Getting a DUNS Number for Your Businesses: How to Apply, and What You Need to Know

If you’ve never heard of a DUNS number before, you might think someone just called you a dunce. It sounds like a typo or some made-up term for a process that doesn’t even exist. But if you have recently been asked for one while applying for a grant, onboarding with a new supplier, or registering on a business platform, it is worth understanding what it actually is and why so many organizations require it.

The short version is that a DUNS number is how the business world keeps track of who you are. It is an identifier that follows your business across commercial and government databases, allowing lenders, suppliers, and agencies to look you up, verify your information, and track your financial history over time. Getting one is free, the process is straightforward, and for many businesses it eventually becomes a prerequisite for doing business with larger organizations.

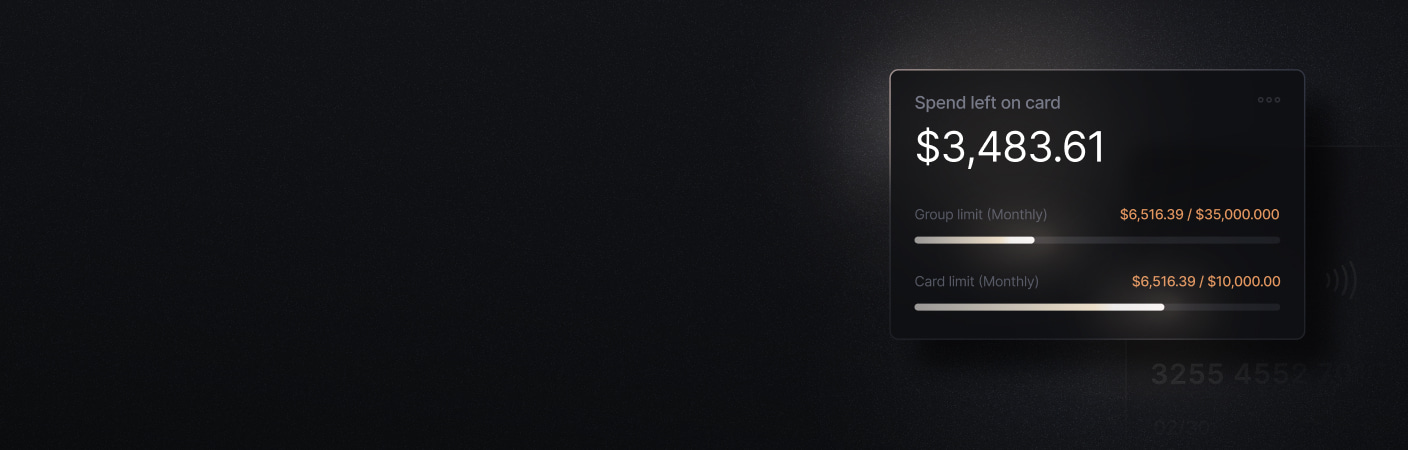

A DUNS number helps establish your business identity with lenders and suppliers, but credit eligibility is only one part of your broader financial picture. Slash is a business banking platform built to give business owners clearer visibility into how money moves through their operations.¹ Slash can support the kind of organized financial activity that reflects well on a business overall, with real-time analytics and customizable card controls to help you stay on top of spending as your company grows.

What is a DUNS number?

Dun & Bradstreet is a business data and analytics company that has been collecting and maintaining commercial information for 185 years. It operates one of the largest business databases in the world and is responsible for issuing the DUNS numbering system, which businesses, lenders, suppliers, and government agencies use to identify and verify companies' financial records.

The DUNS number itself is a nine-digit identifier assigned to a single business entity. It serves as a consistent reference point across commercial and government databases, allowing payment history and commercial activity to be tracked over time. If you operate multiple locations or subsidiaries, each one may receive its own number.

What a DUNS Number is not

A DUNS number is not a credit score, and obtaining one does not automatically generate a credit report. It also does not guarantee loan approval, favorable lending terms, or improved creditworthiness. Having one assigned to your business is really just the starting point, not a reflection of your financial standing in itself.

What it does do is give Dun & Bradstreet a reference point to begin building a business credit report over time, as your company accumulates payment history and commercial activity. A lender or supplier may later request that report as part of their own evaluation process, but the DUNS number itself is simply the identifier that makes that tracking possible.

When does a business need a DUNS number?

Most early-stage businesses do not need a DUNS number on day one. If you are freelancing, running a sole proprietorship, or just getting started, it is unlikely to come up right away. As your business grows and begins engaging with outside organizations, however, a DUNS number may become a requirement. Here are several common scenarios that typically require your business to have a DUNS number:

- Grant applications: Many federal and state grant programs require applicants to have a DUNS number before they can register or submit an application. If you are pursuing federal contracts or government funding, obtaining one is typically a prerequisite.

- Supplier onboarding: Some suppliers and vendors require a DUNS number as part of their onboarding process to verify that your business is a legitimate, registered entity before extending credit terms or entering into contracts.

- Platform verification: Certain business platforms and marketplaces use a DUNS number lookup to verify business information during registration, particularly those that serve enterprise clients or government buyers.

- Building a business credit report: A DUNS number is what allows Dun & Bradstreet to begin tracking your payment history and commercial activity. Without one, there is no mechanism for that data to be associated with your business in their database.

- Lender reviews of financial health: When applying for a business loan, some lenders will pull your Dun & Bradstreet business credit report as part of their review. Having an established DUNS number and a track record attached to it can be a factor in how they assess your business.

A DUNS number establishes your business identity, but day-to-day financial visibility matters just as much. Slash gives business owners real-time analytics and customizable cards to keep spending organized and cash flow healthy.

The standard in finance

Slash goes above with better controls, better rewards, and better support for your business.

How to get a DUNS number: Step-by-step guide

Before walking through the steps, it is worth noting that DUNS numbers are available for free to U.S.-based businesses, Canadian businesses, and certain operators at specific companies and government organizations. If your business falls into one of those categories, here is how to get started:

Step 1: Check whether your business already has a DUNS number

Before applying, it is worth checking whether your business already has a DUNS number. Many business entity records already exist in the Dun & Bradstreet database, even if you never applied for a number. Businesses can be assigned a DUNS number through third-party data collection or prior commercial interactions, so there is a reasonable chance yours is already in the system. You can verify this using the DUNS number lookup tool on the Dun & Bradstreet website before moving forward.

Step 2: Gather the information you’ll need to apply

Having everything ready before you start will make the application process straightforward. You will need the following:

- The legal name of your business

- Your business address. If you have multiple locations, you will need to apply for a separate DUNS number for each one

- Your business phone number

- The name of the business owner, president, or CEO

- The legal structure of the business

- The year the business was established

- The primary industry your business operates in

- The total number of full- and part-time employees

Step 3: Apply through Dun & Bradstreet

Once you have your information ready, you can apply directly through the Dun & Bradstreet website. The online application is the most common route and tends to move quickly. If you prefer, there is also an option to apply by phone. Either way, the application is free and the process itself is fairly simple.

Step 4: Verify details with D&B if needed

After submitting your application, you may be contacted by a Dun & Bradstreet representative to validate the information you provided. This is a routine part of the process and is just meant to confirm that your business information is accurate before a number is issued.

What to expect after you apply for a DUNS number

Once your application has been processed and approved, you will receive an email from Dun & Bradstreet containing your new DUNS number. Keep that email somewhere accessible, as it will serve as your primary confirmation.

How long does it take to get a DUNS number?

In most cases, you can expect to receive your number within 30 business days of applying. If you need it sooner, Dun & Bradstreet offers an expedited option that can speed up the process for a fee of $299.

How to find and verify your DUNS number

If you have misplaced your confirmation email or simply want to double-check your number, you can look up your business information using the DUNS number lookup tool on the Dun & Bradstreet website. This allows you to verify that your business details are accurate and up to date in their database.

How a DUNS number ties into business credit

Getting a DUNS number is often framed as a credit-building move, and while that is not entirely wrong, it is a little more nuanced than that. The number itself is just an identifier. It does not generate a credit score the moment it is issued, and it does not improve your creditworthiness on its own.

As your business opens accounts, works with suppliers, and builds a payment history, that activity gets associated with your DUNS number in the Dun & Bradstreet database. Those records gradually form a business credit report, which a lender or supplier may pull when deciding whether to extend credit, offer loan terms, or enter into a contract with your business. The DUNS number is what makes that process work smoothly. Without it, there is no consistent way for outside parties to locate and verify your business information across different systems.

A related misconception is the assumption that personal and business credit are the same thing, or that a strong personal credit history will carry weight in business evaluations. In actuality, they are separate systems built on different data.

Your personal credit score, calculated through models like FICO and reported by agencies like Experian, is tied to your Social Security number and reflects your history as an individual borrower. Business credit, on the other hand, is tied to your business entity and built entirely from commercial activity. Dun & Bradstreet tracks this through the PAYDEX score, which measures how consistently and promptly your business pays its suppliers and vendors.

The practical takeaway is that a DUNS number sets the stage, but your payment behavior is what actually builds your business credit over time. A business owner who obtains a DUNS number early and then pays suppliers on time, maintains healthy financial activity, and monitors their business credit report is in a much stronger position than one who applies for a number and assumes the work is done.

From a DUNS number to day-to-day finance operations with Slash

Building a DUNS number and establishing business credit is an important part of setting your company up for long-term financial health, but credit is only one piece of the picture. Day-to-day financial visibility, spending control, and cash flow management matter just as much, and that is where Slash comes in.

Slash is a business banking platform designed to give business owners clearer insight into how money moves through their operations. While Slash cards do not report to business credit bureaus, meaning they won't directly contribute to your PAYDEX score or Dun & Bradstreet credit report, they are built to support the kind of disciplined financial activity that reflects well on a business overall. Keeping spending organized, maintaining healthy cash flow, and avoiding unnecessary debt are habits that matter to lenders and suppliers, and Slash is designed to make those habits easier to maintain.

Those capabilities are supported by a set of features designed to give business owners more control, visibility, and flexibility across daily operations, including:

- Slash Visa® Platinum Card: Issue unlimited virtual cards with customizable spending controls across every department, earning up to 2% cash back on spending.

- Data-driven analytics: Monitor transactions in real time through analytics dashboards that provide immediate visibility into organizational spending.

- Accounting integrations: Automatically sync transaction data with QuickBooks for simplified reconciliation and reporting. Connect via Plaid to integrate with additional financial tools, or import data from Xero to enhance your accounting workflow.

- Diverse payment methods: Send and receive ACH and wire transfers to 180+ countries, or real-time domestic payments using RTP and FedNow. Native support for USD-pegged stablecoins like USDC and USDT enable near-instant, low-cost international transfers on the blockchain.⁴

- Slash Capital Financing: Access short-term financing with flexible 30-, 60-, or 90-day repayment terms to help bridge cash flow gaps.⁵

Apply in less than 10 minutes today

Join the 3,000+ businesses already using Slash.

Frequently asked questions

Is a DUNS number the same as an EIN?

No, these are two different identifiers that serve different purposes. An EIN, or Employer Identification Number, is issued by the IRS and is used primarily for tax purposes. A DUNS number is issued by Dun & Bradstreet and is used to identify your business in commercial and government databases. Your business may need both, but they are not interchangeable.

How to Find My EIN Number Online: Quick Tax Guide

Does a DUNS number expire?

No, DUNS numbers do not expire. Once it is assigned to your business, it stays with that entity permanently. That said, it is a good idea to periodically verify that the business information attached to your number in the Dun & Bradstreet database is accurate and up to date, particularly if your business has moved, changed its name, or undergone any other significant changes.