What is an International Payment Gateway and How Does It Enable Global B2B Transactions?

As businesses expand beyond domestic borders, the ability to move money internationally has become a core operational requirement. International payment gateways now play a critical role in enabling global B2B transactions, allowing companies to accept, process, and send payments across countries, currencies, and banking systems.

However, choosing the right payment processor isn’t always straightforward. Transaction fees vary widely, not all gateways support the same currencies or regions, and available payment methods can differ significantly by market. For finance teams managing international vendors, subsidiaries, or contractors, these differences can introduce unnecessary friction and cost.

This article breaks down what international payment gateways are, how they work, and which solutions are best suited for global transactions. We’ll review top international payment gateways, outlining their strengths, limitations, and ideal use cases. We’ll also explore how integrated platforms like Slash can unify payments, automate approvals, and provide clear visibility into international cash flow and multi-entity reporting, especially for teams paying international vendors or contractors across borders.¹

What are international payment gateways?

An international payment gateway is a technology platform that facilitates cross-border payments by securely authorizing, processing, and settling transactions between buyers and sellers located in different countries. These gateways act as intermediaries between merchants, banks, card networks, and local payment rails.

In practice, an international payment gateway handles currency conversion, compliance checks, fraud prevention, and communication between financial institutions. When a transaction occurs, the gateway validates the payment details, converts currencies if needed, routes the transaction through the appropriate networks, and ensures funds are settled into the recipient’s account.

For businesses managing cross-border payment flows, international payment gateways help reduce operational complexity while ensuring transactions remain compliant with regional regulations.

Key benefits of international payment gateways may include:

- Global reach: Accept and send payments in multiple countries and currencies

- Currency conversion: Automatically convert funds at the point of transaction

- Payment method diversity: Support cards, bank transfers, digital wallets, and local rails

- Security and compliance: Built-in fraud detection, encryption, and regulatory adherence

- Operational efficiency: Faster settlement and streamlined reconciliation

What is the best payment gateway for international transactions?

There’s no single “best” international payment gateway for every business. The right solution depends on transaction volume, geographic coverage, payment methods, and how closely payments need to integrate with broader financial operations.

Below are some of the most widely used international payment gateways, along with their defining characteristics:

Slash

While Slash is not a traditional merchant payment gateway, it brings banking, payments, and financial operations into one unified platform, making it especially powerful for global B2B use cases.

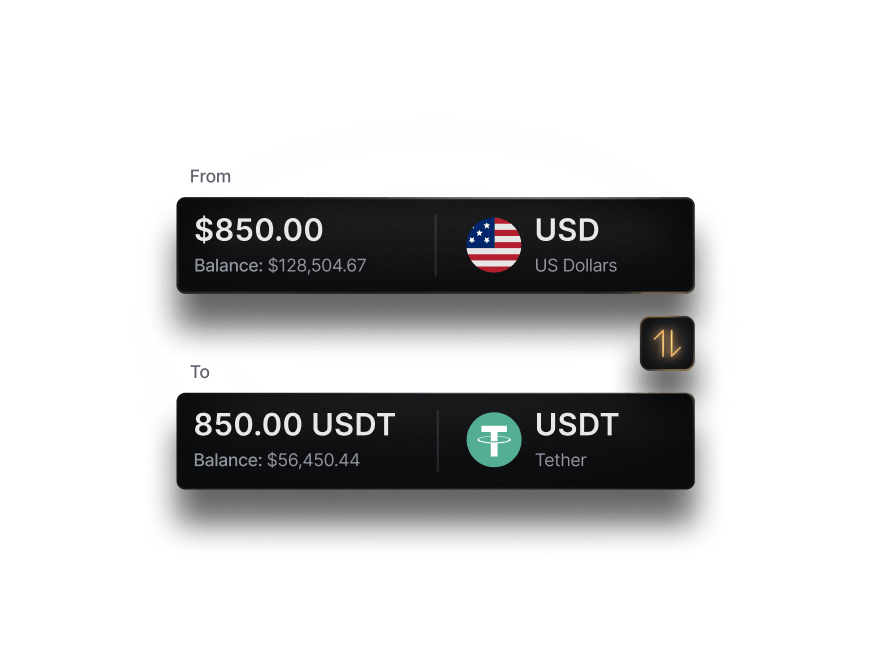

Slash supports global payments via SWIFT to over 180 countries, offers native cryptocurrency support for holding and transferring dollar-denominated funds, and provides unlimited virtual and physical corporate cards.⁴ Built-in automation, approvals, and accounting integrations allow teams to manage vendor payouts, expenses, and multi-entity cash flow from one centralized dashboard.

For companies operating across borders or managing multiple legal entities, Slash simplifies cross-border payments, vendor management, and financial reporting—without juggling multiple tools or gateways.

Slash business banking

Works with cards, crypto, plus cards, crypto, accounting, and more.

Stripe

Stripe is one of the most popular payment gateways for online businesses with international customers. It supports dozens of currencies and countries, offers powerful APIs, and integrates easily with e-commerce platforms and SaaS tools.

Pros:

Strong developer tools, global card acceptance, extensive integrations

Cons:

Fees can add up at scale; limited control over FX pricing

PayPal

PayPal is widely recognized and trusted globally, making it easy for businesses to accept international payments quickly. It supports multiple currencies and offers buyer protection features.

Pros:

High customer trust, fast setup, global reach

Cons:

Higher transaction and currency conversion fees

6 PayPal alternatives for International Payments: Top Picks

Square

Square is best known for domestic payments but offers limited international capabilities, mainly for card-based transactions in select countries.

Pros:

Easy setup, strong POS tools

Cons:

Limited international coverage and B2B use cases

FIS Global

FIS Global provides enterprise-grade payment processing and financial infrastructure for large multinational organizations.

Pros:

Scalable, secure, enterprise support

Cons:

Complex onboarding, not ideal for smaller teams

Adyen

Adyen is a global payments platform built for large, international merchants. It supports local payment methods in many regions and offers advanced analytics.

Pros:

Strong global coverage, unified commerce

Cons:

Best suited for high-volume enterprises

Checkout.com

Checkout.com focuses on high-performance global payments with strong fraud prevention and local acquiring capabilities.

Pros:

Fast processing, strong security

Cons:

Pricing transparency varies by region

Braintree

Owned by PayPal, Braintree supports global card payments and digital wallets, making it popular among mobile and app-based businesses.

Pros:

Flexible integrations, PayPal ecosystem access

Cons:

Limited beyond card and wallet payments

Sage Pay

Sage Pay (now Opayo) is primarily focused on UK and European markets, with tools designed for businesses already using Sage accounting software.

Pros:

Accounting alignment, regional expertise

Cons:

Limited global coverage

Amazon Pay

Amazon Pay allows customers to use their Amazon accounts to pay internationally, but it’s primarily consumer-focused.

Pros:

Strong brand trust

Cons:

Limited B2B and payout flexibility

Key criteria for selecting an international payment gateway

Choosing the right international payment gateway requires balancing cost, coverage, and operational fit. Below are the most important factors to evaluate.

Geographic coverage

Ensure the gateway supports the countries where your customers, vendors, or subsidiaries operate. Some gateways excel in Europe or Asia but offer limited global reach.

Supported currencies

Multi-currency support is essential for minimizing conversion friction and improving transparency in international transactions.

Payment methods

Beyond credit cards, look for support for bank transfers, local payment rails, and alternative payment methods common in your target regions.

Fees and FX rates

Transaction fees, currency conversion markups, and settlement costs can vary widely. Understanding total cost of ownership is critical.

Security and compliance

Strong fraud prevention, encryption, and compliance with regulations like PCI DSS and regional data protection laws are non-negotiable.

Integrations and automation

Gateways that integrate with accounting, ERP, and expense tools reduce manual reconciliation and improve financial visibility.

Scalability

As transaction volume grows, your gateway should scale without performance issues or unexpected fee increases.

Reporting and visibility

Clear reporting across currencies and entities helps finance teams manage global cash flow effectively.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

Start optimizing your global payments today with Slash

Selecting the right international payment gateway is a strategic decision for businesses expanding globally. By understanding the differences in features, costs, and operational models, organizations can choose solutions that support long-term efficiency and compliance.

Slash global payments help streamline international transactions by combining banking, payments, and financial operations into one platform. With support for cross-border wire transfers, vendor payouts, stablecoin or fiat payments, and deep accounting integrations, Slash provides centralized visibility into global cash flow and multi-entity finances.

For teams looking to modernize their payment strategy and reduce operational complexity, Slash complements traditional gateways while unlocking emerging digital payment methods. Exploring Slash is a practical step toward more efficient global financial operations.

Apply in less than 10 minutes today

Join the 5,000+ businesses already using Slash.

Frequently asked questions

What is the difference between IBAN and SWIFT?

An IBAN (International Bank Account Number) identifies individual bank accounts, primarily in Europe, while SWIFT codes identify banks globally. SWIFT is commonly used for international wire transfers, including many global B2B payments.

What are international credit card processing fees?

International credit card processing fees typically include a base transaction fee, cross-border fee, and currency conversion markup. These costs vary by gateway and card network.

Mastering Cross-Border Fees: The Ultimate Guide on What They Are and How to Reduce Them

Can Slash help manage multiple international payment gateways?

Yes. Slash provides centralized visibility and reporting across accounts, vendors, and entities, making it easier to manage payments even when multiple gateways or rails are involved. With built-in payment automation, finance teams can reduce manual work and improve oversight across global operations.