How to Build a Credit Card Policy for Your Employees

A corporate credit card program is only as good as the rules that govern it. With a tight corporate credit card policy, business expenses are consistent and employees get to enjoy perks on the side. Without effective rules, however, these cards can become a source of confusion, overspending, misuse, and even financial risk.

A well-crafted corporate credit card policy protects company funds and empowers employees to make timely, compliant purchases. Developing that policy is a process that must be comprehensive and precise, leaving no room for wrongdoing. Even with clearly outlined rules, it can be a challenge to ensure guidelines are followed in a scaling, multi-level workplace.

In this guide, you’ll learn the essential components of an effective corporate card policy, see real-world examples, explore best practices for implementation, and gain a practical template to simplify adoption. We’ll also discuss how Slash’s corporate card platform offers granular spending controls, merchant restrictions, automated categorization, and detailed visibility into transactions, giving finance teams the tools to monitor compliance and reduce unauthorized charges.¹

What Is a Company Credit Card Policy?

A company credit card policy is a formal document establishing rules and procedures for company-issued credit cards. It defines approved expense categories, spending limits, documentation requirements, consequences for violations, and which employees receive cards. Your policy may also include reimbursement steps that should be taken when an employee accidentally uses their own personal credit card on a business expense meant for the corporate card. These guidelines help to keep spending consistent and can increase overall financial control.

Allowing employees to wield corporate cards without a policy opens your organization up to the following risks:

- Unauthorized spending: A lack of clear limits can lead to repeated purchases that fall outside the scope of business expenses.

- Accounting headaches: Poor documentation and erratic corporate card use creates reconciliation challenges that lead to inaccurate reporting.

- Tax complications: When business purchases are mixed with personal purchases on expense reports, you’ll miss deduction opportunities and the IRS may flag your expenses.

- Cash flow uncertainty: Uncontrolled spending leads to an inconsistent cash flow that prevents accurate forecasting.

- Confusing approvals: You can try to pass employee purchases through the approval process, but without spending limits and pre-established categories, you may struggle to sort through them all.

Enforcing a comprehensive corporate card policy can be made easier with a deep level of oversight and control. The Slash business banking platform provides real-time spend insights and sophisticated controls purpose-built to prevent company credit card misuse. With the Slash Visa® Platinum Card, you can set granular spending limits by employee, department, or merchant category. You’ll also receive real-time alerts when suspicious transactions occur, enabling proactive intervention.

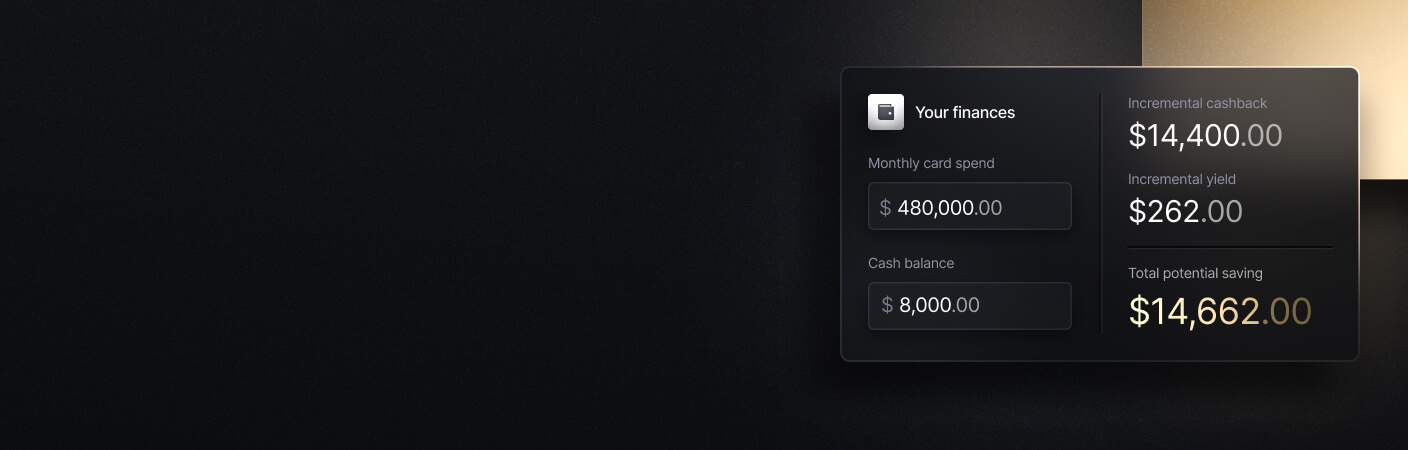

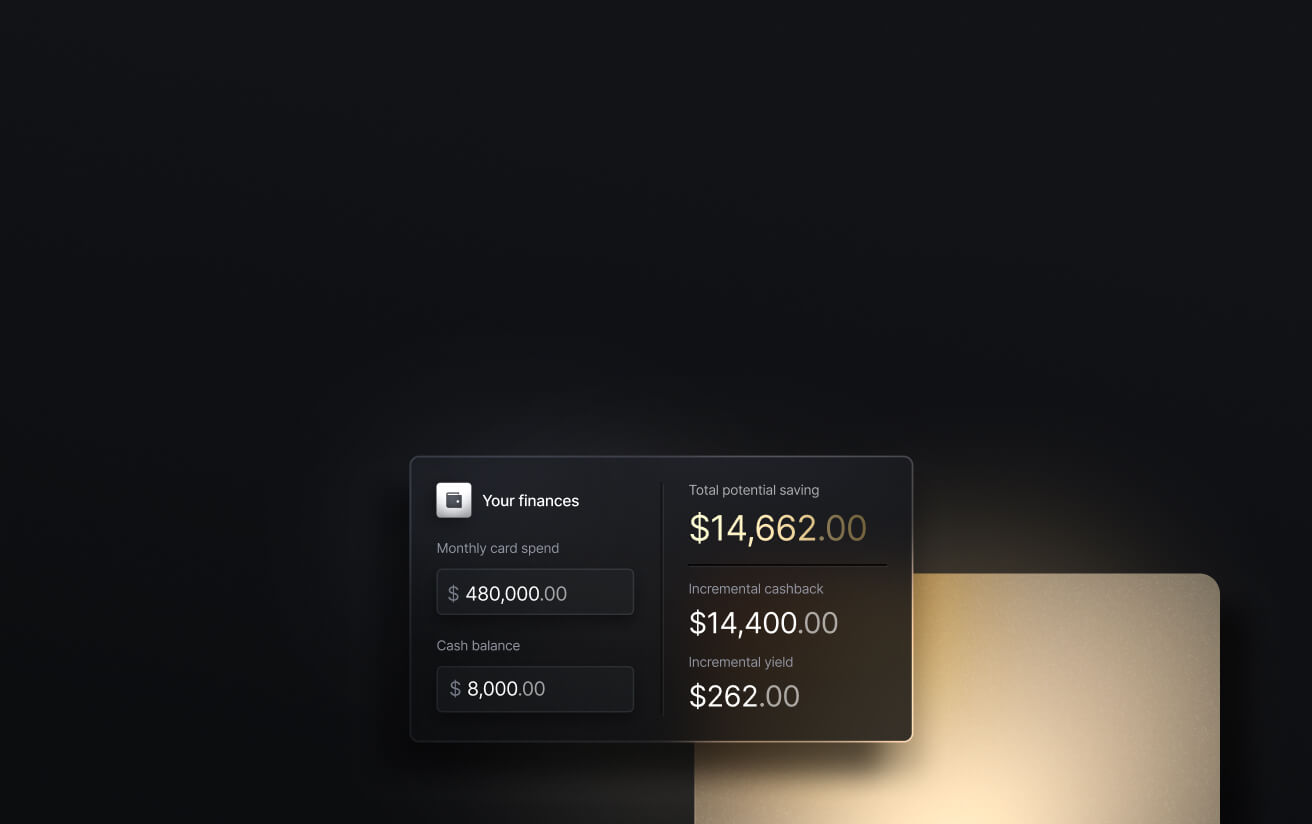

See the ROI behind your spend

Use this calculator to understand impact, then manage and track it all in Slash.

Best Practices for Creating a Compliant and Clear Policy

Consistency and Clarity in Language

The goal of your written company credit card policy is to communicate the guidelines as clearly and unequivocally as possible. Write in straightforward language using consistent terms throughout, and format for easy reference with headings, bullet points, and tables for complex figures like spending limits.

Simple, Enforceable Guidelines

There’s a balance to aim for when it comes to creating corporate card guidelines: you don’t want to be so broad that employees can interpret rules differently, but you also don’t want to be so specific that everyone gets confused when trying to recall details. Clarity and simplicity is best, as rules like "all meals require itemized receipts" beat complex thresholds that change based on amount, location, and attendees.

Automated Alerts and Spend Caps

Using technology to automatically enforce rules saves your company time and reduces employee burden. The Slash Visa® Platinum Card pairs with the Slash dashboard to unlock real-time transaction monitoring, category restrictions, and customizable credit limits. You can also configure automated alerts to be sent out when a purchase is particularly large or from an unknown vendor.

Regular Training and Employee Communication

Provide comprehensive initial training that covers all policy elements with real-world examples and scenarios. You’ll also want to conduct annual refreshers focusing on common issues, recent changes, and recurring compliance problems, as training shouldn’t be a one-and-done.

Periodic Audits and Reconciliation

Whether monthly or quarterly, you should conduct cyclical expense reviews examining all transactions. Verify that documentation is present, expenses are properly categorized, and spending aligns with policy. Doing this also allows you to see deeper than you typically can; a cardholder’s purchases may all be technically policy-compliant, but seeing them laid out over months could reveal a pattern that might raise a couple questions.

Key Components of an Effective Corporate Card Policy

Clear Eligibility and Issuance Rules

Define who receives cards based on role, function, or business need. You may develop different levels of access, where some employees are given cards with higher limits and broader expense categories, while others are more restricted. Slash enables you to issue unlimited virtual cards with preset spending rules that can be tracked on one centralized dashboard, along with physical cards for your team.

Approved and Prohibited Expenses

Provide specific lists with clear examples to eliminate ambiguity. Approved purchases can include expenses like business travel and office equipment, while prohibited expenses can include things like personal entertainment and family related expenses. With Slash’s ability to restrict purchases to specific merchants and categories, you won’t have to worry about out-of-policy expenses, as they won’t be enabled to begin with.

It’s also smart to address some gray areas before they arise, like impromptu snacks for the office or gifts for departing employees.

Spending Limits and Card Authorizations

Establish clear limits that align with employee roles and responsibilities. This includes both daily/weekly/monthly spend limits and single transaction price limits. The Slash card comes equipped with powerful spend controls with configurable limits and automated categorization, ensuring each employee spends company funds on the types of expenses they’re meant to.

Define the approval process employees must take when they need to exceed limits, whether for an emergency or a sudden business opportunity. You’ll also want to set authorization requirements for different purchase types; for example, office tech might require IT approval while marketing expenses need a sign-off from the marketing manager.

Documentation and Receipt Requirements

Specify that all expenses require itemized receipts, not just credit card statements. Each purchase should come with specific information as context, including business purpose, attendees for meals and entertainment, and possibly the outcome of the expense. Additionally, set up missing receipt protocols, requiring employees to sign statements explaining the expense and why they don’t have documentation.

Approval Workflow and Timelines

Define which expenses are high-value enough to require pre-purchase approval, and establish post-purchase review processes where managers and finance teams review expenses within specified timeframes. Your team may be widespread enough to require approval hierarchies that see direct managers approving routine purchases while department heads approve larger expenditures. No matter the size of your company, Slash can be configured to instantly route these submissions to appropriate approvers based on amount, category, or department.

Consequences for Policy Violations

Lastly, set clear rules that scale disciplinary action to the severity of the policy violation. Verbal and written warnings may follow early offenses, while card suspension and firings may follow more serious violations. You may want to include notes about how intent matters, and that intentional misuse will be considered fraud and treated more harshly than honest mistakes.

How to Implement Your Corporate Credit Card Policy

Communicate Policy to Teams Clearly

To effectively roll out your new corporate card policy, you’ll want to utilize as many avenues as you can. Start with a leadership announcement explaining the policy's purpose, the benefits for both company and employees, and when it takes effect.

Then, provide multiple communication touchpoints, such as an email announcement with policy attached, an all-hands presentation, department-specific briefings, and one-on-one sessions with cardholders. The policy should be easily accessible on your intranet, in employee handbooks, and anywhere else that’s convenient.

Train Cardholders on Expectations

Schedule mandatory training covering both policy elements and the rationale behind them. When cardholders understand why rules exist, they become easier to remember and compliance improves as a result. For example, when you explain that receipt requirements are driven by tax regulations, the burden can feel less arbitrary. Discuss other real world examples that show the cause and effects of following protocols.

Set Up Approval Workflows

It’s best to create workflows for both before and after purchase. For pre-purchase approvals, have employees submit cases via an expense management platform so managers can approve or reject with explanations within 24 hours. Post-purchase submissions aren’t necessarily as time sensitive, and may involve multiple levels of administration. In any case, receipts should be submitted right after purchase, and approvals may take a couple business days, depending on your process.

Use Dashboards to Monitor Compliance

Expense management systems like Slash offer dashboards that track key metrics like submission timeliness, documentation, spending vs budgets and limits, trends in specific categories, and policy violations. You can also set up automated reports highlighting compliance issues for proactive management.

Review Feedback and Refine Over Time

Establish feedback mechanisms where employees report ambiguities, suggest improvements, or flag situations where policy isn't working well. Track common questions and recurring issues; if employees repeatedly ask about the same provision, it likely needs clarification. You’ll be able to make improvements to policy language or rules before misunderstandings grow out of hand.

Ready-to-Use Corporate Credit Card Policy Template Example

Each cardholder should read and sign your corporate policy within 1 or 2 business days after receiving a new card. Your policy will include more specific details and examples, but this is a good place to start:

CORPORATE CREDIT CARD POLICY

Policy Purpose: This policy was created to outline rules surrounding company credit cards. These rules are necessary to encourage responsible spending, reduce risk of fraud, streamline expense tracking, and remain tax compliant.

Eligibility: Cardholders include: directors, sales representatives, purchasing staff, and others with specific business needs. Issuance requires finance department review and VP approval. Cards are to be returned immediately upon employment termination.

Approved Expenses:

- Business travel (economy airfare, standard hotels up to $250/night in major cities)

- Client entertainment ($100/person)

- Office supplies

- Software

- Professional development

- Marketing materials

Other company-related expenses are eligible upon pre-purchase approval. Any expenses deemed to be outside of the scope of business are prohibited.

Spending Limits:

- Senior Leadership: $2,000 daily, $10,000 monthly

- Department Heads: $1,000 daily, $5,000 monthly

- Managers: $500 daily, $4,000 monthly

- Individual Contributors: $300 daily, $2,500 monthly

Documentation: Itemized receipts are required within 7 days including merchant name, date, purchase amount, and payment method. Missing receipts require a signed affidavit with manager approval, and will incur a penalty without.

Approval Workflow: Purchases that exceed limits require pre-approval within 24 hours. Post-purchase approvals must be delivered by approvers within 3 business days. Any purchases deemed out-of-policy will be flagged and escalated for review.

Violations:

- Minor: Verbal warning → written warning → 30-day suspension

- Moderate: Written warning + reimbursement, 60-day suspension + retraining

- Serious: Immediate revocation + full reimbursement, termination with possible legal action

Review Period: This policy will be comprehensively reviewed each year. Changes can be made mid-year based on necessity.

Acknowledgment: I agree to comply with this policy.

Employee: _____________ Date: _______ Manager: _____________ Date: _______

Simplify Expense Tracking Today with Slash

A thoughtfully designed corporate credit card policy transforms an administrative necessity into a strategic advantage. When coupled with the Slash Visa® Platinum Card, companies gain real-time insights and easy approval workflows on one integrated business banking platform.

Slash's tools enforce your policy rules automatically. Set spending limits by individual, department, or category, restrict merchant types where personal purchases are common, and receive real-time alerts when unusual transactions occur or limits are reached. This proactive approach prevents misuse and fraud before they happen.

We help businesses streamline expense management while enforcing corporate card policies through sophisticated automation and controls. With both physical and virtual cards available, you can provide appropriate payment options for different use cases while maintaining complete oversight. The Slash Card also offers up to 2% cashback on eligible purchases, turning your business spending into meaningful returns. These rewards can offset costs or contribute to cash flow, unlocking an extra layer of financial control.

Beyond card management, Slash provides a complete financial operations platform with multi-entity management capabilities, global ACH, international wire transfers, and native crypto support.⁴ We also integrate with QuickBooks, which enables users to two-way sync their financial information with Slash and arrange everything on one dashboard.

All this comes with comprehensive reporting tools that give finance teams everything they need to manage company expenses efficiently and keep corporate card spending in check.

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Frequently asked questions

How often should a corporate credit card policy be reviewed?

Corporate credit card policies should undergo formal review at least annually to ensure they remain relevant and effective as your business evolves. However, more frequent reviews may be warranted when significant changes occur. You never know when a cardholder's misuse may unwittingly expose a flaw in the guidelines.

The key is balancing stability with adaptability. Communicate policy updates clearly, provide training on changes, and give employees adequate notice before new requirements take effect.

What is the difference between a corporate card and a business card?

At their core, credit cards and charge cards both let you borrow funds to make business expense purchases. Their main difference is in their required pay cycles: credit cards allow users to accrue interest and debt over long periods of time, while charge cards don’t carry interest and must be paid in full at the end of each month.

Credit cards are best for businesses that are looking for financial flexibility, while charge cards are best for businesses that prioritize expense management and want to monitor their spending more closely.

Corporate Cards vs Business Credit Cards: 5 Differences You Need to Know

Can a corporate credit card policy help with accounting?

Definitely. Along with reducing fraud and misuse, responsible spending streamlines expense management. When receipt requirements are clearly outlined to employees, expense reports become a breeze.