Unknown chargesmean unknown risk

Understand your business exposure before it compounds.

Seeing a PARCHMENT UNIV DOCS charge on your statement?

Common ways PARCHMENT UNIV DOCS charges might appear on your statement

- DEBIT CARD PURCHASE PARCHMENT-UNIV DOCS 7372

- CHKCARD PARCHMENT-UNIV DOCS 480-719-1646 AZ

- CHECKCARD PARCHMENT-UNIV DOCS 480-719-1646 AZ

- POS PURCHASE PARCHMENT-UNIV DOCS 480-719-1646 AZ

- PENDING PARCHMENT-UNIV DOCS 480-719-1646 AZ

- POS REFUND PARCHMENT-UNIV DOCS 480-719-1646 AZ

- VISA CHECK CARD PARCHMENT-UNIV DOCS 480-719-1646 AZ

What is Parchment Univ Docs?

Parchment is a credential service that allows students and institutions to request, verify, and send academic transcripts, diplomas, and other official documents. Learn more at parchment.com.

Common causes for PARCHMENT UNIV DOCS charges

- Ordering official transcripts or academic records from a university using Parchment’s platform.

- Electronic or mailed delivery of documents to institutions, employers, or individuals.

- Processing fees associated with credential verification or shipping.

- Refunds or credit adjustments when orders are canceled or duplicated.

Decoding PARCHMENT UNIV DOCS charge tags

- PARCHMENT-UNIV DOCS identifies the transaction as a credential / document order processed through Parchment.

- Numbers like 7372 or 480-719-1646 AZ are merchant or processor identifiers, often including a phone number and location.

- Prefixes CHKCARD, CHECKCARD, POS PURCHASE, PENDING, or POS REFUND indicate how the transaction was processed (card, hold, refund).

- VISA CHECK CARD shows the card network used for the transaction.

What to do

if you

don’t recognize this charge

Spot, verify, and resolve suspicious charges in minutes.

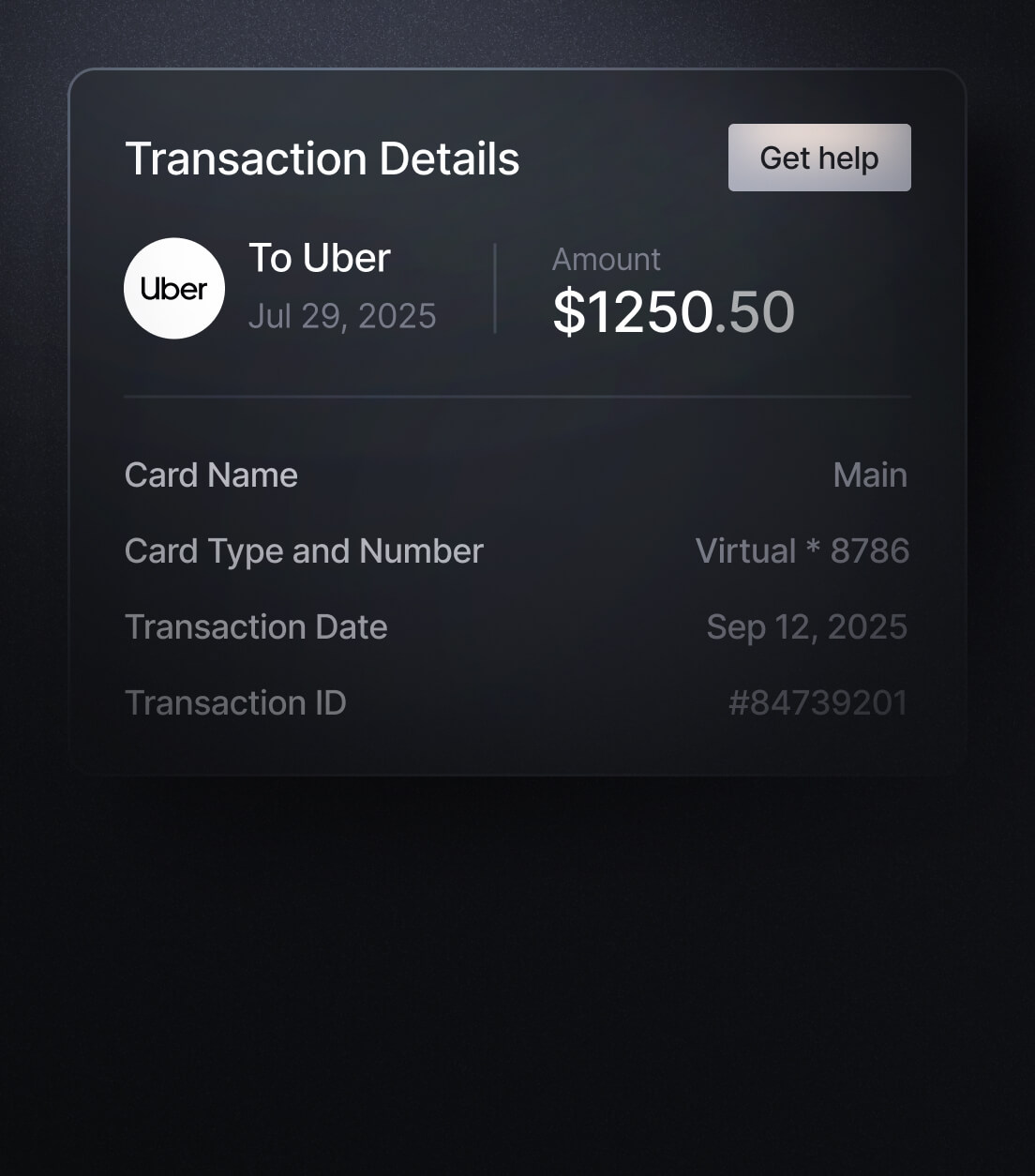

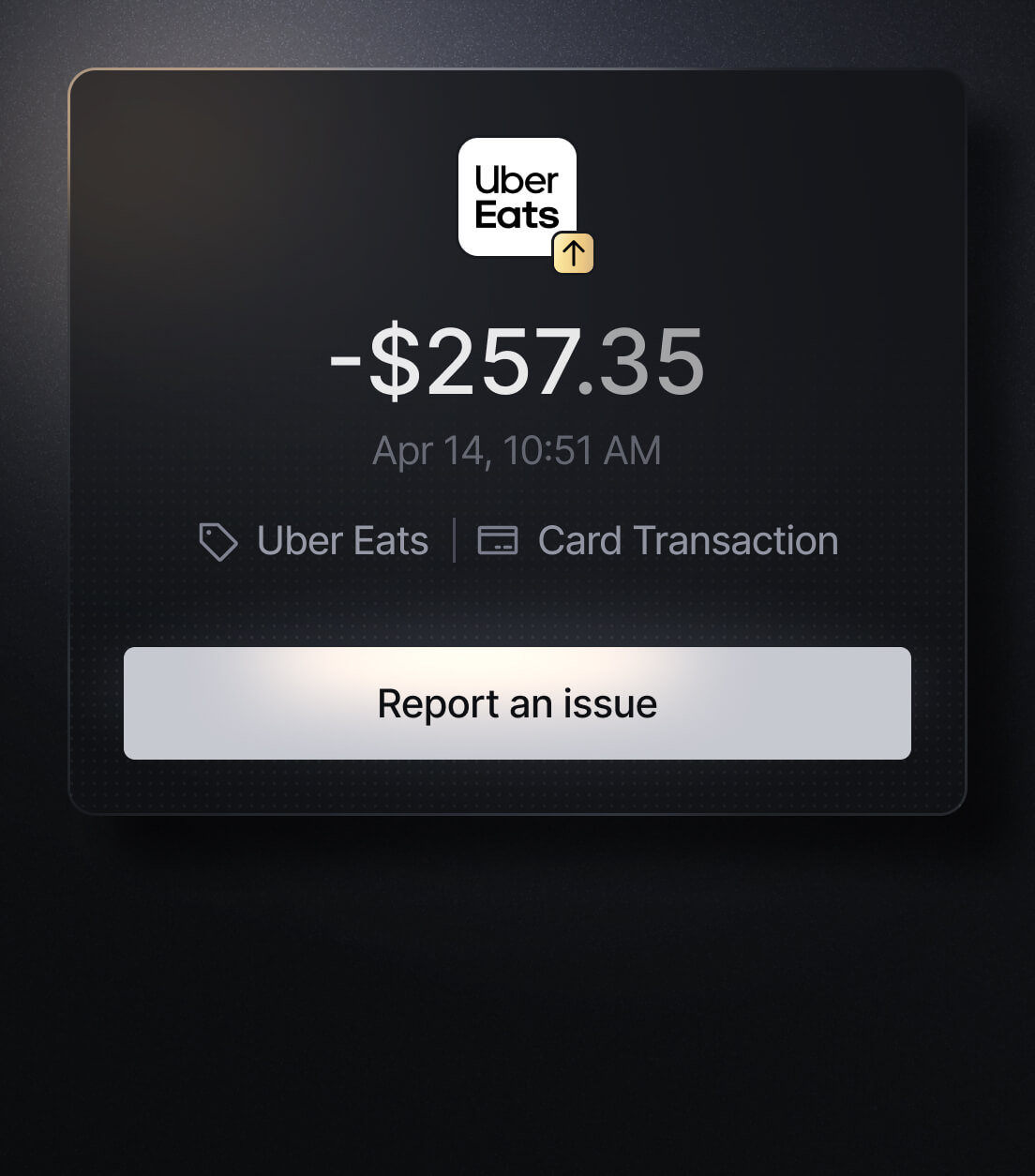

Easily Identify Every Charge with Slash

See exactly where, when, and how each charge occurred, complete with merchant names, payment types, and connected team cards with Slash’s detailed card logs and expense tracking tools.