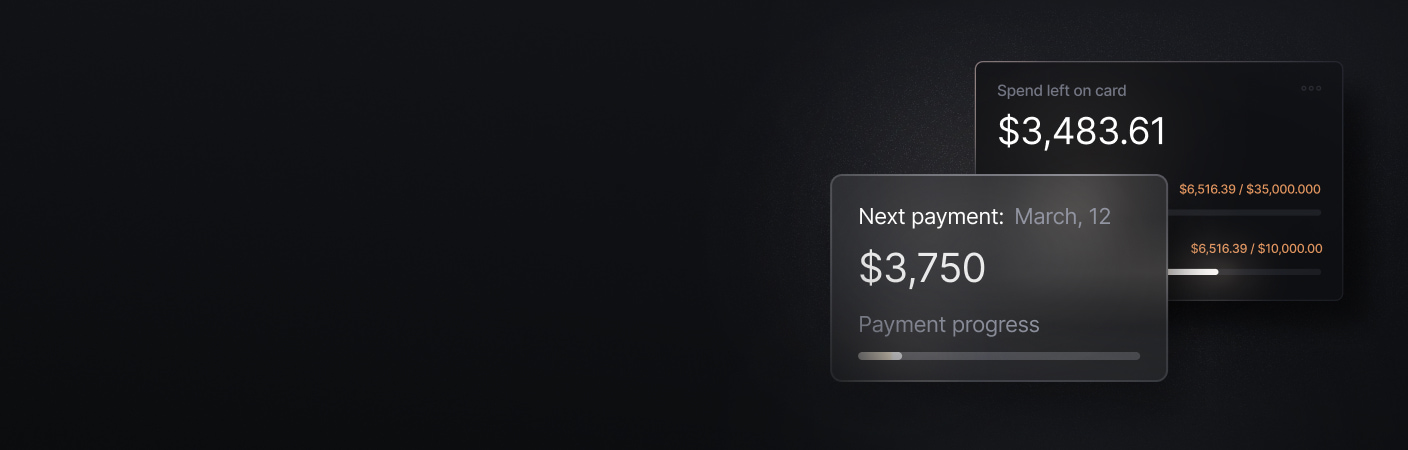

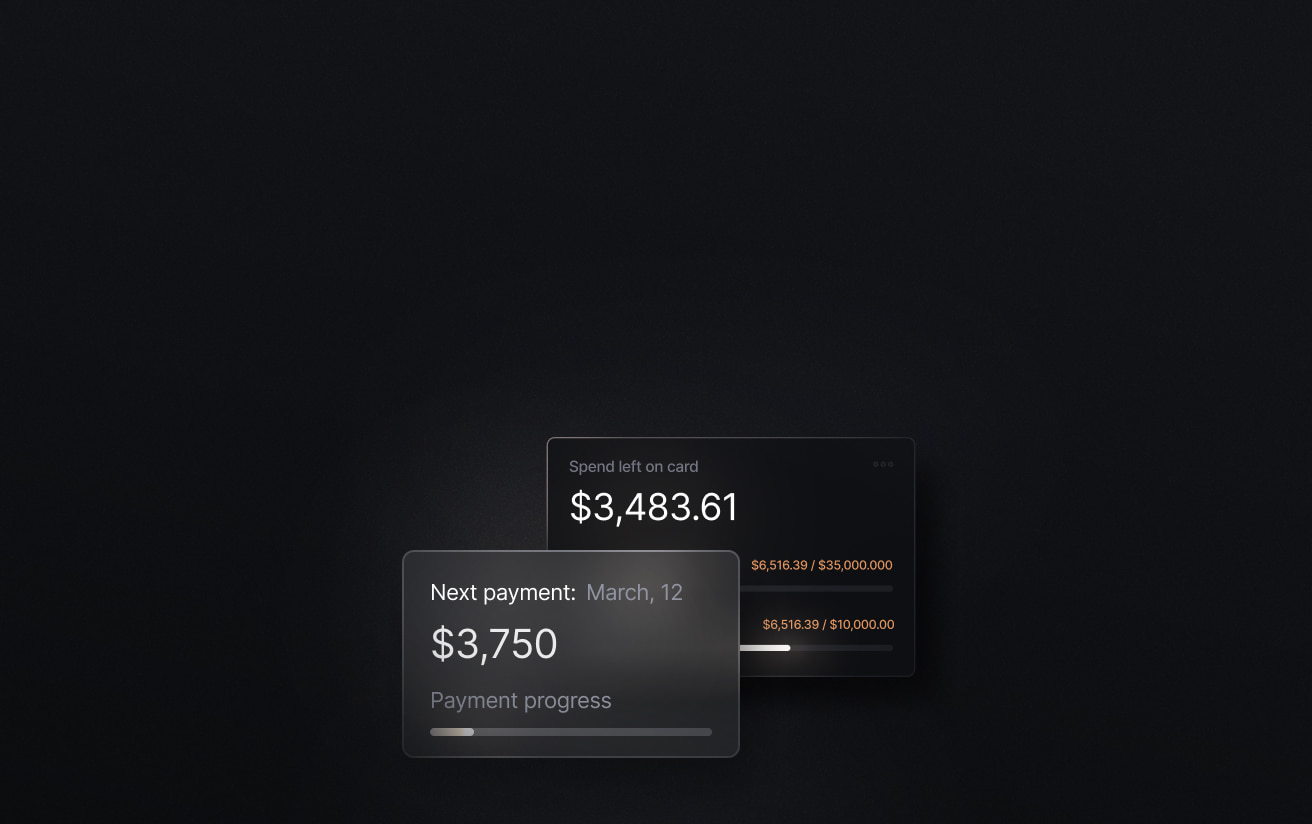

- Modern business banking tools: Schedule recurring payments, manage company spending with granular card controls, and access working capital to improve liquidity when needed.⁵ Create separate virtual business bank accounts to silo cash flows and improve visibility across different areas of your operations, with real-time analytics covering AP activity and cash flow across all payments and accounts.

- High-yield treasury: Put idle cash to work with treasury accounts backed by Morgan Stanley and BlackRock money market funds, earning up to 3.86% annualized yield.⁶

- Slash Visa Platinum Card: Earn up to 2% cash back across all company card spend; set spending rules by category, merchant, or team; and issue unlimited virtual cards for recurring vendor payments or controlled employee access.

- Accounting integrations: Sync transactions directly with QuickBooks to keep your books automatically up to date. Slash also connects via Plaid and supports data imports from tools like Xero, making it easy to integrate with existing accounting workflows.

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Frequently asked questions

How do AP automation tools integrate with other business systems?

AP automation tools integrate by syncing payment, invoice, and vendor data directly with your existing financial systems, reducing manual data entry and reconciliation work. Slash offers a two-way sync with QuickBooks and supports data imports from Xero, allowing businesses to fit AP automation into established accounting and banking workflows.

The Best QuickBooks Integrations to Automate Accounting

How do providers ensure compliance and reporting in accounts payable activities?

Accounts payable providers support compliance and reporting by enforcing approval workflows, maintaining audit trails, and standardizing invoice and payment processes. Slash builds these controls directly into our platform, giving teams the tools they need to maintain consistent reporting and centralized records needed for compliance and audit processes.