E-Commerce Bookkeeping: A Complete Guide from Setup to Automation for Your Online Store

Your online store processes hundreds of orders daily across Shopify, Amazon, Etsy, and other platforms. Each sale requires multiple financial entries: gross revenue, marketplace fees, payment processing costs, sales tax, shipping expenses, and inventory adjustments. Without the proper systems in place, you may spend hours each week manually entering transaction details, reconciling payment processor deposits, and trying to piece together an accurate picture of your store’s profitability.

Instead of drowning in spreadsheets, automated accounting systems allow transactions to flow directly from each sales channel into your ledger, where they’re categorized, reconciled, and prepared for tax reporting. Real-time dashboards show exactly which products and channels drive profit, current inventory levels, and how sales tax is tracked across jurisdictions.

In this guide, we’ll cover the fundamentals of ecommerce bookkeeping, common pitfalls to avoid, and best practices for building reliable financial systems. We’ll also explain how Slash works alongside accounting platforms like QuickBooks and Xero to streamline accounting workflows by automating transaction capture and improving expense visibility, helping keep your books accurate and up to date. By pairing your accounting system with Slash’s all-in-one business banking platform, ecommerce businesses can centralize spending, payments, and cash management while ensuring transaction data flows cleanly into their books.¹

What is e-commerce bookkeeping?

Ecommerce bookkeeping is the systematic recording, organization, and tracking of all financial transactions related to running an online store. Unlike traditional retail bookkeeping, it accounts for the unique characteristics of online sales, including multiple payment processors, digital sales channels, shipping costs, marketplace fees, chargebacks, and cross-border transactions.

The main benefits of using automated bookkeeping software for your ecommerce store include:

- Accurate financial reporting: When you can see exactly how much each marketplace contributes to your bottom line after accounting for taxes, fees, and expenses, you can allocate resources more effectively and identify which channels deserve additional investment.

- Tax compliance: Proper tracking of sales tax across multiple jurisdictions, paired with detailed transaction records, makes tax filing more efficient and reduces audit risk. Additionally, using an integrated business banking platform like Slash can help streamline tax filing by ensuring transactions are captured and categorized before syncing into your accounting system.

- Informed decision-making: Real-time financial tracking provides faster insight into unusual spending patterns or discrepancies, which can help reduce fraud risk. Instead of waiting until month-end to understand your financial position, you can adjust strategies day to day based on current cash flow, profitability trends, and expense patterns.

- Cash flow management: Understanding when money comes in and goes out helps prevent cash shortages and supports better planning. Ecommerce businesses face unique cash flow challenges, including inventory purchases, variable marketplace payout schedules, and seasonal demand—accurate bookkeeping can help you manage these dynamics.

- Scalability: Organized financial systems make it easier to grow without losing control of your finances as transaction volume increases. As you expand into new sales channels or product lines, pairing a strong bookkeeping system with a full-stack banking solution like Slash can prevent bottlenecks down the line.

What does ecommerce bookkeeping involve?

Ecommerce bookkeeping covers the day-to-day financial processes that keep your online business accurate, compliant, and financially transparent. It ensures that every sale and payout is properly recorded so you can understand performance and make informed decisions as your business grows. Below is some additional, ecommerce-specific information about accounting:

- Reconciling accounts: Regular reconciliation helps catch errors, missing fees, chargebacks, or timing differences that could otherwise distort your financials. Reconciling may include matching bank deposits and payment processor payouts to individual sales records, verifying processor statements, and confirming that all transactions are accounted for.

- Managing sales tax: Your store must calculate, collect, and track sales tax across states and jurisdictions based on economic and physical nexus requirements. Using banking and accounting platforms with integrated merchant services, such as Slash working alongside QuickBooks, can help ensure transaction data flows cleanly into your accounting system for more accurate tax reporting.

- Tracking inventory costs: Proper inventory tracking is essential for understanding margins and ensuring your balance sheet reflects inventory as an asset. This can include recording inventory purchases accurately, calculating cost of goods sold (COGS), and accounting for inventory write-offs, shrinkage, or adjustments.

- Generating financial reports: Reports provide visibility into your store’s profitability, liquidity, and operational efficiency. They are also critical for tax filing and used for strategic forecasting. Reporting involves producing profit and loss statements, balance sheets, and cash flow statements.

6 Common Mistakes in Ecommerce Bookkeeping

Even experienced ecommerce sellers can make bookkeeping mistakes. When accounting data is incomplete or distorted, the impact can be costly, leading to tax issues, cash flow gaps, or faulty decision-making. Recognizing common mistakes can help you avoid errors and maintain more accurate books:

Mixing Personal and Business Finances

Using personal accounts for business expenses or business funds for personal spending can create accounting confusion, complicate tax filing, and create legal issues if your business structure requires financial separation. Ecommerce businesses can maintain clear separation by using the Slash Visa Platinum Card for day-to-day transactions and Slash's virtual business bank accounts, which can be configured to separate cash flow from different storefronts, helping ensure every dollar is properly tracked and categorized.

Failing to Track All Fees and Expenses

Platform fees, payment processing costs, shipping charges, advertising spend, and software subscriptions add up quickly. Many sellers focus on top-line revenue without fully accounting for these expenses, leading to overstated profit margins. Slash provides a unified view of transactions across corporate cards, virtual accounts, and incoming or outgoing payments. By consolidating all inflows and outflows into a single analytics dashboard, ecommerce businesses can more easily identify major cost centers and understand their spending patterns.

Ignoring Multi-Channel Sales Complexity

Selling through your own website, Amazon, eBay, Etsy, and other marketplaces introduces different fee structures, payout schedules, and reporting formats. Recording only net deposits without separating gross sales, fees, and taxes hides channel-level performance and makes accurate bookkeeping difficult. Platforms with merchant services that integrate directly with leading storefronts, like Slash, can help break down this complexity.

Inconsistent Record-Keeping

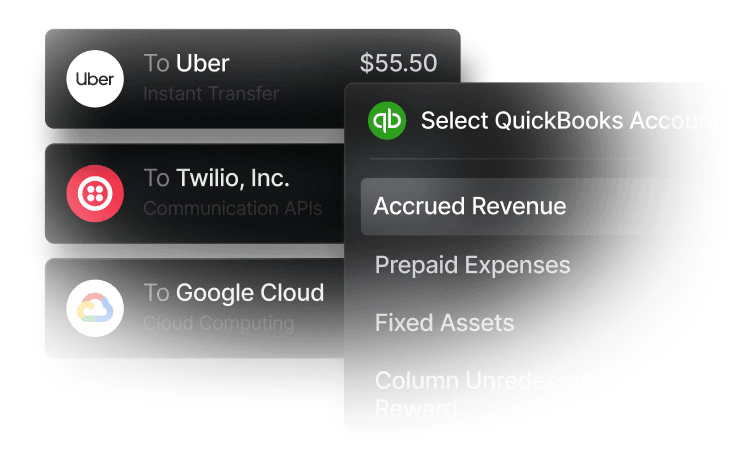

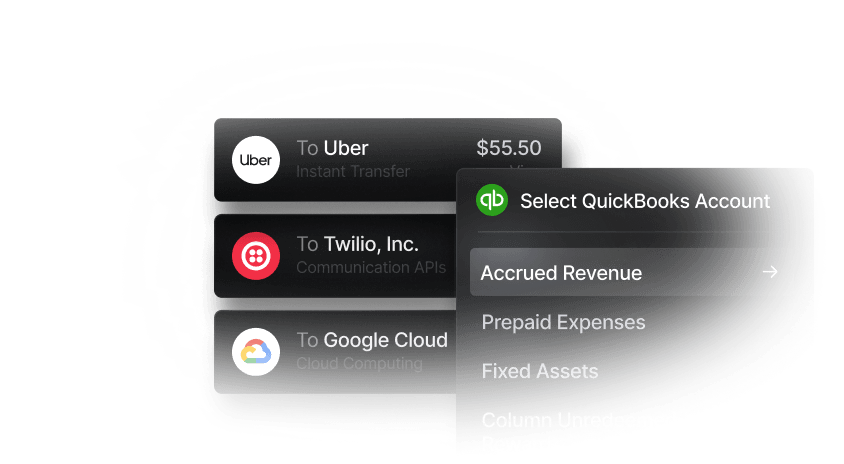

Sporadic transaction recording, missing receipts, and delayed reconciliation create gaps in financial data that compound over time. These gaps make it harder to identify errors, produce accurate financial statements, or respond to tax inquiries. Using Slash for card spending, bank transfers, or cryptocurrency payments ensures transaction details and receipts are captured automatically and exported cleanly into QuickBooks.⁴

Misclassifying Inventory and COGS

Treating inventory purchases as immediate expenses rather than assets, or failing to calculate cost of goods sold accurately, can distort your store's profitability. When inventory accounting is incorrect, you may make pricing decisions based on inaccurate margins, miscalculate your tax liability, or lack clear visibility into which products actually generate profit. Accounting systems can handle this by moving the cost from your inventory asset account to the cost of goods sold when a sale occurs, which properly reflects both the timing and impact of the expense on your financial statements.

Overlooking Sales Tax Obligations

For ecommerce owners in the U.S., do not assume that you only need to collect sales tax in your home state. Economic nexus laws create tax obligations in states where you have no physical presence based on your sales volume or revenue in those states. Failing to register, collect, or remit sales tax properly can result in penalties and back-tax liabilities that may significantly impact your ecommerce business. Accounting systems like QuickBooks address this by automating sales tax calculation across jurisdictions.

Comparing the Best Bookkeeping Software for Ecommerce in 2026

Choosing the right bookkeeping software can significantly impact how efficiently you manage your ecommerce finances. Each platform offers different strengths, from comprehensive accounting suites to specialized marketplace reconciliation tools. While accounting platforms handle reporting and reconciliation, pairing them with a modern business banking solution like Slash helps ensure transaction data flows cleanly into your books from the start. Below are some of our top picks:

Intuit QuickBooks

Slash integrates with QuickBooks Online by exporting all your categorized transaction data, enabling you to automatically reconcile accounts, draft expense reports, and prepare for taxes without manual edits. QuickBooks excels in integration with business banking platforms and merchant services, connecting seamlessly with Shopify, Amazon, eBay, Etsy, and other platforms.

Key features:

- Its API ecosystem means you can sync data from payment processors like Stripe and PayPal, shipping platforms, and inventory management systems.

- QuickBooks' own inventory management tracks inventory quantities in real-time, automatically adjusts cost of goods sold when products sell, and provides detailed inventory valuation reports.

- The financial reporting suite generates over 65 customizable reports including profit and loss statements, balance sheets, cash flow statements, and ecommerce-specific reports like sales by channel and inventory profitability analysis.

- Reconciliation tools with bank feed automation import and categorize transactions from integrated bank accounts and payment processors.

Price: Plans range from $35/month (Simple Start) to $235/month (Advanced), with a 50% discount typically available for the first three months.

Xero

Known for its clean design and logical navigation, Xero makes bookkeeping accessible even for users without extensive accounting backgrounds. With over 1,000 third-party integrations available through the Xero App Store, you can connect specialized tools for inventory management, sales tax compliance, and marketplace reconciliation while maintaining Xero's intuitive experience as your central accounting hub. Slash enables you to pull transaction data from Xero seamlessly.

Key features:

- Xero integrates with ecommerce platforms including Shopify, WooCommerce, BigCommerce, Amazon, and others through its extensive app marketplace.

- Xero tracks inventory levels in real-time and automatically calculates COGS as items sell through your online store. The system sends low stock alerts and provides inventory value reports that update your balance sheet automatically.

- Xero's advisor directory helps you find certified professionals who specialize in ecommerce if you need additional support.

Price: Plans range from $15/month (Early) to $78/month (Established), with all plans including unlimited users.

A2X

A2X is a unique entrant on this list because it's more like an ecommerce-specific add-on rather than a full accounting platform—it's specifically designed for reconciling your sales channels. A2X specializes in reconciling marketplace sales, making it particularly valuable for sellers on Amazon, Shopify, Walmart, or eBay. It breaks down the complex settlement reports from these ecommerce platforms into clean journal entries that sync directly with QuickBooks or Xero. A2X handles the tedious work of accounting for fees, taxes, refunds, and promotions automatically, ensuring your finances accurately reflect marketplace transactions and maintain proper tracking of sales across channels.

Key features:

- Not a full accounting solution on its own, A2X integrates with QuickBooks, Sage Intacct, Xero, and others for ecommerce-specific workflows that track expenses and revenue from merchant services.

- Set specific rules for different storefronts about how transactions are categorized, taxed, and mapped within your ledger.

Price: Priced per seller for merchant services, ranging from $29/month to $79/month.

Bench

Bench provides bookkeeping services as a service, pairing software with dedicated bookkeepers who handle your monthly books. For ecommerce businesses without in-house accounting expertise, Bench offers a hands-off solution where professional bookkeepers categorize transactions and prepare financial statements. However, the subscription cost is higher than DIY software options, and you'll have less control over day-to-day financial processes.

Key features:

- Dedicated bookkeeping experts available to advise you on tax filing, reconciliation, and more. This human touch differentiates Bench from pure software solutions—you have professionals managing your books who understand ecommerce complexity.

- Advising is paired with an online dashboard that integrates with payroll systems, payment processors, and storefronts to track cash flow and expenses automatically.

- P&L statements, balance sheets, and 1099 reporting prepared by your dedicated bookkeeper.

Price: Plans from $199/month to $699/month.

Freshbooks

FreshBooks offers user-friendly accounting software designed for small businesses and solopreneurs. While less specialized for ecommerce than some alternatives, it provides solid invoicing, expense tracking, and bookkeeping features. Its simplicity makes it appealing for online businesses just starting out, though growing ecommerce operations may eventually need more dynamic multi-channel capabilities to track inventory or manage complex financial statements.

Key features:

- Employee time tracking that logs hours toward a project or client, then automatically adds them to an invoice for billing.

- Upload receipts to automatically capture details about the merchant, total, and taxes for review.

- Employee mileage tracker app that enables you to categorize business and personal trips and edit trip details so you can claim deductible expenses.

Price: Plans from $8.40/month to $26/month. Additional add-ons for payments, adding team members, and payroll increase monthly costs. The highest-tier Select plan requires a custom quote.

Best financial platform for accounting integration: Slash

While not a standalone bookkeeping system, Slash is a financial operations platform that significantly enhances bookkeeping workflows for ecommerce businesses. It automates key accounting tasks by auto-categorizing transactions, applying smart mappings, and syncing financial data directly with major systems like QuickBooks and Xero. Slash also provides merchant services for storefronts like Shopify and Amazon.

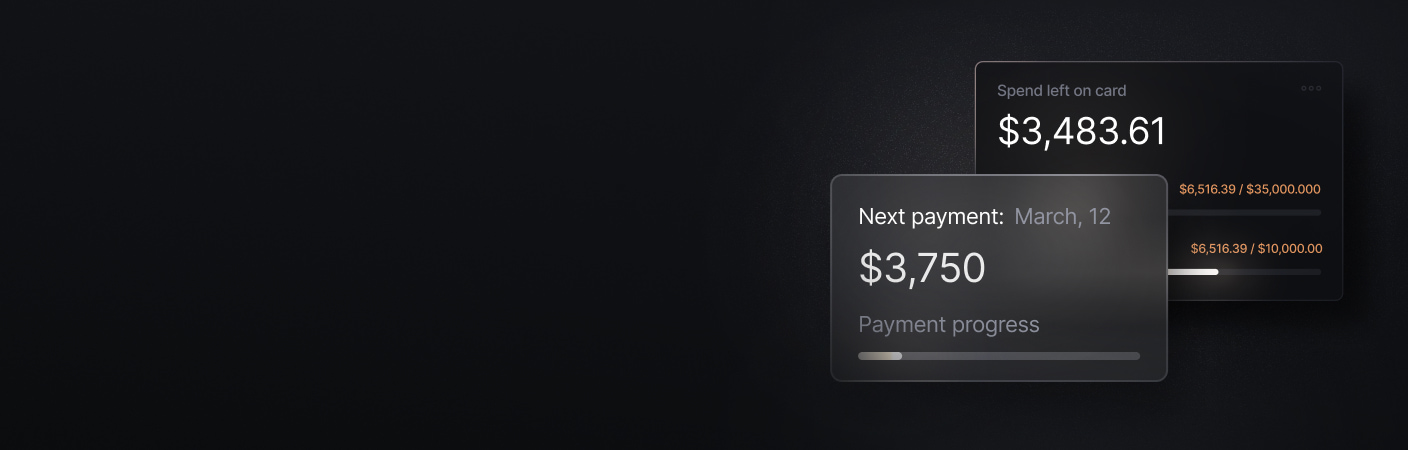

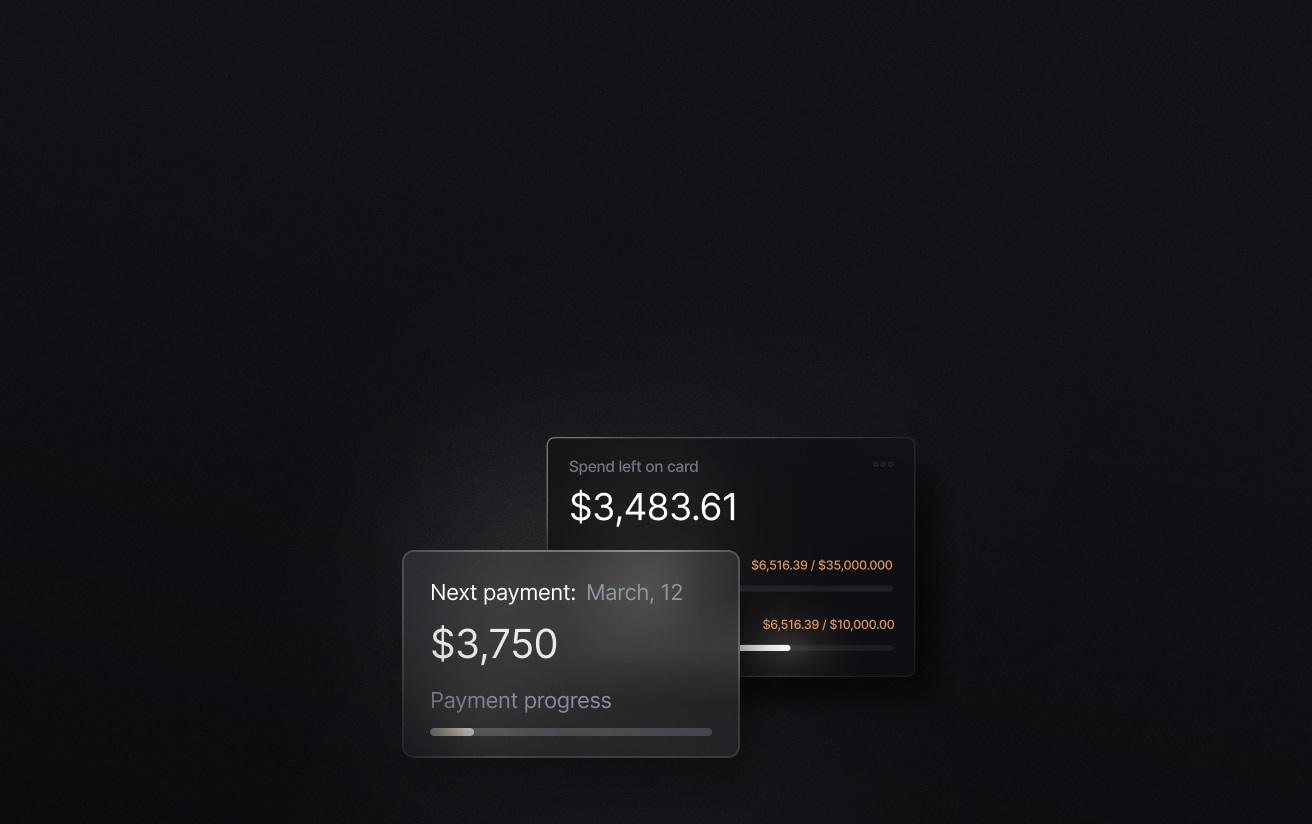

- Slash Visa Platinum Card: Earns up to 2% cash back on spending, issue unlimited virtual cards, set customizable spending limits and controls, and monitor card activity in real time from a centralized dashboard. All transactions are automatically captured for streamlined reconciliation and reporting in Quickbooks.

- Virtual accounts and expense management: Create configurable bank accounts to separate funds by purpose, region, or team. Automatically capture payment details, gain real-time insights into cash flow, enforce compliant spending policies.

- Native crypto support: Hold, send, and receive crypto directly within the Slash dashboard. Use USD-pegged stablecoins like USDC and USDT for near-instant, low-cost transfers, with seamless on- and off-ramps between crypto and fiat at conversion fees under 1%.

- Global USD Account: Enable international businesses to hold, send, and receive U.S. dollars without requiring a U.S. bank account or registered LLC.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

Smart Bookkeeping Practices for Growing Ecommerce Businesses

Implementing smart bookkeeping practices from the start prevents future headaches for your ecommerce business. These strategies can build the foundation for accurate financials, efficient operations, and informed decision-making as you scale.

Build Your Cloud Accounting Infrastructure

Moving to cloud-based accounting software provides real-time access to your financial data from anywhere and enables automatic syncing with your sales channels. Choose a platform like QuickBooks Online or Xero that integrates with ecommerce platforms and offers multi-user access. Slash enhances this cloud infrastructure by syncing transaction data directly with QuickBooks or Xero, eliminating manual data entry and ensuring your cloud accounting system stays current without constant manual updates.

Tailor Your Chart of Accounts for Ecommerce

The default chart of accounts in most accounting software wasn't designed for online retail. Customize yours to reflect ecommerce-specific categories: separate revenue accounts for each sales channel (Shopify, Amazon, Etsy), detailed expense categories for platform fees and shipping, and proper COGS tracking for inventory. Slash's smart mapping capabilities can automatically categorize transactions into your custom chart of accounts, helping you maintain consistency and accuracy as transaction volume grows.

Manage Sales Tax Efficiently

Understand where you have nexus, register in those states, and set up automated sales tax collection through your ecommerce platform. Use sales tax software that integrates with your accounting system to handle calculation and reporting. Regular monthly reviews of your nexus obligations help you stay ahead of changing laws and expanding obligations as you grow across different marketplaces.

Integrate Inventory Management with Bookkeeping

Your inventory management system should communicate directly with your accounting software to automatically update COGS when products sell and adjust inventory values when you receive stock. This integration eliminates manual data entry, reduces errors, and ensures your balance sheet accurately reflects inventory as an asset—critical for understanding true profitability.

Implement Regular Reconciliation Routines

Set a schedule for reconciling bank accounts, credit cards, and payment processors—weekly for high-volume accounts, monthly for others. Regular reconciliation catches errors early, identifies chargebacks and unauthorized transactions, and ensures your books accurately reflect your actual cash flow. Make it a non-negotiable part of your financial routine to maintain healthy finances. Slash simplifies reconciliation by automatically capturing every transaction from your virtual accounts and cards, with real-time syncing to your accounting software that keeps everything aligned and ready for quick monthly close.

Streamline Your Ecommerce Financial Management with Slash

The complexity of managing financials across multiple sales channels, payment processors, and marketplaces can quickly become overwhelming without the right systems in place. By using tools that reduce manual accounting work, your ecommerce store can maintain financial clarity and control as you scale.

Working in tandem with leading accounting software like QuickBooks and Xero, Slash streamlines how you keep your books up to date by capturing every transaction detail—whether it’s a card swipe, virtual account payment, or marketplace settlement—and automatically categorizing it before syncing into your accounting system.

Slash’s intelligent automation features reduce time spent on manual data entry and reconciliation, allowing you to focus more on growing your business. With Slash, you get:

- Corporate charge cards that earn up to 2% cash back, with real-time spending controls and unlimited virtual card issuance.

- Configurable virtual accounts to separate funds by purpose, sales channel, or storefront.

- Automated transaction capture and categorization that syncs cleanly into accounting platforms like QuickBooks.

- Centralized visibility into inflows and outflows to help identify cost centers and monitor spending patterns.

Together, these features give ecommerce businesses the infrastructure to manage complex finances while keeping their books clean and organized. Learn more at slash.com to see how the right financial operations platform can streamline your entire bookkeeping workflow.

Apply in less than 10 minutes today

Join the 5,000+ businesses already using Slash.

Frequently Asked Questions

How is ecommerce bookkeeping different from traditional accounting?

Ecommerce bookkeeping involves multiple sales channels with different fee structures, various payment processors with different settlement schedules, and multi-state sales tax obligations. Each platform reports financial data differently, requiring specialized workflows to accurately track revenue, expenses, and profitability across channels.

How can ecommerce accounting software improve financial management for DTC brands?

Even if your ecommerce store only exists on your website, accounting software can provide real-time visibility into performance across sales channels and automate the recording of thousands of transactions. This means better understanding of which products and channels drive profitability, enabling data-driven decisions about inventory management, pricing, and marketing spend.

The Best Multi-Entity Accounting Software: Comparison, Features, and Benefits

How do I track inventory in ecommerce bookkeeping?

Platforms like QuickBooks Online and Xero offer native inventory tracking that automatically records purchases as assets on your balance sheet and moves costs to cost of goods sold when products sell. These systems integrate directly with Slash for business banking and with ecommerce platforms to update inventory values in real-time across all your sales channels.

When should I hire a bookkeeper?

Consider hiring a bookkeeper when transaction volume makes DIY bookkeeping too time-consuming, when you're missing reconciliation deadlines, or when you can't confidently answer questions about profitability or cash flow.