The 7 Best BILL Alternatives for Modern Financial Operations

There are two constants in business: you need to pay the people you owe, and you need to collect the money owed to you. Managing these processes—accounts payable (AP) and accounts receivable (AR)—used to be slow, manual, and full of opportunities for error. Today, management looks completely different. Modern platforms can automate routine tasks, accelerate payments, and give you real-time visibility into your business’s cash flow.

BILL, formerly known as Divvy, is one of the most recognizable tools in this space. Its user-friendly interface can help teams streamline invoice-to-pay workflows and stay organized around customer payments. For companies looking to tighten up their AP/AR process, it’s a strong place to start.

But BILL has its limits. Because it’s built so specifically around accounts payable and receivable, it doesn’t address many of the broader financial needs companies expect from a single platform. BILL lacks key features like built-in treasury tools, dynamic virtual accounts, and modern payment rails. And its corporate card program comes with restrictive rules and conflicting terms that often make earning and keeping rewards more trouble than it’s worth. When you factor in subscription costs that scale per user, the value gap becomes even harder to ignore. In short, BILL can feel expensive for what it leaves out.

In this guide, we’ll break down 7 of the best BILL alternatives. You’ll see how each platform compares, where they outperform or fall short, and which types of businesses they’re best suited for. You’ll also see how Slash stands out as a complete financial solution, with powerful card controls, a full business banking stack, and real-time cash flow analytics together in one platform.¹ And with invoicing features rolling out now, Slash will offer in-app AP/AR capabilities that can make your financial operations even more seamless.

Why businesses are looking for BILL alternatives

BILL does a solid job with accounts payable automation, but many companies may hit a point where they need more than invoice processing and basic payment capacity. As financial operations get more complex, BILL’s narrower feature set (along with some of its quirks) can start to present limitations. Here are the most common reasons teams may want to explore other options:

Limited payment diversity

BILL handles the basics like ACH, wires, and localized bank transfers, but that’s where coverage ends. There’s no support for real-time rails (RTP/FedNow) or crypto transfers. For domestic payments, access to real-time rails when you need to pay a supplier quickly can resolve urgent operational issues, strengthening supplier relationships and reducing friction in your workflows downstream.

For cross-border payments, crypto rails can be a faster, lower-cost alternative to traditional banking rails. Stablecoin transfers avoid excessive processing or FX fees, and payments settle almost instantly anywhere in the world. Slash provides access to both real-time and crypto payments, an important capability that most competitors don’t match.⁴

An underwhelming corporate card

The BILL Divvy card is an unusual mix between a prepaid card, a charge card, and a traditional credit card. Cardholders can choose a billing cycle (weekly, semi-monthly, or monthly), and each schedule comes with different rewards-earning potentials. However, even though the card draws from a line of credit, employees must manually request funds from administrators through the mobile app, similar to how prepaid cards work.

This structure lags behind competitors like Slash, which allows admins to set automated spending rules for teams and individuals instead of approving ad-hoc requests.

A rewards program that’s not very rewarding

BILL’s points-based rewards program may seem competitive at first, but its terms can make it unnecessarily difficult to generate meaningful value. Some of the biggest limitations include:

- A 12-month waiting period for new accounts before you can redeem any rewards.

- A monthly 30% credit-line spend requirement to keep the points you earned; miss it, and your rewards vanish.

- Slow payouts, with cashback sometimes taking up to 15 business days via ACH or mailed checks.

- Conflicting rules, where the highest point multipliers (up to 7x) require daily or weekly billing cycles. Yet, choosing the shortest billing cycle can make the monthly 30% spend requirement difficult to satisfy, putting cardholders at greater risk of losing the rewards they generated.

Even when you do earn points, the value is low: each point is worth just $0.0052, or about half a cent. That low redemption rate can be far less valuable than what you’d get from a flat-rate cashback card like the Slash Platinum Card, which earns up to 2% on purchases. For a detailed look at how points-based programs can dilute rewards value, see our Brex alternatives guide.

Incomplete financial management at a premium price

BILL is ultimately an AP/AR management tool, not a full financial operating system. It lacks modern treasury infrastructure and high-yield savings accounts; it doesn’t provide virtual accounts to compartmentalize cash flows; and it offers no dedicated financing product beyond the credit tied to the Divvy card. Despite this limited scope, BILL’s pricing starts at $45 per user per month and can reach $89 per user, which can add up quickly for growing teams. Slash, by contrast, gives your business access to the full functionality of the platform for free. Or, pay $25 per month for your entire team to unlock 2% cashback on card spend and unlimited free domestic transfers.

What are the best alternatives to BILL?

Perhaps worst of all for BILL is that its specialized functionality is not entirely unique in the fintech landscape anymore. Many platforms offer accounts payable or accounts receivables capabilities now, alongside more competitive rewards or complete financial management tools. Here are 8 of the strongest competitors to BILL today, where we highlight their key benefits and possible drawbacks:

Slash

Slash is rolling out its invoicing tool soon. You’ll be able to generate invoices using customer data already stored in your Slash dashboard, track payment status through an intuitive management view, and send or receive invoice-related payments via crypto. And invoicing is just one part of what makes Slash a stronger all-in-one financial platform.

Additional features that outperform BILL include:

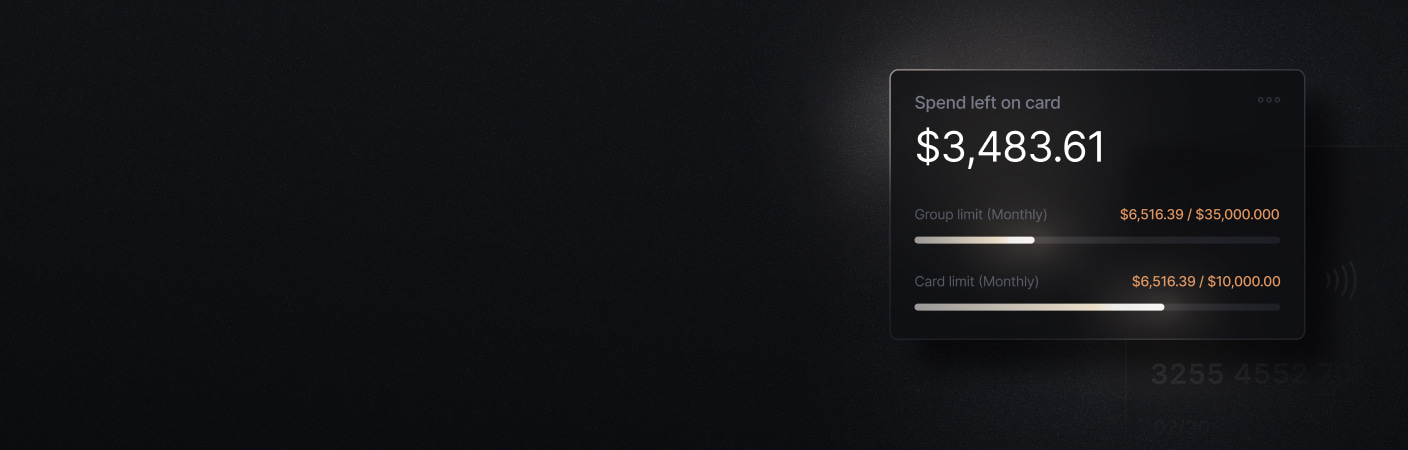

- Slash Visa® Platinum Card: A corporate charge card that earns up to 2% cashback on spending. Create card groups for each team, set custom spending rules at the team or individual level, and access flexible limits that scale as your business grows.

- Working Capital financing: Access a line of credit tailored to your business needs. Draw funds whenever you need a short-term liquidity boost and choose repayment terms of 30, 60, or 90 days.⁵

- Native crypto support: Send and receive USD-pegged stablecoins directly in-app across 8 different supported blockchains. Utilize built-in on/off ramps to seamlessly convert between cash and stablecoins like USDC, USDT, and USDSL.

- Integrations: Streamline your accounting with deep integrations into QuickBooks and Xero. With QuickBooks Online, you can speed up reconciliation and month-end close through clean exports of card and account activity. And with Plaid, you can pull in third-party payment data for unified visibility across your entire financial landscape.

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Tipalti

Tipalti, like BILL, is primarily an accounts payable platform rather than a full-stack financial solution. It’s built with mid-market and enterprise companies in mind, while BILL tends to be more accessible for small and medium-sized businesses. While Tipalti does excel at AP automation, it shares many of BILL’s limitations: high pricing, unclear card terms, and minimal built-in banking functionality.

Some of Tipalti’s key features include:

- AP management: OCR invoice capture, automated approval routing, and streamlined payment execution powered by Tipalti AI. However, its AR capabilities are far more limited than what you’d find in BILL or what Slash will soon include with its invoicing tool.

- Tipalti Card: The Tipalti Card is positioned as a rewards-earning tool for vendor payments rather than a card built for everyday employee spend control. While it may be useful for larger teams already using Tipalti for AP workflows, the card’s rewards terms are not disclosed, making it difficult to assess the true value it delivers.

- Multi-currency and global payments: Tipalti can send payments globally in multiple different fiat currencies, and streamline supplier onboarding with a multi-language vendor portal. Payments can be sent via ACH, domestic and international wire; no support for real-time or crypto payments.

Downsides: Tipalti ranges in price from $99-$199 per month, reflecting its enterprise-focused market position. Paywalled behind its more expensive tier are two important capabilities—global payments and multi-entity support—which competitors like Slash offer on the free plan. Tipalti also lacks access to real-time rails or crypto support. The Tipalti card has opaque terms, with vague ‘cash rebate’ rewards and limited functionality compared to other cards on this list.

Stampli

Stampli is an AP management and a procure-to-pay platform, meaning it supports companies from the moment they source products and services through to paying the final invoice. It also offers AI-powered AP tools and a corporate card that syncs with the platform. However, its non-AP features lag behind what competitors provide.

Stampli’s key features include:

- Procure-to-pay: Procurement is the strategic sourcing and acquisition of goods, services, and materials for your business. Stampli says it streamlines this process through tight integration with AP, giving teams better visibility and control over spending requests. But compared with more robust, enterprise-grade procurement tools, Stampli lacks an in-app sourcing and purchasing dashboard, which can limit the ability to negotiate savings or manage compliance at scale.

- AP management: Stampli’s AP automation is comparable to other dedicated AP tools on this list. Its AI-powered invoicing features include OCR data extraction, two- and three-way matching, and automated approval routing that simplifies invoice processing.

- Cards and Direct Pay: The Stampli Card earns a low 1% cashback, putting it far behind other rewards programs in this guide. Its payment functionality is also limited: Stampli’s “Direct Pay” relies on integrations with your existing bank rather than offering native payment rails. As a result, you’re still bound by your bank’s processing times, fees, and global transfer limitations.

Downsides: Because Stampli relies heavily on third-party financial infrastructure for payments and procurement, it isn’t as all-in-one as it appears. Its business card offers minimal rewards and limited flexibility, making it a weaker fit for teams that want consolidated AP management and expense tools in one platform.

Spendesk

Spendesk and Stampli are surprisingly similar. Both platforms address AP, expense management, and procurement workflows. Both lean on AI to streamline financial processes. And both fall short when it comes to corporate card programs and payment infrastructure. The biggest difference is that Spendesk is built primarily for the European market, which means users outside the UK and EU may see reduced functionality.

Some of Spendesk’s key features are:

- Procurement and AP: Like Stampli, Spendesk doesn’t offer a true procurement sourcing dashboard. Instead, it focuses on automating approvals, adding visibility, and using analytics to optimize procurement workflows. Its AP tools include familiar OCR invoice capture and invoice management features comparable to others on this list.

- Prepaid cards: Spendesk issues prepaid company cards—not credit or charge cards—which require manual top-ups. To its credit, Spendesk does tailor its card toward employee spend management rather than bill pay. However, the prepaid structure removes flexibility, and the platform offers no rewards program at all, making the card less valuable than competitors.

- Expense management and accounting: Spendesk uses Wise’s payment infrastructure to send payments, supporting around 30 currencies with relatively fast settlement times. But it doesn’t support direct bank transfers or crypto rails, limiting payment options compared to more modern platforms. It also is limited in one major area: Spendesk only recently enabled QuickBooks sync, and it’s available only to U.S. customers who make a special request to the Spendesk team.

Downsides: Spendesk is best suited for European businesses, where it receives the most complete feature set. Overall, it’s one of the more limited options on this list—missing rewards, native payment rails, credit products, and other capabilities offered by more full-featured platforms. Its strongest use cases are invoice processing and lighter procurement workflows, but it would struggle to function as a comprehensive financial solution.

Melio

Melio is one of the most accessible bill payment and invoicing tools for small businesses. Its interface is simple to navigate, setup is quick, and the platform focuses on helping teams move money and manage vendor relationships with minimal friction. In total, it is one of the stronger BILL alternatives for small businesses, thanks to its intuitive interface, contractor onboarding, and competitive faster-payment options; however, it’s more expensive than alternatives with comparable functionality.

Features of Melio include:

- Contractor onboarding: A standout feature is the ability to collect contractor W-9s and sync 1099 data directly to your accounting platform. This makes year-end tax prep significantly easier for businesses that rely heavily on contractors.

- QuickBooks and Xero integrations: Melio plugs directly into the two most popular small-business accounting platforms, ensuring bills, payments, and invoice data stay synced without manual entry.

- “Instant” transfers: Melio offers an accelerated ACH option marketed as “instant,” but it’s not a true real-time payment rail. Transfers still rely on sped-up ACH, charge a 1% fee, and are only available in certain circumstances. By contrast, Slash provides unlimited, dedicated real-time rails—available 24/7/365—for free with its Pro plan.

Downsides: Melio lacks broader business banking and treasury capabilities, access to real-time payment networks, and native crypto support—areas where solutions like Slash provide a more comprehensive toolset. Also, Melio structures its pricing around access to features and caps how many bank transfers you can execute per month. Its free plan only permits 5 ACH transfers per month with very limited functionality; to get the most from Melio, users may want to upgrade to the unlimited plan, which is $80/month.

Brex

Brex is a broader financial management and banking platform rather than a dedicated AP or procurement tool. Like Slash, it brings together virtual accounts, rewards-earning corporate cards, invoicing tools, and treasury features to create a more unified financial infrastructure at a reasonable price.6 However, Brex is significantly less accessible for certain business types compared with competitors like Slash, and it has some notable drawbacks in both rewards value and payment capabilities.

Brex’s features include:

- Brex Card: Brex offers a corporate charge card with points-based rewards, but the effective cash value of those points often falls short of what you’d earn with a simple flat-rate cashback card. For a detailed breakdown, see our Brex alternatives guide.

- Invoicing and accounting: Brex provides invoicing tools and integrations with accounting systems like QuickBooks and Xero. Like Slash, Brex pairs these tools with native business accounts and multiple banking rails, offering more flexibility than platforms that rely on limited or third-party payment infrastructure.

- Travel and expense management: One of Brex’s standout features is its built-in travel booking experience, which ties directly into the Brex rewards program. Teams can book flights, hotels, and transportation in-app while maintaining compliance and earning boosted rewards.

Downsides: Brex still lacks some modern payment rails; there’s no crypto support yet and no access to real-time payment rails. Brex’s rewards points can deliver very limited cash value compared to a straightforward cashback rewards card. And, Brex is fairly inaccessible for SMBs, as applicants are expected to have significant venture capital backing or at least $1m in annual revenue to qualify.

What factors should I consider when choosing a BILL alternative?

Every platform on this list includes (or will soon include) OCR technology for invoice scanning and processing, which are core functions for AP and AR management. So when you’re evaluating BILL alternatives, it’s best to look past the shared basics and focus on the details that actually shape day-to-day operations: how each platform handles payment processing, reduces manual data entry, automates workflows, and integrates with your existing systems. Here are some important criteria to keep in mind:

Pricing and cost structure

Pricing is often the biggest surprise with AP/AR tools. Because many of these platforms compete with enterprise software, their subscription models can feel misaligned with the value they provide. BILL’s per-user fees can add up quickly, Tipalti runs between $99 and $199 per month, and Melio’s full functionality costs around $80 per month. Slash, on the other hand, provides its full platform for free, and you can unlock unlimited free domestic transfers plus industry-leading 2% cashback for just $25 per month.

Accounting software and ERP integrations

Any AP solution that handles payments should sync seamlessly with leading accounting systems like QuickBooks and Xero. ERP integrations such as NetSuite or Sage Intacct can add even more flexibility for larger companies. Most platforms meet these standards, though there are exceptions; for instance, Spendesk has limited QuickBooks connectivity (U.S. customers only) and requires a manual request to activate the integration, which can introduce friction into your workflow.

Payment processing options

Access to traditional banking rails is essential. Services like Spendesk, which relied on Wise’s P2P infrastructure, or Stampli, which outsources its payment capabilities, can be much more limited than a unified AP and payments software. Real-time payments are still rare; Melio offers a faster ACH option, while Slash gives you dedicated real-time rails available 24/7, 365 days a year. Slash also supports global payments via SWIFT to more than 180 countries and offers native crypto transfers for near-instant, low-fee international payments. Being able to pay directly from your Slash business account without shuffling funds between banks adds another layer of convenience.

Scalability and ease of use

Some platforms are approachable for small teams but quickly hit their ceiling; Spendesk and Stampli fall into this category with limited procurement depth and modest rewards programs. On the other end of the spectrum, Coupa delivers enterprise functionality but is far too complex and expensive for most SMBs. The ideal solution offers an intuitive experience that grows with you, giving you multi-entity support, virtual accounts, configurable card controls, and a modern interface without unnecessary bloat. Slash fits this middle ground well.

Corporate card features and rewards

Don’t get swindled by points-based rewards programs. Even with optimized spending that hits category multipliers, many points-based systems like BILL’s and Brex’s end up with a lower effective cash value than a flat-rate cashback card. Slash delivers the best cashback of the bunch, earning up to 2% on card spending. Plus, that 2% is more straightforward than competitors, as it doesn’t require credit utilization thresholds to keep the rewards you earn.

Start optimizing your business banking today with Slash

Some tools improve AP workflows but lack certain payment rails. Others offer procurement features but sacrifice ease of use. Many introduce rigid rewards programs, costly pricing models, or limited international capabilities. Slash doesn’t force you to choose between these trade-offs, instead unifying each of the industry-leading features together into one software.

With Slash, your team gets a complete business banking experience: corporate cards that earn up to 2% cashback, virtual accounts for separating cash flows, BlackRock and Morgan Stanley high-yield treasury accounts that earn up to 4.1%, powerful employee spend controls, and more.⁶

With our upcoming invoicing tools, you will be able to manage AP and AR directly in-app by streamlining invoice creation and customer payment collection. And, our payment diversity is better than any alternative, with domestic real-time payments, wire transfers to more than 180 countries, and native crypto support across 8 supported blockchains.

Slash also includes features that go far beyond what BILL or its peers offer. The Slash Global USD Account gives non-U.S. businesses direct access to USD banking infrastructure and crypto payments without needing a U.S. LLC.³ For tech-forward teams, the Slash API unlocks even more possibilities; enable real-time treasury movements into internal systems or build custom approval workflows tailored to your business logic. Finance teams can connect Slash directly to their internal tools for reconciliation, payment orchestration, auto-generated vendor payouts, crypto on/off-ramping, and more.

Don’t get stuck with an AP tool pretending to be an all-in-one solution. Slash gives you a true banking-first platform that outpaces dedicated AP software.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

Frequently asked questions

How do transaction processing times compare across different alternatives?

Processing speeds can vary widely across alternatives. Some platforms rely solely on checks, ACH and wire transfers, which may introduce delays during processing. Some offer accelerated ACH, but few match Slash’s support for real-time rails or native stablecoin transfers.

How scalable are these alternatives as a business grows?

Scalability depends on how much a platform can support increasing transaction volume, more complex approval workflows, multi-entity structures, and diverse payment needs. Tools built purely for AP tend to cap out quickly, while enterprise suites can become overly complex or expensive for mid-market teams. Slash, however, is designed to scale with your operations no matter your business’s growth stage.