What is a negative card balance?

We’ve all checked our business credit card’s balance just to discover a higher number than we were expecting. It’s easy to forget about past expenses, especially when multiple employees have access to the business account. But have you ever logged in to your credit card account and seen a negative number?

Having a negative balance on your business card doesn’t necessarily mean you’ve done something wrong or that there’s a cause for concern. If you’re running a small business with tight capital, it can actually be a good thing, as your card issuer is now the one that owes you money. However, negative balances that go unchecked can create accounting and tax compliance issues for businesses with more complex operations. In short: a negative balance means you’ve got more funds in your account than you expected, but it can also be a symptom of disorganized finances.

There are a few things that can cause a negative balance, such as unexpected refunds and overpayments. In this guide, we’ll discuss all the ways this can occur, what to do to resolve it, and how to make sure it doesn’t keep happening. We’ll also compare the different payment structures of corporate credit cards and charge cards before taking a look at how the Slash corporate charge card can help you monitor your finances, avoid surprise credit balances, and more.¹

What Are the Common Causes of Negative Card Balances?

As you use your business credit card, you accrue owed payments over time, reflecting in a positive dollar amount on your balance sheet. A negative dollar amount means the opposite has happened, and your credit card issuer is supposed to give money back to you. Here are some ways this can end up happening:

- Refund: If a purchase was made on the credit card, and the item was returned for a full refund, that dollar amount would flow back into your account as a negative charge.

- Statement credit: Some credit cards that offer cash back reward it to you as a statement credit, which takes owed money off your balance.

- Overpaying your balance: Depending on how you time your credit card repayments or if you set a consistent amount to pay off, you could end up paying your issuer more than you owe, resulting in a negative balance.

- Disputed charge reversal or fraud: If an employee used the company credit card to make an unauthorized charge, you may have disputed it and had the funds return to your account.

- Fee reversals: Many credit card companies are flexible for their long-time customers, and will waive a late fee if it’s a first time offense. If you paid off a balance with a hefty late fee and got it reversed, it will result in a negative dollar amount.

It’s important to note that these scenarios don’t automatically result in a negative balance. Your business card balance will only reach the negative if your balance was around zero when you received money back from your card issuer. You may have gone through several instances of refunds and disputed charges that you never thought twice about because it simply lowered your positive balance.

Business-specific Scenarios

Here are a few real-world examples of ways business credit cards can end up with a negative balance:

- Several employees were planning on flying to a networking event, but one person’s flight was cancelled due to weather. Their ticket gets refunded, and that money returns to the account.

- You’ve been paying your credit debt off with an $1000 payment each month, and you finally catch up to what you owe without realizing it, putting $1000 on an $800 balance.

- You spend a lot of money in a month and accrue lots of cashback rewards, then pay off the bill before the rewards officially arrive. If your issuer pays it back as a statement credit, you’ll have some funds in the negative.

- An employee makes an unauthorized restaurant purchase of $90 on a weekend, and you dispute the charge. Whenever the dispute is processed, that dollar amount will come back.

What Happens When You Have a Negative Balance?

Carrying a negative balance doesn’t affect your account standing in any way, nor does it hurt your credit score. If anything, there’s a chance it helps your credit score – many credit card companies track your credit utilization ratio, which measures how much of your allotted credit you use each cycle. Using 10-30% of your monthly limit has a positive impact on your credit score, and you’ll be close to that range after resolving your negative balance.

Holding on to a negative balance for an extended period is acceptable, if you so choose. The dollar amount will simply remain as a statement credit, and isn’t affected by interest in one direction or the other.

How Long Can You Keep a Negative Balance?

The length of time you’re allowed to hold on to a negative balance varies based on your card issuer’s policies. It tends to be between six months and two years, but it’s smart to check with them first. If and when you do reach that limit, an automatic refund trigger will occur and the money will be returned to your account, setting your balance back to $0.00.

That being said, there aren’t too many good reasons your business credit card should remain in the negatives for an extended period of time. Unless your account received a massive refund from a purchase that fell through, a consistently negative balance is a sign your account is either dormant or going completely unwatched.

If you’re looking for a better way to keep track of your company’s finances, you might want to look into a corporate charge card.

Credit Cards vs Charge Cards: Key Differences

Credit cards and charge cards both let you borrow funds to make purchases. Their main difference is in their required pay cycles: credit cards allow users to accrue interest and debt over long periods of time, while charge cards don’t carry interest and must be paid in full at the end of each month.

With a charge card, you’ll never hold on to a negative balance for an extended period because it will always be spotted and resolved in a month or less. This means you get to avoid the growing debt and unchecked purchases that can come with standard credit cards. However, since you’ll be paying off the total each month, accidental double payments or overpayments can still occur, resulting in negative balances.

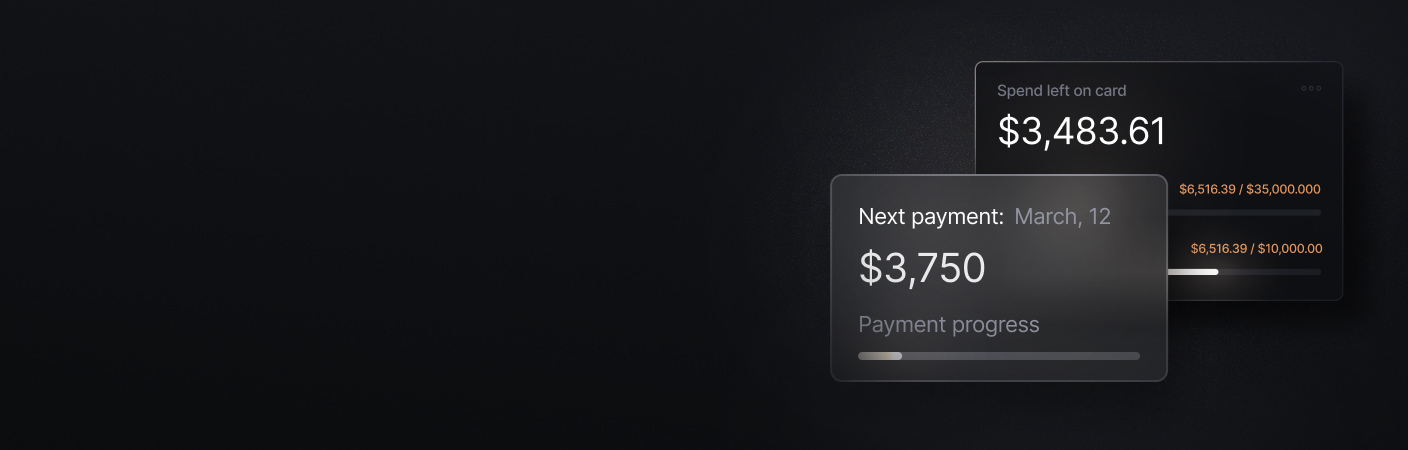

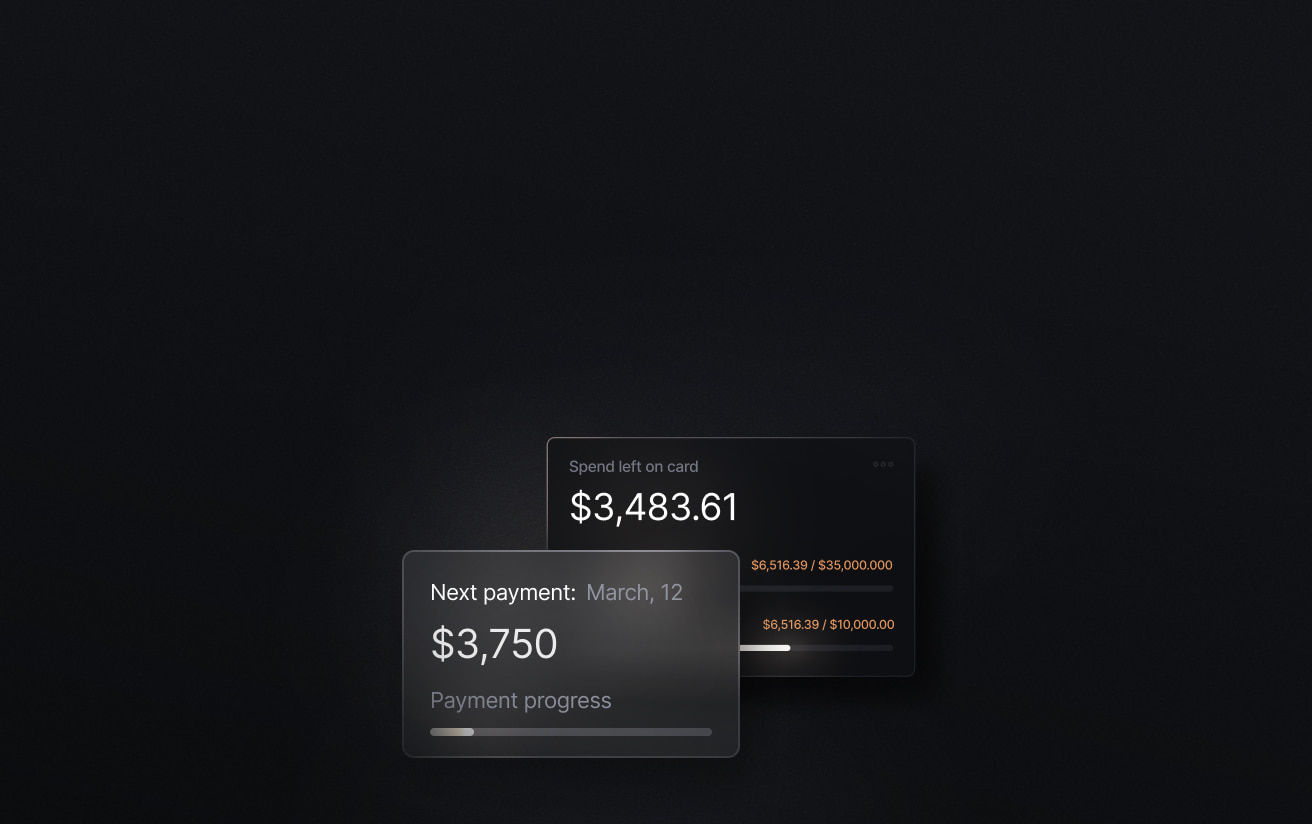

Charge cards also encourage better expense tracking, as a month’s worth of charges are reviewed each cycle and negative charges can be spotted right away. The Slash Visa Platinum card integrates its corporate charge card directly into our business banking dashboard, which unlocks a deeper level of transaction monitoring and spending limits. It also offers up to 2% cashback, which is a higher rate than many competitors.

Credit cards do give account holders more flexibility, as the lack of a monthly deadline enables a company with tight margins to use extra capital. However, an overreliance on credit cards leads to debt, high interest, and poor credit scores. The choice between the two cards can depend on what financial situation your company is in and how you’d like to manage your spending.

Ways to Resolve a Negative Card Balance

Here are a few different avenues you can take to wipe away your negative balance:

- Keep spending like you usually would. If you have a -$50 balance and spend $160 on a team dinner, your balance will go back up to $110.

- Request a refund check or direct deposit in order to return the money to your account right away. To do this, contact customer service with your account details and spending history in hand. Under the Truth in Lending Act, issuers must process your request in seven business days.

- If you have a balance transfer credit card, you can actually take your negative balance and transfer it over to a card with a positive balance. Sending a -$100 balance over to a card with a $400 balance would result in a $300 balance.

- You can just be patient! As mentioned before, an automatic refund will eventually be triggered to send the money back to you.

Best Practices for Preventing Negative Balances

Consistently reviewing and tracking your cash flow is the smartest way to avoid dealing with negative balances. Review statements before making returns, set up account alerts for credits received, and check your current balance before making large, flat payments.

While you can’t necessarily avoid refunds and cancelled purchases, you can mitigate some of the issues that create negative balances. The Slash charge card provides granular controls and spending guardrails, ensuring that employee purchases can only come from approved vendors. This means that unauthorized purchases are rare, and those that do occur can be immediately addressed thanks to real-time transaction monitoring.

Business Account Management Tips

It’s difficult to keep your credit card balance in check when you’re not managing your spending efficiently from the top down. A good start is to establish a robust expense tracking system. Slash’s expense tracking software supports automated data entry and expense categorization so you can accurately track company-wide expenses. Our tools also allow you to track ACH, wire, and crypto payments as they process.⁴

In addition, you’ll be able to stop accidental overpayments before they happen with our system’s real-time balance monitoring. When it comes to refunds and item returns, on the other hand, establishing clear procedures and emphasizing communication among your team members is your best bet.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

Impact on Business Cash Flow and Accounting

There are a few interesting effects a negative balance may have on your company’s bookkeeping. On your general ledger, a negative balance is technically an asset rather than a liability. Because credit card balances are almost always labeled as liabilities, this may create confusion in your accounting system. It can also create reconciliation challenges; the negative balance can end up mistakenly recorded as a payable rather than a receivable.

Tax deductions can also be affected. For instance, if a business expense item like a printer is purchased and returned, it can be erased in your credit card account but remain present among your recorded tax deductions. This is where communication and clear procedures really help.

When to Contact Your Card Issuer

Most negative balances are nothing to worry about, but there are occasions when that negative number could actually be a reason to contact your credit card company. Bugs do happen on occasion – if you have a balance that looks like -$4,294,967,295, that’s probably an integer overflow glitch, not an unbelievable employee spending spree.

You may also reach out to them if a disputed payment hasn’t been returned in around 7 business days, as either your dispute was denied or something went wrong on their end. It’s best to familiarize yourself with their refund policies before ending up in a situation with disputes and extra statement credits.

Take Control of Business Expenses With the Slash Corporate Charge Card

The Slash Visa Platinum Card gives you the power to fix negative balances and customize employee spending habits. Our configurable spending limits, category restrictions, and real-time payment monitoring enable you to take charge of your business’ cash flow and reconcile each transaction at the end of the month. The Slash card also comes with up to 2% cash back on every business purchase, earning you extra capital that you can reinvest as your company scales.

Each card – physical and virtual – is accessible on the dashboard of our business banking platform. This platform comes with a full suite of financial tools, including:

- Powerful integrations with accounting platforms like Quickbooks that allow you to streamline your month-end close and align your card and payment data

- Diverse payment options such as global ACH, domestic wires, and international SWIFT transfers

- Native crypto support that supports stablecoins such as USDC and USDT, unlocking fast, low-cost methods of moving funds

- Working capital financing that lets you choose between 30, 60, or 90 day repayment terms⁵

The Slash business banking platform can completely transform your organization’s financial toolset. Addressing your unexpected negative card balance is only the start.

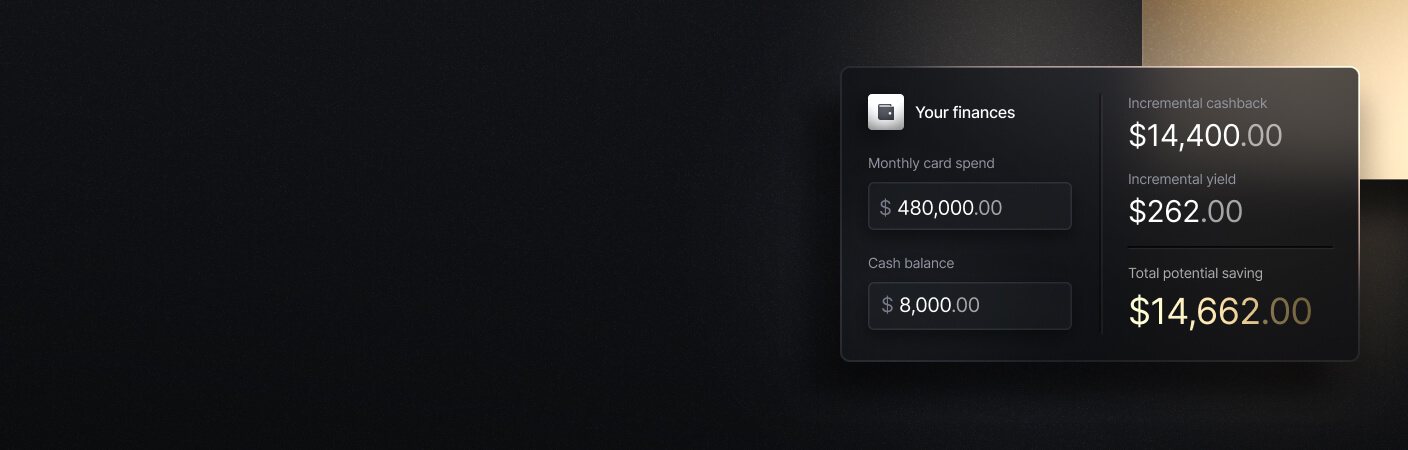

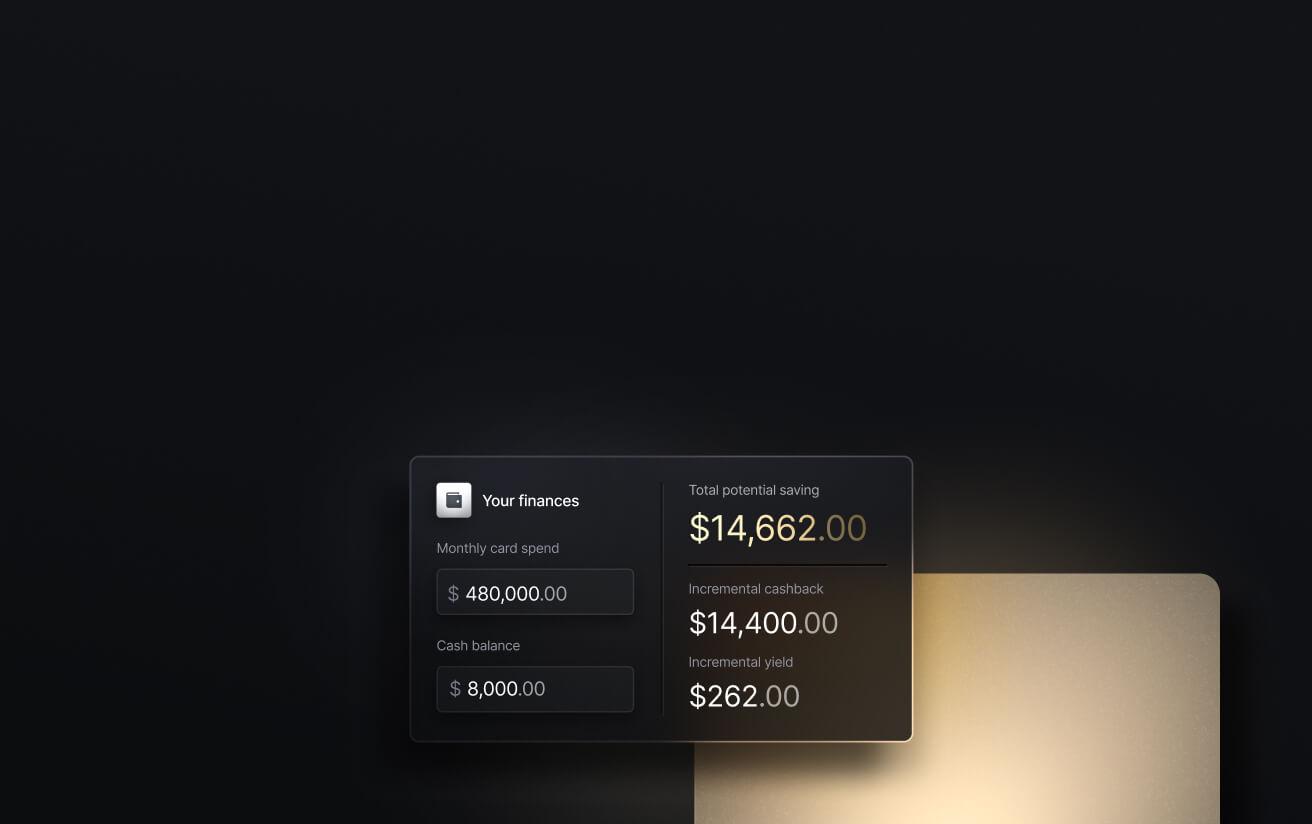

See the ROI behind your spend

Use this calculator to understand impact, then manage and track it all in Slash.

Frequently asked questions

Can I get cash from a negative card balance?

When your card company refunds you your money, it can come in the form of a check, which you can quickly cash. That’s the closest you can get to receiving cold, hard cash from point A to point B.

What if my business needs the money immediately?

Get in touch with your card company as soon as possible and ask them if there are options available for expedited refunds or alternative solutions. That being said, your company must be in a curious financial situation if it needs their negative balance to be turned into cash immediately while simultaneously having a full line of credit to work with.