What is an ACH Routing Number and Why Does It Matter?

For most businesses, electronic payments are part of daily operations. Payroll, direct deposits, vendor payments, and recurring bills all rely on accurate routing and account information to settle properly. The ACH routing number plays a key role in directing these payments to the correct financial institution, ultimately helping to ensure funds are delivered both securely and on-time.

An ACH routing number is a nine-digit code used by banks and other financial institutions to identify where an ACH payment should be delivered. It tells the Automated Clearing House network which bank should receive an electronic funds transfer before the funds are applied to the correct account. If the routing number is incorrect, ACH transfers may be rejected, delayed, or sent to the wrong financial institution—and recovering those funds can be difficult.

ACH payments are popular because they are inexpensive, secure, and scalable, but that efficiency also means errors can propagate quickly. Incorrect routing or account information can lead to delayed, rejected, or misdirected payments that are difficult to recover. Business banking platforms like Slash can help businesses reduce these risks by centralizing ACH payment workflows, storing verified routing and account details, and minimizing manual data entry.¹ By giving teams real-time visibility into payment activity and cash flow, Slash makes it easier to send ACH payments accurately and manage them at scale.

How an ACH routing number works

ACH stands for the Automated Clearing House, which is a U.S.-based electronic network for transferring funds between banks. ACH is just one form of interbank transfer service; other bank transfer services include wire transfers and real-time networks like RTP and FedNow. ACH uses batch processing, meaning that many payments are grouped together and settled simultaneously, which helps reduce processing costs. Wire transfers, by contrast, are processed individually and typically settle more quickly, but at a higher cost.

An ACH routing number is a nine-digit code assigned to a financial institution for use on the ACH network. This number identifies the recipient’s bank during electronic funds transfers and is used by banks and payment processors to route transactions to the correct institution before they are applied to a specific account. While a business bank account may have multiple routing numbers for different payment rails, the ACH routing number used for electronic payments remains consistent for that account within the ACH system.

When sending an ACH transfer, it’s important to identify the beneficiary’s ACH routing number. This is the number that corresponds to the recipient’s bank. When initiating an ACH transfer for the first time, double-checking both the beneficiary routing number and account number helps prevent misdirected payments.

If an ACH transfer is executed incorrectly, recovering the funds can be difficult or time-consuming for the sender. For more information about mistakenly sent electronic payments, refer to the rights and protections outlined in the Electronic Funds Transfer Act.

Different types of routing numbers

When most people think of routing numbers, they picture the nine-digit number printed on the bottom-left corner of a paper check. These are known as ABA routing numbers, named after the American Bankers Association, which originally developed the routing system to standardize check processing across U.S. banks.

On an individual check, three numbers typically appear along the bottom:

- ABA routing number: The leftmost 9-digit number

- Account number: The number in the center, which can vary in length

- Check number: The rightmost 3-to-4 digit number

ABA routing numbers are primarily designed for processing paper checks. In many cases, the ABA routing number may be the same as the routing number for ACH payments, but this isn’t always the case.

Some financial institutions assign separate ACH routing numbers that differ from their check routing numbers, particularly for electronic funds transfers or accounts associated with specific processing centers. Because of this, it’s important not to assume that the routing number printed on a check is always the correct routing number for ACH transfers. To ensure that you’re receiving EFTs correctly, ask your bank provider if there is a separate routing number for ACH transfers.

Wire transfers may also use routing numbers that differ from those used for ACH payments or paper checks. Financial institutions that process domestic wires through the Federal Reserve’s Fedwire network, including large banks such as Bank of America, typically require a wire-specific routing number and may reject a wire transfer that uses a routing number taken from a check or an ACH destination. To locate the correct routing number for a wire transfer, the sender should consult the recipient’s bank directly or review the bank’s wire transfer instructions, which usually specify a separate routing number for wire transactions.

Additionally, international wire transfers often require a SWIFT code rather than a U.S. routing number. SWIFT is a global interbank messaging system that uses its own standardized code format to identify banks and branches worldwide, operating separately from U.S. routing number systems altogether. With Slash, you can send international wires to over 180 countries in 135+ different currencies via the SWIFT network.

Slash business banking

Works with cards, crypto, plus cards, crypto, accounting, and more.

ACH routing number vs account number

There’s a straightforward way to understand the difference between routing numbers and account numbers: routing numbers are like ZIP codes, while account numbers are like street addresses. The routing number determines which bank a payment should be sent to, while the account number determines which specific account at that bank should receive the funds.

A routing number corresponds to an entire financial institution, not to an individual bank account. If two people have accounts at the same bank or credit union, their accounts will typically share the same ACH routing number and ABA routing number for that payment type.

During the payment process, the routing number is ingested first by a payment processor. It is used to route the transaction through the appropriate clearing system, such as the ACH network, and to direct the payment to the correct receiving bank. The routing number also allows intermediary systems, including the Federal Reserve and ACH operators, to validate the destination institution and determine where the transaction should be delivered.

Once the payment reaches the recipient’s bank, the account number is used to complete the final step of the transaction. The account number identifies the specific deposit account within the bank’s internal ledger that should be credited or debited. At this stage, the bank matches the incoming transaction to its account records, posts the funds to the correct account, and updates the account balance accordingly.

When you need an ACH routing number and how to find it

ACH transfers are used every day in business operations, and many common payment scenarios require identifying and verifying an ACH routing number before funds are sent. Below are some of the most frequent situations in which you may need to locate or confirm a routing number:

- Direct deposit: Direct deposit is commonly used for company payroll. To process direct deposit correctly, employers must collect both the employee’s ACH routing number and bank account number. If a paycheck does not post after setup, the issue may be an incorrect routing number. A new employee may rely on the routing number printed on their checkbook, which may not be the correct number for direct deposit ACH payments.

- External payments: When sending an ACH payment to a vendor, supplier, or independent contractor, routing numbers can also be used as part of payment verification. The ABA Routing Number Lookup is an online registry that lists all financial institutions with assigned ABA routing numbers. If a routing number returns a different bank, branch, or geographic region than expected, it’s a signal to reverify routing and account information before sending funds.

- Recurring payments: Recurring ACH payments are commonly used for service providers, subscriptions, and ongoing vendor relationships. With Slash, businesses can save verified routing and account information and schedule recurring ACH payouts, ensuring payments are sent on time and with consistent, accurate details.

In Slash, you can begin sending an ACH payment by clicking the “Transfer Funds” button in the Payments dashboard. From there, you can select a recipient from stored contact and payment information or add a new recipient. Once a recipient is selected, a dropdown menu displays destination details, including the beneficiary bank name, account number, and ACH routing number, making it easy to review and confirm payment information before sending funds.

Making the right financial move with Slash

Slash makes it easy for businesses to verify and send ACH transfers securely. In addition to standard ACH payments, Slash supports Global ACH transfers, which are low-cost bank payments that originate on the U.S. ACH network and settle through foreign clearing house systems such as BACS in the United Kingdom, BECS in Australia, and SEPA across the European Union. Businesses can also automate recurring ACH payments, export payment data into QuickBooks, and monitor cash flow in real time using detailed analytics.

Slash brings banking and financial management into a single dashboard, giving businesses better visibility into cash flow and access to modern payment rails. Additional ways to send funds and optimize business finances with Slash include:

- International wires: Send wire transfers through the SWIFT network to more than 180 countries in 135+ different currencies. Slash allows you to store supplier bank details and SWIFT codes, helping streamline cross-border payments and reduce repetitive data entry.

- Real-time transfers: Slash supports real-time domestic payment rails, including RTP and FedNow, which enable near-instant bank transfers within the U.S. These networks provide a faster alternative to traditional electronic funds transfers. With the Pro plan, users can send unlimited RTP and FedNow transfers at no additional cost.

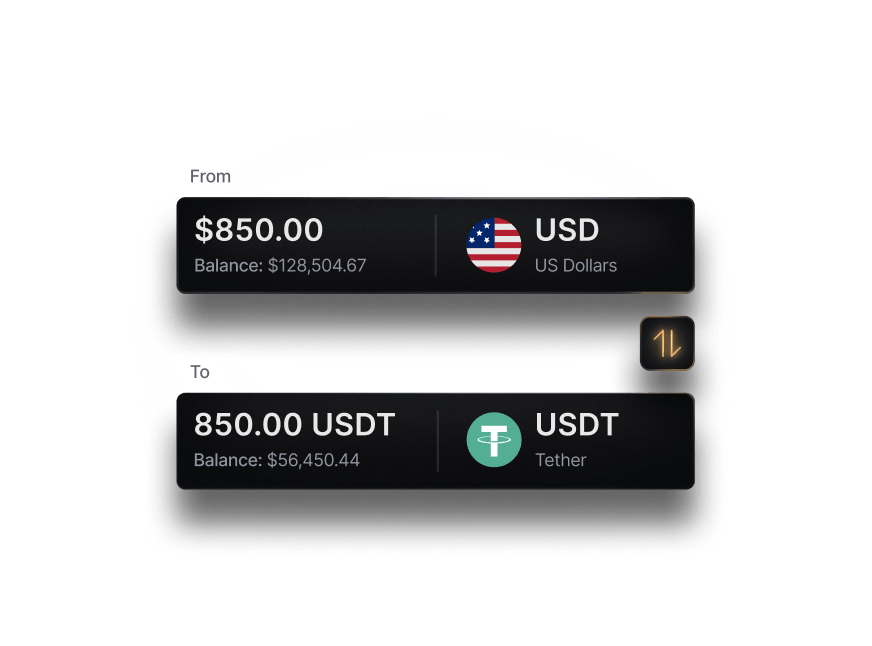

- Native cryptocurrency support: Slash offers built-in on- and off-ramps for converting USD into stablecoins such as USDC and USDT.⁴ Cryptocurrency transfers bypass traditional banking rails, avoid many processing fees, and typically settle within seconds, making them particularly useful for international payments.

- Slash Visa Platinum Card: The Slash Visa® Platinum Card earns up to 2% cash back on company spending. Businesses can issue unlimited virtual or physical cards, apply granular spending controls, receive real-time alerts, and sync card transactions directly with cash flow analytics in the Slash dashboard.

- Integrated accounting: Slash enables clean exports of remittance and transaction data into QuickBooks, helping streamline reconciliation, expense reporting, and tax preparation while keeping financial records consistent and up to date.

Apply in less than 10 minutes today

Join the 5,000+ businesses already using Slash.

Frequently asked questions

What happens if I use the wrong routing number for a direct deposit?

If the routing number is incorrect, the direct deposit may be rejected or sent to the wrong financial institution, delaying payment. Recovering misdirected funds can take time and may require assistance from both banks.

Is an ACH routing number the same as a wire routing number?

No. Many banks assign different routing numbers for ACH payments and wire transfers, and using the wrong one can cause the transaction to fail.

ACH vs Wire Transfer: Key Differences, Costs, Limits & Use Cases

Can a routing number change over time?

Yes. Routing numbers can change due to bank mergers, branch restructuring, or changes in payment processing systems, so it’s important to verify routing information before sending payments.