Corporate P-Cards Explained: Everything Finance Teams Need to Know

There are a number of ways to approach employee spending within your organization. Those who decide to offer corporate credit cards to their team are faced with a question: between business credit cards, corporate cards, and charge cards, what works best for your team’s needs?

This decision often comes down to a company’s spending habits. For instance, businesses can rely on credit cards for large expenses that can take several months to repay on credit. However, it’s not always necessary to assign all workers the same cards used for these transactions. For companies that want to keep employee spending simple and streamlined, the purchase card (P-card) may fit the bill.

A P-card allows employees to make approved business purchases directly without relying on cumbersome purchase order systems. These specialized payment tools reduce administrative overhead, improve spending visibility, and accelerate procurement while maintaining necessary controls.

In this guide, we'll explain how P-cards work, highlight their benefits, and outline best practices for implementing an effective program that balances employee autonomy with financial oversight. We’ll also discuss how the Slash Visa® Platinum Card combines the best features of both purchase cards and corporate credit cards.¹

What Is a Corporate Purchasing Card?

A corporate purchasing card (P-card) is a specialized business payment card designed specifically for the procurement process. In fact, P-card can also stand for procurement card. Unlike general business credit cards, P-cards are optimized for low-value, high-frequency purchases such as office supplies, maintenance items, and operational necessities.

These cards also come with a different payment cycle than credit cards. P-cards are a type of charge card, which means their balance must be paid in full at the end of each month. While these cards don’t offer as much long-term flexibility, they enable tighter controls and better tracking, which are important in regards to frequent expenses.

P-cards are designed to cut down on purchase orders and approvals for routine transactions that shouldn't need them. They’re typically meant for vendor payments and procurement transactions rather than meals, travel, or other everyday purchases. These cards usually come with merchant category restrictions and transaction controls aligned with the cardholder's role. Organizations can issue P-cards to employees who regularly make operational purchases, such as facilities managers, administrative staff, or department heads.

The choice of corporate card isn’t limited to just credit cards and P-cards, however. The Slash Visa® Platinum Card takes the best features of both and combines them on one charge card. With the Slash card, businesses get the granular controls and spend limits common in P-cards alongside the cashback rewards and wide use cases of a business credit card.

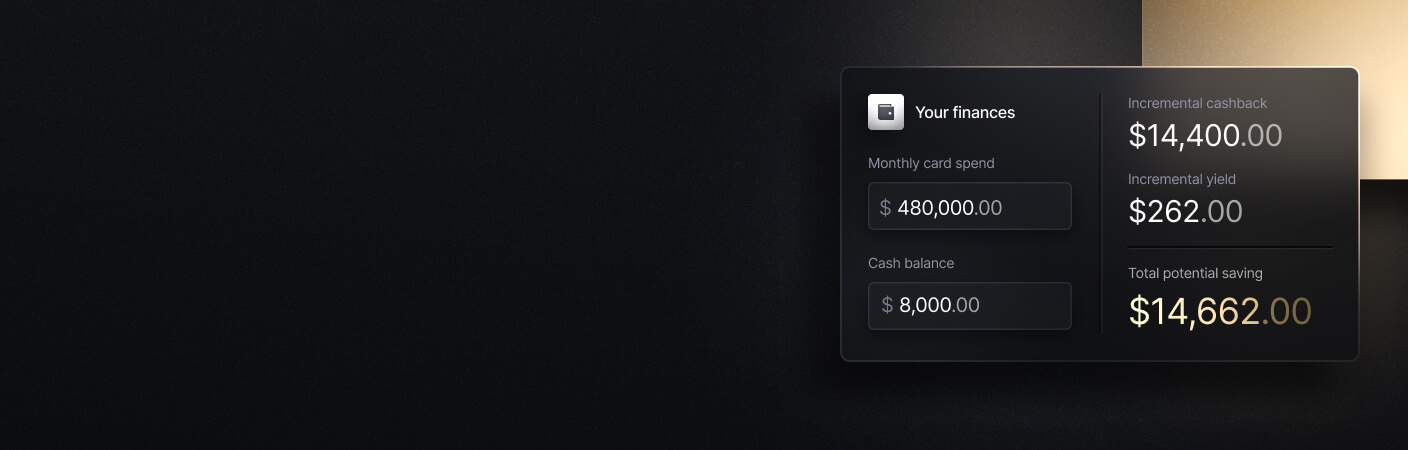

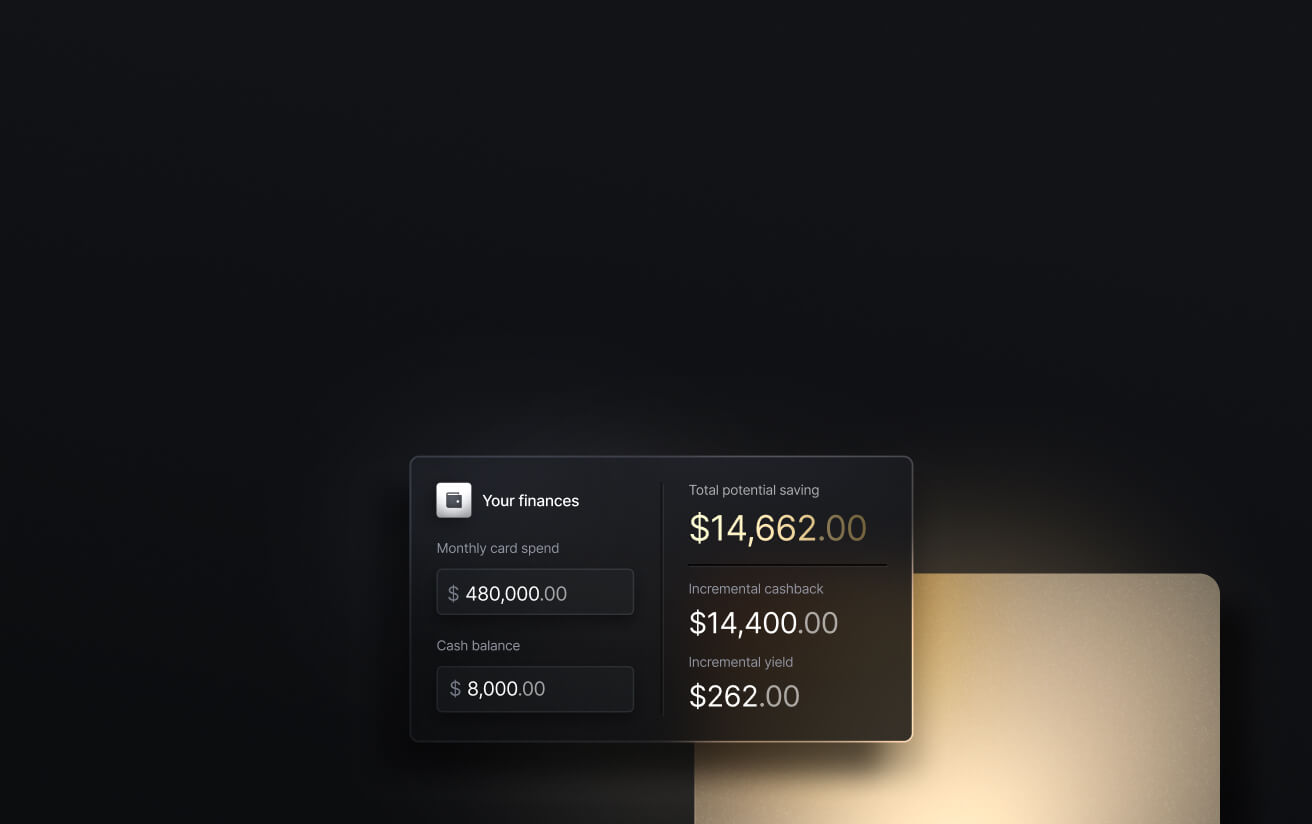

See the ROI behind your spend

Use this calculator to understand impact, then manage and track it all in Slash.

How Does a Purchase Card Payment Work?

Understanding the P-card workflow helps finance teams implement programs effectively. Here's the step-by-step process:

Issuance and Program Setup

An organization chooses a card provider to establish a P-card program aligned with their corporate policies and spending patterns. Finance teams can configure system parameters governing all activity: default spend limits, restricted merchant categories, transaction frequency limits, and reporting requirements.

Card Assignment to Employees and Departments

Cards are issued to employees with purchasing responsibilities. Each assignment can include cardholder-specific spending limits, merchant category restrictions based on authorized purchases, transaction frequency and size limits, and initial training on usage and compliance.

As an example, a facilities manager might receive a card with a $5,000 monthly limit restricted to hardware stores and maintenance suppliers, while an office administrator gets a $2,000 monthly limit for office supplies and software.

Spending Controls and Limits

Modern P-card programs implement multiple layers of control to prevent misuse and ensure policy compliance. Individual transaction limits restrict the maximum amount per single purchase, while monthly limits cap total spending over a billing cycle.

Merchant Category Code (MCC) restrictions block purchases from unauthorized merchant types like entertainment venues, restaurants, or personal retail stores. These automated controls enforce policy compliance proactively so businesses don’t have to wait for post-purchase expense reviews to catch violations.

Purchase Process

The P-card’s purchase process is designed to be straightforward. Your cards will only be enabled at approved vendors, and when a purchase is made, transactions can automatically be categorized in your expense management and accounting system, then settled. This skips the approval processes and purchase orders that often end up being utilized on standard credit cards.

Real-Time Tracking and Reporting

As transactions occur, they appear immediately in the P-card’s management system. Finance teams gain instant visibility into all purchases including cardholder identity, merchant information, transaction amount, date and time, and merchant category. Solutions like Slash offer dashboards that provide aggregated views of spending by department, category, vendor, or time period, helping identify trends and opportunities.

Monthly Reconciliation and Auditing

At month-end, finance teams review submissions for completeness and policy compliance, match receipts to transactions, verify appropriate business purposes, and route questionable purchases for additional review. Approved transactions post to the general ledger with appropriate expense categorization, while any exceptions require cardholder explanation and management approval.

What Are the Benefits of Using a Purchasing Card?

- Streamlined Procurement and Reduced Admin Burden: Since they’re built for routine purchases, P-cards can eliminate purchase order paperwork and lengthy approval processes.

- Better Budget Control and Real-Time Visibility: With real-time dashboards, finance teams see spending as it occurs rather than weeks later during expense processing.

- Fewer Manual Expense Reports: P-cards handle both direct vendor purchases and procurement through a single system, reducing the amount of necessary expense reports.

- Faster Vendor Payments and Improved Supplier Relationships: Vendors receive immediate payment rather than waiting 30-60 days for invoice processing.

- Enhanced Spend Controls and Policy Enforcement: Automated controls enforce policy at the point of purchase – transactions that exceed limits or come from restricted merchants will be declined.

- Simplified Reconciliation and Reporting: Electronic transaction data feeds directly into accounting systems, leading to comprehensive reporting that provides spending insights for better financial planning.

Business P-Cards vs. Other Business Cards: A Complete Comparison

Understanding the differences between P-cards and other business payment cards helps organizations choose the right tools for specific use cases:

P-Cards vs. Corporate Cards

While P-cards focus on procurement and vendor payments for operational needs, corporate credit cards serve broader purposes including travel expenses, client entertainment, and general business expenditures. P-cards implement strict merchant category restrictions, transaction limits, and approval requirements tailored to procurement. Corporate cards typically have more flexible spending parameters accommodating diverse business expenses.

Corporate cards typically go to executives, managers, and any employees who travel frequently or entertain clients, while P-cards are meant for team members with regular purchasing responsibilities, such as facilities managers and office administrators.

When it comes to transaction limits, P-cards generally have lower ceilings ($500-$5,000 per purchase) but may have higher monthly limits due to frequent operational purchases. Corporate cards, on the other hand, often have higher transaction limits to accommodate travel and entertainment expenses. These cards can actually carry relatively low monthly limits, since these expenses aren’t constant.

P-Cards vs. Business Credit Cards

Business credit cards are like small-scale corporate cards, often serving as general-purpose payment tools for small businesses or departments. They sometimes lack sophisticated controls, relying on overall credit limits. P-cards provide granular controls including merchant restrictions, transaction limits, and category-based approvals.

Business credit cards may include personal guarantees from business owners, while P-cards operate under corporate liability with no personal guarantees required. Since business credit cards are meant for small business owners, cardholders often include a few select employees.

Both of these cards can offer rewards programs, though structures differ. It's a good idea to evaluate cashback programs, as platforms offering competitive rates can generate significant returns on procurement spending, effectively reducing net costs for business purchases.

P-Cards vs. the Slash Card

Like P-cards, the Slash Visa® Platinum Card provides real-time spending visibility on a charge card that must be paid in full on a monthly basis. However, the Slash card surpasses P-cards in its ability to offer up to 2% cashback on business purchases.

While P-cards are meant for specific employees in charge of procurement and vendor purchases, the Slash card can be given to any team member at any level of administration. Expenses from graph paper to conference tickets are gathered and automatically sorted on one platform. Since such a wide array of expenses are possible with the Slash card, your per-transaction and monthly limits are completely customizable. You can even assign multiple virtual cards to a team and set a collective limit for that group.

Not all P-cards integrate with accounting tools, but Slash syncs both ways with solutions like Quickbooks, allowing financial data to be connected quickly and clearly. The Slash card and all-in-one dashboard enable a higher level of organization and flexibility that isn’t easy with P-cards, business credit cards, or corporate cards.

Managing P-Card Spending: Best Practices for Implementation

Successful P-card programs require thoughtful implementation and ongoing management. Let’s go over some tips:

- Set Card-Specific Limits and Controls: Customize each card based on the user's role and purchasing needs.

- Automate Transaction Oversight: If possible, connect your P-card program directly to your accounting software. Transactions should flow automatically into the general ledger with appropriate expense categorization, eliminating manual data entry and reducing reconciliation time.

- Track Transactions and Watch for Fraud: Real-time monitoring enables immediate intervention when suspicious activity occurs such as multiple rapid transactions, purchases at unauthorized merchants, or spending patterns that deviate from norms.

- Audit Usage Regularly and Adjust Limits: Conduct quarterly reviews of all P-card activity, identifying cards with no usage, cards consistently hitting spending limits, and spending patterns suggesting misuse.

- Train Cardholders on Policy: When given P-cards, employees need to understand policy requirements, proper documentation procedures, merchant restrictions, and consequences for violations.

- Leverage Automation to Simplify Reconciliation and Reporting: A great P-card platform will offer automated receipt matching, expense categorization based on merchant data, policy compliance checking, exception flagging for unusual transactions/fraud, and customizable reporting dashboards.

How to Choose a P-Card Provider: Top Features to Look For

Not all P-card providers offer the same benefits. Here are some key features you may want to prioritize when making your choice:

Unlimited Physical and Virtual Cards

Your corporate cards shouldn’t hinder your business’s spending with needlessly low limits or excessive fees. Virtual cards are particularly valuable for online purchases, vendor-specific arrangements, or temporary purchasing needs. Slash allows businesses to assign unlimited physical and virtual cards for any category of spend.

Customizable Spending Limits per Card

Each cardholder should have limits tailored to their role, spending patterns, and business needs. Look for platforms allowing granular control at multiple levels: per-transaction limits, daily spending caps, monthly budget allocations, and merchant category restrictions.

Real-Time Visibility into All Transactions

Some P-card solutions support dashboards that display current transaction data, spending against budgets, merchant information, and cardholder details. The ability to filter and analyze spending by department, category, vendor, or time period transforms transaction data into actionable insights.

Vendor-Specific Restrictions

Platforms like Slash allow restrictions at the individual vendor level, not just merchant categories. Many P-cards offer tools that allow purchases only at specific approved vendors, or require additional approval for purchases from new suppliers.

Accounting Software Integration

Seamless integration with platforms like QuickBooks can be very helpful, as transactions can sync automatically with proper expense categorization, eliminating manual data entry.

Simplify Corporate Spending with Slash

Purchase cards represent a significant advancement in corporate procurement, replacing purchase order processes with quick, controlled spending that empowers employees while maintaining financial oversight. The Slash business banking platform has improved upon the P-card’s formula with the Slash Visa® Platinum Card.

The Slash Card combines the advanced visibility, spend controls, and financial responsibility of the P-card with the freedom of the corporate credit card. The sky is the limit when it comes to spending thresholds and expense categories – but when you want to bring that limit back down to earth, you can set controls of your choice. Our fraud protection tools ensure transactions outside of set limits are automatically declined, helping you to prevent out-of-policy spending before it happens.

Slash's analytics dashboard transforms transaction data into actionable insights. Track spending patterns, vendor consolidation opportunities, budget variances, and cost-saving initiatives. Customizable reports support financial planning, forecasting, and strategic decision-making.

You can also earn up to 2% cashback on eligible purchases, effectively reducing net procurement costs. Unlike rewards programs that require complex redemption or offer limited value, Slash delivers straightforward cashback that directly impacts your bottom line. The inclusion of unlimited virtual cards means employees from all levels of administration can help earn that cashback with each business expense.

If your organization is seeking a corporate card with sharper spend controls or a P-card that allows a wider range of purchasing ability, the Slash Visa® Platinum Card may be the answer.

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

FAQs

Is there a difference between a procurement card and a purchasing card?

P-card providers may refer to their "P" with either one of these words, but ultimately procurement cards and purchasing cards mean the same thing. Procurement and purchasing themselves, however, have slightly different meanings: procurement refers to the specific acquisition of items meant for business, while purchasing generally refers to any expense.

How can I prevent fraud among my P-cards?

Many P-card solutions offer automatic fraud detection, alerting administrators to unauthorized purchases attempted outside approved vendors or amounts. Without these tools, the increased visibility these cards offer still enables finance teams to spot fraud -- but the process will be more manual and error-prone.

Business Fraud Prevention: A Guide for Protecting Your Company

What is the procurement process?

The procurement process is the strategic, end-to-end cycle of identifying, sourcing, negotiating, and acquiring goods or services from external suppliers to meet operational needs. The P-card simplifies this process by skipping steps like purchase orders and invoice approvals, which lowers processing costs.