Profit and Loss Management: Turning Financial Insight into Better Decisions

You didn’t start your business to lose money. But growth doesn’t always show up as higher profit. Costs creep in, pricing decisions compound, and small misalignments can begin to erode margins. To add to the frustration, it can feel like every cost-cutting or sales-boosting move addresses the wrong problem.

At this point, you need to learn to stop reacting to financial metrics and start managing them. An income statement is more than a check on whether you’re profitable. Used correctly, it becomes a tool for understanding why results look the way they do. By paying attention to metrics, margins, and how costs and revenue interact, businesses can adjust operations earlier, before those issues affect your bottom line.

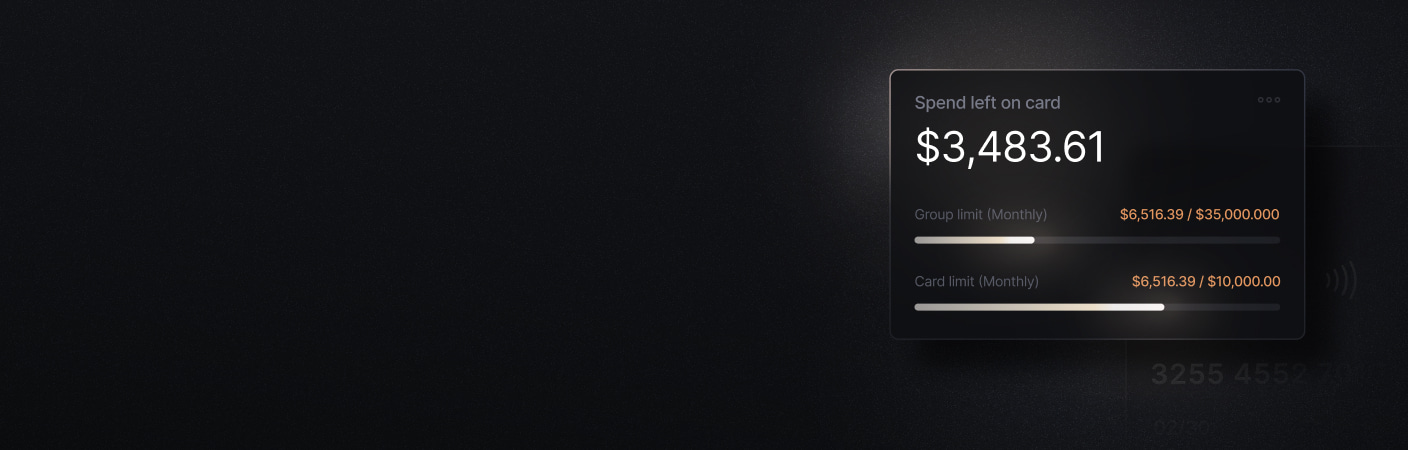

Doing that consistently requires accurate, timely financial data that reflects how money actually moves through the business. Slash brings bank accounts, corporate cards, and payment activity into a single view, making expenses easier to track and connect to your bottom line.¹ With automated categorization and accounting integrations, Slash helps you avoid lumping transactions into a generic “operating expense” pile, giving you clearer insight into your company’s financial health. Continue reading to learn more.

What is P&L management?

Profit and loss management is the ongoing process of monitoring, analyzing, and improving your income statement—the financial report that shows whether your business is actually profitable. You can think of your income statement as your business’s financial report card. It shows total revenue at the top, subtracts expenses as you move down the page, and reveals your net profit or loss at the bottom line.

Like a report card, the final grade matters—but understanding why you earned it matters more. If you struggled in one subject, you’d know exactly where to focus your efforts to improve. P&L management works the same way: weak results should point to specific operational issues, giving you clear signals about what needs to change.

Looking at your P&L this way turns raw numbers into a narrative about your company’s financial health. Diligent monitoring of profit and loss metrics helps you identify trends before they become critical problems, reveals which products or services actually generate profit, and provides the data needed to make informed decisions about pricing strategies, expense management, and revenue growth.

What’s included on an income statement?

An income statement breaks down how your business generates revenue, what it costs to operate, and whether you ultimately earn a profit or take a loss. A standard profit and loss report contains these line items; together, they can reveal a lot about your company’s financial health:

Analyzing how these figures react to one another can show how business decisions relate to your overall financial performance. For example, increases in revenue don’t automatically improve net income if cost of goods sold or operating expenses rise at the same pace. Likewise, improving gross profit by raising prices or reducing direct costs means a larger share of each additional dollar of revenue carries through the income statement, ultimately increasing net income.

Viewing your income statement analytically can help to better align strategic decision-making with broader company goals, whether that’s improving profit margins, controlling operating costs, or scaling profitably over time.

Why P&L management matters for small businesses

Small businesses often have simpler income statements, with fewer revenue streams and cost categories compared to a larger company. That simplicity makes profit and loss management easier to understand, but it also means small changes can have an outsized impact. Without diversified income or expense buffers, a single slow month, lost client, or unexpected cost can quickly affect profitability.

For example, an HVAC operator may see margins shrink if equipment costs spike or seasonal demand drops. A healthcare supplier might feel immediate pressure when a major client pushes for lower pricing. A marketing agency could struggle if payroll grows faster than revenue. Regular P&L analysis helps surface these issues early, while there’s still time to adjust.

These dynamics make profit and loss management a core discipline rather than a reporting exercise. Used consistently, P&L data supports several benefits that affect how your company’s money is spent, planned, and adjusted:

Aligns spending with company strategy

Your income statements can reveal how your spending reflects your broader priorities. If your goal is growth but operating expenses are rising without a corresponding increase in revenue, something is off. Comparing income and expenses against strategic goals helps ensure resources are directed where they matter most.

Strengthens budgeting and forecasting

Using past profit and loss metrics can give you a more realistic baseline for financial planning. By reviewing historical trends in revenue swings, cost of goods sold, and profit margins, you can build budgets and forecasts based on how your business actually performs instead of relying on assumptions. This makes it easier to anticipate seasonal swings, manage operating costs, and plan for future liquidity needs.

Improves investor and lender confidence

Clear, consistent P&L management signals financial discipline. Lenders and investors want to see that you understand your numbers, can explain changes in performance, and take action to improve profitability. Well-maintained financial statements with stable or improving earnings make your business easier to evaluate and to trust—giving you a stronger position when applying for business loans or approaching new investors.

Helps identify risks early

Most financial problems develop gradually, not overnight. Expenses may rise slightly faster than revenue, margins may compress, or operating costs may slowly erode net income. Reviewing your income statement regularly and comparing it across periods helps catch these trends early, giving you time to correct course before cash flow becomes a problem.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

What are the core responsibilities for P&L management?

Once you understand how an income statement is structured, the next step is applying its insights to your operations. In practice, there are a few key areas business owners typically focus on:

- Revenue optimization: Identifying opportunities to increase total revenue without disproportionately increasing costs. This can include diversifying income streams, adjusting pricing strategies based on demand or cost changes, and prioritizing customer retention, since retaining existing customers is usually more cost-effective than acquiring new ones.

- Margin improvement: Evaluating profitability at the product, service, or customer level rather than in aggregate. Analyzing margins individually can help you see which of your products or services actually make money, which barely break even, and which lose money. Then, you can focus effort and investment on what strengthens your bottom line.

- Cost control: Monitoring operating expenses to ensure they scale appropriately with revenue. This includes separating fixed and variable costs, renegotiating supplier contracts, and conducting regular reviews to eliminate unnecessary or inefficient spending.

- Variance analysis: Comparing actual results against budgets and forecasts to understand where performance diverges from expectations. Investigating variances on a regular basis helps identify underlying issues (such as pricing pressure, cost creep, or demand shifts) before they majorly impact financial health.

Practical ways to approach P&L management

Managing profit and loss doesn’t require rigid formulas or perfect processes from day one. For most businesses, it’s an iterative practice that improves as systems mature and patterns become clearer. The approaches below focus on building visibility and consistency around the key drivers of revenue, costs, and profitability, making your P&L easier to use as an operational tool rather than just a reporting requirement:

Tracking revenue and cost streams

Seeing revenue and expenses in one place makes P&L management easier to maintain over time. Slash combines bank accounts, corporate cards, and inflows from payment processors into a single system, giving you a unified view of how money moves through the business. Expenses are automatically categorized, and rules can be set to align those categories with how your operations are structured. More detailed expense tracking can yield clearer insights when you analyze profit and loss patterns.

Separating fixed and variable expenses

Fixed expenses like rent, insurance, and base payroll tend to remain stable regardless of sales volume. Variable expenses such as cost of goods sold, shipping, and commission-based pay fluctuate with revenue. Separating these on your income statement can clarify which levers have the greatest impact on your bottom line. For example, if losses are driven primarily by fixed expenses, improving profitability may require cost reductions rather than higher sales.

Using consistent accounting policies

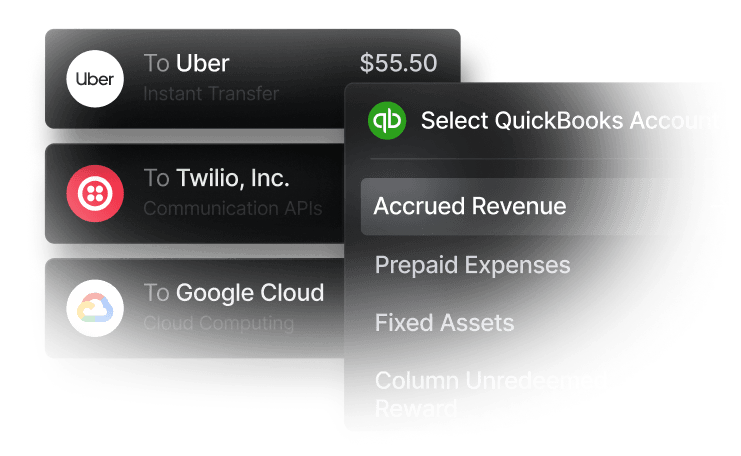

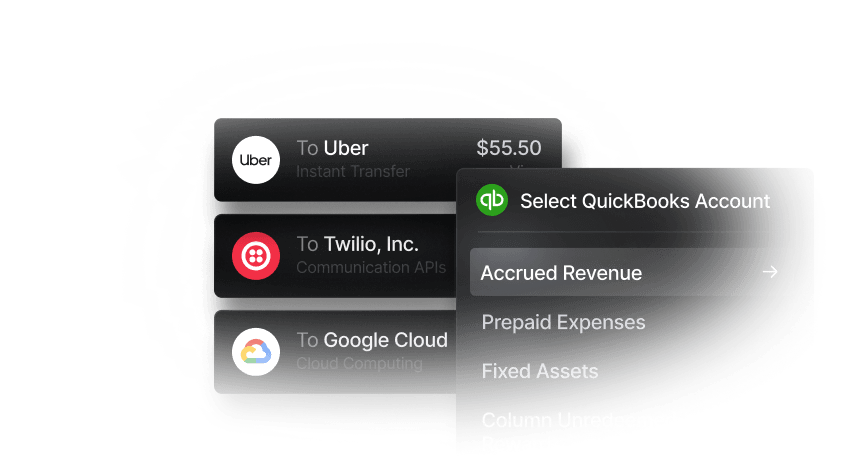

Sticking with the same accounting method (cash or accrual) and applying income and expense categories consistently each period allows for more meaningful comparisons. When revenue recognition and cost treatment follow the same rules over time, trends are easier to spot and performance is evaluated on comparable data rather than one-off results. Syncing financial data from Slash into QuickBooks helps automate routine workflows like transaction matching, categorization, and reconciliation, making it easier to maintain consistency as volume grows and reducing the risk of manual errors that distort your P&L.

Forecasting and comparing budgets to actual results

Budgets work best when they’re used as a reference point, not just as a static target. Comparing actual revenue and expenses to budgeted expectations helps surface variances, so you can get to work identifying what’s driving them. Building forecasts from historical performance, market conditions, and planned initiatives gives those comparisons context and makes it easier to adjust spending, pricing, or operations before small gaps begin to affect profitability.

Reviewing profit margins over time

Profit margins show how much of your revenue actually turns into profit, and you can use them to calculate metrics related to your business’s efficiency. Gross profit margins highlight whether pricing and cost of goods sold are in balance. EBITDA margins show how efficiently your core operations convert sales into operating profit. Looking at both over time helps reveal whether margin pressure is coming from direct costs, operating inefficiencies, or overhead growing faster than revenue. Comparing margins across periods or against industry benchmarks can also help determine whether changes are temporary or structural.

Connecting P&L insights to business goals

A profit and loss statement becomes more useful when viewed through the lens of your broader objectives. For example, businesses focused on growth may tolerate lower short-term profitability in exchange for expansion; meanwhile, those prioritizing cash flow may emphasize tighter expense control and faster collections. Letting business goals guide how you interpret P&L results helps ensure financial decisions support the direction you’re trying to move.

Common mistakes in P&L management

Once you move past just scanning the numbers on your income statement, P&L management can get complicated. Using metrics like EBITDA, margin trends, and variance figures can be unintuitive at first, especially when they don’t align with what’s happening operationally.

Understanding how common mistakes related to your business decisions show up in your P&L statement can make it easier to use your income statement as a practical management tool rather than just a reporting artifact. Here are some common mistakes:

- Confusing cash flow with profitability: It’s possible to be profitable on paper while still struggling to pay bills. This often happens when revenue is recognized before cash is collected, or when large upfront expenses strain cash reserves. Operationally, this shows up as tight liquidity despite positive earnings, leading to delayed payments or a need for short-term financing.

- Ignoring non-operating expenses: Focusing only on operating performance can obscure costs like interest, taxes, or one-time charges. These expenses may not affect day-to-day operations, but they directly impact net income and the bottom line. When overlooked, your business may overestimate how much flexibility it has to make investments, leading to strained liquidity later.

- Failing to account for all costs: Incomplete expense tracking can massively distort your margins. Using a financial platform like Slash can ensure that all of your expenses are accounted for and properly categorized, with receipt and transaction capture across your cards, payments, and other money movements.

- Reviewing infrequently: Looking at your P&L only quarterly or annually can limit its usefulness as a management tool. Margin compression or expense creep are issues that develop gradually, and infrequent review may delay corrective action.

- Making decisions based on incomplete data: Decisions made without segmented revenue, detailed expense categories, or historical comparisons can cause you to miss underlying drivers of performance. This may result in cutting the wrong costs, investing in underperforming areas, or misinterpreting short-term shifts as long-term trends.

How to use tools financial management software for P&L management

Using accounting software in tandem with a business banking platform can help you automate much of the data capture and analytics required for effective use of your financial metrics. Below, we’ll explain how accounting tools like QuickBooks and Xero can support P&L management, as well as how Slash integrates with these tools to make reporting seamless:

Automated data integration

Effective P&L tools pull financial data from multiple sources to reduce manual entry and keep reports up to date. QuickBooks connects with Slash to ingest data from virtual accounts, payments, and corporate cards, allowing transactions to be automatically categorized in Slash and matched in QuickBooks. Xero similarly syncs bank feeds and supports integrations through its app marketplace, including Slash, to centralize revenue and expense data.

Real-time reporting

Access to up-to-date financial data makes it easier to respond to changes in revenue and expenses as they happen. QuickBooks and Xero both update dashboards as new transactions sync from Slash, providing current views of profit and loss, cash flow, and other key metrics. Slash complements this by offering real-time cash flow analytics and clear breakdowns of vendor and partner spend, helping teams identify major cost centers at a glance without waiting for month-end reports.

Customizable reports

Different businesses need different slices of their P&L data. QuickBooks offers flexible reporting templates and deeper customization on higher tiers, including dashboards and budgeting tools. Xero lets you tailor financial reports and add tracking categories to report by department, project, or product line.

Variance analysis and budgeting

Comparing actuals to budget or forecast highlights performance gaps. QuickBooks supports budgeting and variance analysis, and its higher plans include trend analysis and forecasting tools.  Xero also enables comparisons between actual and budgeted figures in its reporting module.

Forecasting and scenario planning

Projecting future performance helps with strategic decisions. QuickBooks has forecasting tools in higher plans that use historical data to model future outcomes. Xero’s base reporting doesn’t include advanced built-in forecasting, but you can add third-party tools from its app marketplace for scenario planning.

Turn financial visibility into profitability with Slash

Effective P&L management depends on timely, accurate data and the ability to act on it quickly. Slash unifies bank accounts, card spend, and incoming payments across your business so profit and loss reporting reflects how your operations actually run.

With real-time analytics into your cash flow, Slash helps you see which activities drive profitability and where adjustments will have the greatest impact on the bottom line. Card-level controls make it easier to enforce spending goals—whether that means tightening budgets in lower-margin areas or enabling higher-limit spending for strategic investments. And when cash flow comes under pressure due to timing gaps or unexpected expenses, Slash’s short-term working capital options can help bridge those gaps without forcing reactive spending cuts that hurt your long-term profitability.⁵

Those capabilities are supported by a set of industry-aware features designed to give finance teams more control, visibility, and flexibility across daily operations, including:

- Slash Visa® Platinum Card: Issue unlimited virtual cards with customizable spending controls across every department, earning up to 2% cash back on spending.

- Accounting integrations: Automatically sync transaction data with QuickBooks for simplified reconciliation and reporting. Connect via Plaid to integrate with additional financial tools, or import data from Xero to enhance your accounting workflow.

- Expense tracking: Simplify how spending is tracked across departments and teams with line-item visibility and automatic receipt capture.

- Diverse payment methods: Send payments to medical suppliers with Slash Pro, which enables free, unlimited domestic ACH, wire transfers, and real-time payment rails like RTP and FedNow.

- Slash Capital Financing: Access short-term financing with flexible 30-, 60-, or 90-day repayment terms to help bridge cash flow gaps.

- Data-driven analytics: Monitor transactions in real time through analytics dashboards that provide immediate visibility into organizational spending.

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Frequently asked questions

What’s the difference between EBIT and EBITDA?

EBIT measures profit after operating expenses but before interest and taxes, while EBITDA also excludes depreciation and amortization. EBITDA is often used to evaluate operating performance without the impact of financing decisions or non-cash accounting charges.

Why is customer feedback important for profit and loss management?

Customer feedback helps explain revenue trends and margin changes that numbers alone can’t show. Insights about pricing sensitivity, product value, or service issues can inform decisions that directly affect retention, revenue growth, and profitability.

How often should I review and update my profit and loss reports?

Many businesses may benefit from reviewing P&L reports monthly to spot trends and adjust operations, as opposed to quarterly or annually.

Expense Reports: How to Track, Manage, and Simplify Costs

How do marketing and sales teams fit into profit and loss management?

Marketing and sales decisions should be guided by the real drivers behind your profits & losses. Doing a push for marketing when your losses stem from high manufacturing costs may be an inefficient use of your resources; similarly, acquiring new customers can be costly, so it may be more effective to retail the customers you already have during a slower season.