Accounting Automation Software that will Simplify Your Finances and Expense Management

The future of finance is changing fast, and so should your accounting operations. Accounting automation software can be a useful tool for any business's financial management process. Forgoing outdated accounting methods can enhance efficiency in everyday operations by automating reconciliation, minimizing the risk of error when preparing expense reports, and streamlining preparation for internal audits. Fewer errors free up time and resources for higher-value work, making streamlined accounting operations a critical component of a modern finance stack.

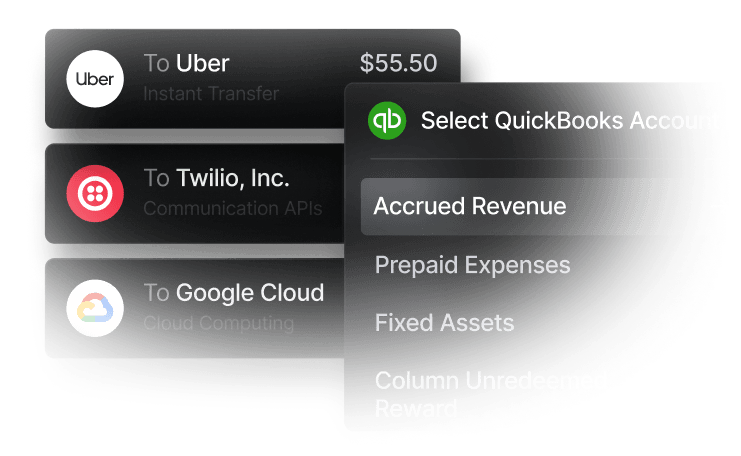

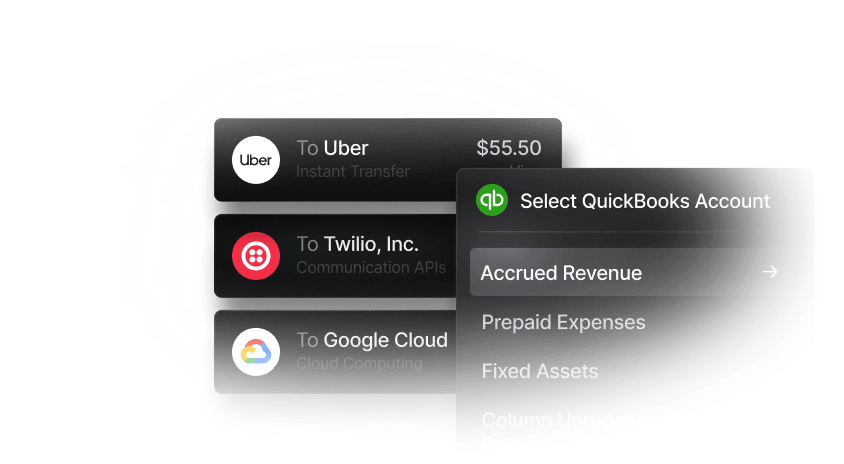

Accounting software is most effective when paired with a business banking platform that centralizes financial data. These platforms can automatically collect and organize payment information across the entire business, eliminating the need to cross-reference multiple systems. Slash is a financial platform that unifies transaction data across payments, cards, and accounts, and syncs cleanly with QuickBooks to reduce manual data entry.¹ But, before choosing an accounting automation solution, it’s important to compare options based on your specific business needs.

In this guide, we’ll showcase various accounting software tools available to businesses today. We’ll explain the best ways to automate finance workflows, which can help to optimize your business’s reporting and regulatory processes. Each software tool comes with its own benefits and challenges, so understanding which services are most applicable to your business can be the first step to streamlining financial workflows.

What is automated accounting software: Key features and importance

Automated accounting software is a modern upgrade to traditional accounting methods that can streamline processes such as reconciliation, expense reporting, invoice management, audit preparation, and tax filing by using technology to improve financial workflow efficiency.

Some of the high-level benefits that your business can expect from implementing automated accounting software include:

- Enhanced data accuracy. Automation can quickly find and minimize errors such as duplicate transactions, missing receipts, or misclassifying transactions.

- Time efficiency. Manually going through bank statements and invoices can slow down the time it takes to close your books.

- Simplified financial reporting. Accounting software can simplify reporting by automatically generating profit and loss statements, balance sheets, and necessary tax forms

Traditional accounting can be grueling, with teams spending hours on manual data entry in expense report spreadsheets. These manual processes are prone to errors, which often lead to time-consuming cleanups later on. Automated accounting systems help streamline financial management by reducing these inefficiencies:

External integrations

To get the most from an automated financial setup, many accounting systems enable syncing with third-party financial platforms, ERP systems, and more. These integrations enable users to push and pull financial data between platforms, which is an important capability for minimizing manual data entry. Quickbooks, for example, integrates seamlessly with Slash; Slash users can push all transaction data directly into their account platform, and then use that data to reconcile, draft reports, and more.

Invoice management

Automating invoice creation and tracking helps simplify the billing process and keeps purchases for products or services organized and efficient. Modern accounting platforms can use AI to support accounts payable controls such as two-way and three-way matching. Two-way matching compares invoices to purchase orders, while three-way matching verifies invoices against purchase orders and receiving documents, such as receipts or packing slips, to help ensure accuracy before payment.

Generated reports

Financial reporting, including drafting income statements and balance sheets, is vital to a business’s long-term health because it informs decision-making and forecasting. Some automated accounting software can generate these reports automatically, giving business owners a more accurate and up-to-date view of their company’s financial position.

Time-tracking and workflow approvals

Time tracking is a core tool for understanding labor-cost allocation, as it allows businesses to see how employee hours translate into costs across different roles, projects, or tasks. How these costs are allocated directly affects profitability and can inform more accurate budgeting and forecasting. Automating time tracking within an accounting or payroll system can help ensure that labor data is consistent, whereas manual time entries can be more prone to errors.

What are some effective accounting automation tools?

There are many accounting automation tools on the market, and their features and capabilities can vary. Depending on your business model and operational needs, certain features may matter more than others. Below are our top choices of automated accounting systems to consider:

Xero

Xero is an accounting software platform that allows users to use third-party app integrations and AI-powered reconciliation features. Another key strength of Xero is its automated accounting and their focus on accounts payable and payroll add-ons.

Who it's for: Small business accountants managing multiple entities and need third-party app integrations.

Subscription price: Starting at $25/month; Xero's highest-tier Established plan is $90/month.

Intuit Quickbooks

Known for its comprehensive accounting system, Quickbooks is another accounting automation software that integrates data from banking services like Slash. Transactions can be synced, and industry-specific workflows can be altered depending upon your business needs with features such as expense categorization and report generation.

Who it's for: Small businesses and mid-sized companies that need a reliable accounting software with a minimal learning curve.

Subscription price: QuickBooks Online pricing ranges from $19-$137.50/month. Each additional entity requires an additional subscription.

Oracle NetSuite

NetSuite is an enterprise resource management system (ERP) catered for startups and enterprises; its automated accounting features work alongside a variety of cloud-based resources to help scale business operations. They are primarily a business management suite that includes automated accounting tools, however they also include other business offerings such as CRM and human capital management.

Who it’s for: Growing businesses with 3-10+ entities that need an easily scalable accounting system.

Subscription price: Starting around $999 per month base license plus $99 per user/month. Total costs typically range from $20,000 to $100,000+ annually depending on modules and user count.

Microsoft Dynamics 365

Microsoft Dynamics 365 is a multi-solution platform that connects data across sales, operations, finance, and other business functions. As part of its Enterprise Resource Planning (ERP) suite, it includes automated accounting capabilities such as general ledger, project accounting, and budgeting.

Who it’s for: Large enterprises that need powerful multi-entity accounting workflows tightly integrated into their Microsoft system.

Subscription price: Starting at $80 per user/month with the Finance modules starting at $210 per user/month.

BlackLine

BlackLine is an AI financial and cloud software platform with a strategic focus. By utilizing automation, their platform works to automate record-to-report and invoice-to-cash processes. BlackLine also features a central hub for governance and risk management, as well as a dashboard that lets users visualize data.

Who it’s for: Mid-sized or large businesses, more typically used for corporate finance teams.

Subscription price: BlackLine does not provide fixed prices, but instead creates customized pricing based on details including the amount of users or number of integrations.

FreshBooks

FreshBooks is an all-in-one small business software with tools such as receipt capture, financial reporting and cash flow management, invoicing, and billing. Their SaaS accounting tool is best used for freelancers and small services.

Who it's for: Service-based small businesses, freelancers, and consultants managing 1-3 simple entities with straightforward accounting needs.

Subscription price: Starting at $252/year and ranges up to $700/year. Multiple businesses require separate subscriptions.

Deltek

For more project-based businesses, Deltek provides financial planning and compliance tools for mid-to-large firms. These firms may be in industries ranging from architecture to construction or government contracting.

Who it’s for: Project-based businesses that track long lifecycles rather than single transactions.

Subscription price: Requires a custom quote.

Spendesk

Spendesk is a spend management platform that offers real-time spend visibility and automated reconciliation. It’s best used for finance teams within the EU to control and track team budgets, expense workflows, and reporting dashboards.

Who it’s for: Small to medium sized businesses that want to help companies centralize their spend management.

Subscription price: Requires a custom quote.

The best business banking platform for accounting integration: Slash

Slash offers several key features needed for small to medium businesses, combined in a singular platform. With Slash, you can sync accounting data from elsewhere with your business banking accounts, use unlimited virtual and physical cards with smart spend controls, and manage vendor payments, including international payments, all from one dashboard.

- Automate data sync: Push transaction data directly to your accounting software in real time with the Slash API, eliminating manual entry and reducing errors. Configure automated mappings to sort your transactions into tax-compliant expense categories.

- Split transactions: Split a single transaction into multiple accounting items for proper allocation ahead of tax season.

- Multi-entity support: Keep finances organized across your subsidiaries by centralizing your statements and accounts while maintaining unified visibility.

Slash business banking

Works with cards, crypto, plus cards, crypto, accounting, and more.

Which accounting processes are best suited for automation?

Below, we’ll discuss which accounting tasks are best suited for automation and why they tend to be more time-consuming when handled manually:

Processing vendor invoices and managing payables

Working with vendors is common for many businesses, but sometimes invoices carry discrepancies or need legal approvals. Automation can swiftly verify these details and get vendors paid accurately.

Handling employee expenses and reimbursements

If each employee has to manually create an expense report, this takes away valuable time that may be better suited for their everyday professional responsibilities. Automating the reimbursement process lets teams focus on what matters.

Reconciling bank statements and transactions

Going through transactions manually to check for mismatches can be repetitive. The mechanical nature of this work is more prone to human error, so automating this process can minimize the likelihood of these mistakes.

Preparing financial reports and closing accounts

To close accounts or prepare financial reports confidently, it’s essential to standardize the process. Automation can keep reports consistent and easily documented so there is a reduced reliability on spreadsheets alone.

Managing purchase orders and procurement workflows

As companies grow, so can purchase order volume. To keep up with the speed of orders, automation can take the load of that volume off the shoulders of team members and ensure an increase in speed without losing oversight.

What factors should you consider when selecting accounting automation software?

Before choosing which accounting automation software is right for your business, consider the following criteria and capabilities:

- Streamlined data entry: Improve accuracy across essential bookkeeping tasks such as accounts payable or expense categorizing.

- Invoice categorization: Your accounting platform should feature OCR technology to capture information automatically from uploaded invoices. Some systems also will use AI to match invoices to their appropriate purchase orders and transactions, taking the hassle out of reconciliation.

- Flexible approval workflows: Accounting systems can route financial documents to the correct team or administrator based on who needs to authorize or review; automatically send invoices to your accounts payable team and receipts to your finance team.

- All transactions in a single dashboard: Some businesses may oversee multiple entities that need management of their transactions, expenses, and card balances. Accounting automation software can track all of that data in one single dashboard, reducing the strain of manual tracking.

Implementing accounting automation in 5 easy steps

Before implementing automated tools, consider the following steps that will help businesses evaluate how to integrate these changes:

Evaluate existing accounting workflows

Understand what aspects of your existing accounting workflow could be more efficient. Which systems are involved, when are entries made, and when are approvals needed? Having this information can show you what approval systems are taking too long and slowing down progress. By doing a full internal review of your current system, you can better understand which parts of the process need to be reorganized.

Ensure you have the right accounting platform for automation

Make sure you understand the key differences between various account software. For instance, some platforms are better supported for large teams versus smaller teams, so evaluating these operational priorities can help narrow down your decision making.

Run pilot implementations to test automation

Testing gives you a run-down for how automation will play out for your finances more specifically. A pilot test is a great time to use real data sources instead of mock information before fully committing to any service. This lets businesses evaluate how accurate the reconciliation is compared to a manual report.

Train your team on new processes

Help your team learn and integrate the new process to transition. Once finance teams are trained, they can evaluate which processes become more efficient with automation, and how their new role and responsibilities shift to work alongside the software instead of separate from it.

Scale automation across additional workflows

Once you’ve tested and trained your team, you can begin to scale automation across additional workflows by adding new users and updating documentation and training to reflect new processes. It’s most helpful to scale workflows that performed well in the pilot and overall reduced the manual effort of the team.

Streamline your financial management today with Slash

Keeping accounting records separate from everyday financial activity often leads to unnecessary back-and-forth and manual work. Slash helps bridge that gap by seamlessly syncing your transaction data with your accounting workflows.

Slash enables businesses to simplify accounting processes with auto-categorized transactions, customizable mappings, and seamless integrations with platforms like QuickBooks and Xero. Real-time tracking and unified data can also provide better visibility into expenses and spending trends, making it easier to monitor financial performance as it happens. In short, finance teams can close the books faster and with less manual effort.

Slash offers additional tools designed to modernize business financial operations, including:

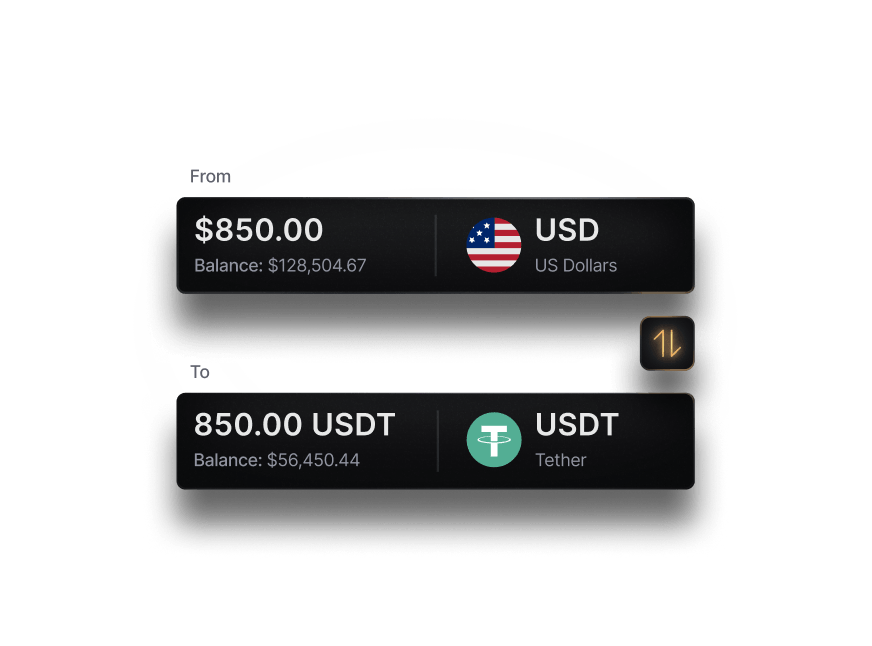

- Cryptocurrency payments: Businesses can send and receive USD-pegged stablecoins like USDC and USDT. This allows companies to access potential benefits like faster settlement and lower processing costs, while avoiding the price volatility associated with many other cryptocurrencies.⁴

- Global USD Account: The Slash Global USD Account enables foreign business owners to send and receive USD around the world without a U.S. bank account or registered LLC.³

- Multi-entity financial controls: Slash supports businesses operating multiple entities with consolidated visibility of all your accounts. View all of your statements in one place, and separate different cash flows with configurable virtual accounts.

- Working Capital financing: Slash’s Working Capital is designed for growing businesses who need flexible financing. Users can choose between flexible 30, 60, or 90 day repayment terms so companies can continue to scale while still supporting liquidity for daily operations.⁵

Simplify how your business manages money. Start using Slash to unify payments and simplify your accounting. Learn more at slash.com today.

Apply in less than 10 minutes today

Join the 5,000+ businesses already using Slash.

Frequently asked questions

Will automated accounting software replace accountants?

No, automated accounting will not replace accountants, but it will change their everyday work process. Accountants will still be needed for automation oversight and strategic advising.

What is the best AI to use for accounting?

Slash integrates with Quickbooks, which uses OCR technology to help match bank feed transactions with related invoices, bills, or receipts. These tools can also assist in identifying potential discrepancies in bookkeeping, helping teams review and correct errors more efficiently.

The Best QuickBooks Integrations to Automate Accounting

How much time can automation realistically save my accounting team?

Depending on which accounting processes matter most to your business, accounting software can significantly reduce the time spent on manual tasks. Actual time savings depends on the depth of your accounting processes and the size of your business.